42 vanguard retirement expense worksheet

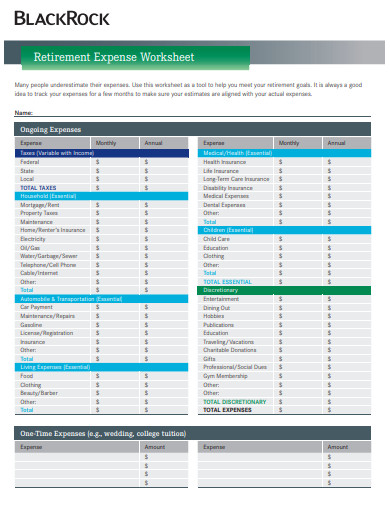

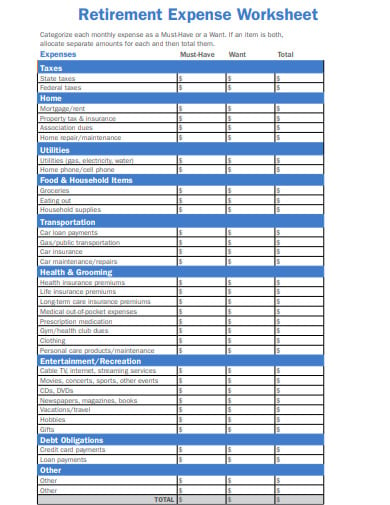

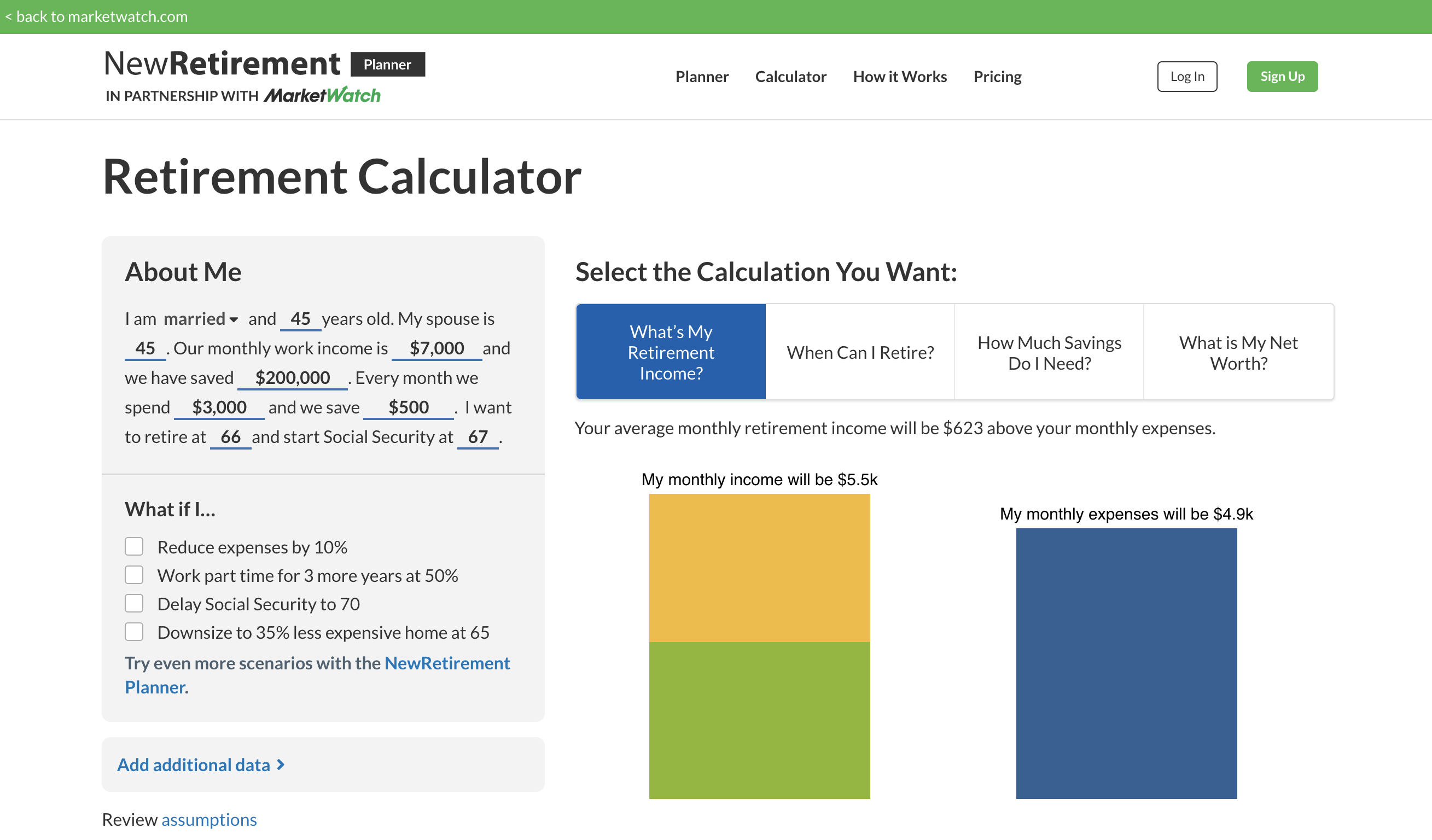

Vanguard - Retirement Expense Worksheet Size up your spending. Rethink your living situation. Retirement Expense Worksheet. How much do you have to spend? Is there a shortfall? Consider income annuities. Taking Social Security benefits. Retirement Expenses Worksheet | Vanguard - Pinterest Vanguard - Retirement expense worksheet Retirement Advice, Worksheets, Budgeting, Insight, Finance,. Vanguard_Group. Vanguard. 1 followers.

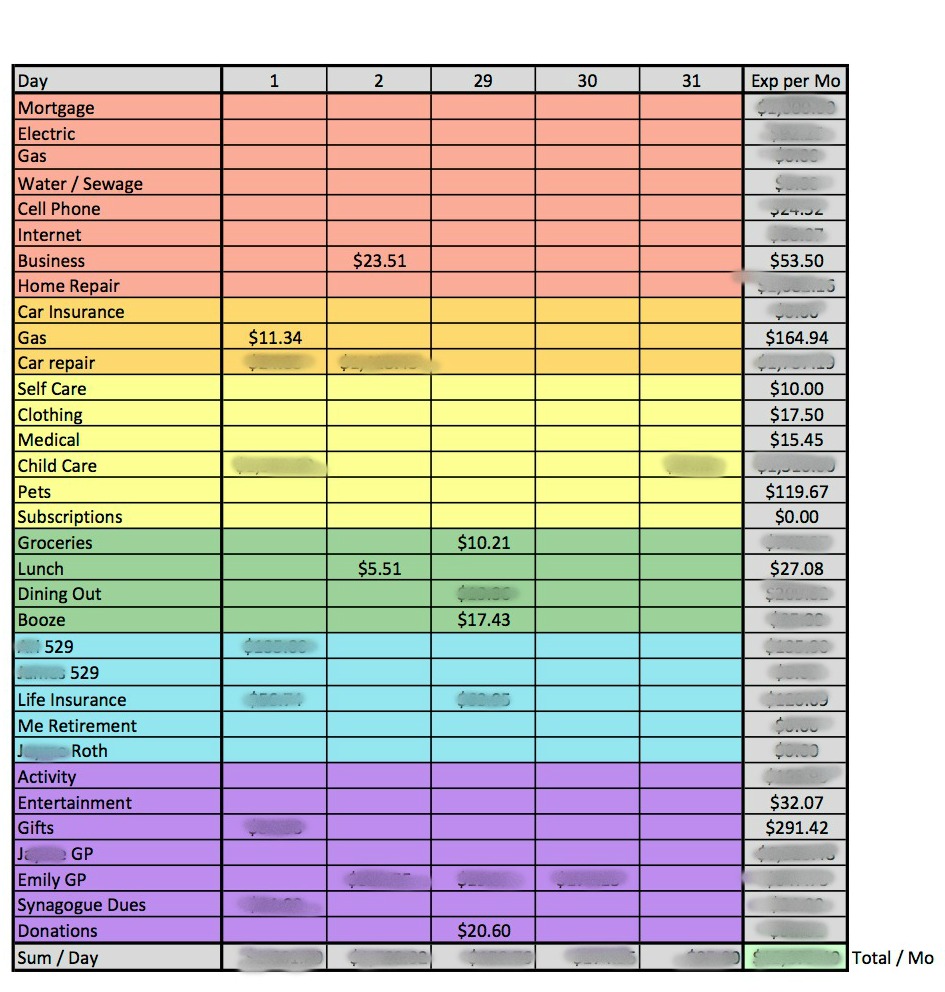

How to Plan for the Biggest Change in Retirement Expenses ... It's the Vanguard retirement expenses worksheet, so that's one. You can just Google for other ones. I would say really what it comes down to is listing out all your expenses that you have today,...

Vanguard retirement expense worksheet

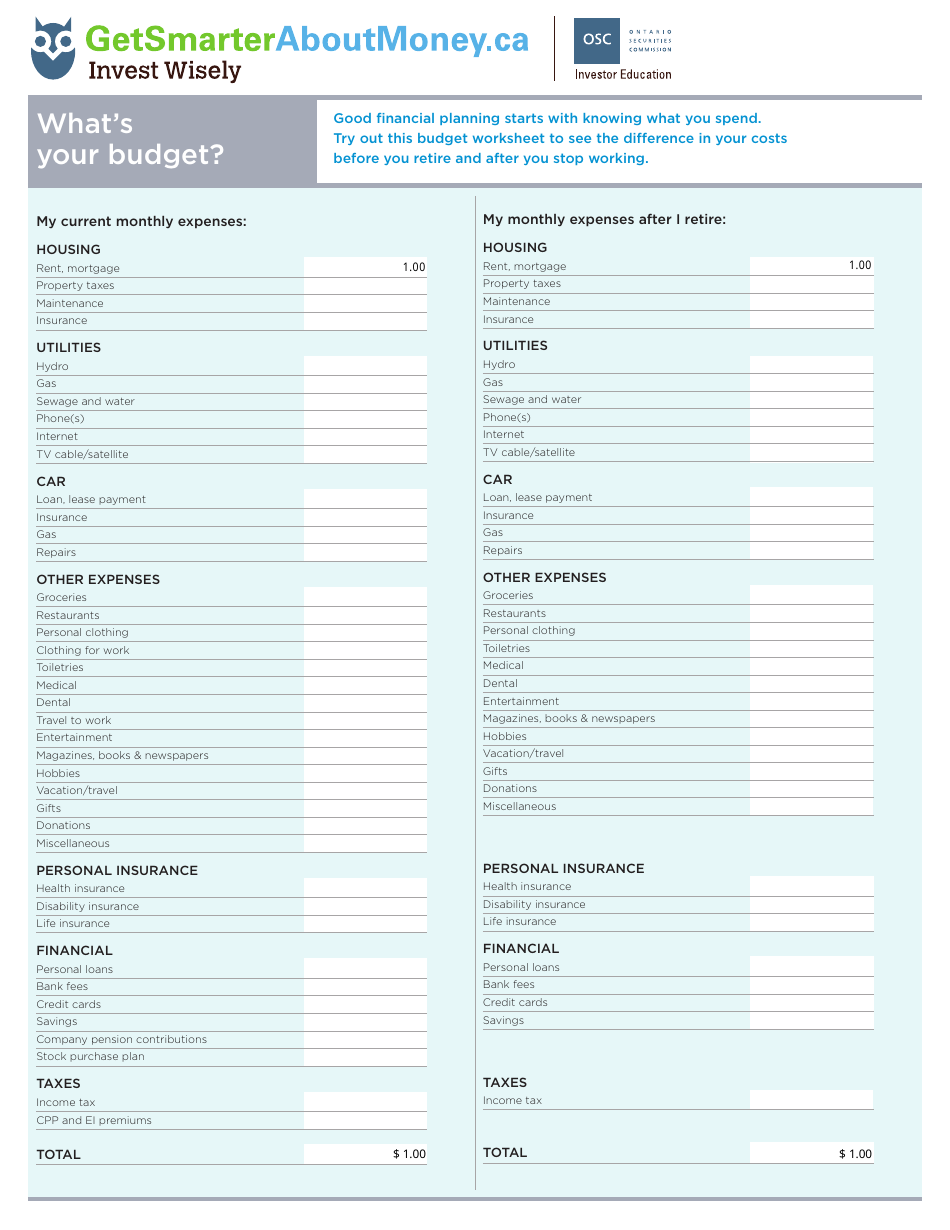

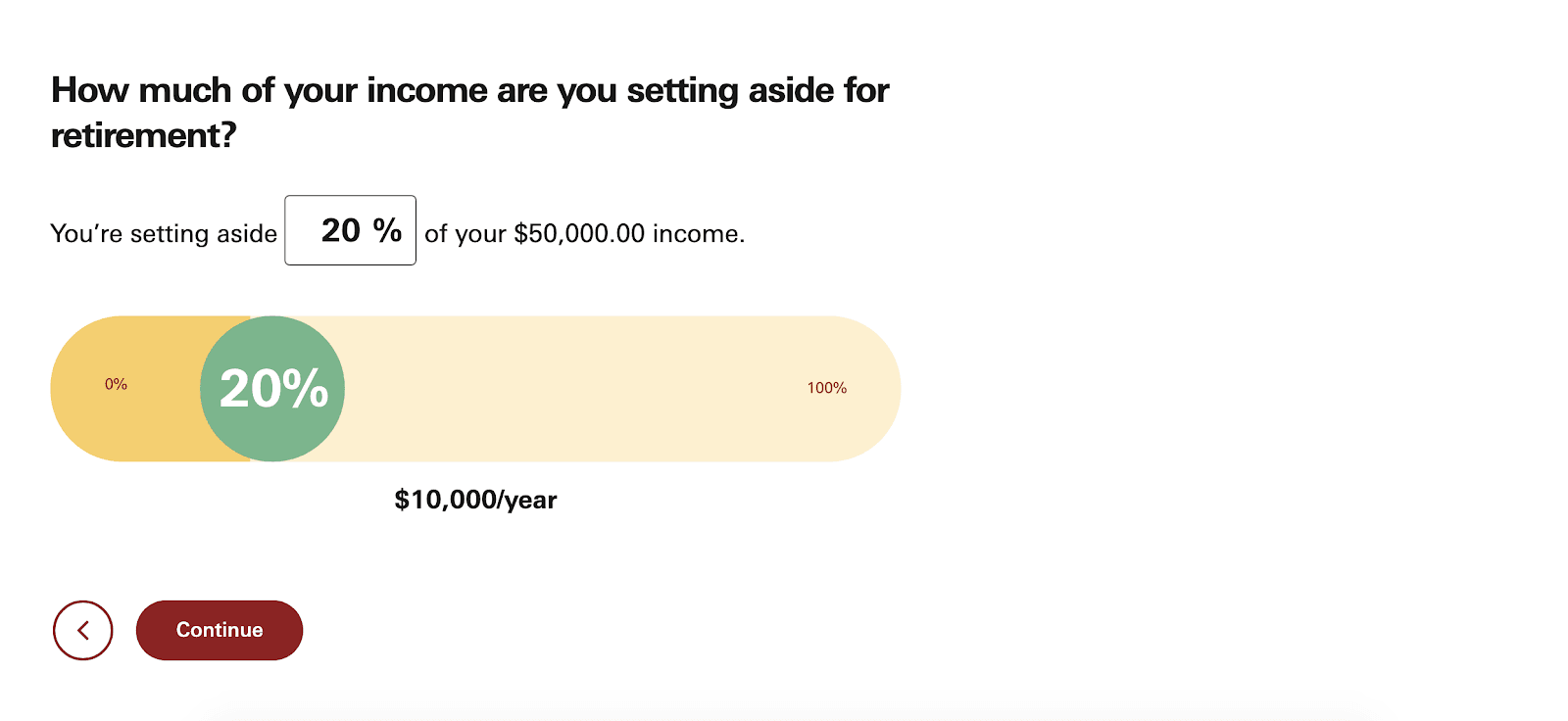

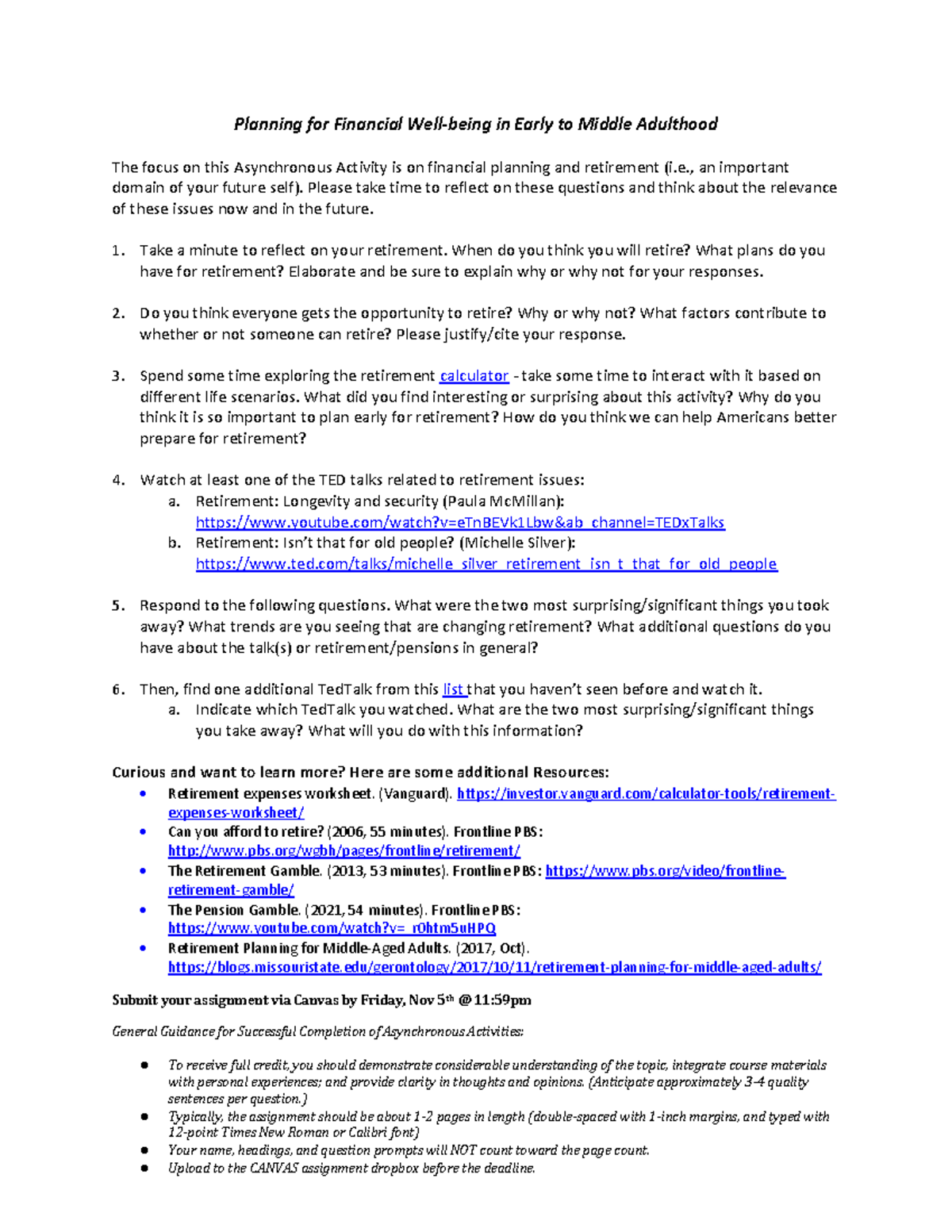

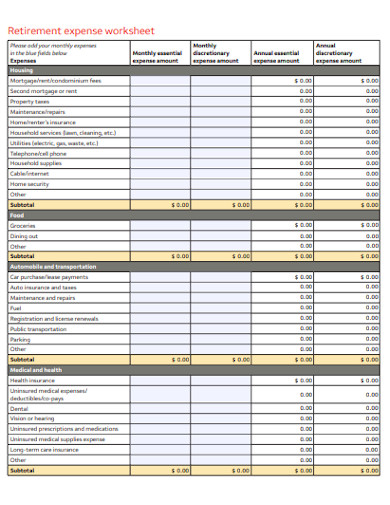

Vanguard - Create your retirement spending plan Start by estimating what your retirement will cost. If you're the kind of person who makes budgets, create a spreadsheet of your expenses today and how you expect them to change in retirement. Otherwise, you can take a back-of-the-envelope approach: Take what you spend today and multiply it by 85% or 90%. Thinking about early retirement? | Vanguard Our retirement expenses worksheet can help you visualize where your money goes. Fill it out now as a pre-retiree, and then estimate what your financial situation may look like once you're retired. Plan to replace 85% to 100% of your pre-retirement income in retirement. Health care in retirement | Vanguard Factor 6: Amount employer subsidizes. If an employer has been carrying part of the weight of your health care costs, the loss of those subsidies can make your retiree health insurance costs feel much higher. On average, our research shows that a 65-year-old woman will lose more than $5,000 a year in employer subsidies at retirement.

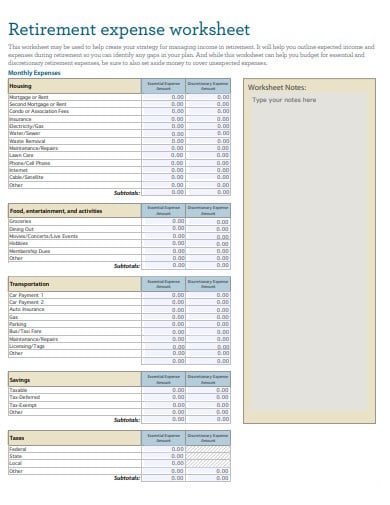

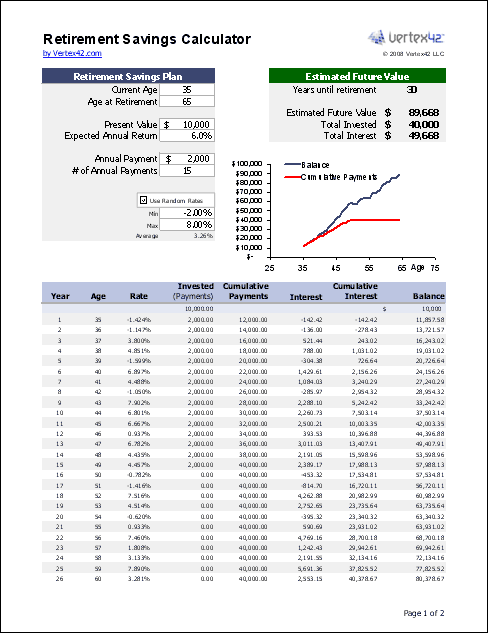

Vanguard retirement expense worksheet. Retirement Calculator - Free Retirement Savings Calculator ... Retirement Expenses Worksheet - personal.vanguard.com - This worksheet has you estimate your retirement budget by entering housing costs, personal expenses, living expenses, medical expenses, etc. A good place to start to figure out how long your retirement income is going to last. Use a retirement planning worksheet | Vanguard Use a retirement planning worksheet | Vanguard Figure out your expenses in retirement See what new expenses you might have once you retire—and which ones you can forget about. Potential new costs to consider Health care expenses Once you reach age 65, you qualify for Medicare, the federal health insurance program. 42 vanguard retirement expense worksheet - Worksheet Resource Retirement Expenses Worksheet - personal.vanguard.com - This worksheet has you estimate your retirement budget by entering housing costs, personal expenses, living expenses, medical expenses ... Vanguard is one of the world's largest investment companies, with more than $4.9 trillion in global assets. Vanguard - See what you spend - Vanguard - Retirement Plans If you chronically spend more than you earn, try to cut out some frivolous expenses. A luxury item like a new TV is not necessarily a need on the same level as, say, a car repair or a doctor's bill. Prioritize your expenses in this order: Short-term needs (repairs and maintenance). Long-term needs (retirement and education).

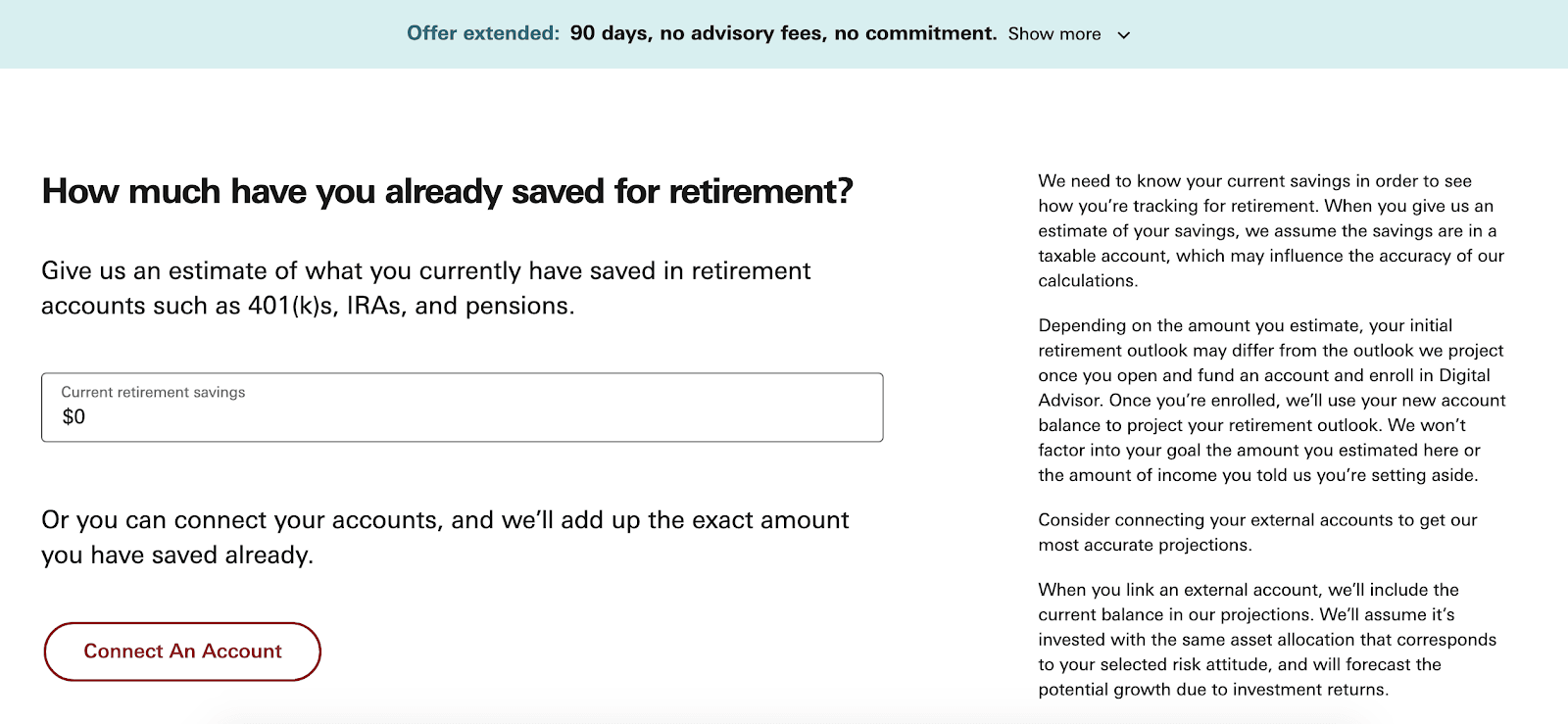

Investment Calculators and Tools | Vanguard For people who invest through their employer in a Vanguard 401(k), 403(b), or other retirement plan. Institutional investors. For retirement plan sponsors, consultants, and nonprofit representatives. ... Retirement expense worksheet. Create a realistic budget for retirement that includes basic and discretionary expenses. Opens a new window. Retirement Expenses Worksheet | Vanguard Retirement expenses worksheet | Vanguard Retirement expenses worksheet You'll have important bills and expenses to pay in retirement. Use this interactive worksheet to help you estimate your monthly retirement expenses. Your expenses Choose the way you want to enter your expense Monthly Annually 7 Best Free Retirement Planning Spreadsheets for 2022 Note: Vanguard provides an easy tool if you simply want to calculate your retirement expenses. Retirement Planning Spreadsheet for Google Sheets The flexible and easy-to-use Retirement Planner spreadsheet estimates the value of your savings and investments into the future. Experiment with growth rate scenarios and project outcomes in real-time. Map out your retirement budget - Principal This worksheet (PDF) helps you examine for income sources and detailed expenses more closely. Before you start plotting your budget in detail, know that for most people, different types of retirement income cover different expenses. A typical retirement budget may look like this: Build your budget.

Tools and Calculators Overview | Vanguard Investment analysis (1) Whether your retirement is off in distance, right around the corner, or already here, these tools can lend a hand at any stage of retirement planning. Planning for retirement tools (5) Retirement income calculator. Estimate the potential income you could earn from your investments. Get started. Retirement expense worksheet. Vanguard - Tools and calculators - Retirement Plans PDF Retirement expense worksheet - Wells Fargo And while this worksheet can help you budget for essential and discretionary retirement expenses, be sure to also set aside money to cover unexpected expenses. Investment products and services are offered through Financial Advisors at Wells Fargo Advisors. How to Plan for the Biggest Change in Retirement Expenses It's the Vanguard retirement expenses worksheet, so that's one. You can just Google for other ones. I would say really what it comes down to is listing out all your expenses that you have today,...

Vanguard Retirement Expense Worksheet - Worksheet : Resume ... Vanguard Retirement Expense Worksheet. February 28, 2019 by Role. Advertisement. Advertisement. 21 Gallery of Vanguard Retirement Expense Worksheet. Retirement Expense Worksheet. Blackrock Retirement Expense Worksheet. Retirement Expense Worksheet Blackrock. Retirement Expense Worksheet Excel.

Vanguard - Living in retirement Health care. To send a link to this page, fill out the form below and click Send. (All fields required.) (Enter up to 5 addresses, separated by commas.) Note: Vanguard will never use the e-mail addresses you enter here for marketing purposes, nor will we sell or give these addresses to any third party. For more information, read Vanguard's ...

PDF Retirement income planning worksheet - Merrill Additional Expenses (including one-time purchases) $ Expected Pay Offs $ After you've documented your expenses in retirement and income sources, your Merrill Lynch Wealth Management Advisor can work with you to create a retirement income plan that seeks to align your portfolio and the income it generates to your individual goals and situation.

Health care in retirement | Vanguard Factor 6: Amount employer subsidizes. If an employer has been carrying part of the weight of your health care costs, the loss of those subsidies can make your retiree health insurance costs feel much higher. On average, our research shows that a 65-year-old woman will lose more than $5,000 a year in employer subsidies at retirement.

Thinking about early retirement? | Vanguard Our retirement expenses worksheet can help you visualize where your money goes. Fill it out now as a pre-retiree, and then estimate what your financial situation may look like once you're retired. Plan to replace 85% to 100% of your pre-retirement income in retirement.

Vanguard - Create your retirement spending plan Start by estimating what your retirement will cost. If you're the kind of person who makes budgets, create a spreadsheet of your expenses today and how you expect them to change in retirement. Otherwise, you can take a back-of-the-envelope approach: Take what you spend today and multiply it by 85% or 90%.

/BalanceSheet-tablet-no-hands-659322eb6e4745fd98086a6354ebf9c4.png)

/BalanceSheet-tablet-no-hands-659322eb6e4745fd98086a6354ebf9c4.png)

/Review_INV_vanguard-9976a70869cd4e0386976794f2b670f4.png)

0 Response to "42 vanguard retirement expense worksheet"

Post a Comment