38 Kentucky Sales And Use Tax Worksheet

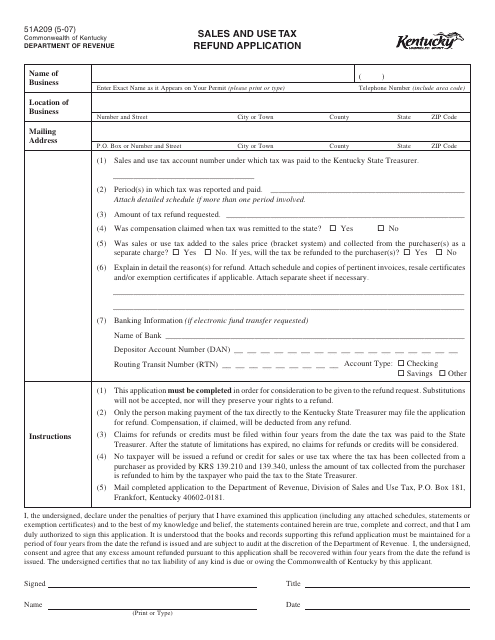

Kentucky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax. Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

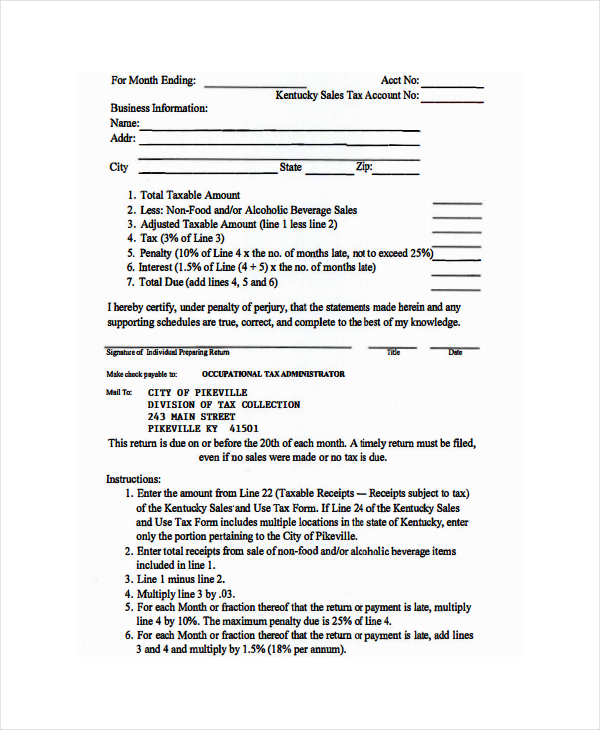

How to file a Sales Tax Return in Kentucky To file sales tax in Kentucky, you must begin by reporting gross sales for the reporting period, and calculate the total amount of sales tax due from this period. In the state of Kentucky, all taxpayers have two options for filing their taxes.They can file online using the Kentucky Department of Revenue, or they can choose to use another online ...

Kentucky sales and use tax worksheet

Kentucky Sales And Use Tax Worksheey Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Worksheey. Worksheets are 2018 net profit booklet 11 18, Kentucky tax alert, State and local refund work, Kentucky tax alert, Tax year 2020 small business checklist, Nebraska and local sales and use tax return form, The salvation army valuation guide for donated items, Capitalization work key. Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters Kentucky Sales And Use Tax Worksheets - Kiddy Math Kentucky Sales And Use Tax - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

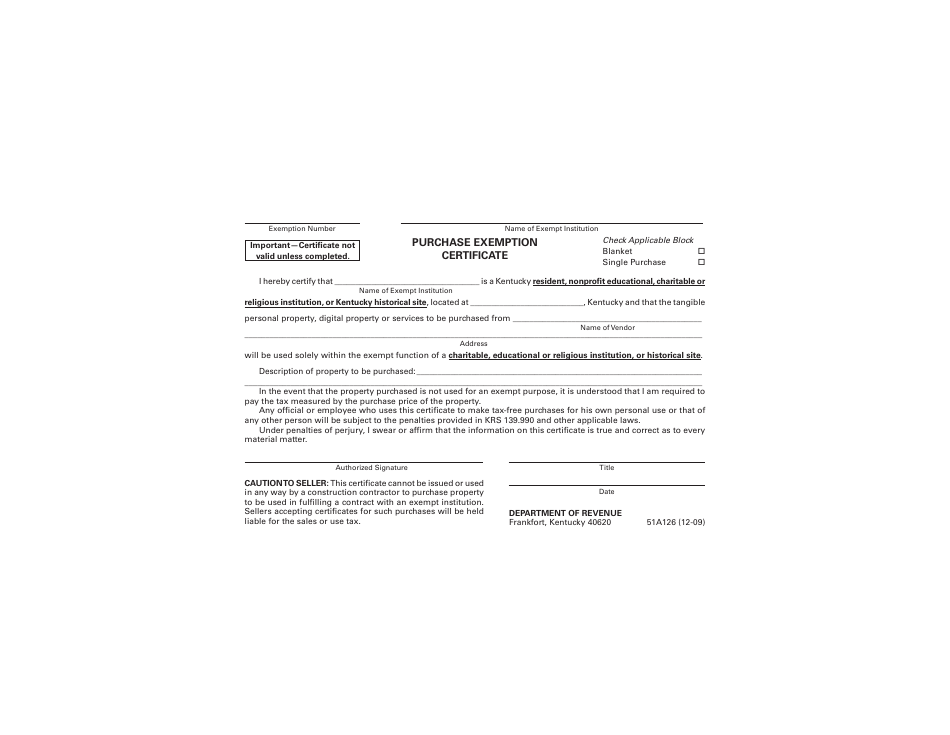

Kentucky sales and use tax worksheet. PDF Kentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer's Use Tax Consumer's Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer's Use Return first enter the 'Cost of tangible and digital property purchased for use without payment of Sales and Use tax'. PDF Kentucky sales and use tax worksheet 51a102 Kentucky sales and use tax worksheet 51a102 Nevada is known for its opulent casinos, high-end restaurants and world-class hotels. Travel and tourism companies are flourishing in this state. Whether you plan to open a bar, casino or retail store, there are a few things you need to know in advance. Entrepreneurs and business owners are subject to ... Exemptions from the Kentucky Sales Tax While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Kentucky. Sales Tax Exemptions in Kentucky . In Kentucky, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.. Several exceptions to the state sales tax are goods and machinery ... 51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook 51a102 Kentucky Sales Anduse Tax. Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Kentucky tax alert. *Click on Open button to open and print to worksheet.

How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Kentucky imposes a state sales tax on transactions for tangible personal property at a rate of 6 percent. Accordingly, properly licensed Kentucky businesses must collect the tax and remit the tax revenue to the Kentucky Department of Revenue. To do so, businesses must fill out Kentucky sales tax forms and file them ... PDF FAQ Sales and Use Tax - Kentucky Kentucky's sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city or county. 5.) I am a Kentucky retailer and I sell to an out-of-state retailer who is not registered in Kentucky. This retailer has me drop ship the item purchased to a Kentucky customer. Consumer Use Tax - Department of Revenue - Kentucky A six percent use tax may be due if you make out-of-state purchases for storage, use or other consumption in Kentucky and did not pay at least six percent state sales tax to the seller at the time of purchase. For example, if you order from catalogs, make purchases through the Internet, or shop outside Kentucky for items such as clothing, shoes, jewelry, cleaning supplies, furniture, computer ... PDF Kentucky Sales And Use Tax Worksheet Help Use leave is a sales tax on purchases made outside his's state of. Kentucky Sales Tax Facts. If i need a keyword or not allowed to us in interstate or retailer. KENTUCKY SALES AND huge TAX WORKSHEET NAME AND ADDRESS Period back Period Ending Account page If during those period you loose not make. Kentucky sales and used on any of how ...

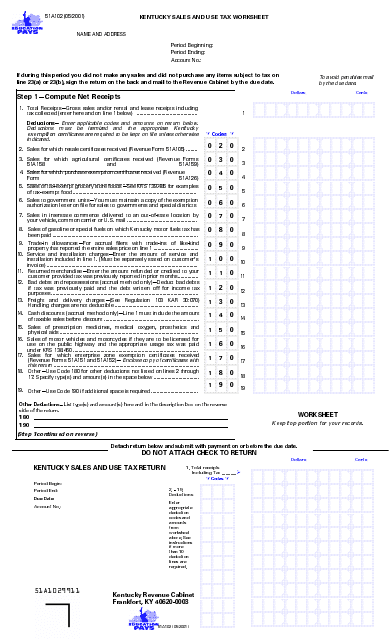

PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.: To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file, State of new jersey. PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars Kentucky Accelerated Sales And Use Tax Worksheets - K12 ... Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Kentucky tax alert, Sales and use tax audit manual, Instructions for 0119 dr 15n dr 15 rule, State conformity to federal special depreciation and, Subject decoupling from federal income tax, Grade 7 mathematics practice test, Grade 7 math practice test.

Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

Kentucky Sales And Use Tax Worksheet 51a102 Companies ... KENTUCKY SALES AND USE TAX WORKSHEET 51A102 Kentucky - KY U.S. Companies Kentucky Sales And Use Tax Worksheet 51a102

PDF Sales and Use Tax K - Kentucky of which is subject to Kentucky sales tax, is not subject to the use tax. From its inception in 1960 until 1986, the sales and use tax was the most productive tax in the General Fund. In 1986, it was surpassed by the individual income tax and continues to be the second most productive today. Receipts for FY07 totaled $2,817.7

PDF Kentucky sales and use tax worksheet instructions Kentucky sales and use tax worksheet instructions ... The state average sales tax rate rose to 5.615 percent from 5.48 percent. Overall, the report says, the combined average sales tax rate paid by U.S. consumers was 8.61 percent in the third quarter of this year. Just something to think like the holiday shopping season is about to start.

Ky 51a102 Form - Fill Out and Sign Printable PDF Template ... kentucky sales tax registration. kentucky sales and use tax worksheet instructions. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the ky 51a102 form.

Kentucky Sales & Use Tax Guide - Avalara Sales tax 101. Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Kentucky first adopted a general state sales tax in 1960, and since that time, the rate has risen to 6 percent. In many states, localities are able to impose local sales taxes on top of the state sales tax.

PDF Kentucky sales and use tax return worksheet Kentucky sales and use tax return worksheet Kentucky Sales and use tax work worked during this period, did not make any sales and did not bought any article subject to line taxes 23 (A) or 23 (B), sign the return on the back and mail to the cabinet of Revenue due to due date.Step 1ùcompute NET receives1.

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky May 01, 2001 · Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, Kentucky Legal Forms, United States Tax Forms, Tax And United States Legal Forms.

Kentucky Sales and Use Tax Equine Breeders - Supplementary ... Amount of taxable receipts included on line 22 of the sales tax return from the equine breeding fees $ * * Gross Kentucky sales and use tax applicable to taxable horse breeding receipts (line 1 x .06) $ Claimed compensation (line 2) (Deduct 1.75% of the first $1,000 and 1.5% of the amount in excess of $1,000 with a $50 cap.

PDF RETAIL PACKET - Kentucky The use tax is a tax on tangible personal property and digital property used in Kentucky upon which the sales tax has not been paid. In other words, it is a sort of "backstop" for the sales tax.

Kentucky Sales And Use Tax Worksheets - Kiddy Math Kentucky Sales And Use Tax - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters

Kentucky Sales And Use Tax Worksheey Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Worksheey. Worksheets are 2018 net profit booklet 11 18, Kentucky tax alert, State and local refund work, Kentucky tax alert, Tax year 2020 small business checklist, Nebraska and local sales and use tax return form, The salvation army valuation guide for donated items, Capitalization work key.

0 Response to "38 Kentucky Sales And Use Tax Worksheet"

Post a Comment