39 1031 like kind exchange worksheet

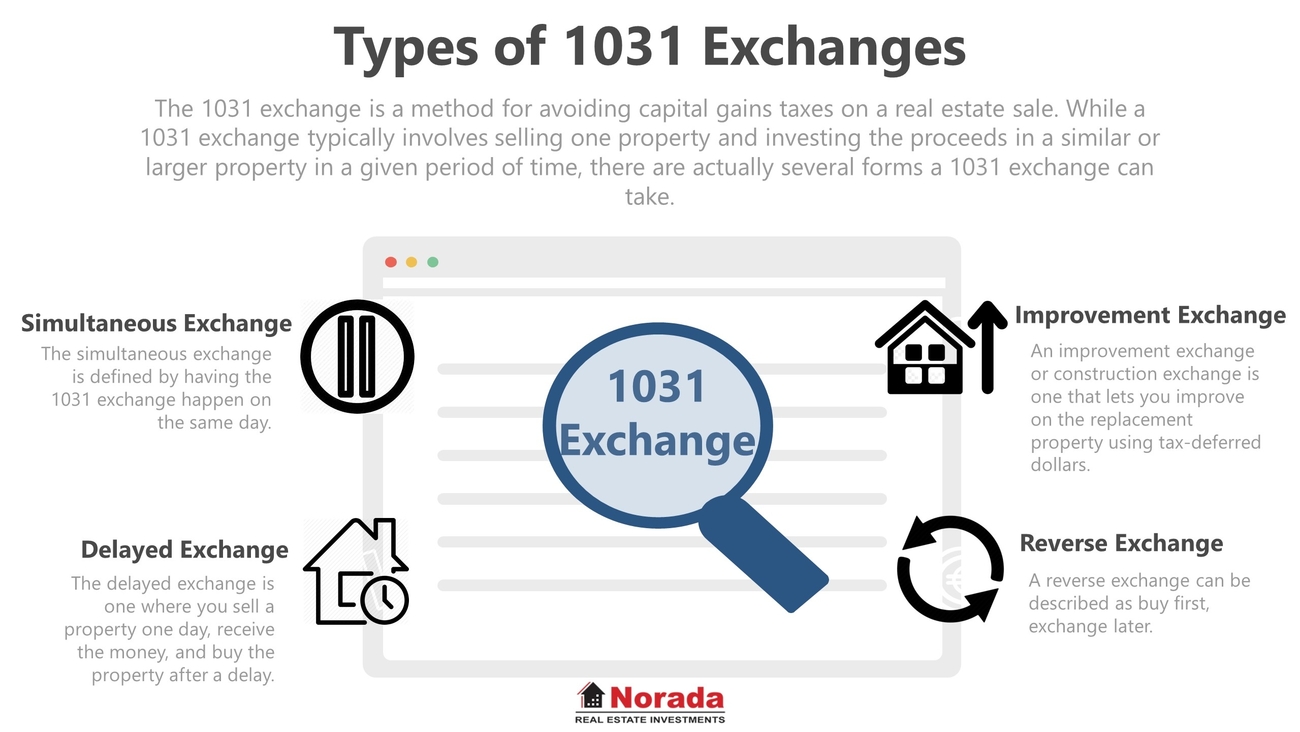

Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824 IRS Form 8824, the Like Kind Exchange form, is where you report your Section 1031 Exchange - Delayed, Reverse, or Construction. The Form 8824 is due at the end of the tax year in which you began the transaction, as per the Form 8824 Instructions. 1031 Tax Exchange Rules: What You Need to Know Broadly stated, a 1031 exchange (also called a like-kind exchange or a Starker) is a swap of one investment property for another. Most swaps are taxable as sales, although if yours meets the ...

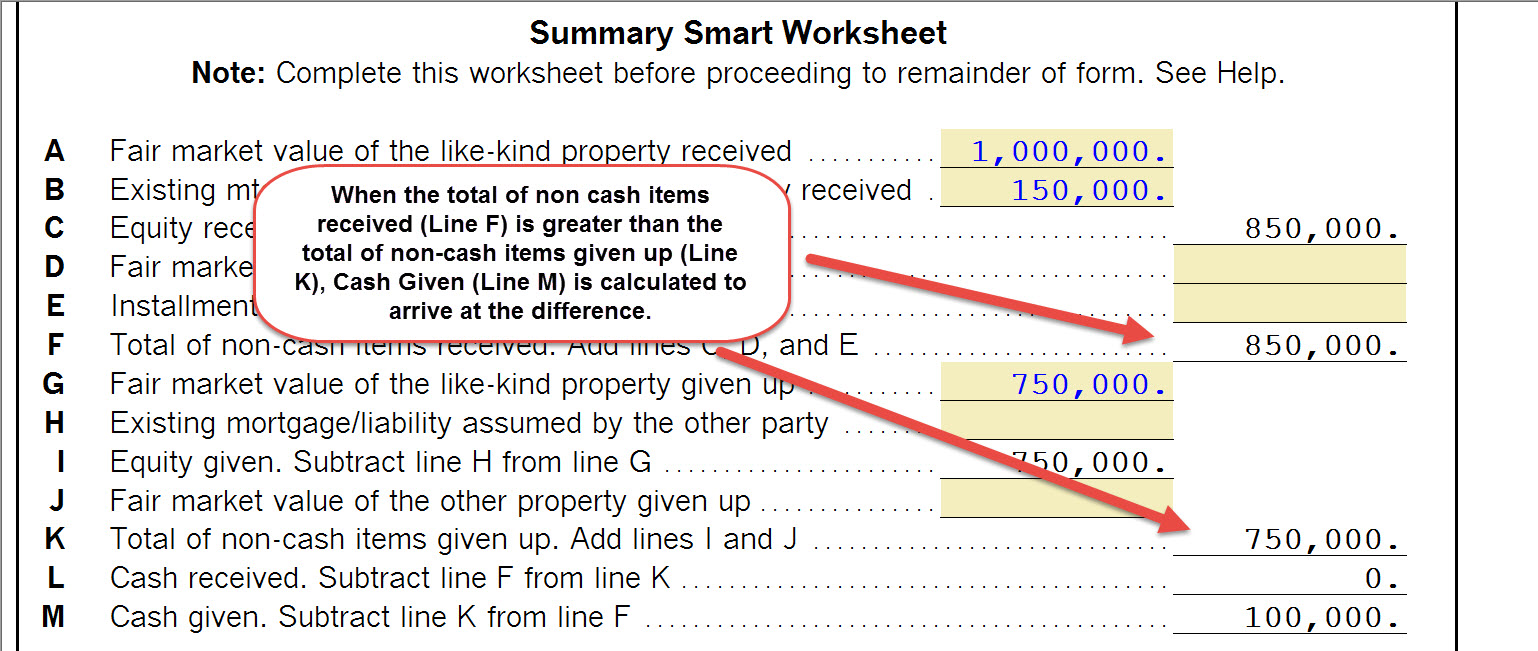

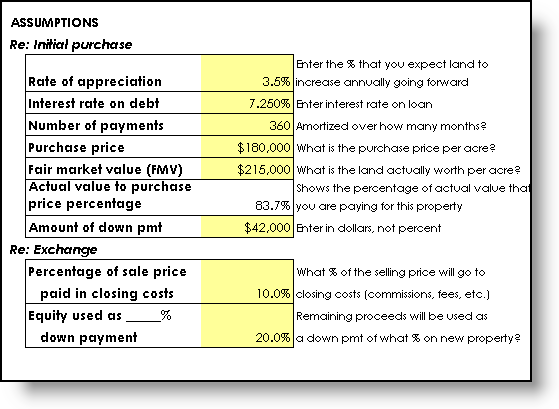

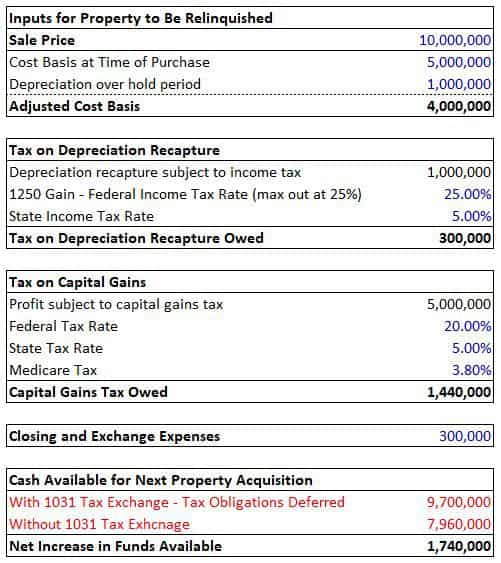

Section 1031 Exchange Calculation Worksheet and Similar ... 1031 Like Kind Exchange Calculator - Excel Worksheet great . Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Smart 1031 Exchange Investments. We don't think 1031 exchange investing should be so difficult.

1031 like kind exchange worksheet

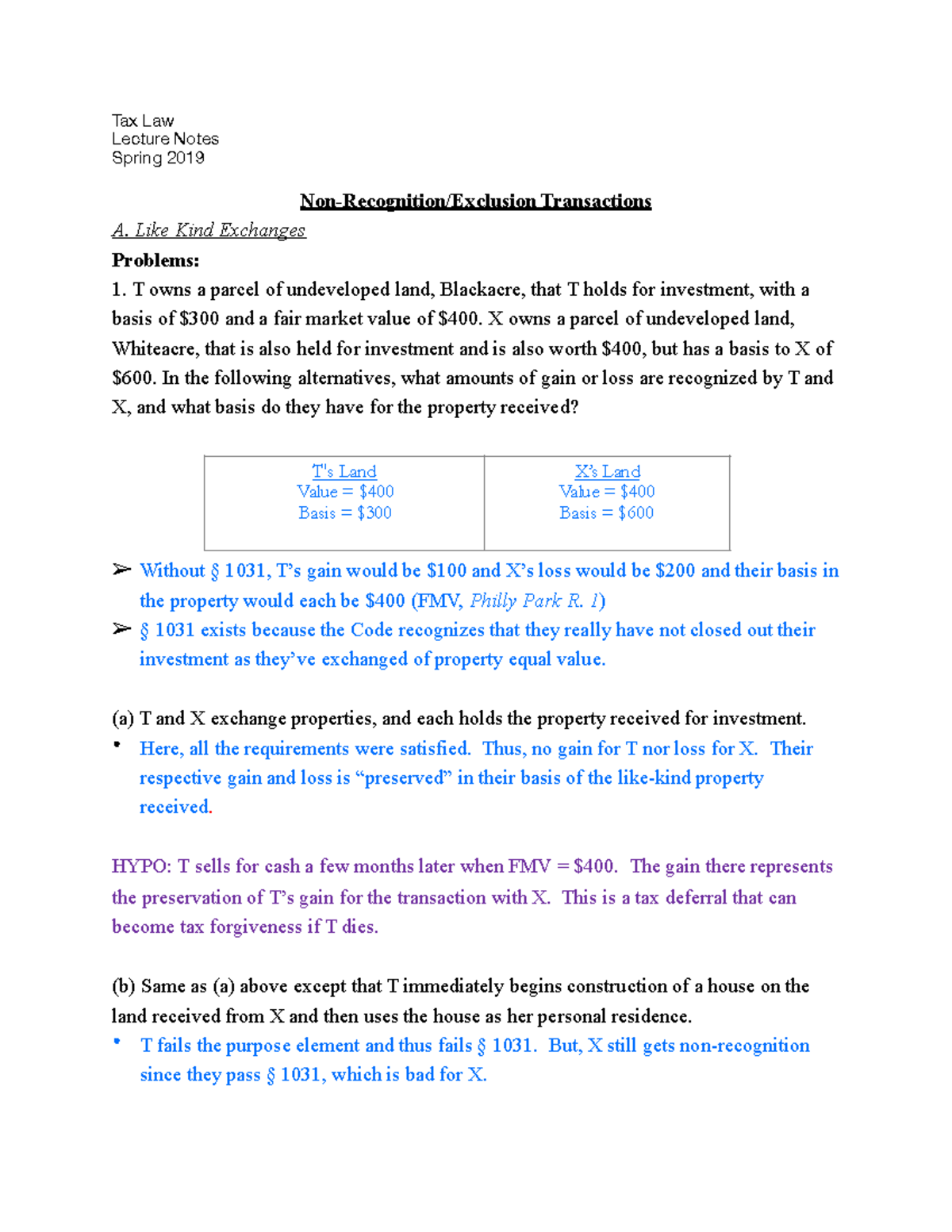

LIKE-KIND EXCHANGE WORKSHEET LIKE-KIND EXCHANGE WORKSHEET. A. Realized Gain. 1. + FMV of all property received. 2. + Total cash received. 3. + Liabilities transferred.1 page PDF 2019 - 1031 Corp Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6 1031 Exchange Excel Template and Similar Products and ... 1031worksheet - Learn more about 1031 Worksheet new 1031worksheet.com. In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property).

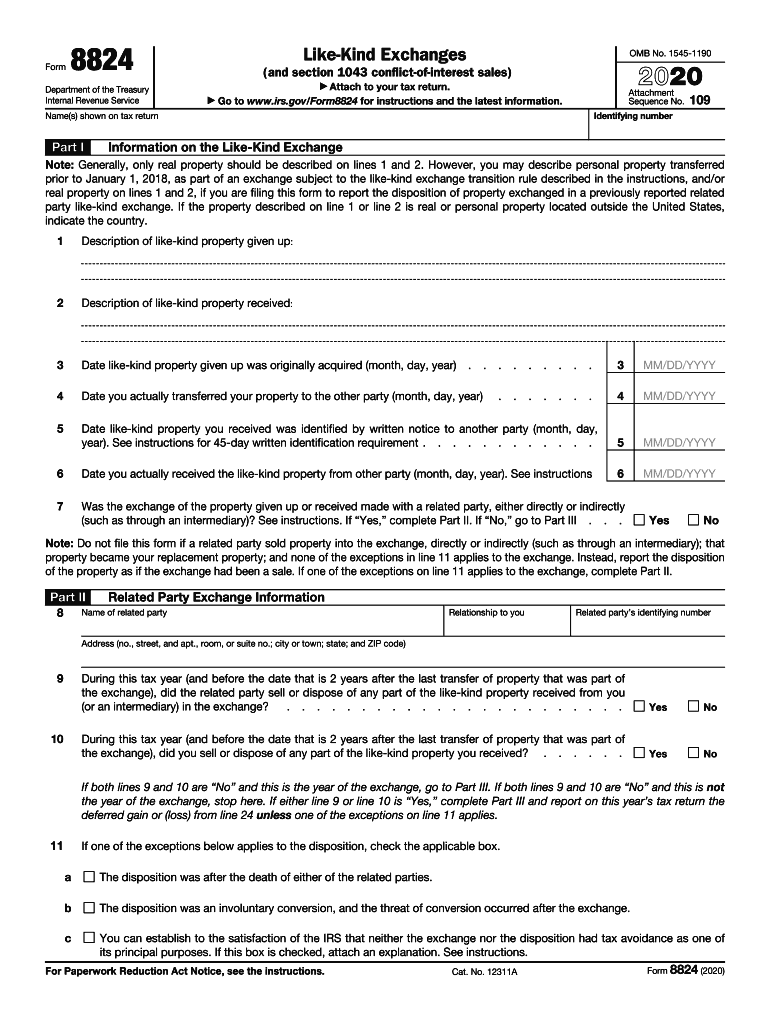

1031 like kind exchange worksheet. 1031 Tool Kit - TM 1031 Exchange Click here for your 1031 Exchange Tool Kit including at 1031 checklist, qualified intermediary locator, close date form, 1031 identification form and more. Click here to schedule your free 1031 exchange and investment consultation. Partial 1031 Exchange | 1031 Exchange for Lesser Value ... IPX1031. The best choice for your 1031. IPX1031 is the largest and one of the oldest Qualified Intermediaries in the United States. As a wholly owned subsidiary of Fidelity National Financial (NYSE:FNF), a Fortune 300 company, IPX1031 provides industry leading security for your exchange funds as well as considerable expertise and experience in facilitating all types of 1031 Exchanges. WorkSheets & Forms - 1031 Exchange Experts Want to start over with a “clean slate”? Download fresh worksheets from 1031TaxPak.com. Page 3. WorkSheet #2 - Calculation of Exchange Expenses.6 pages Like-Kind Exchanges - Internal Revenue Service Like-Kind Exchanges. (and section 1043 conflict-of-interest sales). ▷ Attach to your tax return. ▷ Go to for instructions and the ...

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 The Exchange is reported on IRS Form 8824, Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. By changing any value in the following form fields ... IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange ... Worksheet April 17, 2018. We tried to get some great references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here.

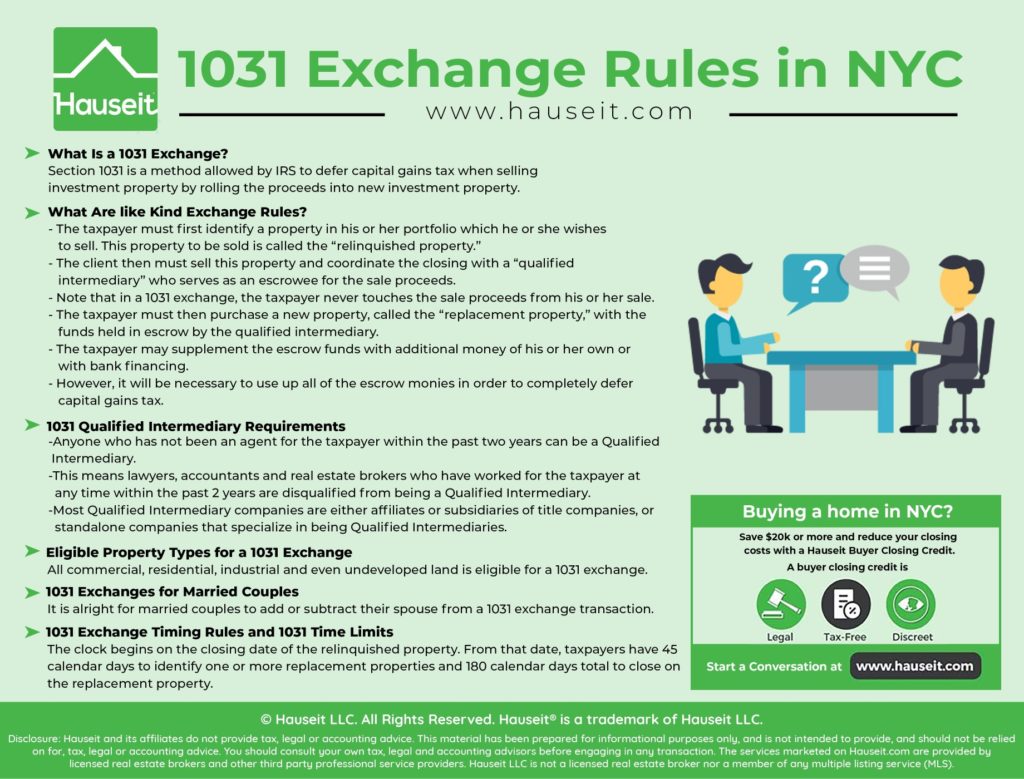

1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value. PDF Like-Kind Exchanges Under IRC Section 1031 as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or How do I complete a like-kind exchange in an Individual ... When a like-kind exchange is entered on like-kind exchanges worksheet and the "Automatic Sale" feature is used, up to five assets can be sold and new continuation assets are created for all five. An additional asset is created if there was Total Cash Paid entered on Income/Deductions > Like-Kind Exchanges > section 3 - line 4 entered in the ... 1031 Exchange Worksheet Irs and Similar Products and ... trend 1031worksheet.com In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property).

Reporting the Like-Kind Exchange of Real Estate Using IRS ... See IRC Section 1031(f). If the exchange is made with a related party then you must also file Form 8824 for the 2 years following the year of exchange. See ...

Inspiration Like Kind Exchange Worksheet - Goal keeping ... Like kind exchange worksheet excel and irs 1031 exchange worksheet can be beneficial inspiration for those who seek an image according specific categories you can find it in this site. By changing any value in the following form fields.

1031.docx - TIMELINE - REPLACEMENT PROP IDENTIFIED WITHIN ... Look at the line marked Basis of like-kind property received. Generally, this becomes the adjusted basis of the new asset, unless there was an additional amount incurred in obtaining it. 4. There are two options for the next step, depending on whether you are using the like-kind exchange rule (A) or electing out of the like-kind exchange rule (B).

PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

1031 Exchange Examples | 2022 Like Kind Exchange Example This is known as a "Partial Exchange" and the portion the exchange proceeds that are not reinvested are referred to as "Boot" and are subject to taxes. Ron and Maggie believe their property can be sold for $2,850,000. Assuming the mortgage balance will be $800,000, their evaluation of a suitable Replacement Property will look like this:

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

1031 Like Kind Exchange Worksheet And Form 8824 Worksheet ... 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template. Worksheet April 17, 2018. We tried to get some great references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here.

Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges ... Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

Replacement Property Basis Worksheet Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf). Contact Us. Mail: Phone: Fax: Email: 1031 Corporation. 1707 N Main St. Longmont, CO 80501.

All Results for Section 1031 Exchange Worksheets Find the formats you're looking for Section 1031 Exchange Worksheets here. A wide range of choices for you to choose from.

IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ...

The 6 Best 1031 Exchange Companies of 2022 - The Balance A 1031 like-kind exchange is a tax strategy to delay paying capital gains taxes when selling investment properties. These taxes can be up to 20% of the sale price. The name 1031 comes from Section 1031 of the U.S. Internal Revenue Code. This section of the tax code lets taxpayers sell a qualified property.

1031 Exchange Excel Template and Similar Products and ... 1031worksheet - Learn more about 1031 Worksheet new 1031worksheet.com. In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property).

PDF 2019 - 1031 Corp Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6

LIKE-KIND EXCHANGE WORKSHEET LIKE-KIND EXCHANGE WORKSHEET. A. Realized Gain. 1. + FMV of all property received. 2. + Total cash received. 3. + Liabilities transferred.1 page

0 Response to "39 1031 like kind exchange worksheet"

Post a Comment