38 1040 qualified dividends and capital gains worksheet

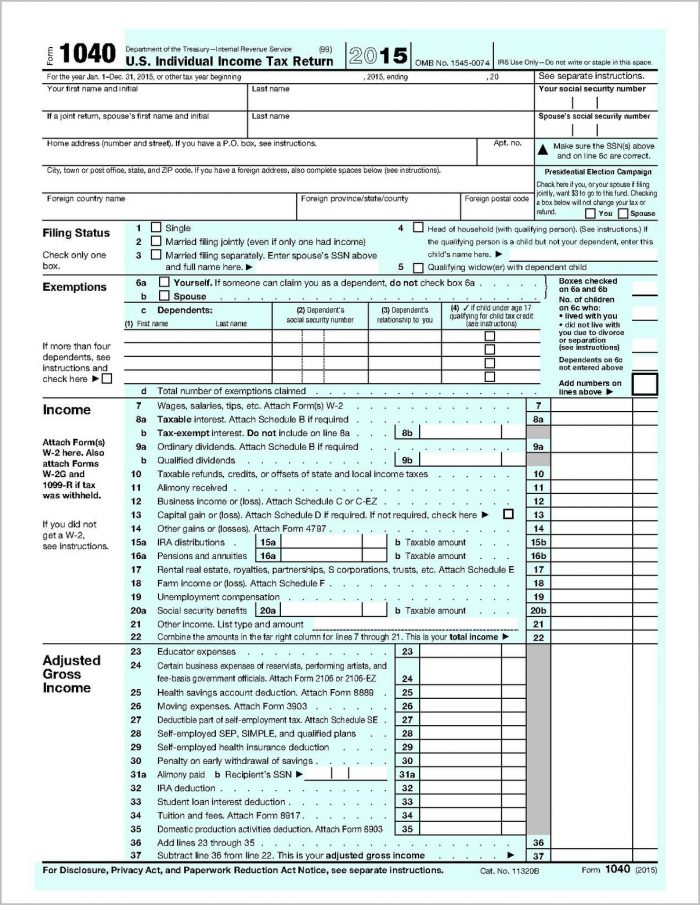

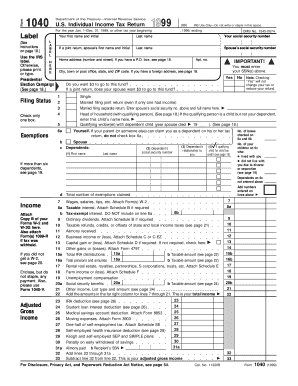

3 weeks ago - IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. In cell A1 insert the worldwide ordinary dividends. Capital gains and qualified dividends. The spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A - Itemized Deductions Schedule B - Ordinary Interest and Ordinary Dividends Schedule C - Profit or Loss from Business Schedule D - Capital Gains and Losses, along with its worksheet Schedule SE - Self-Employment Tax

12.10.2021 · Here’s how to report your capital gains ... you’re directed to the separate Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found in the Form 1040 ...

1040 qualified dividends and capital gains worksheet

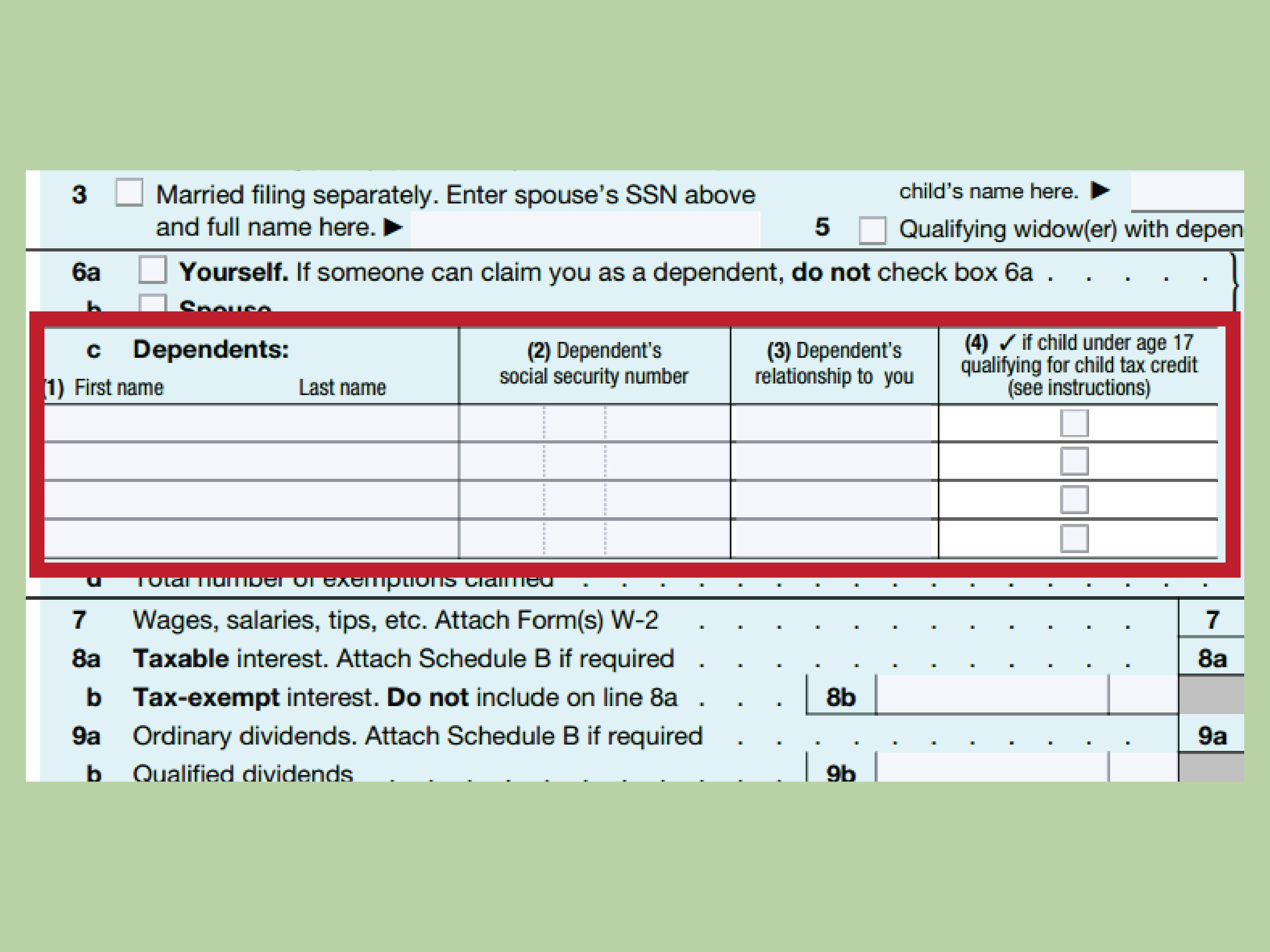

2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your Records See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on ... The Qualified Dividends and Capital Gains worksheet uses taxable income as the starting point for calculating taxes. Where are the qualified dividends reported on Form 1099-DIV? All regular dividends you received will be reported in Box 1a of Form 1099-DIV. Qualified dividends can be found in Box 1b. What is the qualified dividends and capital gain tax Worksheet? The worksheet is intended for taxpayers who only have dividend income or capital gains distributions recorded in boxes 2a or 2b on Form 1099-DIV from mutual funds, other regulated investment companies, or real estate investment trusts, respectively.

1040 qualified dividends and capital gains worksheet. Is the Qualified Dividends and Capital Gain Tax Worksheet Accompanied by other Forms? The worksheet is closely related to Form 1040, Form 2555, Form 2555-EZ. Some information from these forms needs to be used when completing the worksheet. That pesky capital gains tax. Here's how to manage your portfolio, given the tax rate assigned to you. Most have heard the tax lowers overall investment return. It does. Here’s exactly what this tax is and how it impacts your decision makin... Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 . On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures; 2 check-boxes 22.12.2021 · Line 7 asks about your capital gains or losses from the past year. Two common reasons to have capital gains are that you sold stock investments or you sold your house. You likely received a 1099-B or 1099-S if you had capital gains, and you will probably need to attach Schedule D to your 1040. To learn more, try our guide to capital gains tax.

Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ... 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your Records See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Learn more about the Capital Gains Tax Basics at US Tax Center IRS.com is a privately owned website that is not affiliated with any government agencies. IRS.com is a privately owned website that is not affiliated with any government agencie... Income dividends and capital gains distributions are both valid forms of profit for many investors. Whereas income dividends are taxed according to ordinary income rates, capital gains distributions are subjected to IRS guidelines for capit...

Whether or not to reinvest your dividends and capital gains from a mutual depends on several factors. Most investors choose to reinvest, however, there may be times when you want to take the distributions in cash. Reinvesting requires no fe... 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. As Don pointed out, the Qualified Dividends and Capital Gain Tax Worksheet is still pretty much the 2017 version, and is referring to the 2017 Lines on Form 1040. Eventually, the program will be updated to the 2018 version, which should match the 2018 Forms. Learn more about the Capital Gains Tax at US Tax Center IRS.com is a privately owned website that is not affiliated with any government agencies. IRS.com is a privately owned website that is not affiliated with any government agencies. A ca...

Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. ... Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of ...

When To Use Qualified Dividends And Capital Gain Tax Worksheet? Stocks / By The Money Farm Team The worksheet is intended for taxpayers who only have dividend income or capital gains distributions recorded in boxes 2a or 2b on Form 1099-DIV from mutual funds, other regulated investment companies, or real estate investment trusts, respectively.

Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

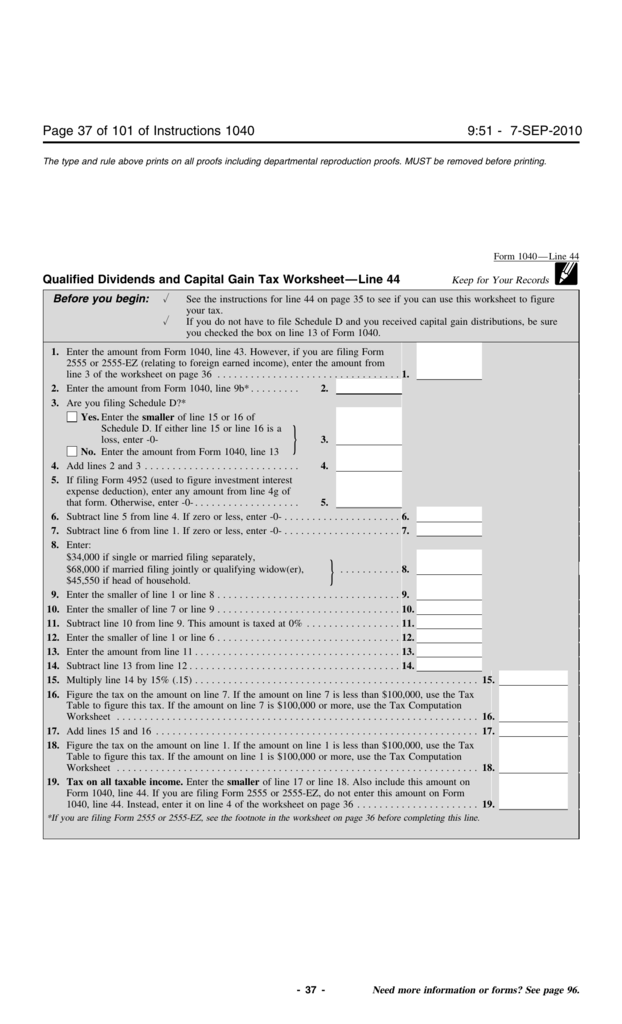

See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ...

•To report a gain or loss from a partnership, S corporation, estate, or trust; •To report capital gain distributions not reported directly on Form 1040 or 1040-SR, line 7 (or effectively connected capital gain distributions not reported direct-ly on Form 1040-NR, line 7); and •To report a capital loss carryover from 2020 to 2021.

Capital gain refers to the increase in value of a capital asset or an investment security upon sale. In other words, if you buy company stock, real estate or fine art and then sell it for more than you paid, you have a capital gain. Capital...

rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative

IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. Total capital gain or loss from Schedule D is entered on a different line of Form 1040.

Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

More people than ever are investing. When stocks, real estate and other types of investments are sold for a profit — meaning they earned the owner income because they sold at a price higher than that at which they were bought — this unique ...

If you’ve sold property for a profit, then you’re taxed on money you’ve made from the sale. The profit is called capital gains, and the tax on profits is called a capital gains tax. As with anything tax related, there’s plenty to learn beca...

June 3, 2019 - Qualified dividends and capital gains worksheet line 27 should be the smaller of line 25 or 26 and transferred to line 44 of the 1040. It is using the larger. I have followed the worksheet and the rest of the worksheet is correct.

A couple of our native Eastern Black Ducks nagging us for food early August. Midwinter in south eastern Australia

Form 1040 Individual Income Tax Return ... Form 1099-Q Payments from Qualified Education Programs ... Form 2439 Undistributed Long-Term Capital Gains Form 2441 Child and Dependent Care Credit Form 2555 Foreign Earned Income Form 3903 Moving Expenses: Form 4137 Social Security Tax on Unreported Tips

IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

Calculate your qualified dividend amount using Form 1099-DIV. Ordinary dividends should be filed in Box 1a, qualifying dividends should be filed in Box 1b, and total capital gain distributions should be filed in Box 2a. Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. To calculate your total tax amount, use the ...

Learn more about the 7 Facts About Capital Gains Tax at US Tax Center IRS.com is a privately owned website that is not affiliated with any government agencies. IRS.com is a privately owned website that is not affiliated with any government ...

Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Qualified Dividends and Capital Gain Tax Worksheet: in the instructions ... Do you have qualified dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line ...

Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. 7 Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution.

When you have qualified dividends or capital gains, you do not use the tax table. Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. The program has already made this calculation for you.

Zona Central de São Paulo a região administrada pela Subprefeitura da Sé, que engloba os distritos da Bela Vista, Bom Retiro, Cambuci, Consolação, Liberdade, República, Sé e Santa CecÃlia. Centro de São Paulo - Capital Instagram @anderson.nikon Fotos Coloridas @anderson.psd Fotos Preto e Branco @anderson.models @recolorizacaofotografica twitter.com anderson_psd

Sep 24, 2021 · Instead, 1040 Line 16 “Tax” asks you to “see instructions.” In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records 2010 Form 1040—Line 44 Before you begin: See the instructions for line 44 on page 35 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax...

For the first time in three years, INC.'s annual academic exercise -- buying $100 worth of stock in each of its hundred fast-growing corporations -- has turned out happy. That is to say, up. The same $10,000 investment might have returned ...

19.07.2021 · IRS Publication 554: A document published by the Internal Revenue Service (IRS) that provides seniors with information on how to treat retirement income, as well as special deductions and credits ...

Bruce Boomer QD Worksheetpdf - Qualified Dividends and Capital Gain Tax Worksheet2019 u2022 See Form 1040 instructions for line 12a to see if the. Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf -. Foundations of sport and exercise psychology 7th edition pdf,foucault history of sexuality pdf,forty studies that changed psychology pdf ...

May 16, 2017 - The strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a form. Instead, 1040 Line 44 “Tax” asks you to “see instructions.” In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax ...

June 6, 2019 - Please show how the results from the Qualified Dividends and Capital Gain Tax worksheet are applied to the 1040 Forms. The 1040 form is treating all my qualified dividends and capital gains as taxable at ordinary rates.

2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) The 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) form is 1 page long and contains: Use our library of forms to quickly fill and sign your H&Rblock forms online. Form 1.: Yes. Add $350 to your earned (H&Rblock)

Refer to the Instructions for Forms 1040 and 1040-SR or the Instructions for Form 1040-NR if your only capital gains and losses are from capital gain distributions. You must file Schedule B (Form 1040), Interest and Ordinary Dividends, if you received more than $1,500 in ordinary dividends or if you received ordinary dividends in your name that ...

ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Qualified Dividends and Capital Gain Tax Worksheet - Line 16 (Form 1040) 2020 Before you begin: FOR ALT MIN TAX PURPOSES ONLY 1. 1. 2. 2. 3. Yes. 3. No.

25.12.2021 · Dividends are income earned by investing in stocks, mutual funds or exchange-traded funds, and they are included in your tax return on Schedule B, Form 1040. Capital gains are the amount an asset ...

Here are the steps to build a worksheet to calculate capital gains. See how the math works and ways to organize your investment data for tax purposes. Thomas Barwick / Getty Images Building a worksheet to calculate capital gains shows how t...

What is the qualified dividends and capital gain tax Worksheet? The worksheet is intended for taxpayers who only have dividend income or capital gains distributions recorded in boxes 2a or 2b on Form 1099-DIV from mutual funds, other regulated investment companies, or real estate investment trusts, respectively.

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

0 Response to "38 1040 qualified dividends and capital gains worksheet"

Post a Comment