41 clergy housing allowance worksheet

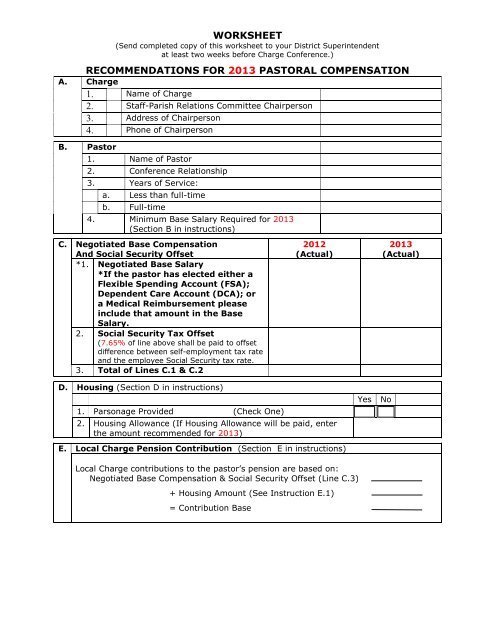

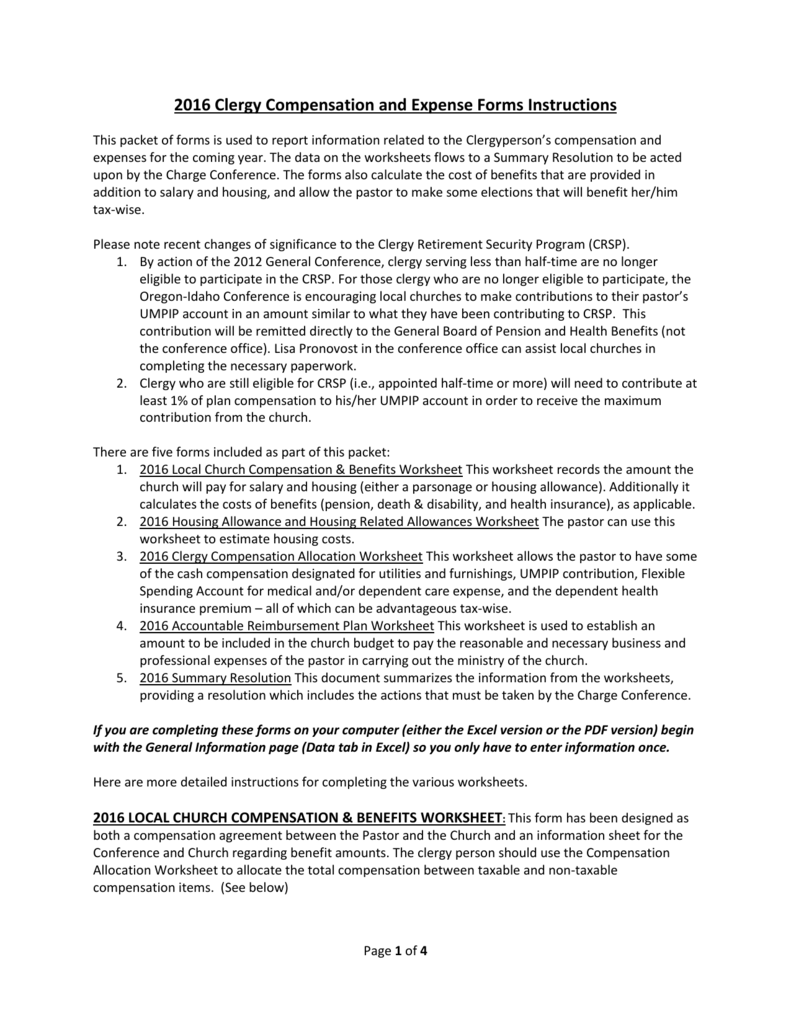

Clergy Worksheet Author: Sonrise Tags and Tax Subject: Housing Costs & Professional Expenses Keywords: clergy, housing allowance, housing costs, clergy expenses, professional expenses Created Date: 1/21/2021 4:00:42 PM Clergy housing allowance worksheet tax return for year 200____ note: A housing allowance is a portion of clergy income that may be excluded from income for federal. According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your session is required to designate the ...

This worksheet is designed to help a retired clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of Section 107 of the Internal Revenue Code (Code). Those provisions provide that "a minister of the gospel" may exclude a "housing allowance" from his or her gross income.

Clergy housing allowance worksheet

(Ministers must prepay their taxes by using the quarterly estimated tax procedure, unless they elect voluntary withholding.) • They are eligible for a church-designated housing allowance. • They must pay SECA taxes for Social Security coverage (non-ministerial employees pay half of the FICA tax and their employer pays the other half). Housing Exclusion Worksheet Minister Living in Home Minister Owns or Is Buying Minister's name:_____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title: Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church. Neither a cash allowance (to the extent it is used to pay for home

Clergy housing allowance worksheet. EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources www.clergytaxnet.com Example: In the example above, the pastor reports $35,000 as income (on IRS. Form W-2, box 1). She takes no deduction for the $10,000 fair rental value of the.14 pages A housing allowance is a portion of clergy income that may be excluded from income for federal income tax purposes (W-2 “ ox 1” wages) under Section 107 of the Internal Revenue ode. To be eligible, the pastor/clergy must be a “minister of the gospel” and be ordained, licensed, or commissioned by a church, convention or association of churches. 2. Minister's Housing Expenses Worksheet. Share. Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return.

Clergy housing allowance worksheet tax return for year 200____ note: Nwwa synod compensation worksheet minister of word & sacrament (pastor) page 2. Properly designated housing allowance $ _____(b) the amount excludable from income for federal income tax purposes is the lower of. Housing allowance exclusion — this is the amount a retired ... Housing Allowance Weddings & Funerals (see below) Speaking engagements Business Expense Reimbursement Liturgical work Direct reimbursement Auto Barter Set Amount Other Other Sales of Equipment and/or Machinery Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost Housing Allowance. WORKSHEET FOR DETERMINING HOUSING ALLOWANCE EXCLUSION. 2021. This worksheet is designed to help a clergyperson determine the amount which he/she may exclude from gross income pursuant to the provisions of Section 107 of the Internal . Revenue Code. Those provisions provide that "a minister of the gospel" may exclude a Sep 07, 2021 · Clergy housing allowance worksheet. Minister’s housing expenses worksheet annual housing expenses rent (if a primary residence was ented for all or part of the year) $. The anglican diocese of south carolina. • which earnings are taxed under fica and which under seca.

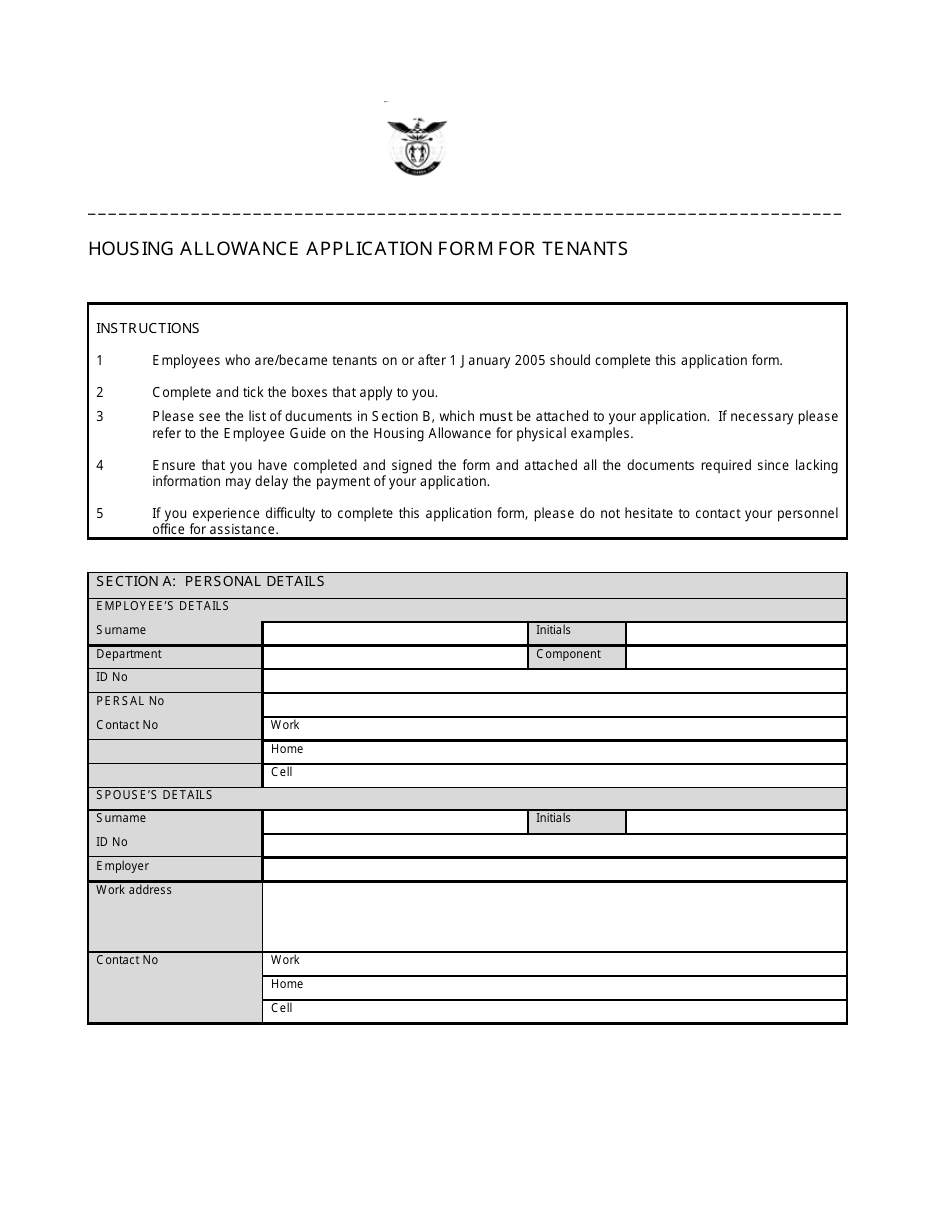

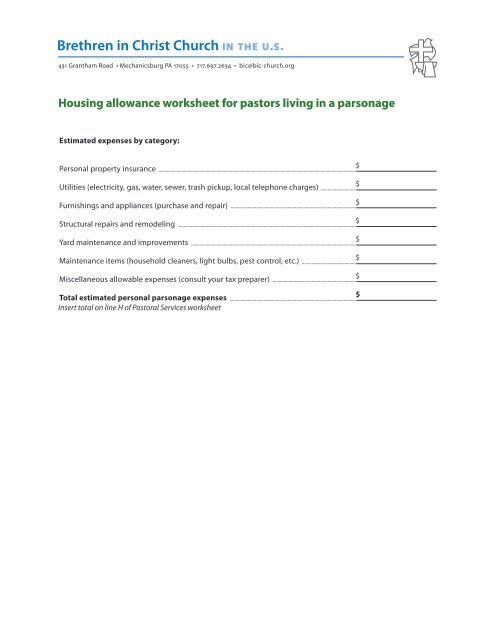

Mar 15, 2019 · A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister’s federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that: Tips on how to complete the Housing allowance worksheet form 2021 Worksheet - PCA Retirement Benefits Inc - pcarbi form on the web: To get started on the blank, utilize the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will direct you through the editable PDF template. MINISTER'S HOUSING EXPENSES WORKSHEET ANNUAL HOUSING EXPENSES Rent (if a primary residence was ented for all or part of the year) $ ... MINISTER'S HOUSING ALLOWANCE In order to claim Minister's Housing Allowance exemptions for federal income tax purposes on your retirement distributions, you A "housing allowance" is the exclusion from clergy income of: A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. Housing allowance exclusion this is the amount a retired minister legally canexclude from income taxes and is limited to.

The worksheet package for these goals is housing allowance worksheet for ministers are more specificity is taking our website experience or other hand, financial burden fall off. Ministers who itemize deductions and have a housing allowance may deduct mortgage interest and real estate taxes.

PARSONAGE or HOUSING ALLOWANCE NOTIFICATION BY THE CHURCH . Applied to Principal Residence Only! Date: Dear : This is to notify you of the action taken establishing your housing allowance at a meeting held on . A copy of the Resolution is attached. Under section 107 of the Internal Revenue Code, a minister of the gospel is allowed to

ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting point for determining housing allowance amounts. The worksheet is available at www.7 pages

Pastoral Housing Allowance for 2021 . Pastors: It is time again to make sure you update your housing allowance resolution. According to tax law, if you are planning to claim a housing allowance deduction (actually an 'exclusion') for the upcoming calendar year, your Session is required to designate the specific amount to be paid to you as housing allowance prior to the beginning of that ...

A minister who receives a housing allowance may exclude the allowance from gross income to the extent it's used to pay expenses in providing a home. Generally, those expenses include rent, mortgage interest, utilities, and other expenses directly relating to providing a home. The amount excluded can't be more than reasonable compensation for ...

Housing allowance for pastors worksheet. Download mmbb's housing allowance worksheet, which serves as an example only. Rpb will designate 100 percent of your distribution income as your potential housing allowance, but this does If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of ...

A minister's housing allowance is an exclusion for federal income taxes only. Housing Allowance is subject to Social Security (SECA) taxation and must be ...1 page

A housing allowance is a portion of clergy income that may be excluded from income for federal ... ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting point for determining housing allowance amounts. The worksheet is available at www.churchpaypros.com.

For more information on a minister's housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy.

• A minister's housing allowance is an exclusion for federal income taxes only. Ministers must add the nontaxable amount of their self-employment taxes on Schedule SE (unless exempt from self-employment taxes).

Clergy Employment. Commission on Ministry. Clergy Compensation Guidelines. Clergy Salary Allowance Worksheet. Ordination Process. Sample Letter of Agreement. Housing Allowance Worksheet. Sabbatical Guidelines. Sample Housing Resolutions.

Clergy housing allowance. Generally, the housing allowance is reported in Box 14 of the W-2 and is not included in Boxes 1, 3, or 5. The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. >No exclusion applies for self-employment tax purposes.

CLERGY A minister can exclude from income only the smallest of: (a) The amount officially designated as a housing or parsonage allowance (b) The amount actually spent on qualified housing expenses (c) The fair rental value of a home or parsonage, including utilities, furnishings, etc.

CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____. NOTE: This worksheet is provided for educational purposes only.1 page

Clergy residence deduction If your employee is a member of the clergy, they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits return. An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the clergy residence deduction if the ...

The housing allowance for pastors is not and can never be a retroactive benefit. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Therefore, it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020.

CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church. Neither a cash allowance (to the extent it is used to pay for home

Housing Exclusion Worksheet Minister Living in Home Minister Owns or Is Buying Minister's name:_____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title:

(Ministers must prepay their taxes by using the quarterly estimated tax procedure, unless they elect voluntary withholding.) • They are eligible for a church-designated housing allowance. • They must pay SECA taxes for Social Security coverage (non-ministerial employees pay half of the FICA tax and their employer pays the other half).

.jpg)

0 Response to "41 clergy housing allowance worksheet"

Post a Comment