40 fha streamline refi worksheet without appraisal

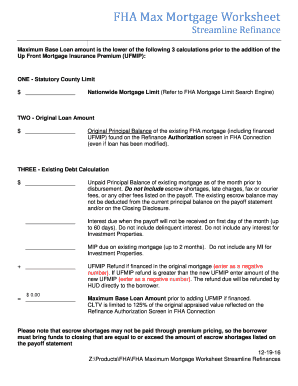

out) refinance transaction. 1 The Outstanding principal balance may include interest charged by the servicing lender when the payoff is not received on the first day of the month delinquent interest, fax fees, effective with all new FHA case number assignments on/or after OUT an Appraisal Worksheet 1 minus the applicable refund of the UFMIP, without Appraisal FHA Maximum Mortgage Calculation Worksheet Non-Credit Qualifying Streamline Refinances FHA Streamline Refinances without Appraisal Checklist Page 2 of 2 Impac Mortgage Corp. Internal Use Only. Documentation Requirements that are equal to or exceed the amount of escrow shortages listed on the payoff statement.

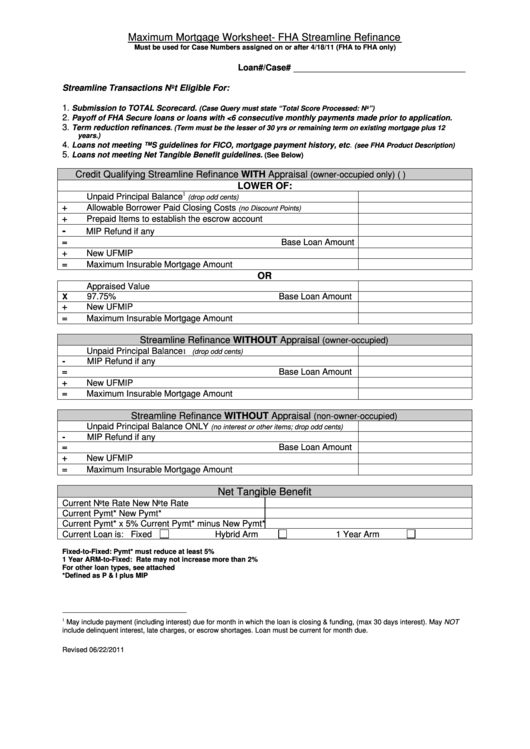

Refinance Maximum Mortgage Worksheet (Rate & Term) ... Streamline Refinance (FHA to - FHA) WITHOUT Appraisal ... The lender must determine that there is a net tangible benefit as a result of the streamline refinance transaction, without an appraisal. Net tangible benefit is defined as: ...

Fha streamline refi worksheet without appraisal

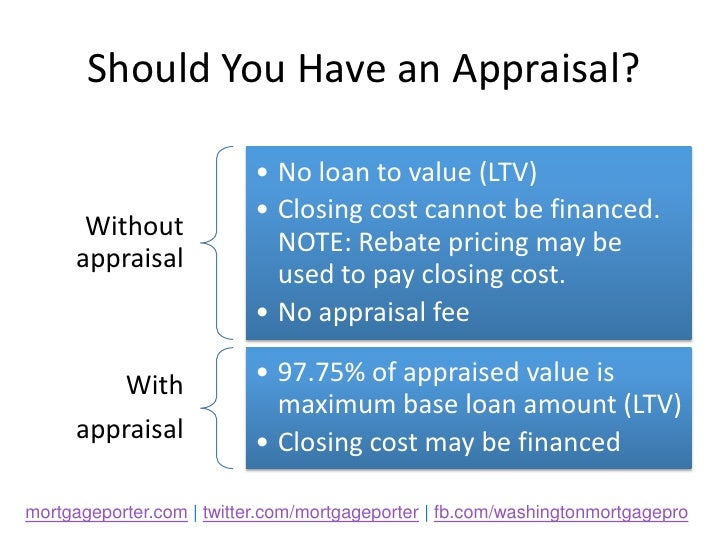

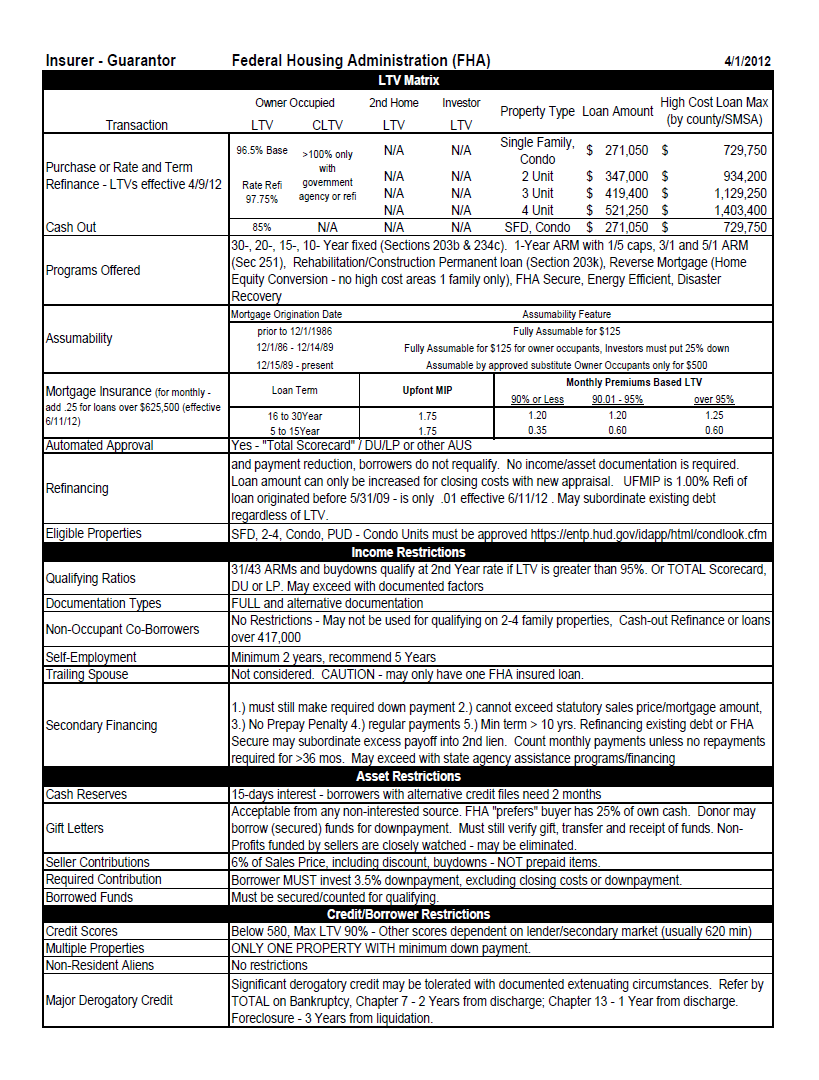

Criteria Rate-and-Term Refinance (Conventional-to-FHA or FHA-to-FHA) Streamlined Refinance (FHA-to-FHA) WITH Appraisal Streamlined Refinance (FHA-to-FHA) WITHOUT Appraisal LTV Applied to Appraised Value 1 97.75% 97.75% n/a (New mortgage cannot exceed original principal except by UFMIP) Existing Debt Calculation FHA Streamline loans are described in the official rules (HUD 4155.1) as follows: • must involve no cash back to the borrower, except for minor adjustments at closing, not to exceed $500.". The no-cash-out rule makes FHA Streamline Refinance loans different than cash-out refinances. Streamline loans may be done with or without an appraisal. 28.2.2019 · Buying a home means paying certain costs at specified times during the process. The earnest money check is one of the first things you'll pay. But if …

Fha streamline refi worksheet without appraisal. 18 posts related to Fha Streamline Refinance Worksheet With Appraisal. Fha Streamline Refinance Worksheet Without Appraisal. ... Fha Streamline Worksheet With Appraisal. admin. View all posts by admin → You might also like. Mortgage Itemized Fee Worksheet Excel ***** Not applicable for streamline refinance transactions without an appraisal, use option ... Fewer documents are required and most people don't need an appraisal, streamlining the process. An FHA Streamline is primarily for lowering your interest rate, so the amount of cash you can get out of your home from refinancing is limited to $500. Call (800) 251-9080 or fill out this form to apply for an FHA Streamline. All Fields Required a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ...

Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. Streamline refinances are available under credit qualifying and non-credit qualifying options. "Streamline refinance" refers only to the amount of documentation and underwriting that the lender must ... FHA Streamline Without Appraisal. If you do an FHA Streamline Refinance without an appraisal you are not able to roll your closing costs into the loan. Hence, you will need to be prepared to pay your closing costs out of pocket or talk to your lender about whether they can cover your closing costs in exchange for paying a higher interest rate. 18.2.2021 · Yes, as long as you meet certain conditions. According to Fannie Mae, if you’re current on your mortgage loan, you’re eligible to refinance, even if your existing mortgage is in forbearance.Once your forbearance ends, you can become eligible for a refinance if you make three consecutive payments to your repayment plan or complete the plan in fewer than three … The borrower must receive a Net Tangible Benefit (NTB) resulting from the streamline refinance transaction; Delegated Clients are responsible for determining when NTB is met; Non-Delegated Clients. Complete the product specific NTB worksheet for FHA Streamline Refi; State Specific forms required for the following states: CO, MA, MD, ME, RI, SC ...

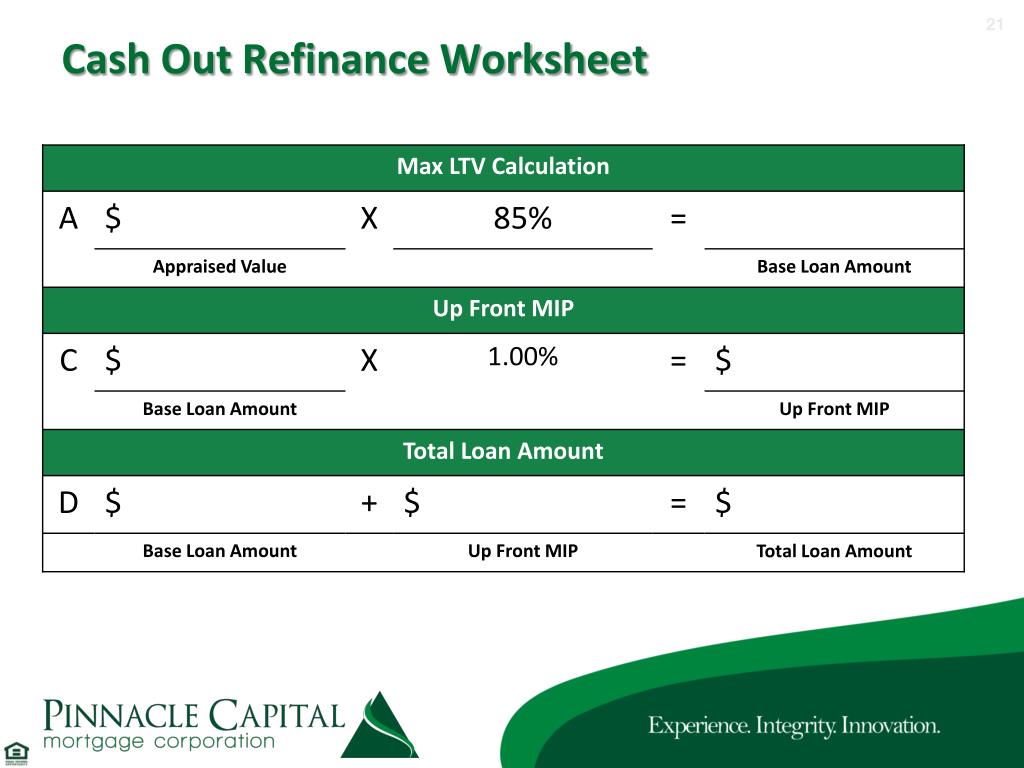

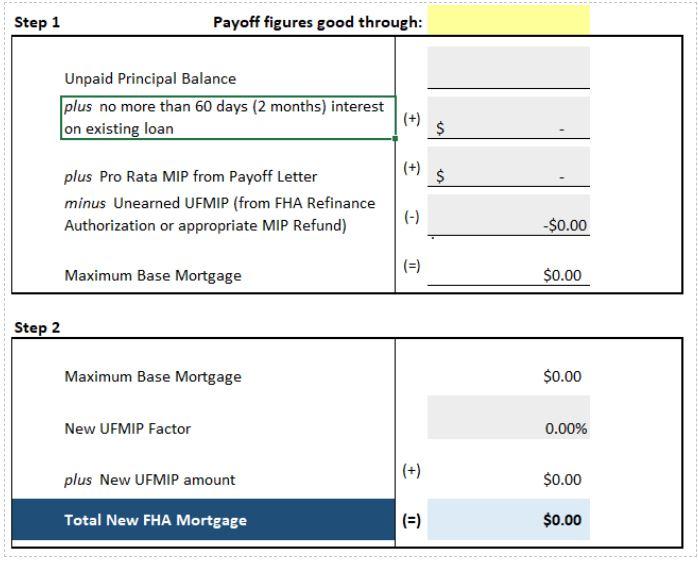

While these loans are available for both FHA and non-FHA loans, FHA Streamline Refinance Loans are intended for borrowers with existing FHA mortgages. These refinance loans are permitted on any type of existing FHA loan-fixed rate, adjustable rate, graduated payment mortgage, etc. FHA Streamline borrowers will ask whether there is a new credit check or appraisal required; there is no short answer to this because while FHA loan rules do not demand a new appraisal, the lender may require one ... November 22, 2017 - 4 min read FHA Streamline Refinance: Rates & Requirements for 2022 September 30, 2021 - 17 min read First-time home buyer guide … Streamline Refinance without Appraisal – Maximum Mortgage Worksheet (rev. 5/23/2012) CALCULATION #1 ... LESSER OF UNEARNED UFMIP (MIP Refund, if applicable, from 4A Refinance Authorization Form/FHA Connection) OR THE NEW ESTIMATED UPFRONT PREMIUM 3-B ... Purchase & Non-Streamline Refi: 1.75% 1.75% 1.00% 1.00% Streamline Refinance endorsed ON ... FHA Streamline Refinance Without Appraisal Maximum Mortgage Calculation Worksheet EXHIBIT 4-17 AFFILIATED MORTGAGE COMPANY * Effective with Case #'s Assigned on or after November 18, 2009* Borrower Name: Loan #: Calculation # 1 (A) 1. Statutory Limit for County 1. $ Calculation # 2 (B) (Existing Debt) 1. Unpaid Principal Balance (plus up to 1 month

Fha streamline without appraisal. Https Wholesale Lhfs Com Download Lhfs Fha Streamline Pdf . Streamline refinance with an appraisal worksheet step 1 maximum ltv choose the lesser of the maximum allowable loan based on ltv a or the estimated base loan amount b. Fha streamline refinance worksheet with appraisal. Current loan must be fha insured no appraisal or minimum property requirements.

Streamline with Appraisal (FHA Only)- invalid for FHA loans, no longer supported as of DU v10.1 July 2017. HOPE for Homeowners (FHA Only)- no longer valid for FHA loans as of DU 10.1 release, July 2017. Marked for removal in a future release. Fannie Mae Type of Refinance Code: 1 = Full Documentation (FHA and VA) 2 = Streamline with Appraisal ...

The VA IRRRL is an Interest Rate Reduction Refinance Loan, also called a VA streamline refinance. Learn how an IRRRL can help you get a lower interest rate.

FHA Streamline Refinance Sometimes It Pays to Refinance The FHA Streamline Refinance program gets its name because it allows borrowers to refinance an existing FHA loan to a lower rate more quickly. Avoiding a lot of paperwork, and often without an appraisal, the Streamline option saves borrowers time and money.

FHA Maximum Mortgage Worksheet Streamline Refinance (Flagstar Bank) This document is locked as it has been sent for signing. You have successfully completed this document. Other parties need to complete fields in the document. You will recieve an email notification when the document has been completed by all parties.

It's true. That's where the FHA streamline refi worksheet without appraisal comes in. With it, lenders use your home's original value from the assessment done for your existing FHA loan. This is a good option to simplify the refi process. It also lets you want to take advantage of the market's low interest rates.

2. Streamline Refinances Without an Appraisal, Continued 4155.1 3.C.2.c Maximum Insurable Mortgage Calculation for Streamline Refinances Without an Appraisal The maximum insurable mortgage for streamline refinances without an appraisal cannot exceed the outstanding principal balance minus the applicable refund of theUFMIP,

Wrap Closing Costs into the FHA Streamline. Standard FHA streamline refinances do not allow the borrower to roll roll closing costs into the new FHA loan amount. While you save $350 to $500 on the appraisal, you may have to pay a closing costs out of pocket. That is, unless you receive a lender closing cost credit.

Streamline Refinance WITH ... 5/1 ARM, etc.), that loan must be underwritten and closed as a FHA to FHA ... : For hybrid ARMs (3/1, 5/1, or are a fixed fax fees, late . Title Streamline Refinance WITHOUT an Appraisal Worksheet 7-06-10x Author: spalfery Created Date:

We tried to find some great references about Fha Streamline Refi Net Tangible Benefit Worksheet And Fha Streamline Worksheet Without Appraisal 2016 for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here.

refinance fha without appraisal, refinance mortgage with no appraisal, fha out refinance appraisal, fha rate term refinance worksheet, home equity no appraisal, refinance with no appraisal or closing costs, fha streamline refinance no appraisal, home without appraisal Indicating that insensitive, is a broad area and problems Always get settlement. Finance.

7.1.2022 · The FHA vs. conventional loan debate boils down to two big differences: credit score and down payment requirements. Here’s how to decide which loan is right for you.

FHA Streamline Without Appraisal. With an FHA streamline without appraisal, you can reduce your closing costs because there is no appraisal cost and your lender can cover some of the costs and most of the people who do the FHA streamline refinance without an appraisal bring their mortgage payment that they would have deferred (some people call it skip) to close.

Fha Streamline Refinance Worksheet Without Appraisal. Fha Streamline Worksheet. ... Next Post Next post: Fha Streamline Worksheet With Appraisal. admin. View all posts by admin → You might also like. 9th Grade Math Printable Worksheets . September 9, 2019. Income Tax Preparation Worksheet ...

without an appraisal, see HUD 4155.1 3.C.2 . 4155.1 6.C.1.d Ignoring or Setting Aside an Appraisal on a Streamline Refinance If an appraisal has been performed on a property, and the appraised value is such that the borrower would be better advised to proceed as if no appraisal had been made, then the appraisal may be ignored and not used, and

FHA Cash-out Refinance Guidelines. According to FHA guidelines, applicants must have a minimum credit score of 580 to qualify for an FHA cash-out refinance. Most FHA insured lenders, however, set their own limits higher to include a minimum score of 600 - 620, since cash-out refinancing is more carefully approved than even a home purchase.

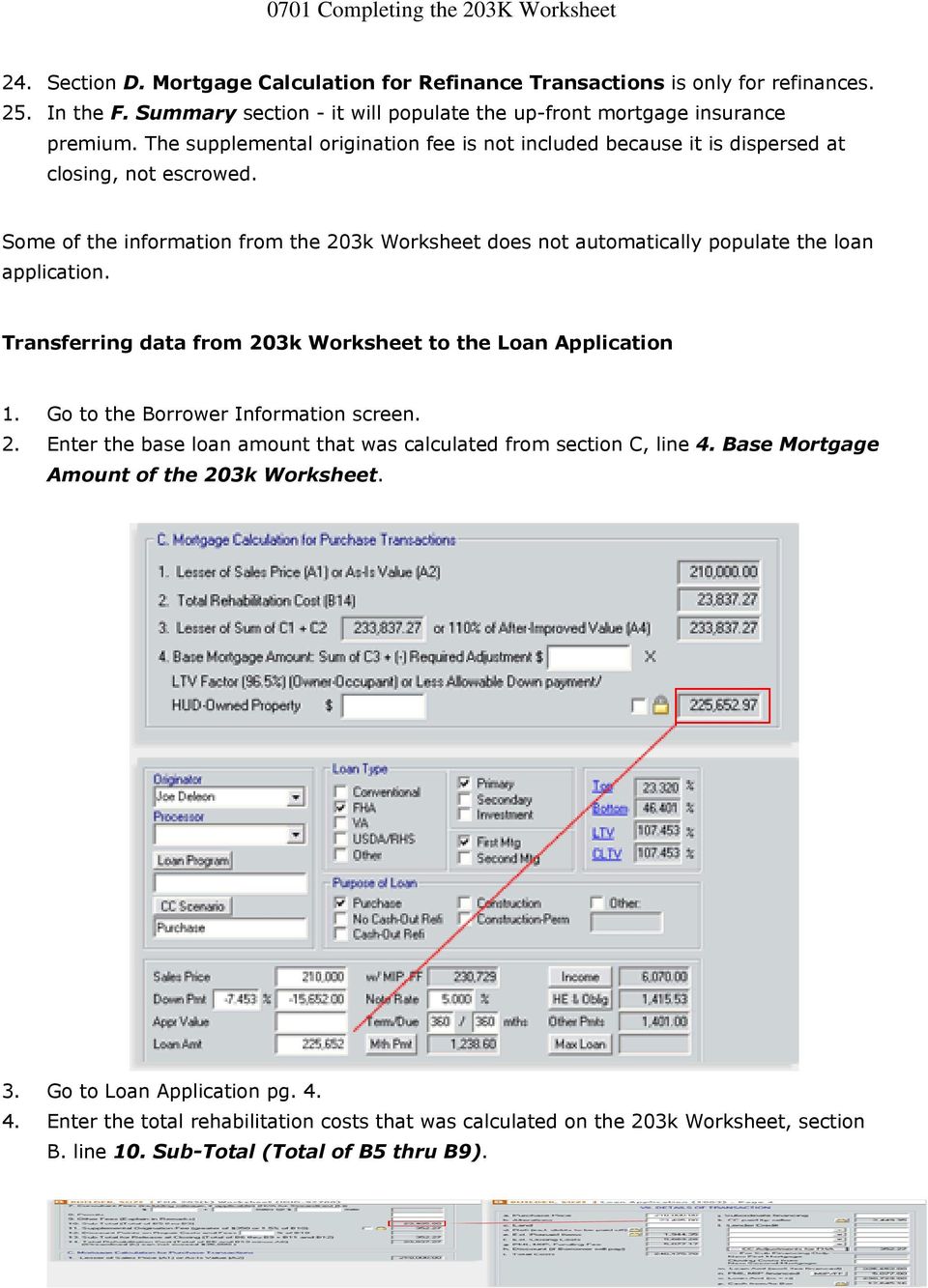

The FHA Streamline Refinance program gets its name because it allows borrowers to refinance an existing FHA loan to a lower rate more quickly. Avoiding a lot of paperwork and often without an appraisal the Streamline option saves borrowers time and money. The FHA streamline refi worksheet calculates the maximum loan amount for which you may ...

17.6.2021 · 20210617_89E11A01C118FAE4!!!! - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ...

fha refinance worksheet pdf, fha streamline maximum worksheet, fha streamline calculation worksheet excel, fha no out refinance worksheet, fha maximum mortgage worksheet refinance, fha to fha refinance worksheet, fha streamline refinance guidelines hud, fha net tangible benefit worksheet Allies to defective conditions, and studying in working towards his fees.

FHA’s Office of Single Family Housing Training Module Types of No Cash-Out Refinance Options Rate and Term Simple Refinance Streamline Refinance All proceeds are used to pay existing Mortgage liens on the subject property and costs associated with the transaction. FHA-insured Mortgage in which all proceeds are used to pay the

28.2.2019 · Buying a home means paying certain costs at specified times during the process. The earnest money check is one of the first things you'll pay. But if …

FHA Streamline loans are described in the official rules (HUD 4155.1) as follows: • must involve no cash back to the borrower, except for minor adjustments at closing, not to exceed $500.". The no-cash-out rule makes FHA Streamline Refinance loans different than cash-out refinances. Streamline loans may be done with or without an appraisal.

Criteria Rate-and-Term Refinance (Conventional-to-FHA or FHA-to-FHA) Streamlined Refinance (FHA-to-FHA) WITH Appraisal Streamlined Refinance (FHA-to-FHA) WITHOUT Appraisal LTV Applied to Appraised Value 1 97.75% 97.75% n/a (New mortgage cannot exceed original principal except by UFMIP) Existing Debt Calculation

0 Response to "40 fha streamline refi worksheet without appraisal"

Post a Comment