39 mortgage insurance premiums deduction worksheet

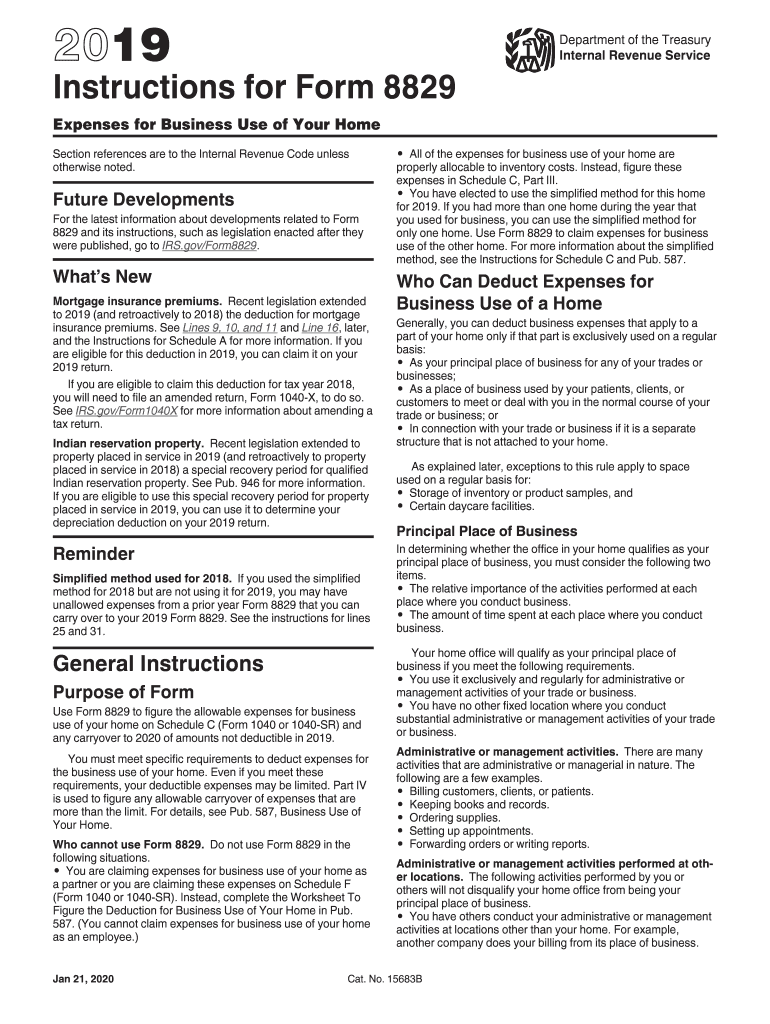

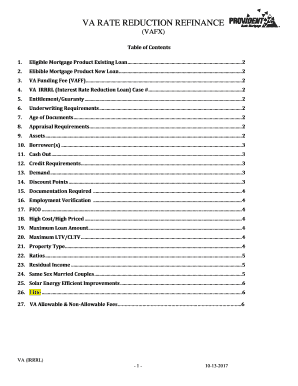

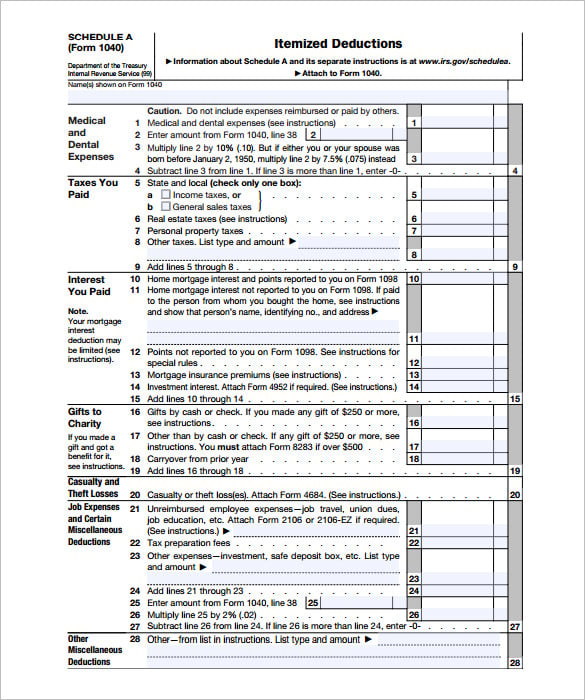

mortgage insurance" during 2019 in connection with home acquisition debt on your qualified home are deductible as home mortgage insurance premiums. Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal Housing Administration, or the Rural Housing Administration, and private mortgage insurance. See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098.

Mortgage Insurance Premiums Deduction Worksheet 2/4 Kindle File Format Individual Income Tax - Department of Revenue The Internal Revenue Service has issued retroactive extensions of several tax matters that include the following: treatment of mortgage insurance premiums as qualified residence interest, exclusion

Mortgage insurance premiums deduction worksheet

See the instructions for line 8d to see if you must use this worksheet to figure your deduction. Enter the total premiums you paid in 2020 for qualified mortgage insurance for a contract issued after December 31, 2006 Enter the amount from Form 1040 or 1040-SR, line 11 Enter $100,000 ($50,000 if married filing separately) Is the amount on line ... on points, mortgage insurance premiums, and how to report deductible interest on your tax re-turn. Generally, home mortgage interest is any in-terest you pay on a loan secured by your home (main home or a second home). The loan may be a mortgage to buy your home, a second mortgage, a line of credit, or a home equity loan. See line 8d in the Instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums.

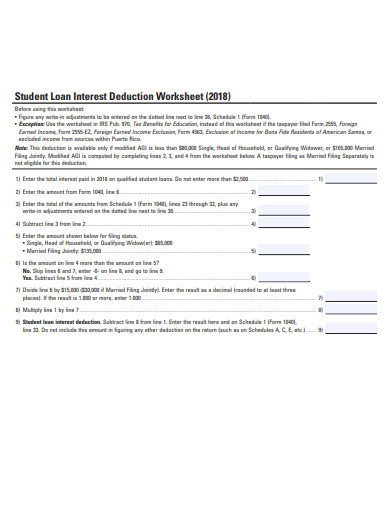

Mortgage insurance premiums deduction worksheet. May 17, 2021 · Health insurance premiums are tax-deductible, but it also depends on the health care services and the amount you pay. You can deduct common items such as medical appointments, surgeries, tests, prescription drugs and durable items like wheelchairs and home care etc., from taxes. Mortgage insurance premiums can increase your monthly budget significantly—an additional $83 a month or so at a 0.5% rate on a $200,000 mortgage. However, in 2006, Congress made these payments tax-deductible to help reduce the burden of these costs. The tax deduction was scheduled to last through the 2016 tax year, but it has been extended through at least 2021. See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098. The mortgage interest ... Feb 13, 2021 · The mortgage interest deduction is a tax deduction that for mortgage interest paid on the first $1 million of mortgage debt. Homeowners who bought houses after Dec. 15, 2017, can deduct interest ...

Aug 05, 2021 · That’s $996 to $2316 in a year on top of your mortgage, interest, and homeowner’s insurance. In the past few years, the rules affecting the federal tax deduction have changed repeatedly. Nov 18, 2020 · Any paid premiums that you don’t deduct as self-employed health insurance can be claimed as an itemized deduction on Schedule A. Also, while you can deduct 100% of health and dental insurance premiums, the amount of long-term care insurance premiums you can deduct varies based on certain criteria. 25 Oct 2021 — on points, mortgage insurance premiums, and how to report deductible ... Worksheet To Figure Your Qualified Loan Limit and Deductible.19 pages 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet Qualified Mortgage Insurance Premiums— Premiums that you pay or accrue for “qualified mortgage i nce” during 2017 in connection with home acquisition debt on your qualified home are deductible as home mortgage insurance premiums. Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the ...

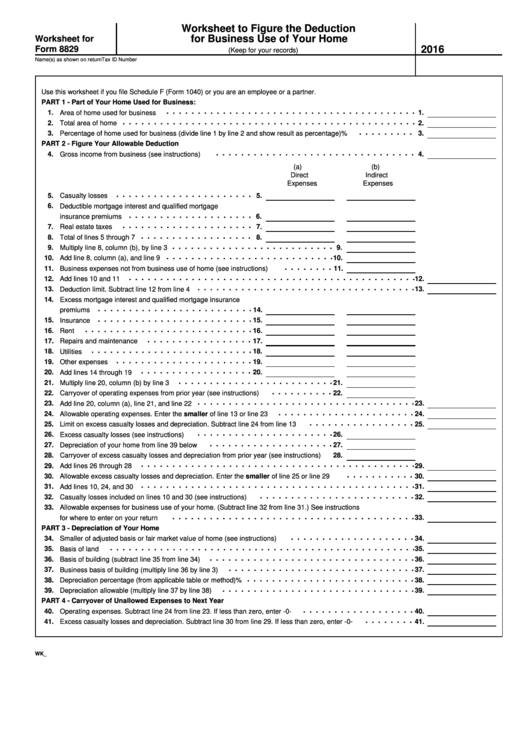

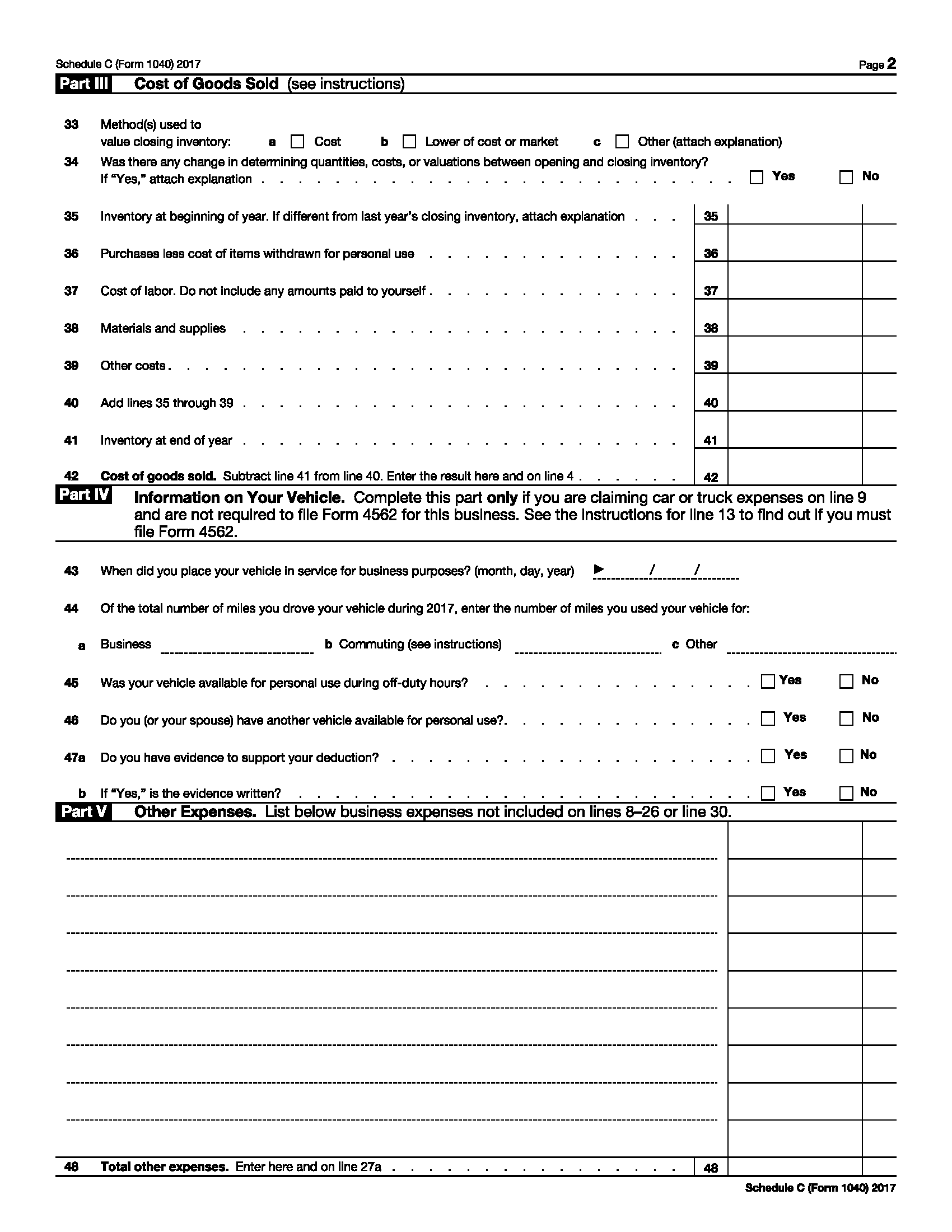

If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ... You can't deduct insurance premiums paid by making a pre-tax reduction to your employee ... State and Local General Sales Tax Deduction Worksheet—Line 5a ... Instead, complete the Worksheet To Figure the. Deduction for Business Use of Your Home in Pub. ... the Mortgage Insurance Premiums Deduction Worksheet for.6 pages creased standard deduction, re-port amounts only on line 28 as instructed. See Increased Standard De-duction Reporting, later. Mortgage insurance premiums. The deduction for mortgage insurance premi-ums has been extended through 2017. You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017.

Looking for Mortgage Insurance Premiums Deduction WorksheetLine 13 to fill? CocoDoc is the best place for you to go, offering you a marvellous and easy to edit version of Mortgage Insurance Premiums Deduction WorksheetLine 13 as you ask for. Its complete collection of forms can save your time and increase your efficiency massively.

Entrepreneurs and startups dream big, but leading teams takes commitment. Only the ambitious, humble, and smart entrepreneurs will be successful. Model: @Austindistel https://www.instagram.com/austindistel/ This photo is free for public use. If you do use this photo, Please credit in caption or metadata with link to "www.distel.com".

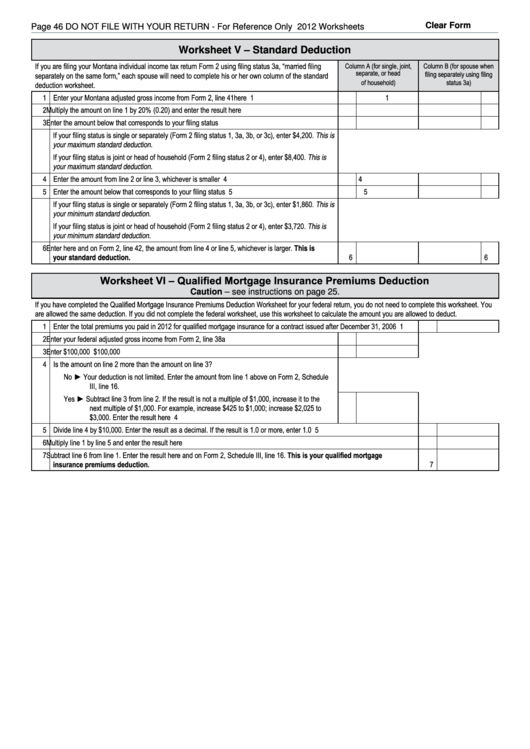

Qualified Mortgage Insurance Premiums Deduction Worksheet See the instructions for line 4 above to see if you must use this worksheet to figure your deduction. RESERVED. 42A740-A (10-18) Page 4 of 5 Schedule A-740 (2018) Instructions for Schedule A FullYear Resident

limited and you must use the worksheet below to figure your deduction. 1. Enter the total premiums you paid in 2017 for qualified mortgage insurance for a contract entered into on or after January 1, ... 2018 Qualified Mortgage Insurance Premiums Deduction Worksheet

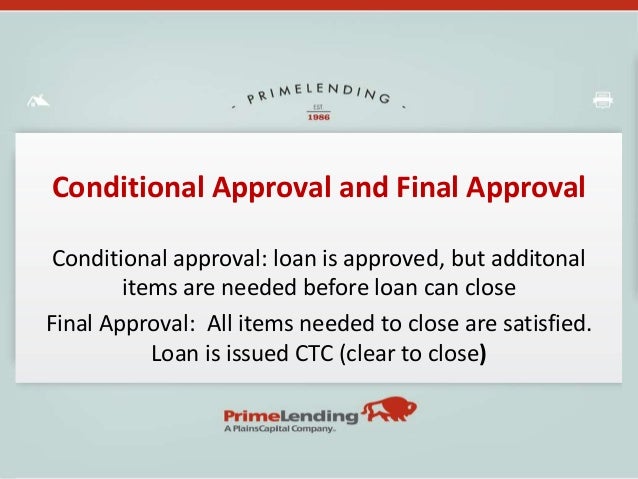

The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction.

1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3.

Mortgage Insurance Premiums. Form 1098, Mortgage Interest Statement. How To Report. Special Rule for Tenant-Stockholders in Cooperative Housing Corporations. Part II. Limits on Home Mortgage Interest Deduction. Home Acquisition Debt. Grandfathered Debt. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest ...

Fresh Mortgage Insurance Premiums Deduction Worksheet The loan may be a mortgage to buy your home or a second mortgage. Otherwise the IRS provides a Mortgage Insurance Premiums Deductible Worksheet on its website to help you calculate how much of a deduction youre entitled to claim as well as an interactive calculator online.

•Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You

Mortgage Insurance Premiums. Form 1098, Mortgage Interest Statement. How To Report. Special Rule for Tenant-Stockholders in Cooperative Housing Corporations. Part II. Limits on Home Mortgage Interest Deduction. Home Acquisition Debt. Grandfathered Debt. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest ...

23 Dec 2021 — However, attached to this PDF is a worksheet that includes the tables that ... can't deduct insurance premiums paid by.1 page

You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38, is more than $109,000 ($54,500 if married filing separately). If the amount on Form 1040, line 38, is more than $100,000 ($50,000 if married filing separately), your deduction is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to ...

14 Dec 2021 — Are the Life Insurance Proceeds I Received Taxable? Deductions. How Much Is My Standard Deduction? Can I Claim a Deduction for Student Loan ...

Dec 01, 2021 · Expenses that qualify for this deduction include premiums paid for a health insurance policy, as well as any out-of-pocket expenses for things like doctor visits, surgeries, dental care, vision ...

20 Aug 2021 — Determine if you can deduct mortgage interest, mortgage insurance premiums and other mortgage-related expenses.

See line 8d in the Instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums.

on points, mortgage insurance premiums, and how to report deductible interest on your tax re-turn. Generally, home mortgage interest is any in-terest you pay on a loan secured by your home (main home or a second home). The loan may be a mortgage to buy your home, a second mortgage, a line of credit, or a home equity loan.

See the instructions for line 8d to see if you must use this worksheet to figure your deduction. Enter the total premiums you paid in 2020 for qualified mortgage insurance for a contract issued after December 31, 2006 Enter the amount from Form 1040 or 1040-SR, line 11 Enter $100,000 ($50,000 if married filing separately) Is the amount on line ...

0 Response to "39 mortgage insurance premiums deduction worksheet"

Post a Comment