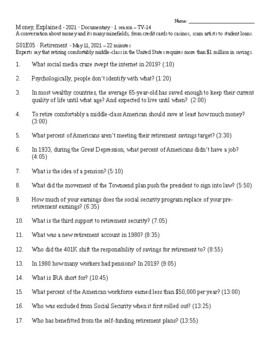

41 funding 401ks and roth iras worksheet

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET -. Funding 401(k)s & Roth IRAs Chart.docx. Complete Funding 401ks and Roth IRAs Worksheet.jpg. Funding 401ks and IRAs Worksheet | Tagua A Roth IRA is the most common type of IRA. It works like the traditional IRA, but it can save you taxes on your retirement income. This will help you save money and keep your spending under control. Funding 401ks and Iras Worksheet and How Much Money Do I Need to Retire Gobankingrates.

Activity: Funding 401(k) s and Roth IRAs Objective: | Chegg.com 401(k). Roth IRA. Total Annual Investment. Adrian is not eligible to open a Roth IRA because he makes too much money. He will put his entire 15% into his 401(k). David & Britney are still within the guidelines for a married couple (based on 2011 contributions of $5,000 per individual).

Funding 401ks and roth iras worksheet

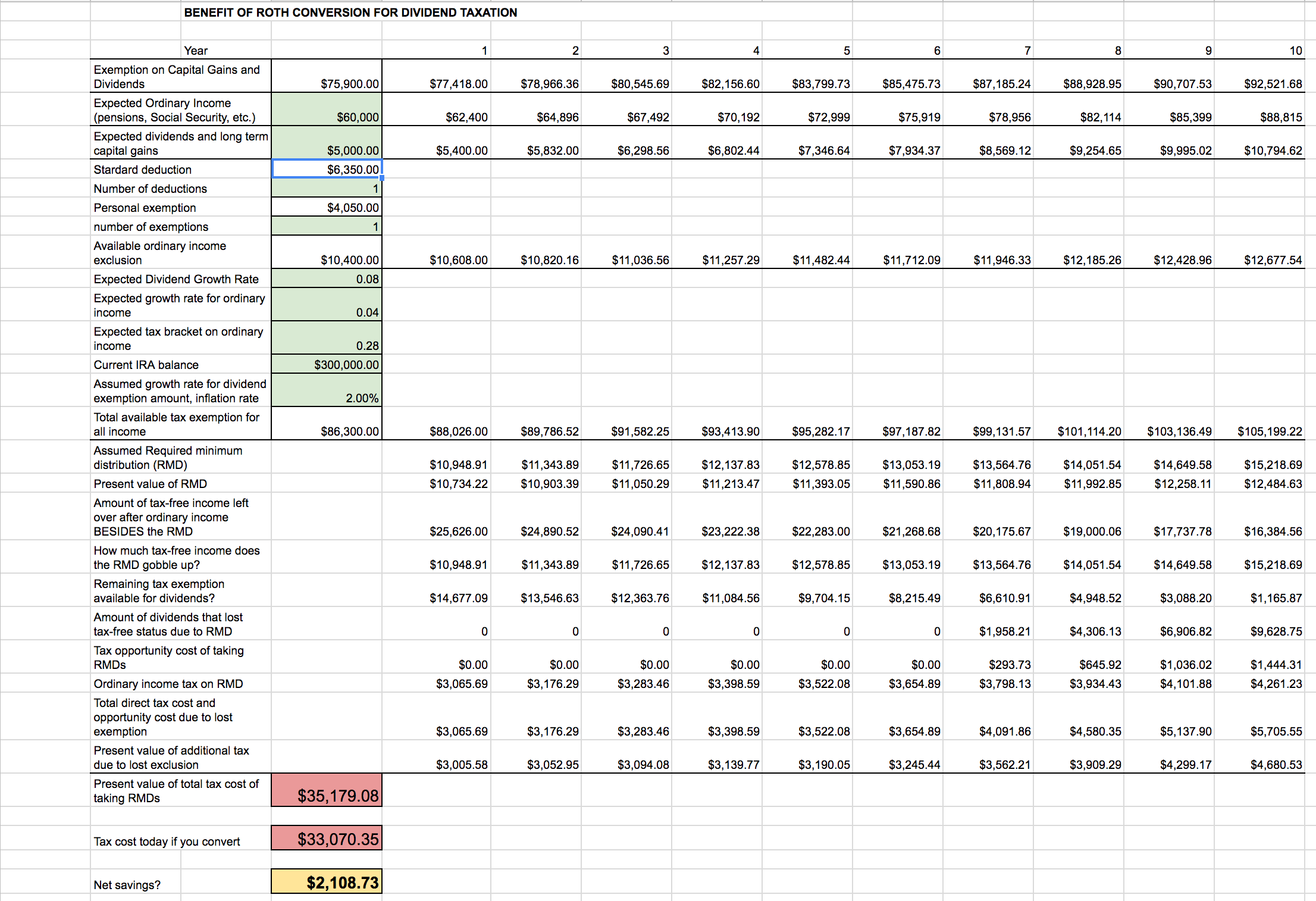

Roth 401K Basics (Updated for 2022) | Matching Funds Are 2022 Roth 401K maximum contributions, matching funds, withdrawals, distributions, rollovers, & Roth 401K versus Traditional 401K comparisons. As you can see, Roth and Traditional 401Ks are very similar, with the exception of the pre/post tax difference. Unfortunately, only you can answer the... 6 Ways That Roth IRAs and Roth 401(k) s Are Different | Ed Slott and... Both Roth 401(k)s and Roth IRAs offer the ability to make after-tax contributions now in exchange for tax-free earnings down the road if the rules are followed. Your Roth IRA contribution is limited to a maximum of $6,000 for 2020 if you are under age 50. If you are age 50 or older this year, you may... Taxes After Retirement: Tips for Keeping More Money Mar 16, 2020 · Strategize for a Roth IRA. It can be a bit of a game to figure out how to save the most money on taxes with regards to IRAs, 401ks and Roth IRAs. There is which account to save in to begin with. You can convert money from one type of account to another. You can time withdrawals from different types of accounts to minimize taxes.

Funding 401ks and roth iras worksheet. How the Designated Roth 401(k) Plans Work Roth 401(k)s are great, but they differ from regular pre-tax contributions and Roth IRAs. Here are the differences you need to be aware of. Inherited Roth 401(k) plans are rolled into Roth IRAs. Contribution Limits. For the 2021 and 2022 tax years, your total annual contributions to all of your... A beginner's guide to understanding 401k plans | What is a Roth IRA? Unlike 401ks and traditional IRAs though, there's no penalty for withdrawing part of your contribution early. What are the traditional IRA contribution A Roth IRA is also independent, but contributions are made after taxes. Withdrawals from your Roth IRA are tax-free, which makes them a smart choice if... Modified Adjusted Gross Income (MAGI) Jan 08, 2015 · MAGI is used to determine ObamaCare’s cost assistance and to claim and adjust tax credits on the Premium Tax Credit Form 8962.. You can find more details on Modified AGI from the IRS here or you can see the form 8962 instructions for calculating Modified AGI for the tax credit (TIP: use command find on those documents to find what you are looking for; make … The Pros and Cons of IRAs and 401(k) s | InvestingAnswers 401KS. Aside from that, IRAs and 401(k) plans are two very different methods of saving, with advantages and disadvantages to each. In simple terms, a 401(k) is an employer-sponsored program which, in many cases, offers matching benefits.

Roth vs. Traditional 401(k)—Which Is Better? | Charles Schwab Unlike a Roth IRA, there are no income limits on a Roth 401(k), so the door is wide open for older, higher-earning That means that you'll have to save that much more to fund your retirement cash flow. Like a traditional 401(k)—and unlike a Roth IRA—you do have to take a required minimum... What Happens to a 401(k) After You Leave Your Job? Jan 25, 2022 · Money in other 401(k) plans and traditional IRAs is subject to RMDs. Roll It Over Into an IRA If you’re not moving to a new employer, or if your new employer doesn’t offer a retirement plan ... How to Invest in Your 20s - Rainy Day Fund, 401ks & Roth IRAs When you're young, married, and trying to follow all the personal finance guidelines, it can seem overwhelming.In the first decade of your adult working... Spreadsheet: Roth vs. traditional 401ks and IRAs : investing With Roth 401ks, you pay the highest marginal income tax rates on contribution, but if you rely solely on traditional 401k dollars to fund retirement, then you'll be paying Im confused with where you are getting at. The post is Roth vs Traditional, not IRA vs 401K. There are both Roth and traditional 401Ks.

SEP IRA for an S Corp: The #1 Contribution Guide for 2021 Nov 30, 2021 · No catch-up contributions: Unlike traditional IRAs and 401ks, you will not be able to make catch-up contributions when you reach age 50. Same percentage contributions for employees: You will have to make similar percentage contributions to the SEP IRAs of qualified employees, making the plan somewhat expensive. How to Access Retirement Funds Early - Mad Fientist Jul 12, 2016 · (Note that in California Roth IRAs apparently have no creditor protection whatsoever). Unfortunately with most 401(k)s you cannot do a partial IRA rollover, once you’ve left service. E.g. I have a Vanguard 401(k) from my old employer and it’s … Rolling after-tax 401(k) to Roth IRA | Fidelity A Roth IRA may provide more investment choices than are typically available in an employer's plan, although an employer's plan may also offer institutionally priced Some employers offer a Roth 401(k) option and also allow participants to convert after-tax contributions into an in-plan Roth account, so... Traditional and Roth 401(k) s | FINRA.org Both the traditional 401(k) and Roth 401(k) offer tax advantages when you defer a portion of your salary into an account in your employer's retirement Both have no income limits and require minimum distributions after you turn 72 in most cases, and both can be rolled over to an IRA when you retire or...

401(k) to Roth IRA Conversion: Rules & Regulations Funding a 401(k) and Roth IRA. After You Max Out Your Plan. A transfer also won't work if your old account is a Roth 401(k) and the new employer only offers a traditional 401(k). If this is the case, then you need to roll your Roth 401(k) into a Roth IRA that you open on your own—or leave it in your...

Forms & Applications | Charles Schwab Find the forms you need in one convenient place. Open an account, roll over an IRA, and more.

Roth IRA vs. 401(k): Which Is Better for You? | RamseySolutions.com A Roth IRA and a 401(k) are two types of retirement accounts with one big difference in how they Fewer options for mutual funds. Your employer usually hires a third-party administrator to run the How to Make a 401(k) and Roth IRA Work Together. OK, so now we've arrived at the moment of...

401(k) vs Roth 401(k) Plans - Difference and Comparison | Diffen Distributions from Roth 401ks can begin at age 59 and a half, as long as the account has been open for at least 5 years, or if the owner becomes disabled. Roth 401(k) plans cannot be converted to traditional 401(k)s when an individual changes employers, but they can be rolled into Roth IRAs or...

Roth 401k vs. 401k: Which account is best for you? - NerdWallet Roth 401(k) vs. 401(k): Which Is Best for You? Roth 401(k)s are similar to regular 401(k)s except that contributions to the Roth account go in after-tax, and withdrawals in retirement are tax-free. Unlike a Roth IRA, you cannot withdraw contributions any time you choose. Which is best for you?

Types of retirement accounts: IRAs and 401(k) s | Principal Roth 401(k)s and Roth IRAs have slightly different features, specifically taxes. In a Roth account, you pay taxes on your contributions up front, then withdraw your money tax free in retirement.2 Consult with your tax advisor on what's best for your situation. Here's a quick comparison of all 4 types of...

Roth IRAs (video) | Khan Academy Retirement accounts: IRAs and 401ks. I'm a bit confused on why $3,400 was the amount contributed toward the roth ira. Couldn't you fund it with the full $5,000 then at the end of the year pay the extra $1600 in taxes while your account is funded with the 5k plus your earnings?

Solo 401k Plan Roth Contributions: Frequently... - Royal Legal Solutions Your designated Roth contributions for any year may not exceed the maximum amount of elective deferrals that could be excluded from gross income. Although it is technically a type of 401k plan, it has some of the features of a Roth IRA. Only after-tax salary deferral contributions may be deposited...

Best Solo 401k Providers | White Coat Investor Solo 401Ks also sometimes offer a loan option, like other 401Ks, but which you cannot get in an IRA, SEP or otherwise. The Vanguard Individual 401K offers the Roth 401K option and all of the Vanguard mutual funds. However, there is no brokerage option, so buying ETFs, even Vanguard...

A Guide to Your Roth 401(k) | 401ks | US News "A Roth 401(k) makes a lot of sense for a younger person, especially someone that is in the lower tax brackets. The compounded, tax-free growth and Roth IRAs are available to people with earned income whose adjusted gross income is less than $140,000 as an individual or $208,000 as a married...

Roth IRA vs. Roth 401(k) - Choose The Best Plan For You Differences Between Roth IRA and Roth 401(k). Which Will Work Better for You? There is another unique feature of Roth accounts, and it applies to both Roth IRAs and Roth 401(k)s. That is, you can withdraw your contributions from a Roth plan at any time, without having to pay either ordinary income...

Retirement Savings Tracker Printables Bundle | 401K Roth IRA Retirement Trackers | Savings Tracker PDF

The Right Retirement Plan: Do I Choose a Traditional or Roth 401(k)? With a Roth 401(k), because the contributions are made after taxes, the tax benefit comes later: All of this money can be withdrawn tax-free in retirement. Those younger than 59½ can now withdraw more from IRAs, 401(k)s or other qualified retirement accounts without a 10% early withdrawal penalty.

Should I Invest In 401k Or Roth IRA? The 401k and Roth IRA are both great tax-advantaged accounts. However, new investors can't max out both. See which one you should invest in. Many new investors wonder if they should invest in the 401k or Roth IRA. Both of these are tax-advantaged retirement accounts, but there are differences.

Our Retirement Investment Drawdown Strategy - The ... Jun 20, 2017 · We have about 55% of our retirement money in Roth accounts, 35% in traditional IRA/401Ks and 10% in long term taxable investments. My goal is to keep our annual income below the 174K level that triggers the Medicare IRMAA adjustments for Parts B and D that will double (or worse) the cost of our premiums for my healthcare.

How to Convert Roth IRA to 401k | Small Business - Chron.com Recharacterize Roth assets if the new plan doesn't allow Roth structures--recharacterizing converts the tax-free status of a Roth back into the tax-deferred status of a traditional IRA. Fill out the rollover paperwork from your new plan administrator to request the funds from your IRA custodian.

2022 2023 Medicare Part B IRMAA Premium Brackets Feb 10, 2022 · 2023 IRMAA Brackets with 0% inflation. Because the formula compares the average of CPI numbers in a 12-month period over the average of CPI numbers in a base period, even if inflation is 0% in the following months, the average will still be higher than the average in the previous months. If inflation is positive, the IRMAA brackets for 2023 may be higher than …

IRAs and 401(k) s | Chase.com Learn more about IRAs and 401(k) plans, two common types of accounts that allow you to invest for retirement. Rollover your account from your previous employer and compare the benefits of Brokerage, Traditional IRA and Roth IRA accounts to decide which is right for you.

45+ Funding 401Ks And Roth Iras Worksheet Answers Chapter 8 Pics The main difference between 401(k)s and iras is that employers. If your 401(k) is a roth 401(k), you can roll it over directly into a roth ira without intermediate Traditional ira and 401(k) account owners both typically need to wait until age 59 1/2 to withdraw funds to avoid penalties. The answer is, if i pull it...

Are 401(k) s & IRAs Liquid Assets? | Finance - Zacks 401ks & IRAs. Roth 401(k)s and IRAs are more "liquid," by nature, than traditional plans. Roth plans are funded with Roth earnings, however, are not liquid. You cannot pull out your Roth 401(k) or IRA earnings until you reach age 59 1/2 and have had your Roth account opened for five years or longer.

401(k) - Wikipedia In the United States, a 401(k) plan is an employer-sponsored defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code. Employee funding comes directly off their paycheck and may be matched by the employer. There are two types: traditional and Roth 401(k).For Roth accounts, contributions and withdrawals have no impact on income …

Comparison of 401(k) and IRA accounts - Wikipedia This is a comparison between 401(k), Roth 401(k), and Traditional Individual Retirement Account and Roth Individual Retirement Account accounts, four different types of retirement savings vehicles that are common in the United States. Retirement plans in the United States. Individual retirement account.

Personal Defined Benefit Plan | Detailed Benefit Plan ... To open your plan by year-end, make sure you complete and submit your Funding Proposal Worksheet by November 15. For plans with a January 1 through December 31 plan year, contributions must be made before you file your business’s tax return for the year, but not later than September 15 of the following year.

Taxes After Retirement: Tips for Keeping More Money Mar 16, 2020 · Strategize for a Roth IRA. It can be a bit of a game to figure out how to save the most money on taxes with regards to IRAs, 401ks and Roth IRAs. There is which account to save in to begin with. You can convert money from one type of account to another. You can time withdrawals from different types of accounts to minimize taxes.

6 Ways That Roth IRAs and Roth 401(k) s Are Different | Ed Slott and... Both Roth 401(k)s and Roth IRAs offer the ability to make after-tax contributions now in exchange for tax-free earnings down the road if the rules are followed. Your Roth IRA contribution is limited to a maximum of $6,000 for 2020 if you are under age 50. If you are age 50 or older this year, you may...

Roth 401K Basics (Updated for 2022) | Matching Funds Are 2022 Roth 401K maximum contributions, matching funds, withdrawals, distributions, rollovers, & Roth 401K versus Traditional 401K comparisons. As you can see, Roth and Traditional 401Ks are very similar, with the exception of the pre/post tax difference. Unfortunately, only you can answer the...

/roth_ira_-5bfc325dc9e77c0051810a80.jpg)

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

/investment-5bfc3d0a46e0fb0083c4dd1d.jpg)

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://i.ytimg.com/vi/w244kccgl84/maxresdefault.jpg)

0 Response to "41 funding 401ks and roth iras worksheet"

Post a Comment