43 farm income and expense worksheet

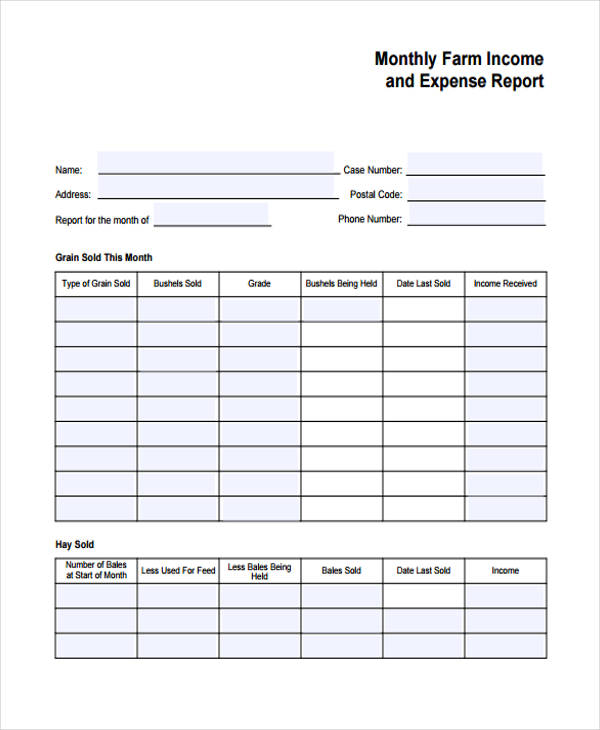

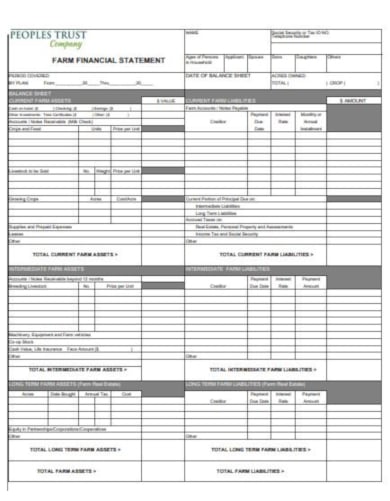

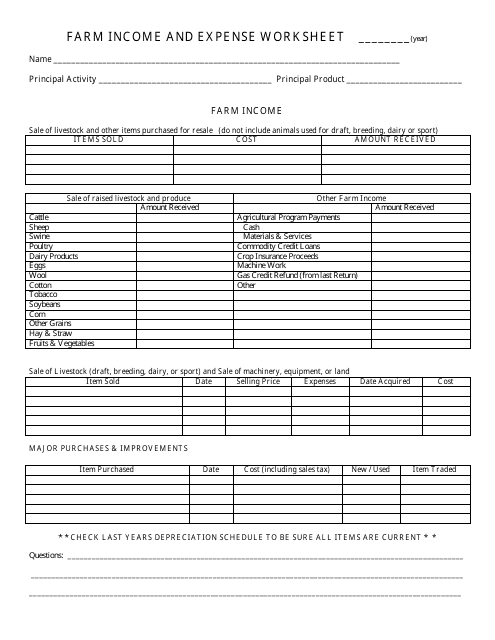

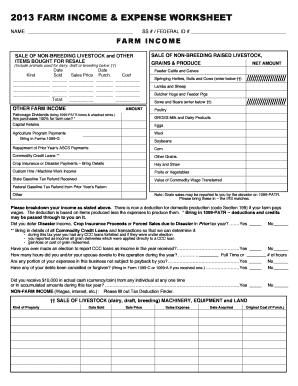

Monthly Farm Expenses Form Template - Pinterest This simple monthly farm expense form includes spaces for the date, the expense, the ... Income and Expense Tracking Worksheet Household Budget Worksheet, ... FARM INCOME AND EXPENSE WORKSHEET - Marquis Tax Services FARM INCOME AND EXPENSE WORKSHEET. Did you materially participate in the operation or management of the farm on a regular, continuous, and.

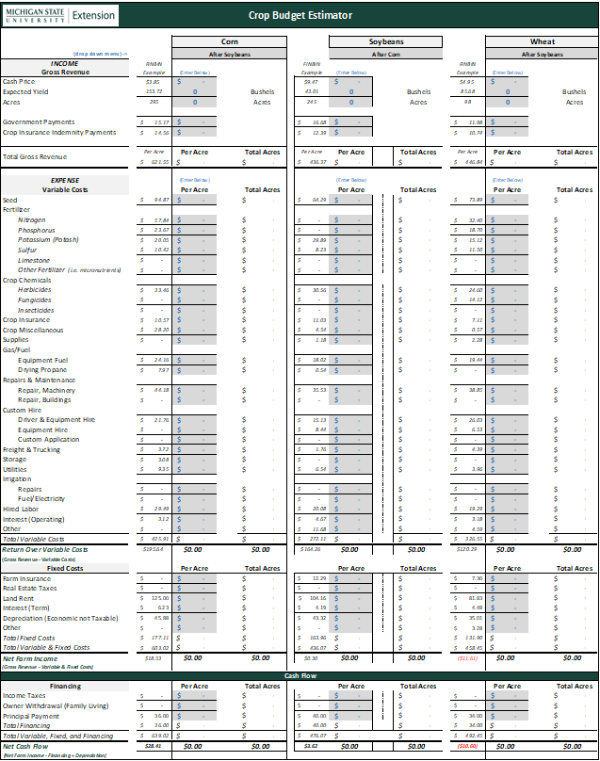

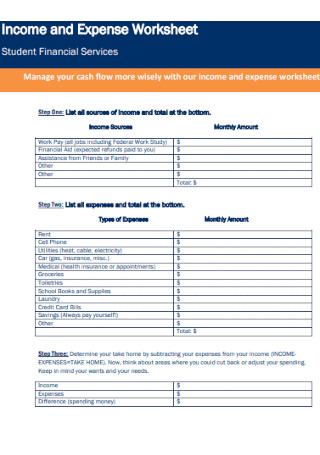

FARM WORKSHEET - INCOME AND EXPENSES Sales of purchased livestock (bulls, horses) or equipment enter below. Custom Hire. Value of goods or services received in barter (describe). Other farm income ...

Farm income and expense worksheet

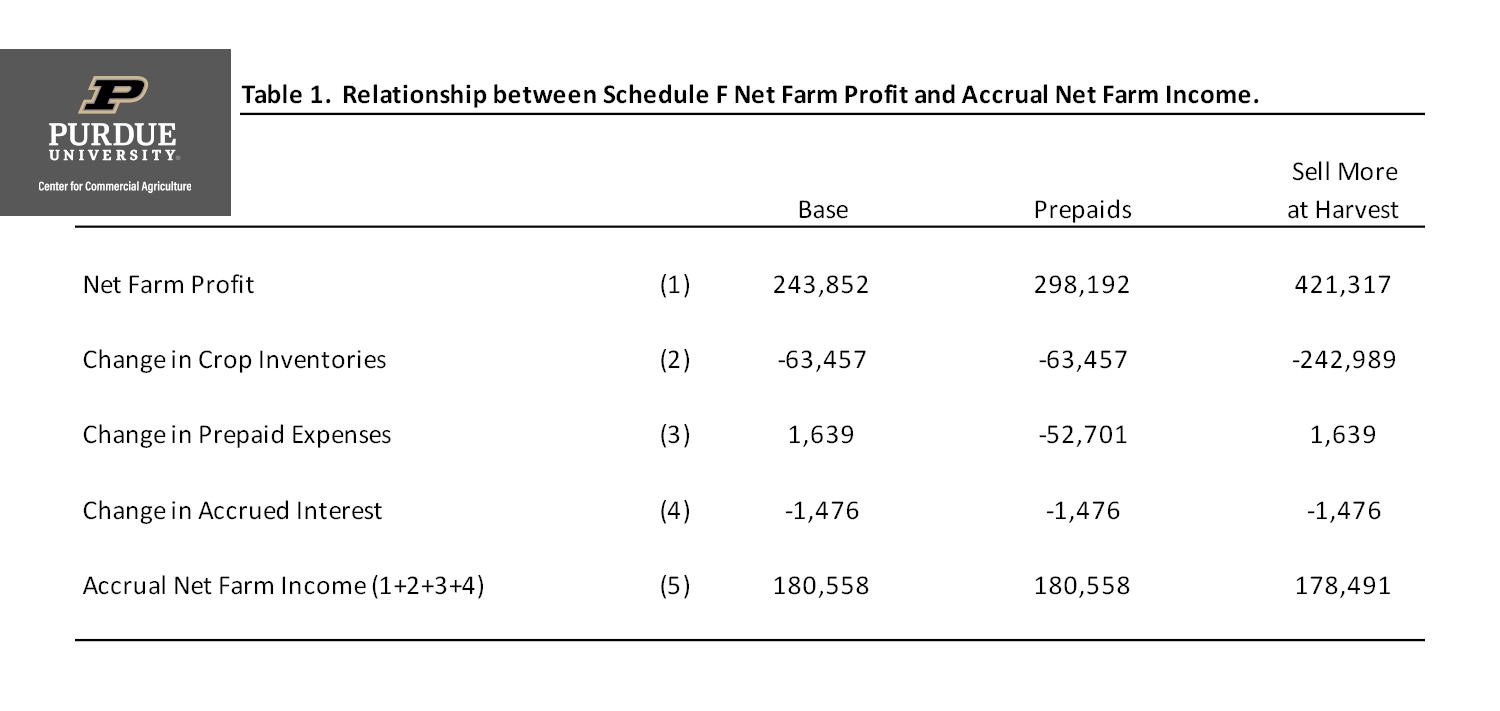

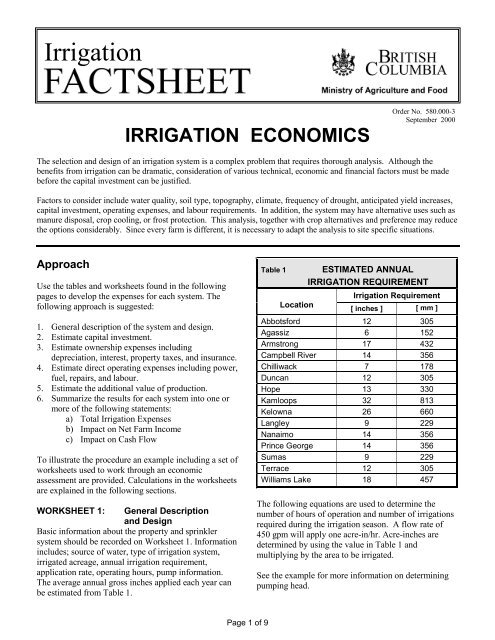

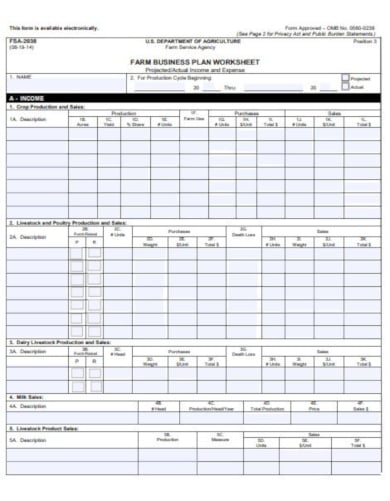

FHA Self-Employment Income Calculation Worksheet Job Aid FHA Self-Employment Income Calculation Worksheet Job Aid Last Reviewed Date: 01/31/2020 For Wholesale Customers Only Page 5 of 12 6. Schedule F – Profit or Loss from Farming When a borrower generates income from ownership of a farm, regardless of that farm being the subject property or not, the Publication 17 (2021), Your Federal Income Tax | Internal ... Your earned income was more than $13,900 ($15,250 if 65 or older and blind). • Your gross income was at least $5 and your spouse files a separate return and itemizes deductions. • Your gross income was more than the larger of: • $2,450 ($3,800 if 65 or older and blind), or • Your earned income (up to $12,200) plus $1,700 ($3,050 if 65 ... FSA-2038 - USDA Farm Service Agency U.S. DEPARTMENT OF AGRICULTURE. Position 3. (08-19-14). Farm Service Agency. FARM BUSINESS PLAN WORKSHEET. Projected/Actual Income and Expense.

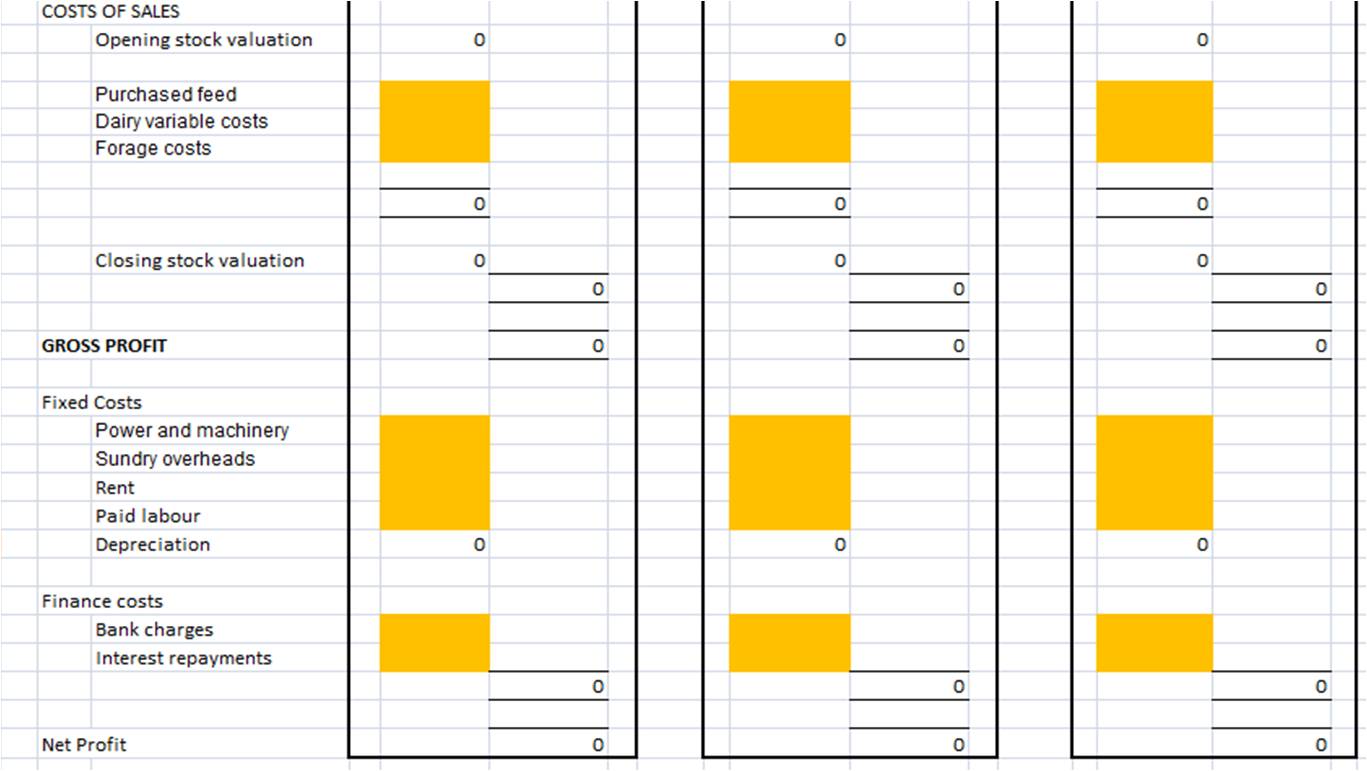

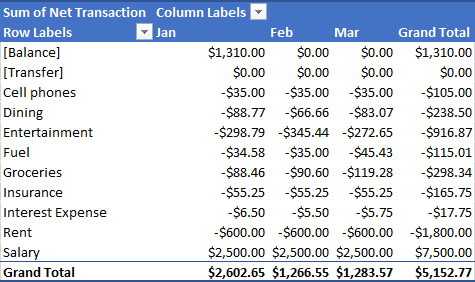

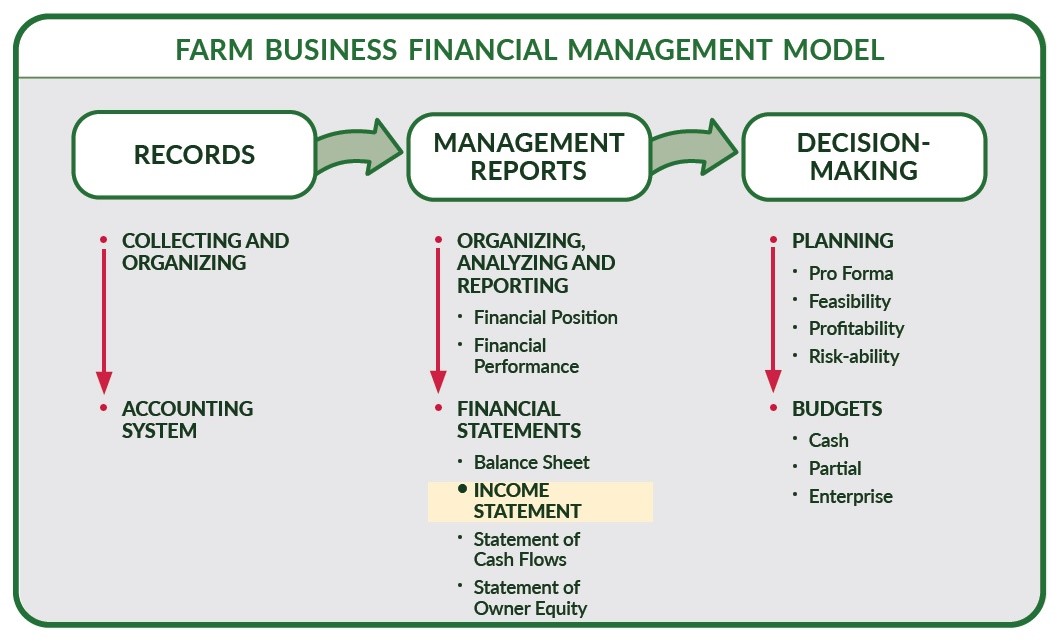

Farm income and expense worksheet. Publication 970 (2021), Tax Benefits for Education | Internal ... Example 3—Scholarship partially included in income. The facts are the same as in Example 2—Scholarship excluded from income. If, unlike Example 2, Bill includes $4,000 of the scholarship in income, he will be deemed to have applied that amount to pay for room and board. The remaining $1,600 of the $5,600 scholarship would reduce his ... FARM INCOME AND EXPENSE WORKSHEET ______(year) FARM INCOME AND EXPENSE WORKSHEET ______(year) ... Agricultural Program Payments ... Expenses. Date Acquired. Cost. MAJOR PURCHASES & IMPROVEMENTS. eForms Home You can click the Browse Forms menu option on the left of the page and search for your form. You can complete the form, print it out and either mail or fax the form to your local service center. Your Farm Income Statement | Ag Decision Maker Income tax and Social Security tax payments are considered personal expenses and should not be included in the farm income statement, unless the statement is for a farm corporation. Interest paid on all farm loans or contracts is a cash expense, but principal payments are not.

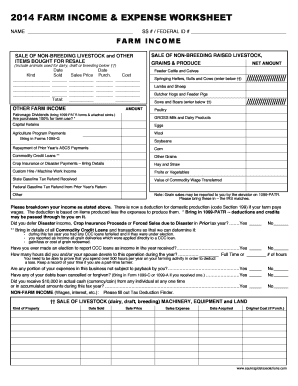

Farm Income Worksheet | Flightax Expense. Banking Fees. $. Rent/Lease – Vehicles, Machinery. $. Breeding Fees. $. Rent – Other Business Property. $. Chemicals. Personal Finance Advice - Personal Financial Management ... MarketWatch offers personal finance advice and articles to help you save money and plan for retirement. farm worksheet Hedging Income (Loss). SALE OF LIVESTOCK (dairy, draft, breeding), MACHINERY, EQUIPMENT & LAND: Kind of Property. Date Sold. Gross Sale. Sales Expense. “2021 FARM INCOME AND EXPENSES WORKSHEET” “2021 FARM INCOME AND EXPENSES WORKSHEET”. Principal Crop or Activity. EIN (if any). Is this farm registered as a Limited Liability Company (LLC)?.

FARM WORKSHEET FARM INCOME 2022 - RFSW Dec 31, 2022 ... INCOME. EXPENSE. Applied for Forgiveness: YES_____ NO_____. PPP Loan, EIDL Grant, & Other Grants. Other Grants: EIDL Advance/Grant Amount:. Farm Income And Expense Worksheet: Farm Record Log Buy Farm Income And Expense Worksheet: Farm Record Log on Amazon.com ✓ FREE SHIPPING on qualified orders. Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. FSA-2038 - USDA Farm Service Agency U.S. DEPARTMENT OF AGRICULTURE. Position 3. (08-19-14). Farm Service Agency. FARM BUSINESS PLAN WORKSHEET. Projected/Actual Income and Expense.

Publication 17 (2021), Your Federal Income Tax | Internal ... Your earned income was more than $13,900 ($15,250 if 65 or older and blind). • Your gross income was at least $5 and your spouse files a separate return and itemizes deductions. • Your gross income was more than the larger of: • $2,450 ($3,800 if 65 or older and blind), or • Your earned income (up to $12,200) plus $1,700 ($3,050 if 65 ...

FHA Self-Employment Income Calculation Worksheet Job Aid FHA Self-Employment Income Calculation Worksheet Job Aid Last Reviewed Date: 01/31/2020 For Wholesale Customers Only Page 5 of 12 6. Schedule F – Profit or Loss from Farming When a borrower generates income from ownership of a farm, regardless of that farm being the subject property or not, the

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

0 Response to "43 farm income and expense worksheet"

Post a Comment