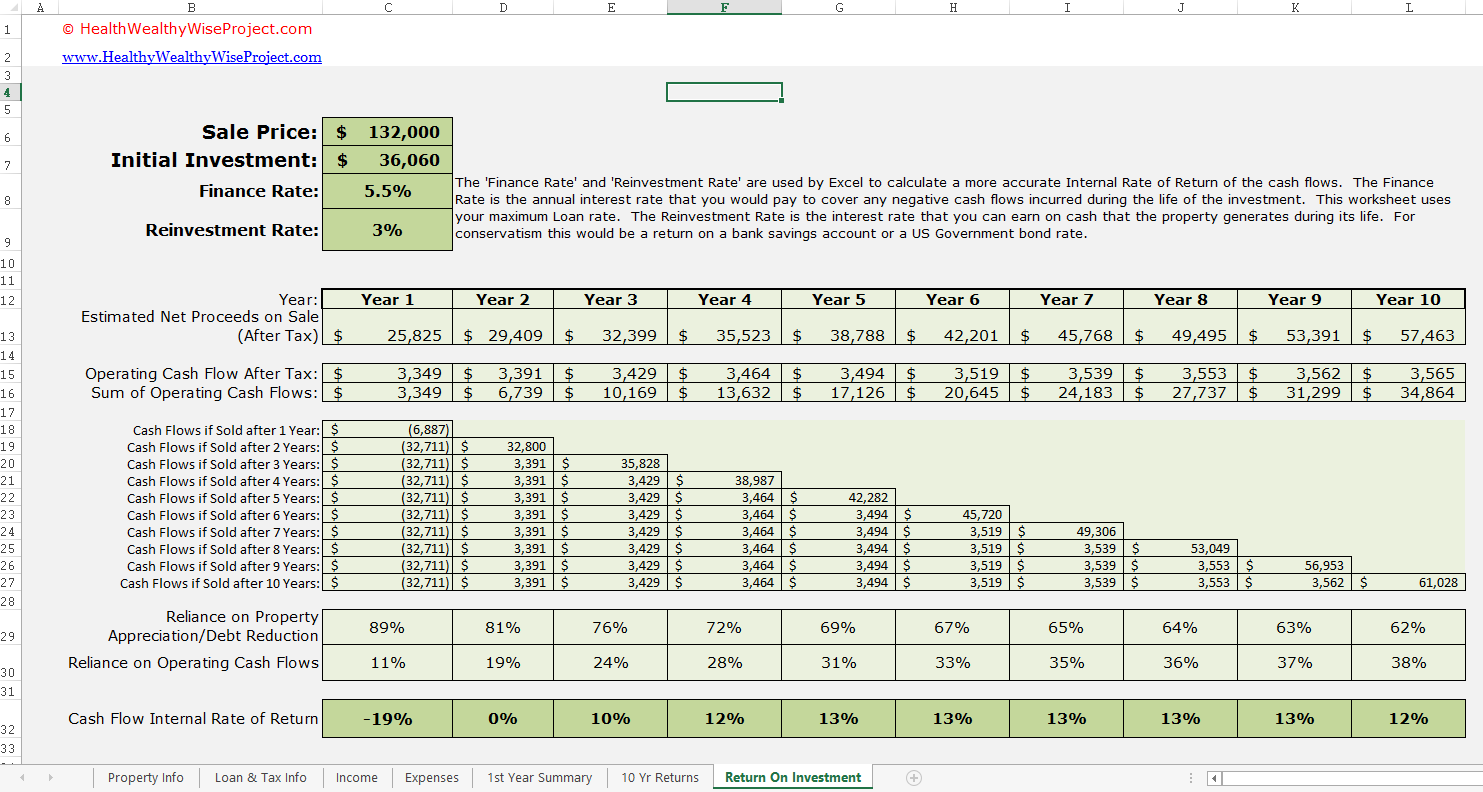

40 fannie mae rental income calculation worksheet

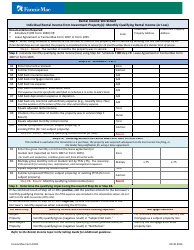

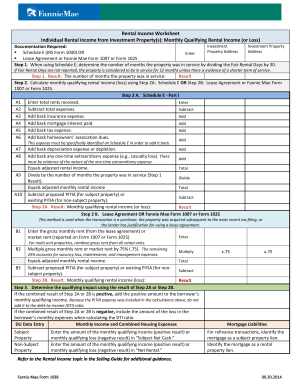

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Web05.10.2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property , B3-6-06, Qualifying Impact of Other Real Estate Owned (06 ... - Fannie Mae Web05.10.2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

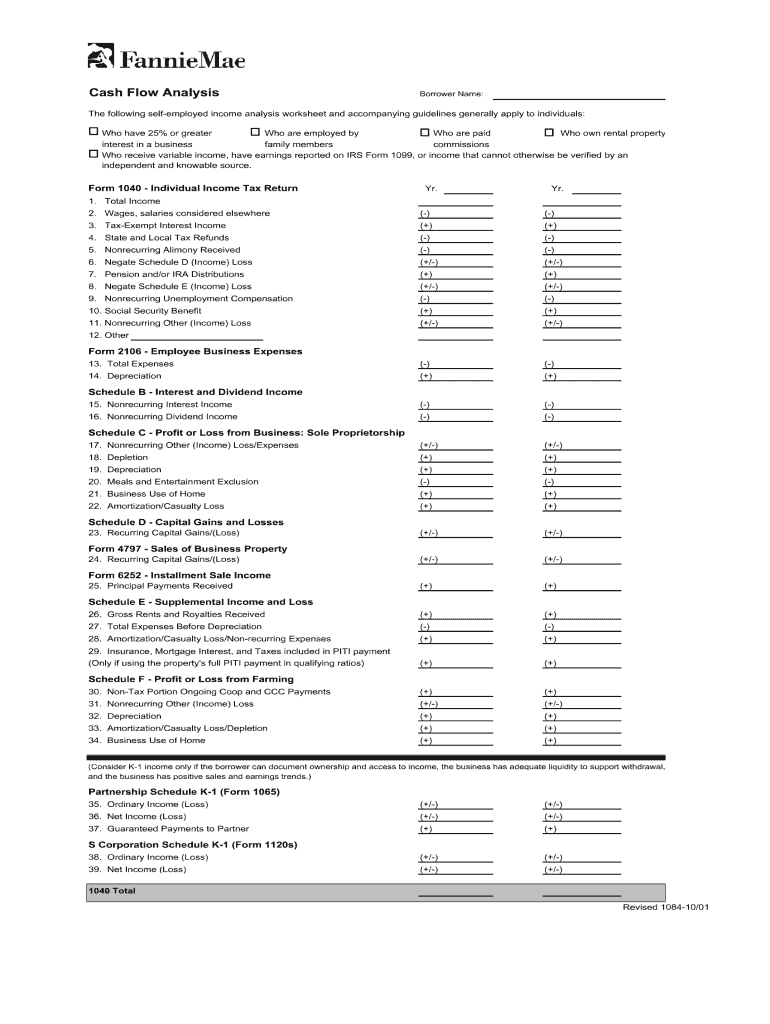

Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Fannie mae rental income calculation worksheet

Partner's Instructions for Schedule K-1 (Form 1065-B) (2017) Code C1. General partner's taxable income or (loss) from other rental activities. Income (loss) reported in box 9, Code C1, is a passive activity amount for all general partners. Report a loss following the Instructions for Form 8582. Report income on Schedule E (Form 1040), line 28, column (g). Claiming Rental Income to Qualify for a Mortgage: How Do Sep 28, 2022 · Rental income calculation worksheets. Fannie Mae provides worksheets so that you can get a sense of what your rental income may be before bringing your paperwork to a lender. Which worksheet will be appropriate for you depends on whether your property is a principal residence, investment property or commercial holding, as well as how many ... B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Web05.10.2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property , Rental Income Worksheet – Individual Rental Income from …

Fannie mae rental income calculation worksheet. Asset depletion fannie mae - beautyuk.shop Web19.10.2022 · fannie mae rental income worksheet fv0 albaqie com. fannie mae annual revenue income statement 2017 2016. fannie. There are certain steps to read a balance sheet and they are:Step 1: First step suggest calculation of assets. Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable … B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Web05.10.2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property , News and Insights | Nasdaq WebGet the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more Income Analysis Worksheet | Essent Guaranty WebDownload Worksheet (PDF) Download Calculator (Excel) Rental Property – Primary Schedule E. Determine the average monthly income/loss for a 2-4 unit owner-occupied property. Download Worksheet (PDF) Download Calculator (Excel) Sole Proprietor Schedule C. Calculate the monthly qualifying income for a borrower who is a sole …

18 inch wood furniture legs - vdv.spigotadjustersal.shop WebThe lender must verify the borrower’s ownership of the account or asset 29/07/ · Income Fannie Mae – Restricted Stock and Restricted Stock Units •No policy for the use as. wabco air brake system troubleshootingFreddie Mac BorrowSmart℠ Income and Property Eligibility Tool. Use this tool to verify if a borrower can qualify for Freddie Mac BorrowSmart℠ geo … 2020 S Corporation Tax Booklet | FTB.ca.gov - California WebDo not report any rental activity or portfolio income or loss on these lines. Rental activity and portfolio income or loss are reported on Form 100S, Side 1, line 7 or Side 2, line 12; Form 100S, Side 6, Schedule K; and Schedule K-1 (100S). Rental real estate activities are also reported on federal Form 8825. Attach a copy of federal Form 8825 ... HECM FINANCIAL ASSESSMENT AND PROPERTY CHARGE GUIDE REVISED ... captured on Fannie Mae Form 1009, Residential Loan Application for Reverse Mortgages. Mortgagees must capture additional required information using Parts IV, V and VI of Fannie Mae Form 1003, Uniform Residential Loan Application, or through an alternative form developed to capture the same information. Mortgagees must ensure that the mortgagor B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Web05.10.2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property , Rental Income Worksheet – Individual Rental Income from …

Claiming Rental Income to Qualify for a Mortgage: How Do Sep 28, 2022 · Rental income calculation worksheets. Fannie Mae provides worksheets so that you can get a sense of what your rental income may be before bringing your paperwork to a lender. Which worksheet will be appropriate for you depends on whether your property is a principal residence, investment property or commercial holding, as well as how many ... Partner's Instructions for Schedule K-1 (Form 1065-B) (2017) Code C1. General partner's taxable income or (loss) from other rental activities. Income (loss) reported in box 9, Code C1, is a passive activity amount for all general partners. Report a loss following the Instructions for Form 8582. Report income on Schedule E (Form 1040), line 28, column (g).

0 Response to "40 fannie mae rental income calculation worksheet"

Post a Comment