42 1023 ez eligibility worksheet

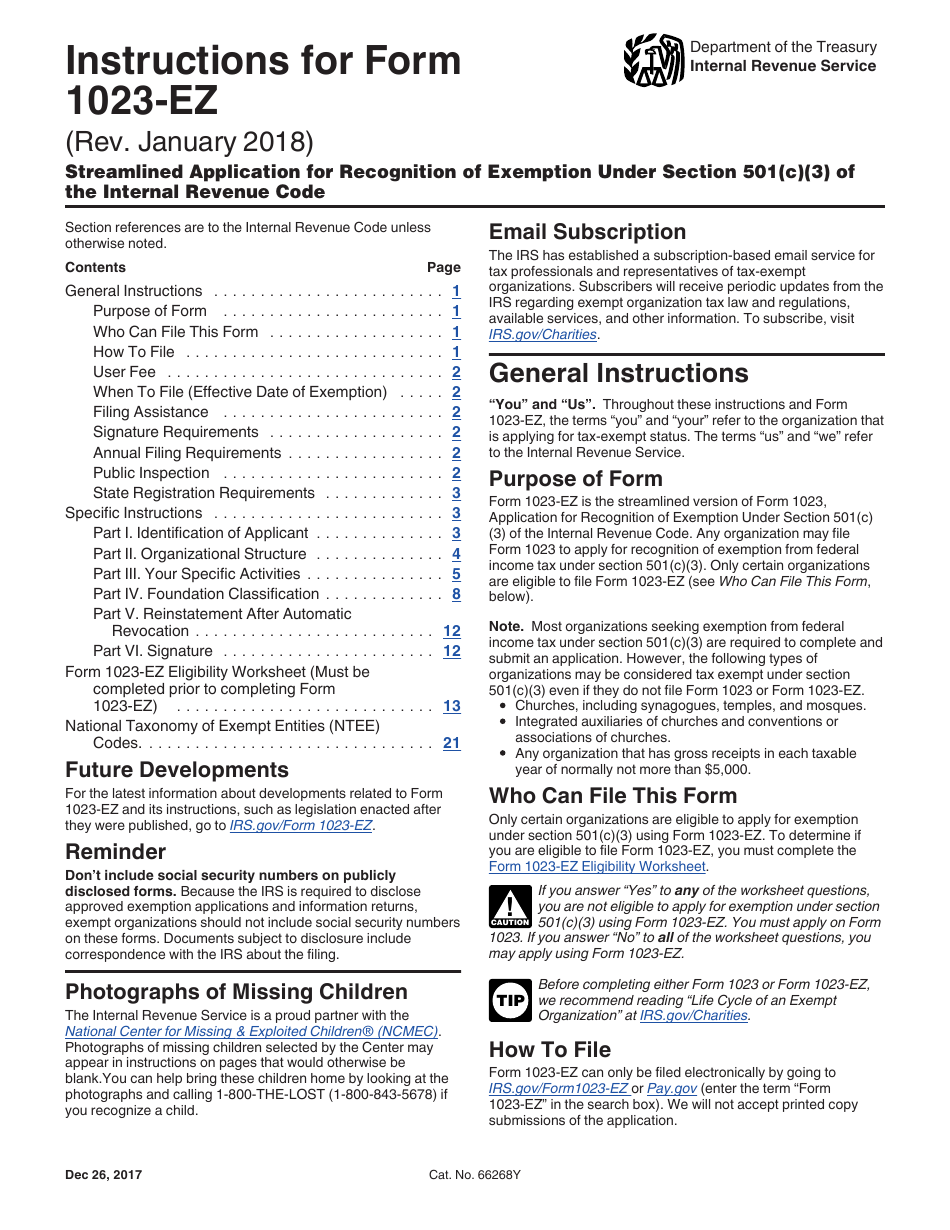

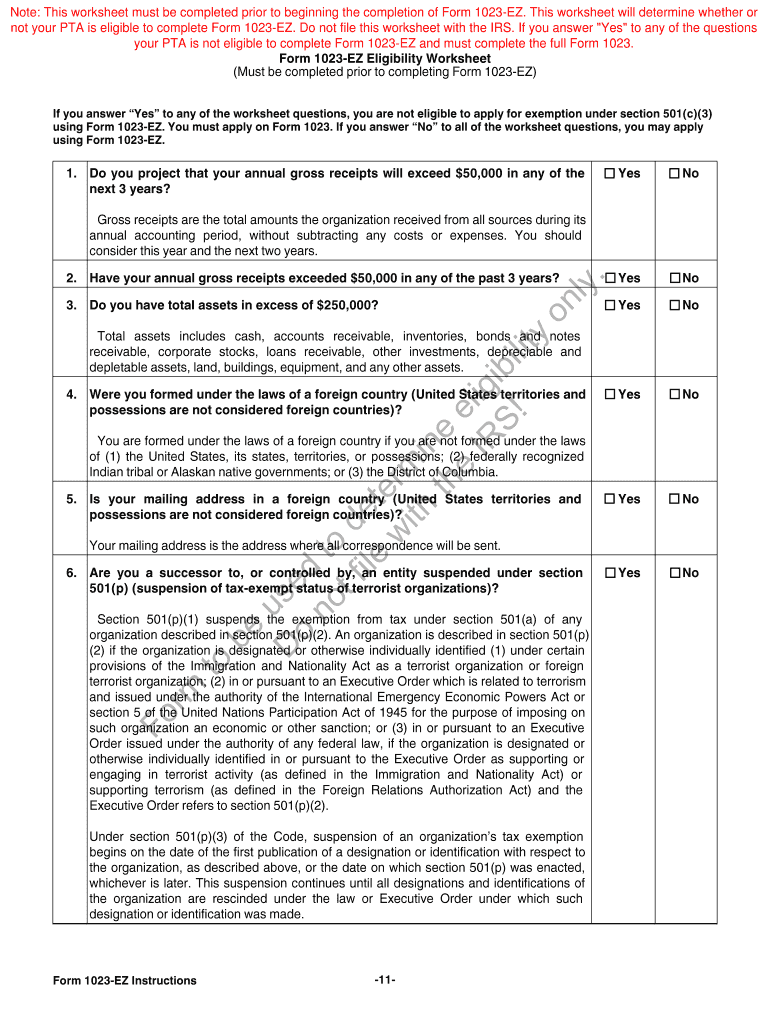

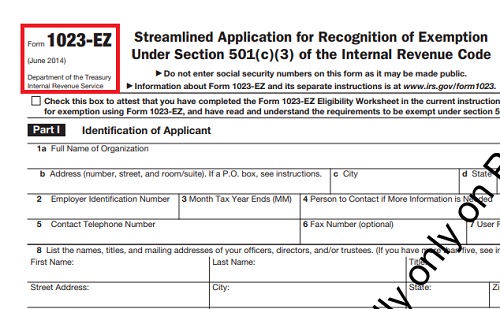

Any group wanting tax-exempt status through the new 1023-EZ form has to pass a 7-page, 26-question eligibility worksheet where just one “yes” answer disqualifies an organization. The other requirements are the annual revenue and assets ceiling. Big-name journalism nonprofits like , the Center for Investigative Reporting... be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption. You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZPDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023.

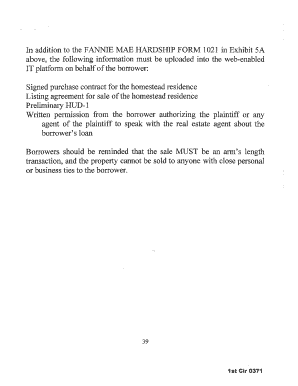

Completing Form 1023 or 1023-EZ..................................................................32 2. Schedule A .....................................................................................................35 G. Tax-Exempt Status Under State Law ....................................................................37... ...

1023 ez eligibility worksheet

Attorney General’s Guide for Charities Best practices for nonprofits that operate or fundraise in California California Department of Justice Charitable Trusts Section Protecting Charitable Assets and Donations for the People of California Message from the Attorney General What makes California great? The generous people who... ... (See page 19 for eligibility details and exclusion amounts); • N.J. Earned Income Tax Credit – The State credit increases to 40% of the federal credit – up from 39% last year. (See page 41); • Pass-Through Business Alternative Income Tax – Members in partnerships or S corporations pay taxes on the entity’s profits... ... If you're in the ballpark, complete the Form 1023-EZ Eligibility Worksheet contained in the Form 1023-EZ Instructions to determine if your nonprofit meets all the requirements for using the shorter streamlined form. If you are eligible to use it, this version of the form is much easier to complete and will take you much less...

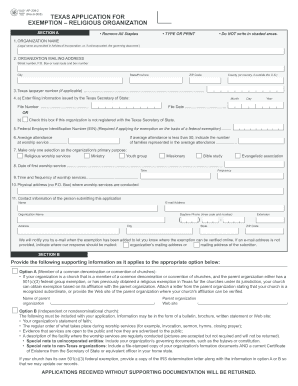

1023 ez eligibility worksheet. Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. You can determine if you qualify for this easier, streamlined option by filling out the eligibility worksheet. File IRS Form 1023 or 1023-EZ within 27 months to receive tax exemption dating from the date of your incorporation. Your exemption will only be valid from the application's postmark date if you wait any longer. You can... F 1 Briefly describe the organization's mission TO PROVIDE HIGH-QUALITY, AFFORDABLE HEALTH CARE SERVICES TO IMPROVE THE HEALTH OF OUR MEMBERS AND THE COMMUNITIES WE SERVE 2 Did the organization undertake any significant program services during the year which were not listed on the prior Form 990 or 990-EZ?... ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the form.

IRS Form 1023-EZ Eligibility Worksheet An organization that seeks to be a tax-exempt charity under Section 501(c)(3) of the Internal Revenue Code must apply for tax exempt status by preparing and filing with the IRS one of the following two IRS forms: 990-EZ7 . . . . . . . . . . . . . . . . . . . . . . fl Yes F No If "Yes," describe these new services on Schedule 0 3 Did the organization cease conducting , or make significant changes in how it conducts, any program services? . . . . . . . . . . . . . . . . . . . . . . . . . . . . F Yes F No If "Yes," describe these changes... ... The Complete Guide to Registering a 501c3 Nonprofit Ilma Ibrisevic May 11, 2021 Complying with bylaws, attaining and maintaining tax-exempt status, managing a Board of Directors… Starting and registering a nonprofit can seem like a complicated and daunting task. However, equipped with the right information and a resilient... Fundraising Solutions Contact Pricing Login Org Signup ilma Ilma Ibrisevic is a content creator and nonprofit... ... Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply

이름: 부호 (*********@***.*** ) 2003/11/26(수) 추천: 선(禪)으로의 초대 안녕하세요 ^^ 以心傳心 코너를 맡게 된 동국대학교 부호스님입니다... 이곳에서는 조사스님들의 삶과 사상이 묻어있는 조사어록이나 선전등을 소개하려합니다. 이러한 선어록이나 선전을... ... To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer “Yes” toof the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to of the worksheet... Another initiative from USDA would reduce 20.7 million burden hours now imposed on recipients of Supplemental Nutrition Assistance by allowing clients to certify eligibility for the program electronically or by telephone, thus reducing burdensome visits to the local program office. OMB believes that a great deal more can be... ... Smaller nonprofits may be eligible to file Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code... Check the IRS website and instructions to the form which include an Eligibility Worksheet you must complete to determine if your nonprofit meets the requirements...

If you're in the ballpark, complete the Form 1023-EZ Eligibility Worksheet contained in the Form 1023-EZ Instructions to determine if your nonprofit meets all the requirements for using the shorter streamlined form. If you are eligible to use it, this version of the form is much easier to complete and will take you much less...

(See page 19 for eligibility details and exclusion amounts); • N.J. Earned Income Tax Credit – The State credit increases to 40% of the federal credit – up from 39% last year. (See page 41); • Pass-Through Business Alternative Income Tax – Members in partnerships or S corporations pay taxes on the entity’s profits... ...

Attorney General’s Guide for Charities Best practices for nonprofits that operate or fundraise in California California Department of Justice Charitable Trusts Section Protecting Charitable Assets and Donations for the People of California Message from the Attorney General What makes California great? The generous people who... ...

0 Response to "42 1023 ez eligibility worksheet"

Post a Comment