39 itemized deductions worksheet 2015

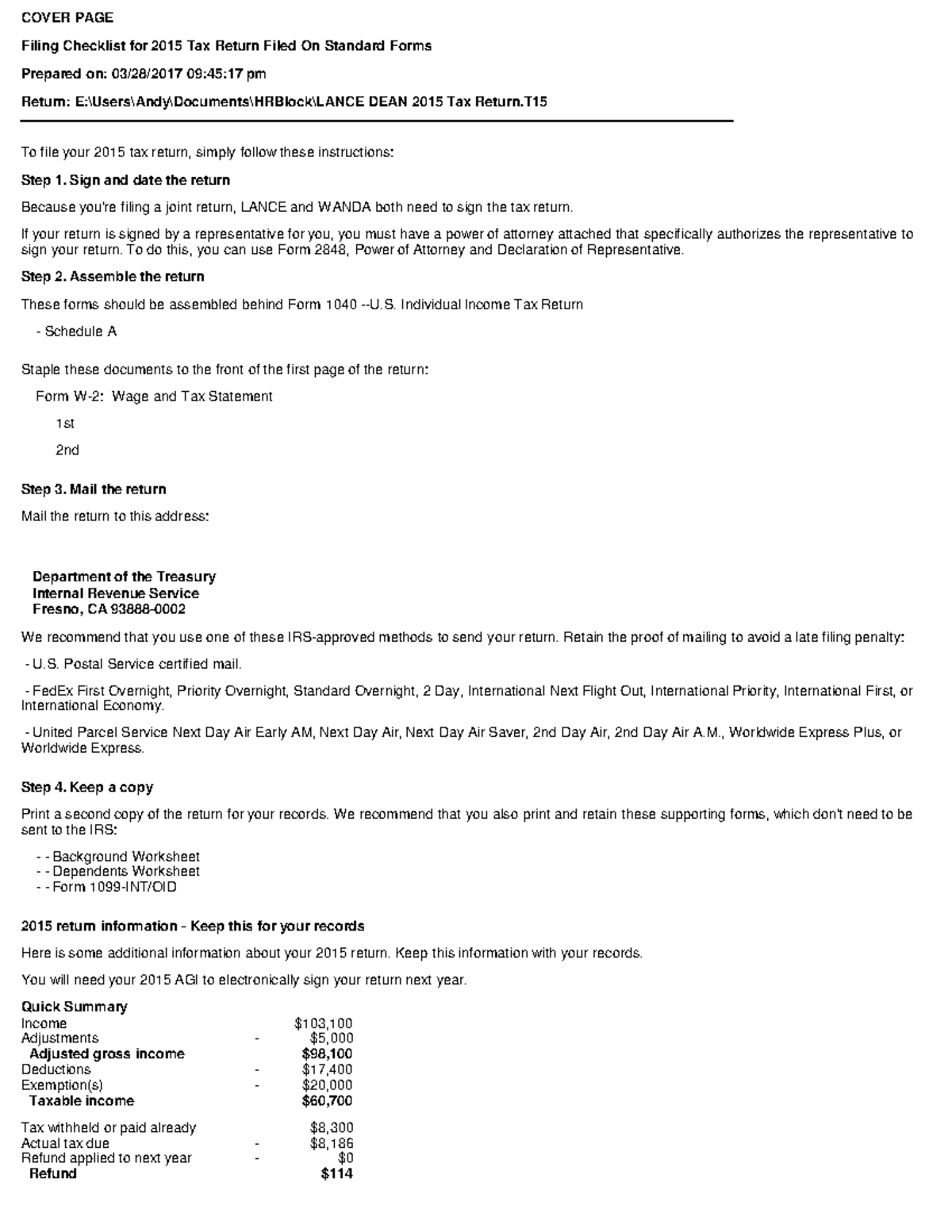

Difference Between Standard Deduction and Itemized... | H&R Block Itemizing your tax deductions makes sense if you: Have itemized deductions that total more than the standard deduction you would receive (like in the ©2015 InComm. All Rights Reserved. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money... Download Itemized Deductions Calculator Excel... - ExcelDataPro Itemized Deductions Calculator is an excel template. It helps the taxpayer to choose between Standard and Itemized Deductions. The standard deduction is a fixed dollar amount to be deducted from taxable income with no questions asked. Whereas the itemized deductions are...

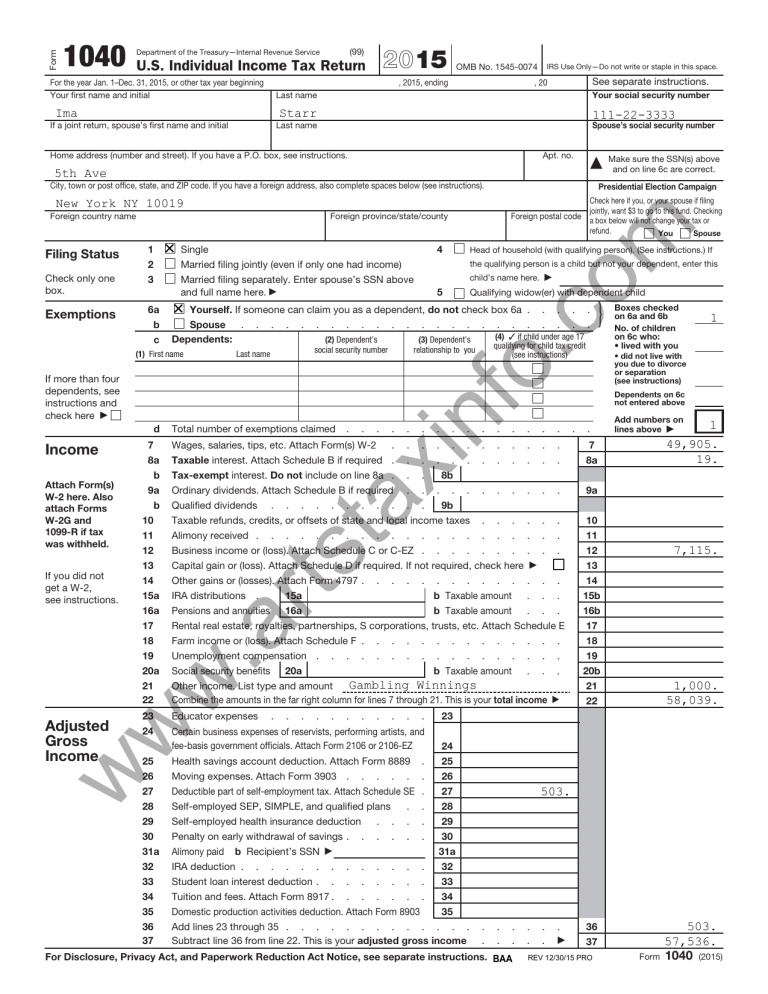

Tax Implications of Starting a New Business - H&R Block 31/01/2020 · Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, taxable scholarships or fellowship grants, and …

Itemized deductions worksheet 2015

PDF Microsoft Word - Itemized Deduction Worksheet Itemized deduction worksheet. You can itemize IF your expenses exceed the standard deduction: Single ‐ $6100, Married Filing Joint ‐ $12,200, Head of Household ‐ $8,950. PDF 2015 ITEMIZED DEDUCTIONS - FINAL as of 9-18-2015.pub 2015 itemized deductions worksheet. For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if. You could record these expenses on this worksheet or just use this worksheet as a checklist of what would be deductible. Solved: Itemized deduction worksheet? Itemized deduction worksheet? TurboTax will automatically select the type of deduction that brings you the most tax benefit based off of your entries within the program. You can view your Scheule A: Itemized Deductions by taking the following steps

Itemized deductions worksheet 2015. Itemized Deductions Itemized Deductions Tax Computation Pub 4012 - Tab F Pub 4491 - Part 5 - Lessons 20 & 21 TAX-AIDE TAX-AIDE NTTC Training - TY2015 4 Possible Itemized Deductions Pub 4012 F-3 ● Worksheet ● If need Form 8283, either link from A Detail worksheet or "Add" the form TAX-AIDE... Itemized Deductions: A Beginner's Guide - Money Under 30 Itemized deductions require more paperwork and record-keeping - but if you had high medical bills, state and local taxes, and sizable interest payments last Deducting stuff from your taxes is honestly pretty satisfying. Whether it's the standard deduction amount or you go the itemized route, either will... Individual Income Tax Forms - 2021 | Maine Revenue Services Worksheet for phaseout of itemized / standard deductions (PDF) Worksheet for phaseout of personal exemption deduction amount (PDF) Form 2210ME underpayment of estimated tax (PDF) Annualized Income Installment Worksheet for Form 2210ME (PDF) Schedules & Worksheets. Schedule PTFC/STFC (PDF) - Property Tax Fairness Credit and Sales Tax Fairness Credit Itemized Deductions Worksheet For Small | Qualads Small Business Expenses Spreadsheet With Tax Itemized Deductions | 1200 X 1553. Thanks for visiting my blog, article above(Itemized Deductions Worksheet For Small) published by lucy at February, 26 2017.

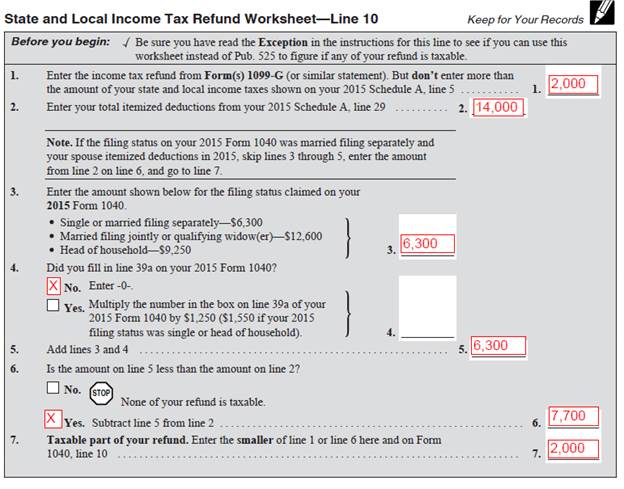

[PDF] Itemised Deductions: A Device to Reduce... | Semantic Scholar Itemised deductions provide an incentive for consumers to declare their purchases, and this forces sellers to do the same. I show that, for any level of taxation, it is possible to increase tax proceeds by choosing the proper level of itemised deduction; the cost for the government on the consumers' side... › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Line 12a Itemized Deductions or Standard Deduction. Itemized Deductions; Standard Deduction. Exception 1—Dependent. Exception 2—Born before January 2, 1957, or blind. Exception 3—Separate return or dual-status alien. Exception 4—Increased standard deduction for net qualified disaster loss. Standard Deduction Worksheet for Dependents ... PDF Drake-produced PDF 2015 State and Local Income Tax Refund Worksheet. (Keep for your records). 2016. Tax ID Number. Worksheet 1 - 2015 Schedule A worksheet as If your 2015 filing status was MFS and your spouse itemized deductions. in 2015, skip lines 3, 4, and 5, and enter the amount from line 2 on line 6 below. IRS Itemized Deductions 30 Realtor Tax Deduction Worksheet - Worksheet Database ... Itemized Deductions Worksheet | Kids Activities. Tax Deductions Gone in 2018 Itemized Deduction Worksheet 2015 - Nidecmege. small business tax worksheet - News. 2019 IRS Tax Form 1040 (schedule A) Itemized Deductions ...

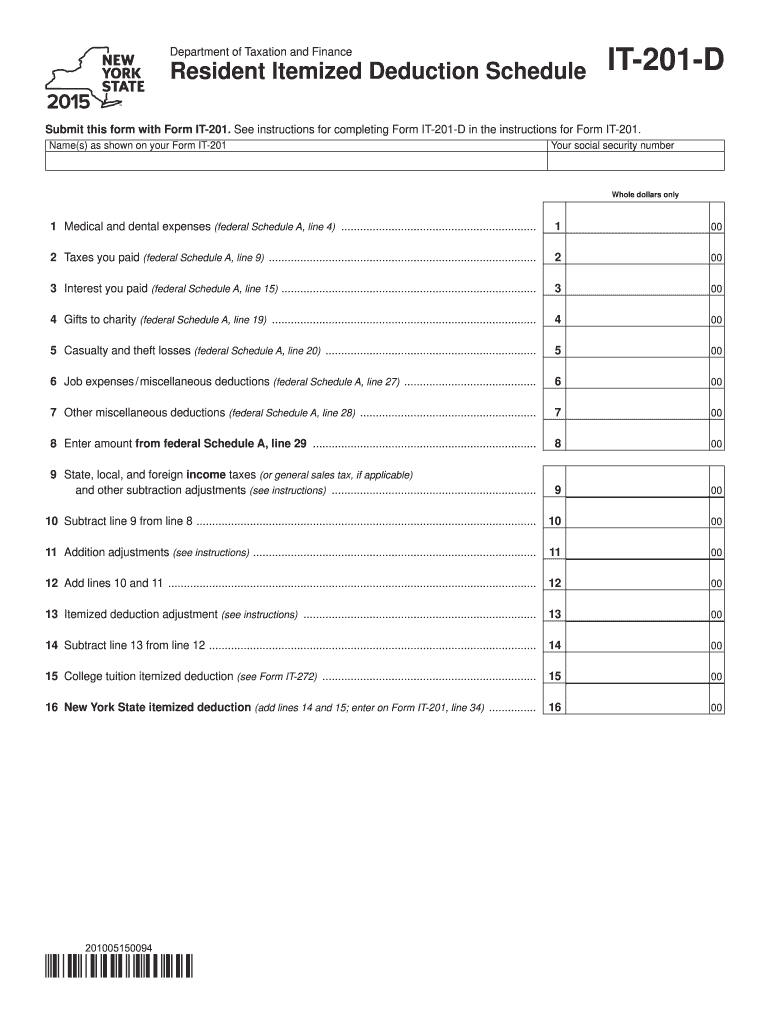

Form IT-203-B:2015:Nonresident and Part-Year Resident ... Nonresident and Part-Year Resident Income Allocation. And College Tuition Itemized Deduction Worksheet. Any part of a day spent in New York State is considered a day spent in New York State. IT-203-B (2015) (back) Enter your social security number. Itemized Deductions Worksheet Printable Itemized Deductions Worksheet Printable .PDF Version. Posted by Taxprosites.com on 10/7/04 Prepared by Back to Basics Seminars. You can itemize if your expenses exceed the standard deduction: Single - $4750, Married filing joint - $9500, Head of Household - $7000. what are schedule a itemized deductions. Search, Edit, Fill, Sign, Fax... Generally, the itemized deductions allowed for Arizona are those itemized deductions allowable under Office of Student Financial Aid 2014-2015 Supplemental Nutrition Assistance Program (Food Stamps) See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. › instructions › i8801Instructions for Form 8801 (2021) | Internal Revenue Service Jan 13, 2022 · Line 2. Enter on this line the adjustments and preferences treated as exclusion items. Exclusion items are only the following AMT adjustments and preferences: certain itemized deductions (including any investment interest expense reported on Schedule E), certain tax-exempt interest, depletion, the section 1202 exclusion, the standard deduction, and any other adjustments related to exclusion items.

5 Best Images of Itemized Tax Deduction Worksheet - 1040 Forms... 1040 forms itemized deductions worksheet 2015, tax refund calculator and schedule c tax deduction worksheet are some main things we will Our goal is that these Itemized Tax Deduction Worksheet images gallery can be a guidance for you, deliver you more ideas and also present you what you want.

2015 AR3 Enter amount from Form AR1000F/AR1000NR, line 24(A) and 24(B): .....2 ... ARKANSAS INDIVIDUAL INCOME TAX. ITEMIZED DEDUCTION SCHEDULE. 2015.1 page

Publication 525 (2021), Taxable and Nontaxable Income ... Overall limitation on itemized deductions no longer applies. Worksheet 2a. Computations for Worksheet 2, lines 1a and 1b; Worksheet 2. Recoveries of Itemized Deductions; Unused tax credits. Subject to AMT. Nonitemized Deduction Recoveries. Total recovery included in income. Total recovery not included in income. Negative taxable income. Unused ...

Itemized Deductions (Tax course) Flashcards | Quizlet Use the Itemized Deductions Worksheet to figure the amount to enter on line 29 if the amount on Form 1040, line 38, is over $311,300 if married filing jointly or Provisions in the ACA increase the deduction from 7.5% of AGI in 2015 to 10% of AGI in 2015 and 2016 for taxpayers under 65 years old.

› 2015-federal-tax-formsFREE 2015 Printable Tax Forms | Income Tax Pro Sep 12, 2019 · You must file federal Form 1040 for 2015 under these circumstances: Failed the Form 1040EZ and Form 1040A requirements. Taxable income of $100,000 or more. Itemized deductions, interest, property tax, medical, dental, etc. Capital gain or loss, other gains or losses. Business income or loss, self-employed, LLC, etc. Farm or fisherman income or ...

apps.irs.gov › app › picklistPrior Year Products - IRS tax forms Itemized Deductions 2015 Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040), Itemized Deductions 2014 Form 1040 (Schedule A) Itemized Deductions ...

Worksheet for Itemized Deductions - Google Таблицы Worksheet for Itemized Deductions. Настройки доступа. Войти.

itemized deductions worksheet printable - Bing Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Mar 20, 2015 · Continue with more related things as follows 2014 itemized deductions worksheet, 2015 california 540 2ez tax table forms and itemized...

› tax-deduction › federal-standardIRS Federal Standard Tax Deductions For 2021 and 2022 Jan 17, 2022 · IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform.

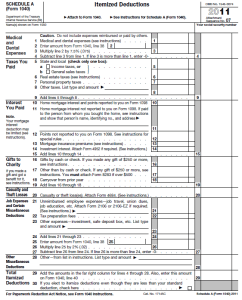

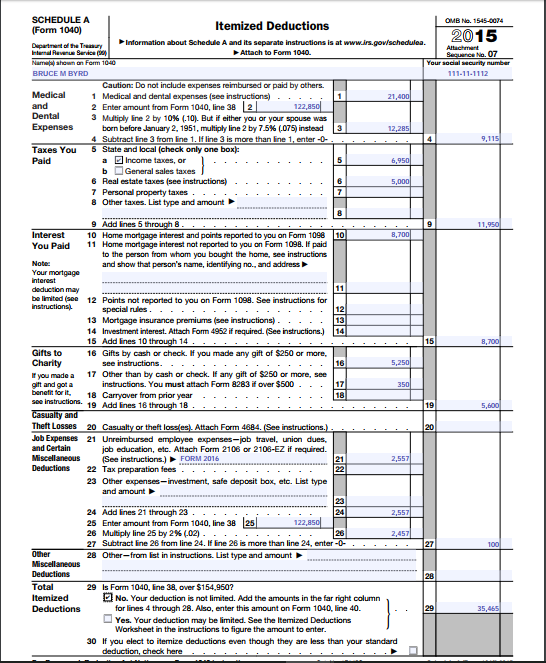

Attach to Form 1040. Itemized Deductions . 29 . Is Form 1040, line 38, over $154,950? 29 No. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30

PDF Itemized Deductions See the Itemized Deductions. Worksheet in the instructions to figure the amount to enter. 30 If you elect to itemize deductions even though they are less If you paid 2015 expenses in 2016, see the instructions for line 9 . ... . 30 Complete line 2 on the front of this form. Do not include in column...

Form MO-SHC - 2015 Self-Employed Health Insurance Tax ... Self-employed individuals with personal exemptions and itemized deductions limited on their federal return because their federal adjusted.

PDF 2021 Instructions for Schedule A Total Itemized Deductions. Line 18. Department of the Treasury Internal Revenue Service. 2021 Instructions for Schedule A. If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, contributions, and other expenses.

Irs Itemized Deductions Worksheet, Jobs EcityWorks itemized deduction worksheet 2015 worksheets gives your Excel worksheet a lot more versatility. In order to use Excel worksheets to do the job that You can type Irs Itemized Deductions Worksheet + your location into the search bar on the homepage, the system will give you the most relevant results.

Itemized Deduction Worksheets - Learny Kids Itemized Deduction Worksheets - total of 8 printable worksheets available for this concept. Some of the worksheets for this concept are Schedule a itemized deductions, Deductions form 1040 itemized, Itemized deductions work, Itemized deduction work tax year, Personal itemized...

Itemized Deduction Definition Itemizing deductions allows some taxpayers to reduce their taxable income, and thus their taxes, by more than if they used the standard deduction. An itemized deduction is an expense that can be subtracted from adjusted gross income (AGI) to reduce your tax bill.

PDF Itemized Deductions Worksheet Itemized Deductions Worksheet. Medical Expenses. Charitable Contributions. Expenses to enable individuals, who are physically or mentally impaired, to work are generally deductible. Adjustments Worksheet.

Itemized Deduction Worksheet printable pdf download View, download and print Itemized Deduction Worksheet pdf template or form online. Miscellaneous Itemized Deductions. The following must exceed 2% State estimated taxes-paid last year

2015 Instructions for Schedule A (Form 1040) - Internal ... Jan 11, 2016 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you ...

› ohio-tax-rates-forms-and-bracketsOhio Income State Tax Rates, Forms, Standard Deductions. IRS Standard Deduction: Federal Standard Deductions 2021 Tax Year Ohio Income Tax Forms Ohio State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed in conjunction with a IRS Income Tax Return.

charitable-worksheet.pdffiller.comDonation Value Guide 2020 Excel Spreadsheet - Fill Online ... When the deductions a contributor wants to claim exceed $500, they should also file the IRS Form 8283. When is Non Cash Charitable Contributions/Donations Worksheet due? The Salvation Army Donation Value Guide should be referred to and the 8283 Form (if applicable) should be submitted when the contributor is filing their yearly tax return.

4 Itemized Deductions Worksheet | FabTemplatez Itemized Deductions Worksheet Line 29 Worksheets for all Itemized Deductions Worksheet 618245 89 best Tax Season images on Pinterest Deductions Worksheet 329438 Fillable self employment tax deductions worksheet Edit line Itemized Deductions Worksheet 277358 Learn...

PDF MergedFile | Claim for College Tuition Credit or Itemized Deduction To compute your college tuition itemized deduction, complete Worksheet 1 in the instructions for this form. How do I claim the college tuition credit or itemized deduction? If you paid qualified college tuition expenses in tax year 2015, complete all sections of Form IT-272 that apply to you.

PDF Itemized deduction worksheet (14A) Itemized deduction worksheet (14A). (To be used only by high-income taxpayers who were required to reduce their federal itemized deductions).

2015 Itemized Deductions Worksheet Printable , 02-2022 2015-Schedule-A-Limit-Worksheet - Itemized Deductions WorksheetLine 29 Keep for Your Records 1 Enter the total of the amounts from Schedule A lines 4 9. Additions Line 1 Itemized Deduction Limitation Complete the worksheet for line 1 on this page if your federal adjusted gross income is...

Itemized Deductions Worksheet | Homeschooldressage.com Itemized Deduction Worksheet - PPS Tax Service from Itemized Deductions Worksheet, source:ppstaxservice.com. DOR Phaseout of 2013 Itemized Deductions from Itemized Deductions Worksheet, source:revenue.wi.gov.

Solved: Itemized deduction worksheet? Itemized deduction worksheet? TurboTax will automatically select the type of deduction that brings you the most tax benefit based off of your entries within the program. You can view your Scheule A: Itemized Deductions by taking the following steps

PDF 2015 ITEMIZED DEDUCTIONS - FINAL as of 9-18-2015.pub 2015 itemized deductions worksheet. For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if. You could record these expenses on this worksheet or just use this worksheet as a checklist of what would be deductible.

PDF Microsoft Word - Itemized Deduction Worksheet Itemized deduction worksheet. You can itemize IF your expenses exceed the standard deduction: Single ‐ $6100, Married Filing Joint ‐ $12,200, Head of Household ‐ $8,950.

0 Response to "39 itemized deductions worksheet 2015"

Post a Comment