39 medicare cost report worksheet a

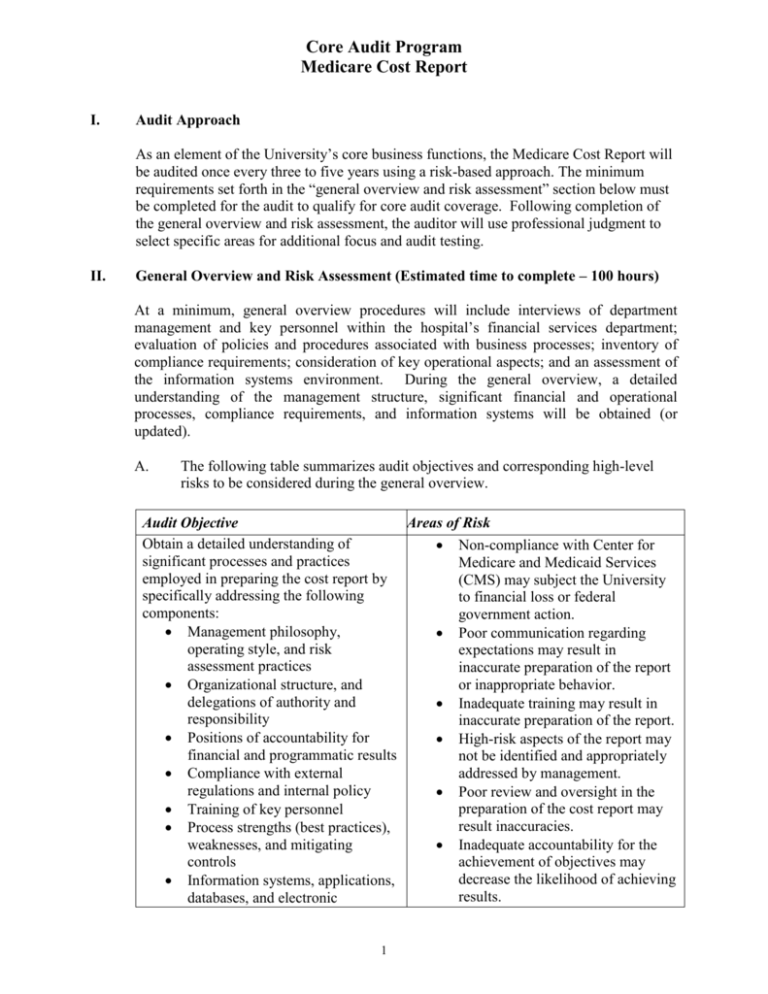

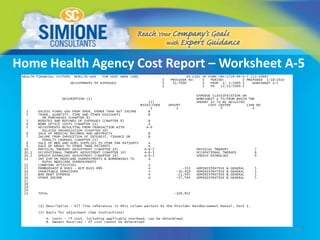

PDF Cost Reporting 101: A Crash Course in the Basics Worksheet A-8: Adjustments to Expenses This worksheet provides for adjustments to remove nonallowable expenses and offset nonpatient care revenue Adjustments increase or decrease reimbursable costs Medicare assumes that nonpatient service revenue is equal to the cost of the service provided PDF 4034 FORM CMS-2552-10 01-22 4034 ... - Cost Report Data situation, any GME costs for the cost reporting period prior to the base period are reimbursed on a reasonable cost basis. Complete this worksheet if this is the first month in which residents were on duty during the first month of the cost reporting period or if residents were on duty during the entire prior cost reporting period.

PDF Medicare Cost Report Download - University of Minnesota Medicare Cost Reports The data are in the Healthcare Cost Reporting Information Systems database (HCRIS) CMS will update the data on a quarterly basis The entire database is overwritten each quarter with the latest information The number of years available will vary depending

Medicare cost report worksheet a

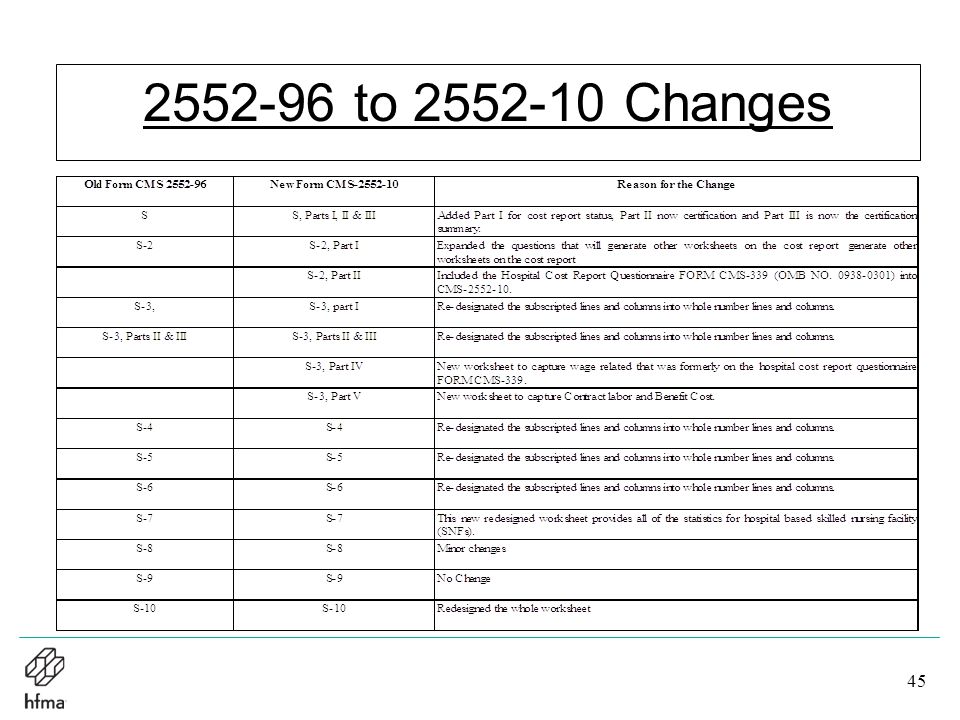

PDF Medicare S-3, Part IV New worksheet to capture wage related cost . that was formerly on the hospital cost . report questionnaire CMS Form 339. S-3, Part V New worksheet to capture contract . labor and benefit cost. Pub. 15-2-40 PDF 04-20 FORM CMS-2552-10 4030.1 4030 ... - Cost Report Data days (Worksheet S-3, Part I, column 24.10) and effective for cost reporting 8, line periods beginning on or after October 1, 2012, the number of outpatient ancillary labor and delivery days (Worksheet S-3, Part I, column 8, line 32.01). PDF 4005 FORM CMS-2552-10 11-17 4005 ... - Cost Report Data Column 1--Enter the Worksheet A line number that corresponds to the Worksheet S-3 component line description. Column 2--Refer to 42 CFR 412.105(b) and 69 FR 4909349098 (August 11, 2004) to determine - the facility bed count. Indicate the number of beds available for use by patients at the end of the cost reporting period.

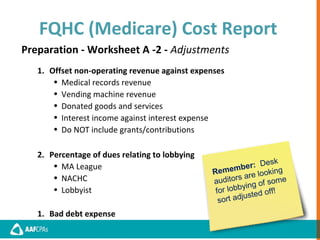

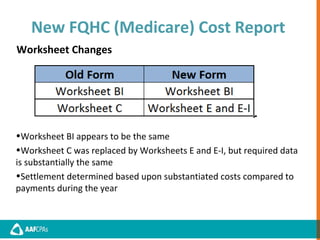

Medicare cost report worksheet a. PDF Medicare Cost Report Preparation - HFMA NJ Worksheet A-8-1 Costs of Services from Related Org. & Home Office Costs Purpose: To adjust costs applicable to services, facilities and supplies furnished by a related organization or a home office to allowable cost. Data Sources: • Home Office Cost Report • Other Related Parties Provider Cost Reports • General Ledger Medicare Cost Report Worksheet S-10 Explained [PODCAST] Mike: Jimmy, why don't you start out by explaining why Worksheet S-10 on the Medicare cost report has become so important. Jimmy: Well, Mike, Worksheet S-10 is critical to any facility that treats a high number of DSH patients. In a facility that has a DSH patient percentage over 15%, it is entitled to a portion of the uncompensated care pool. Introduction to Medicare Cost Reports - ResDAC | Medicare Cost Reports The worksheets collect the following types of information: ˗ Facility characteristics (ownership status, type of facility) ˗ Statistical ˗ Financial ˗ Cost ˗ Charge ˗ Wage Index information 6 . Medicare Cost Reports 7 Example of Hospital Form 2552-10, Worksheet S-3, Part I . 40 medicare cost report worksheet a - Worksheet Works Medicare cost report worksheet a. PDF Medicare Apr 22, 2016 · The FQHC cost report must be submitted to the Medicare administrative contractor (hereafter referred to as contractor) electronically in accordance with 42 CFR 413.24f) (4). ( Cost reports are due on or before the last day of the fifth month following the close of the period covered ...

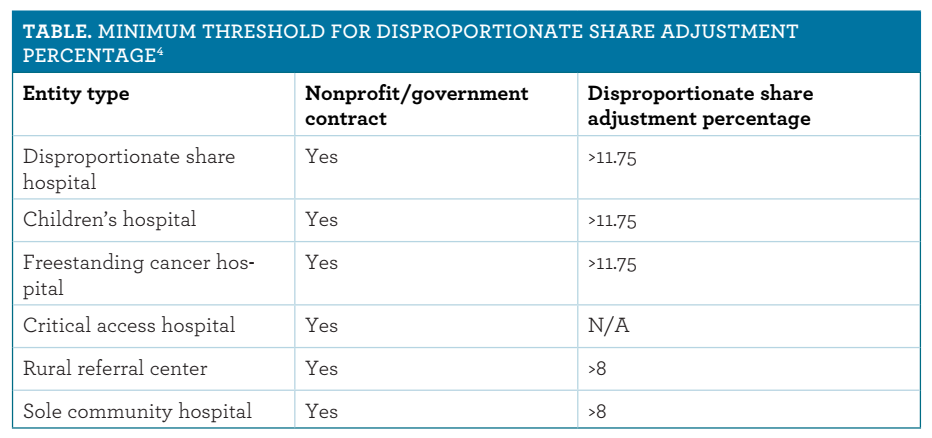

Medicare Cost Report: What is it? The Medicare cost report is comprised of a series of worksheets and schedules that describe the institutional provider's characteristics, financial information, costs and charges. The cost report is utilized to set prospective payment rates such as wage index, Disproportionate Share Hospital ("DSH") adjustment, Indirect Medical Education ... PDF 4020 Form Cms-2552-10 01-22 4020. Worksheet B, Part I Cost ... Use line 204 of Worksheet B-1 in conjunction with the allocation of capital-related costs on Worksheet B, Part II. Complete line 204 for all columns after Worksheets B, Part I, and B-1 are completed and the amount of direct and indirect capital -related cost is determined on Worksheet B, Part II, column 2A. Understanding the Medicare Cost Report - 340B Prime ... 03-18 FORM CMS-2552-10 4090 (Cont.) This report is required by law (42 USC 1395g; 42 CFR 413.20(b)). Failure to report can result in all interim FORM APPROVED payments made since the beginning of the cost reporting period being deemed overpayments (42 USC 1395g). Medicare Cost Report 101 medicare cost report overview. 10/19/18 8 question ... •fully allocated costs from worksheet b, part i are divided by total charges on worksheet c to arrive at ccr for each ancillary cost center

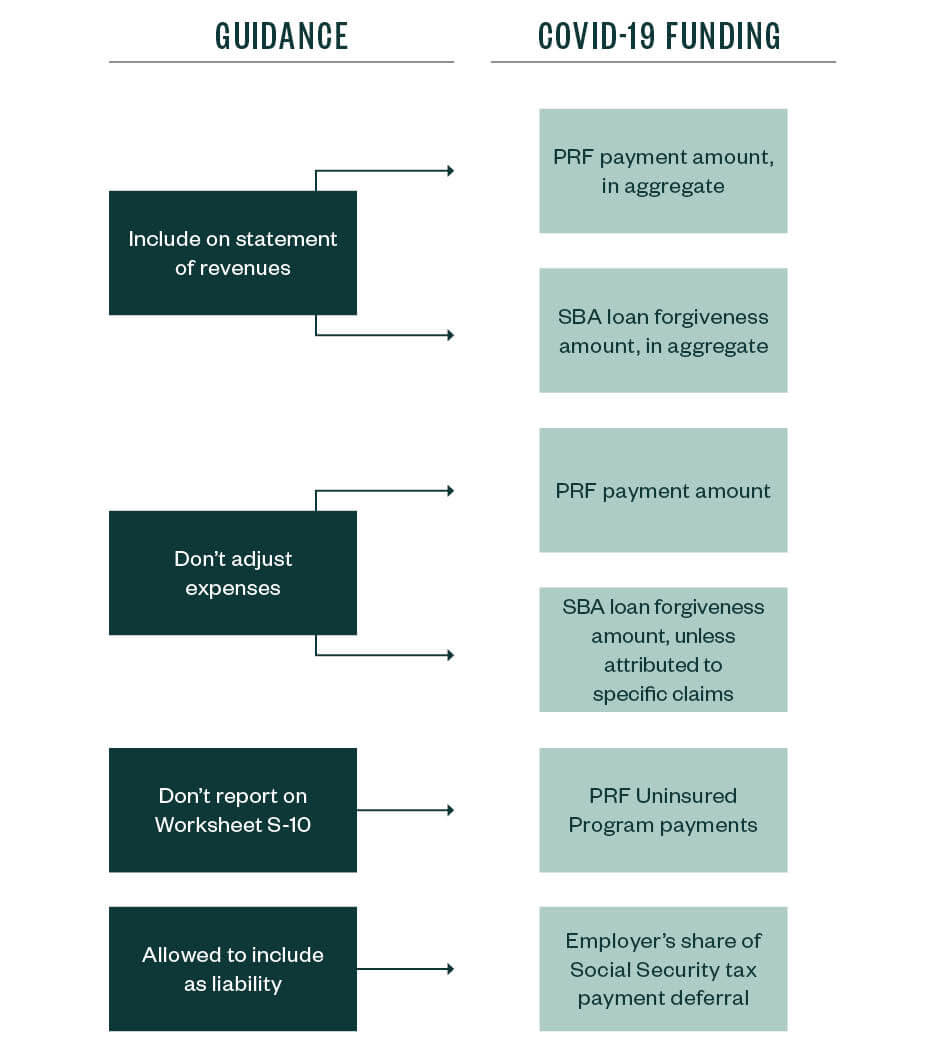

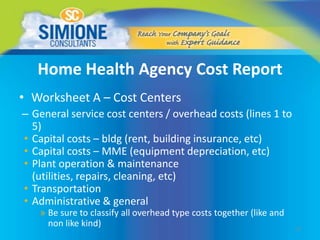

PDF Updates to Medicare's Cost Report Worksheet S-10 to ... revisions and clarifications to the instructions for the Worksheet S-10 of the Medicare cost report. The Worksheet S-10 data is used in the computation of Factor 3 in the calculation of the uncompensated care payment for 1886(d) hospitals under the Social Security Act (SSA) eligible to receive such payments. PDF Medicare The FQHC cost report must be submitted to the Medicare administrative contractor (hereafter referred to as contractor) electronically in accordance with 42 CFR 413.24f)(4).( Cost reports are due on or before the last day of the fifth month following the close of the period covered by the report. For cost reports ending on a day Proposed Changes to the Medicare Cost Report In accordance with the FY 2021 Inpatient Prospective Payment System (IPPS) final rule, CMS is adding a new worksheet to the cost report to collect data associated with payer specific negotiated charge information. This information must be reported for cost reporting periods ending on or after January 1, 2021. Medicare Cost Report Data: Structure | ResDAC The Medicare Cost Report data can be downloaded from the CMS website.The table at that link contains the Hospital, Home Health Agency (HHA), and Skilled Nursing Facility (SNF) cost reports dating back to 1996.You will notice in Figure 1 that hospital cost reports are labelled in the Facility Type column as either "HOSPITAL" or "Hospital-2010."

PDF 3604. WORKSHEET S-2 - Cost Report Data 3604. WORKSHEET S-2 - HOSPITAL AND HOSPITAL HEALTH CARE COMPLEX ... and participates in the Medicare program or is a Federally controlled institution approved by CMS. ... for cost reporting periods beginning on or after July 1, 2002, Medicare swing-bed services will be

PDF 4090 (Cont.) FORM CMS-2552-10 01-22 - Cost Report Data form cms-2552-10 (11-2017) (instructions for this worksheet are published in cms pub. 15-2, section 4013)

Updates to Medicare's Cost Report Worksheet S-10 to ... Updates to Medicare's Cost Report Worksheet S-10 to Capture Uncompensated Care Data. This article is intended to provide additional guidance to 1886(d) hospitals by summarizing revisions and clarifications to the instructions for the Worksheet S-10 of the Medicare cost report. Download the Guidance Document

PDF 2022 Medicare Costs.

Anatomy of a Cost Report - Protecting and Enhancing ... Worksheet: Description: Purpose/Goal: S Series: Statistical data: To properly report statistics related to payer: A Series: Proper classification of expenses by cost center: To report allowable Medicare costs by cost center or department: B Series: Matching of costs to revenue by utilization of a step-down approach: Allocation of overhead costs:

CMS-2552-10 - Centers for Medicare & Medicaid Services CMS-2552-10. A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244.

Worksheet Formats - Cost Report Data Worksheet formats are based on information supplied by the Centers for Medicare and Medicaid Services (CMS).Forms and instructions can be downloaded from the CMS website and are presented here as a convenient reference. * Worksheets which are not yet available on CostReportData.com have been marked with an asterisk. Please contact us if there is a specific sheet to be requested, as an addition ...

Hospital 2552-2010 form | CMS - Centers for Medicare ... Hospital 2552-10 Cost Report Data files. The data included in this release contains cost reports with fiscal years beginning on or after May 1, 2010 . Hospital cost reports beginning before May 1, 2010 are reported on the old form 2552-96, and can be found in other data files on this site.

Medicare - CMS S-3, Part IV. New worksheet to capture wage related cost that was formerly on the hospital cost report questionnaire CMS Form 339. S-3, Part V. New worksheet to ...

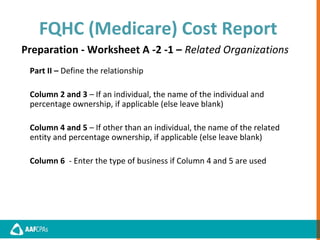

PDF Navigating The Medicare FQHC cost report - AACHC Walkthrough of Worksheet S-1 Part I includes the following information: Line 9 -indicate if FQHC is part of a chain organization as defined by CMS If yes, complete lines 10 -12 Line 13 -indicate if FQHC is filing a consolidated cost report ("yes" or "no")

Analyzing Hospital Medicare Cost Reports Using Base SAS The next set of worksheets is the A series, described as the cost finding worksheets. In Worksheet A, overhead costs (e.g. capital) and revenue-generating costs ...19 pages

PDF Medicare Cost Report, Form CMS-222-17, by revising existing edits, creating new edits, updating and references. Revisions include: • Worksheet S, Part I: • Revised the check box option to read "Electronically prepared cost report" and "Manually prepared cost report," on the worksheet and in the instructions.

Reviews of Cost Report Worksheet S-10 | CMS Overview In the Fiscal Year (FY) 2018 Inpatient Prospective Payment System (IPPS) Final Rule, CMS finalized that uncompensated care data from the Medicare Cost Report Worksheet S-10 would be incorporated into Factor 3 of the Disproportionate Share Hospital Uncompensated Care Payment (DSH UCP). This payment methodology continued with the FY 2019 IPPS Final Rule, and was also proposed in the FY ...

PDF 4005 FORM CMS-2552-10 11-17 4005 ... - Cost Report Data Column 1--Enter the Worksheet A line number that corresponds to the Worksheet S-3 component line description. Column 2--Refer to 42 CFR 412.105(b) and 69 FR 4909349098 (August 11, 2004) to determine - the facility bed count. Indicate the number of beds available for use by patients at the end of the cost reporting period.

PDF 04-20 FORM CMS-2552-10 4030.1 4030 ... - Cost Report Data days (Worksheet S-3, Part I, column 24.10) and effective for cost reporting 8, line periods beginning on or after October 1, 2012, the number of outpatient ancillary labor and delivery days (Worksheet S-3, Part I, column 8, line 32.01).

PDF Medicare S-3, Part IV New worksheet to capture wage related cost . that was formerly on the hospital cost . report questionnaire CMS Form 339. S-3, Part V New worksheet to capture contract . labor and benefit cost. Pub. 15-2-40

0 Response to "39 medicare cost report worksheet a"

Post a Comment