42 2014 tax computation worksheet

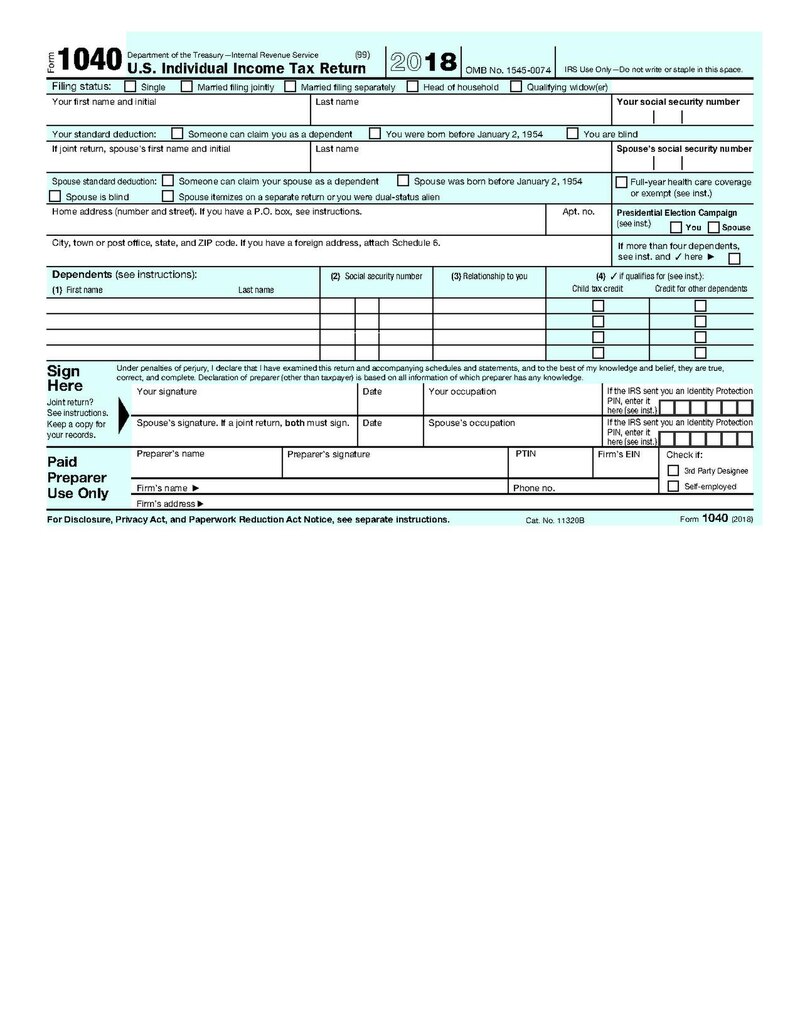

Download IRS Form 1040 "Line 12a, Tax Computation Worksheet" 2019 Tax Computation Worksheet—Line 12a. and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter. Virginia State Tax Forms - Tax-Rates.org Tax-Rates.org provides free access to printable PDF versions of the most popular Virginia tax forms. Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2022 until January 2023. If the form you are looking for is not listed here, you will be able to find it on the Virginia 's tax forms page (see the ...

Deferred Tax: The Only Way to Learn It - CPDbox - Making ... Deferred tax is neither deferred, nor tax: it is an accounting measure, more specifically an accrual for tax. I’m very proud to publish the first guest post ever in this website, written by Professor Robin Joyce FCCA who will explain you, in a detail, how to understand deferred taxation and how to tackle it in a logical way.. This article reflects the opinions and explanations of Robin and I ...

2014 tax computation worksheet

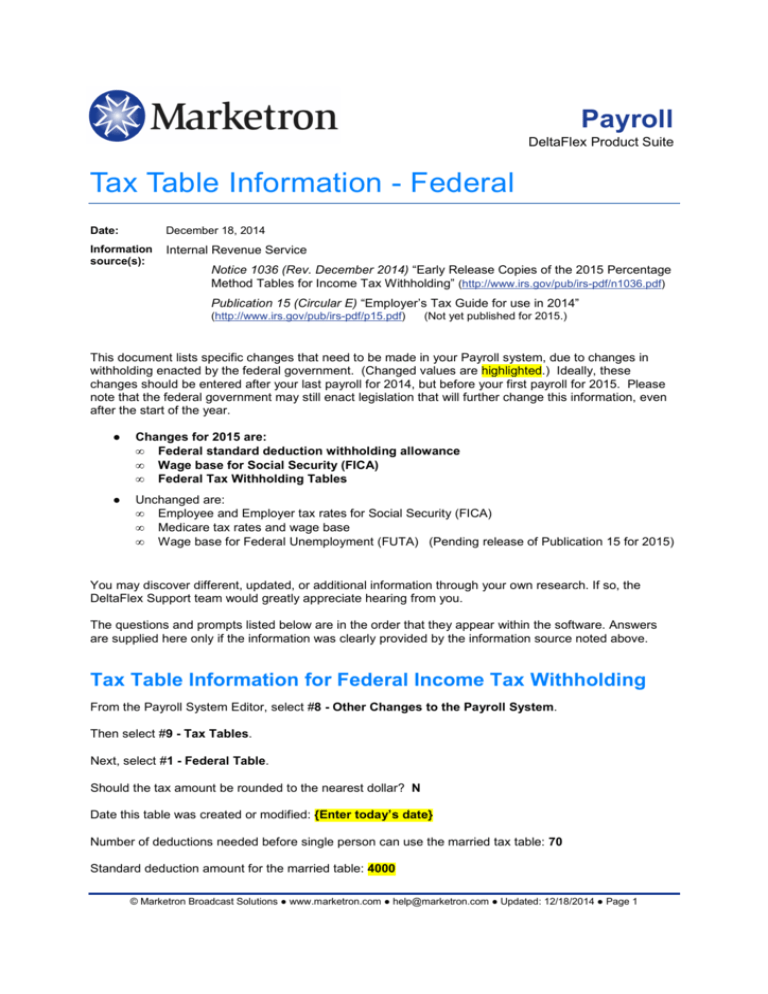

2020 Income Tax Forms | Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms . Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2020 Special Capital Gains Election and … PDF TaxYear-2014-Resident_Booklet.pdf 2014 maryland tax table Tax information and assistance PENSION EXCLUSION COMPUTATION WORKSHEET (13A) Review carefully the age and... PDF Instructions for 2014 Estimated Tax Worksheet 2014 Tax Computation Worksheet Using Maximum Capital Gains Rates (Use this computation if the estate or trust expects a net capital gain or qualified dividends and line 6 of the 2014 Estimated Tax Worksheet is more than zero.) Caution: Do not include any amounts allocable to the beneficiaries of...

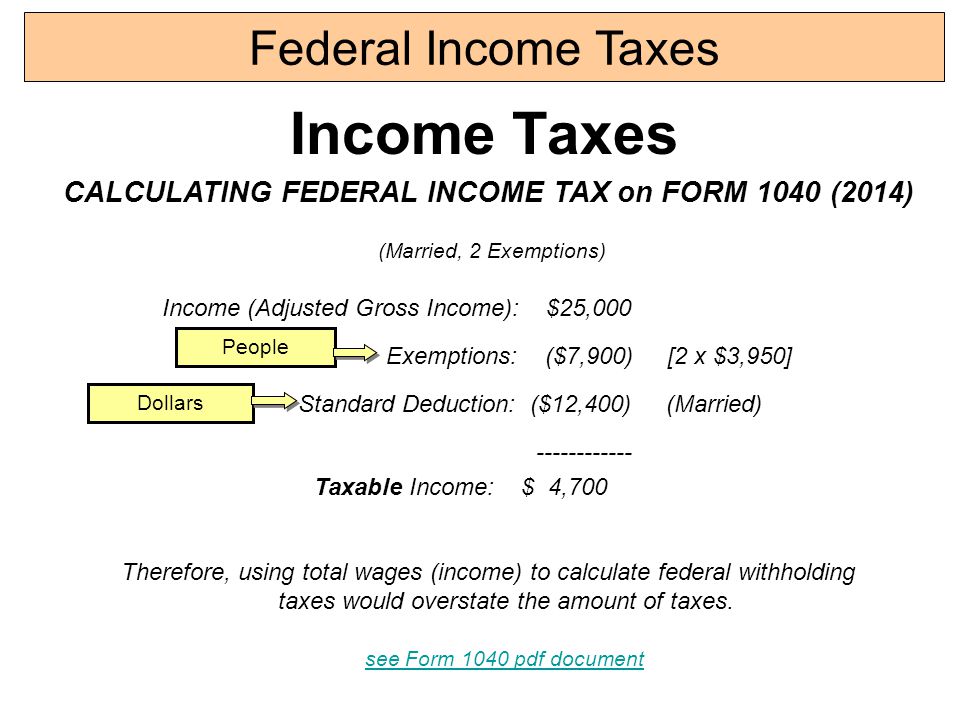

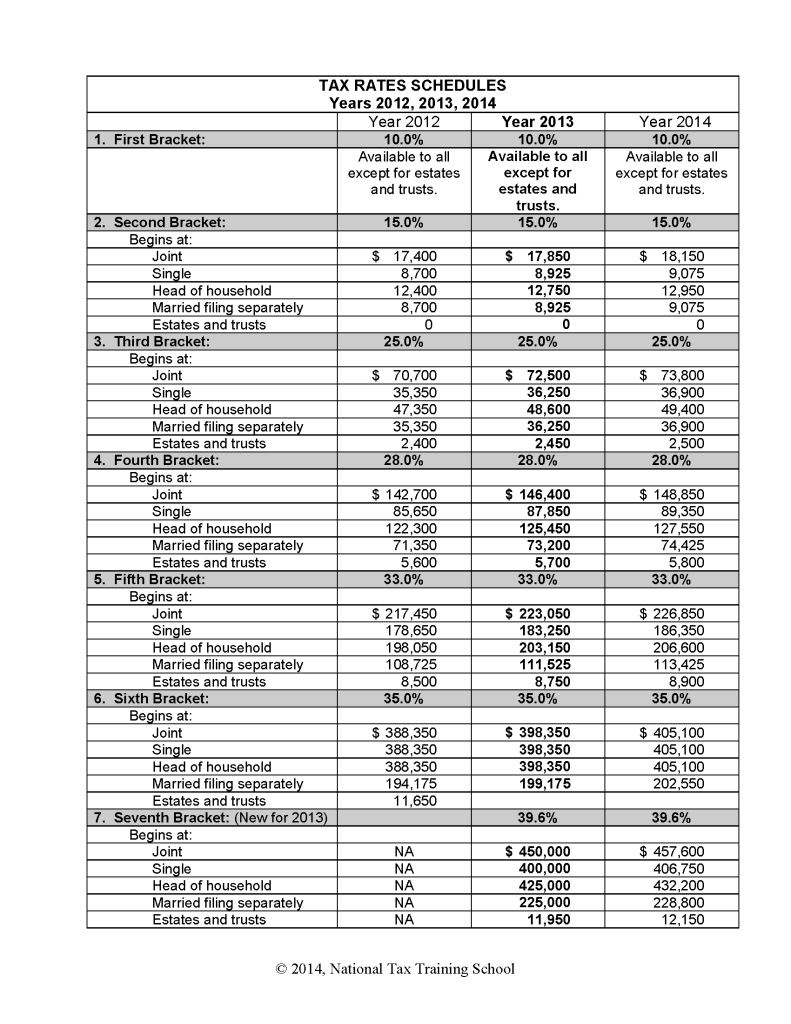

2014 tax computation worksheet. Progressive tax - Wikipedia Tax laws might not be accurately indexed to inflation. For example, some tax laws may ignore inflation completely. In a progressive tax system, failure to index the brackets to inflation will eventually result in effective tax increases (if inflation is sustained), as inflation in wages will increase individual income and move individuals into higher tax brackets with higher … Tax Computation Worksheet 2014 | Mychaume.com Cursive Worksheet Generator from Tax Computation Worksheet 2014 , source: homeschooldressage.com. Social Security Benefit Worksheet Worksheets for all from Tax Computation Worksheet 2014 , source: bonlacfoods.com. How to Fill out IRS Form 1040 with Form... Publication 560 (2021), Retirement Plans ... - IRS tax forms For tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup costs, up to the greater of (a) $500; or (b) the lesser of (i) $250 for each employee who is not a “highly compensated employee” eligible to participate in the employer … Tax Computation Worksheet Tax Return Spreadsheet Awesome Tax Worksheet 1040 Line 44 Save from tax computation worksheet , source:oregondaysofculture.org. 2014 Ez Tax form Irs Help Desk Lovely 8832 form Unique 60 Recent Irs from tax computation worksheet , source:formfiles.com.

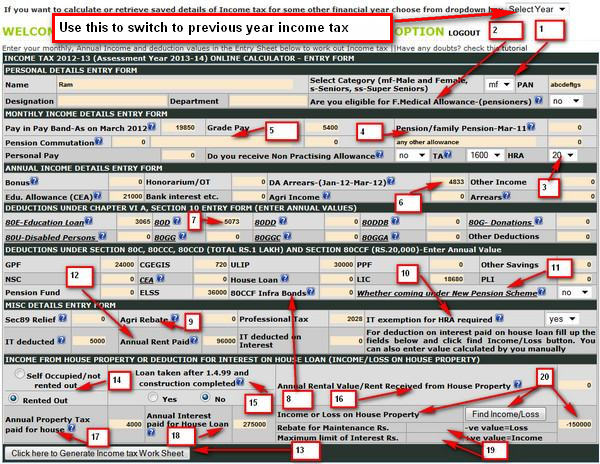

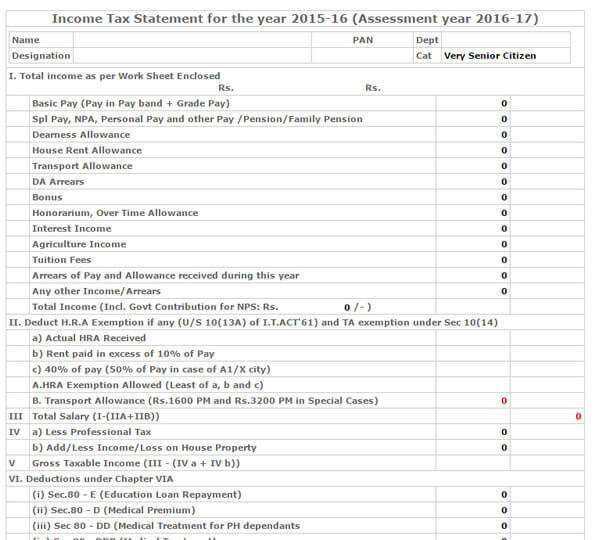

Tax Computation Worksheet The tax computations worksheet provides tax information without using any form or instructions. This permits anyone with minimal technical skills to complete the calculation without having to The tax computation worksheet can be a good way to input information into an income tax software program. Tax Computation Worksheet 2014 Usa - Templates : Resume... 2014 tax putation worksheet exiting the eu the financial 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns 3 21 3 21 Posts Related to Tax Computation Worksheet 2014 Usa. Tax Computation Worksheet - Xls Download - CiteHR Dear All, Please find attached Tax Computation Worksheet for your TDS Calculation. Regards, OCS Team 14th April 2014 From India, Gurgaon. Attached Files (Download Requires Membership). TAX COMPUTAION1.xls (61.0 KB, 303 views). tax computation worksheet - Search Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Inst 1040-C: Instructions for Form 1040-C, U.S. Departing Alien Income Tax Return 2021 01/15/2021 Inst 1040-NR April 29, 2018. Tax putation Worksheet Line 44 from 2014 Tax Computation Worksheet, source:unclefed.com.

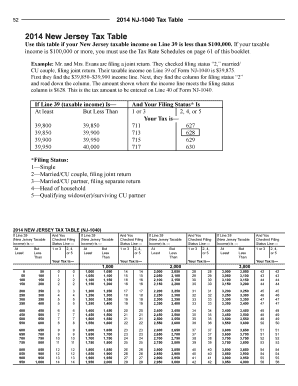

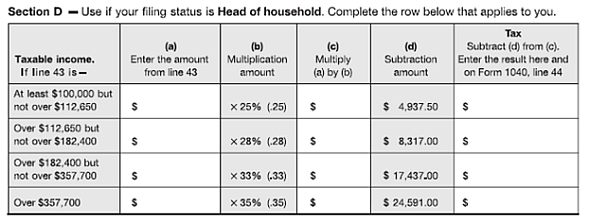

Tax Computation Worksheet Excel Excel. Details: Tax Computation Worksheet 2014 Uk. Excel. Details: Tax Computation Worksheets for 2021. Note. If you are figuring the tax on an amount from Worksheet 2-5 (line 1 or 14), or Worksheet 2-6 (line 2 or 3), enter … 2021 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES $2,641. This is the tax amount they should enter in the entry space on Form 1040, line 16. If line 15 (taxable income) is— And you are— At least But less than Single Married filing jointly * Married filing sepa-rately Head of a house-hold Your tax is— 0 5 0 0 0 0 5 15 1 1 1 1 15 25 2 2 2 2 25 50 4 4 4 4 50 75 6 6 6 6 75 100 9 9 9 9 100 125 11 11 11 11 125 150 14 14 14 14 150 175 16 16 16 ... Tax Computation Worksheet 2020 - 2021 - Federal Income Tax Tax Computation Worksheet for the 2020 taxes you're paying in 2021 can be used to figure out taxes owed. The tax computation worksheet is for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax. PDF Form IT-205-I:2014:Instructions for Form IT-205 Fiduciary Income Tax... Tax computation worksheet 1 If NYAGI worksheet, line 5, is more than $104,600, but not more than $1,046,350, and the estate's or trust's taxable income from Form IT-205, line 5, is $209,250 or less, the estate or trust must compute its tax using this worksheet.

PDF 2014 Tax Computation for Corporations Tax-exempt corporations, tax-exempt trusts, and domestic private foundations must make estimated tax payments if the total estimated tax for the Generally, a corporation figures its tax on the amount on Form 990-W, line 1, using the 2014 Tax Computation for Corporations worksheet shown below...

Preparing a Tax Computation A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Tax adjustments include non-deductible expenses, non-taxable receipts, further deductions and capital allowances.

Estate Tax - FAQ - Georgia Department of Revenue As of July 1st, 2014, O.C.G.A. § 48-12-1 was added to read as follows: § 48-12-1. Elimination of estate taxes and returns; prior taxable years not applicable (a) On and after July 1, 2014, there shall be no estate taxes levied by the state and no estate tax returns shall be required by the state. (b) Tax, penalty, and interest liabilities and refund eligibility for prior taxable years shall ...

Individual Income Tax Forms - Nebraska Department of Revenue Nebraska Incentives Credit Computation for All Tax Years. 3800N. View Forms. 2021 Special Capital Gains Election and Computation (01/2022) 4797N. Form. Nebraska Application for Extension of Time (01/2021) 4868N. Form. 2021 Nebraska Community Development Assistance Act Credit Computation (01/2022) CDN. Form. Nebraska Net Operating Loss Worksheet Tax …

Mark Dayton 2014 Taxes | PDF | Irs Tax Forms | Tax Deduction Mark Dayton 2014 taxes - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Qualified Dividends and Capital Gain Tax Worksheet - Line 44. Name(s) shown on return. MARK B. DAYTON Tax Computation Using Maximum Capital Gains Rates.

2014 Tax Computation Worksheet worksheet maze for kindergarten... 2014 Tax Computation Worksheet. Jule Eugénie September 12, 2021 worksheet. Parents are familiar with using worksheets in math classes.

Tax Computation Worksheet 2014 | Free Printables Worksheet We found some Images about Tax Computation Worksheet 2014

tax computation worksheet - classic.iworksheet.co Tax Computation Worksheet 2014 Homeschooldressage.com - Worksheet Template Tips And Reviews. Income Tax Formula - Excel University. 7 INCOME TAXES 7-1 Tax Tables, Worksheets, and Schedules - ppt video online download. 2014 Tax Computation Worksheet - Nidecmege.

Irs 1040 Tax Computation Worksheet, Jobs EcityWorks Fill Out The Line 12a, Tax Computation Worksheet Online And Print It Out For Free. Irs Form 1040 Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Tax Computation Worksheet - 2014 Form 1040 Instructions - Page 88 Forms and Instructions.

How do I display the Tax Computation Worksheet? The Tax Computation Worksheet does not appear as a form or worksheet in TurboTax. You can see the Tax Computation Worksheet on page 89 of the IRS instructions for Form 1040. Be sure to read the paragraph at the top of the worksheet regarding what amount to enter in column (a). You...

PDF Combined Square Footage Business Tax Computation Worksheet for... I. Compute the square footage business tax before credits. Line 1 Line 2 Line 3. Retain this worksheet with your tax records. Form #006 - Combined Sq Ft Worksheet - revision Jan 2014. * SMC 5.45.080 requires businesses with only an office or place of business location within...

PDF Tools for Tax Pros | 2014 Schedule D Tax Worksheet Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040, line 44 (or in the Instructions for Form 1040NR, line 42) to figure your tax.

PDF 2014 Publication 505 | 2014 Estimated Tax Worksheet Additional Medicare Tax Beginning in 2013, a 0.9% Additional Medicare Tax applies to Medicare wages, Railroad Retirement Tax Act compensation, and self-employment income over a threshold amount based on your filing status. You may need to include this amount when figuring your...

STATEMENT OF SERVICE - FOR COMPUTATION OF LENGTH OF ... STATEMENT OF SERVICE - FOR COMPUTATION OF LENGTH OF SERVICE FOR PAY PURPOSES. For use of this form, see AR 37-104-4; the proponent agency is ASA(FM) PRIVACY ACT STATEMENT. Authority: 37 USC, Section 1006; Executive Order 9397. Purpose: This form is used to document a member's request for verification of military service. It is also used to ...

How Your Tax Is Calculated: Tax Table and Tax Computation... The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. Here's how this works in the Tax Computation Worksheet. First, you determine which row to use. Each one has a range of taxable incomes.

Tax Computation Worksheet | Homeschooldressage.com mon Worksheets 2014 tax putation worksheet 2014 Louisiana from Tax Computation Worksheet, source:madner.info. Publication 505 2017 Tax Withholding and Estimated Tax from Tax Computation Worksheet, source:irs.gov. Liberty Tax Service line Basic In e Tax Course Lesson 6 ppt from Tax...

Tax Computation Worksheet for Line44 Use this Worksheet for both Tax Computation Worksheet and Tax Table, no need to manually search the long and fine printed tax table. Disclaimer: Results received from worksheets and calculators of this websiste are designed for comparative purposes only, and accuracy is not...

Tax Computation Worksheet 2014 | Fronteirastral.com fortable putation In Context Math Worksheets from Tax Computation Worksheet 2014 , source: modopol.com. Best Tax putation Worksheet New How To Fill Out Irs Form 1040 from Tax Computation Worksheet 2014 , source: latinopoetryreview.com.

Tax Computation Worksheet - Fill Online, Printable... | PDFfiller Fill Tax Computation Worksheet, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller Instantly No software. 2010 Tax Computation Worksheet--Line 44 CAUTION !

2017 Personal Income Tax Booklet 540 | FTB.ca.gov This option is only available if you are permitted to report use tax on your income tax return and you are not required to use the Use Tax Worksheet to calculate the use tax owed on all your purchases. Simply include the use tax liability that corresponds to your California Adjusted Gross Income (found on Line 17) and enter it on Line 91. You will not be assessed additional use tax …

PDF Disk128:[15zaf1.15zaf46201] Ba46201a.;4 For a worksheet approach to computing a Unit holder's income and expense amounts, see the Tax Computation Worksheet on page 21. The proper cost depletion schedule to use in computing 2014 cost depletion depends on the date when the Units were acquired, as described below.

Tax Computation Worksheet 2015 In Excel Worksheet : Resume... Resume Examples > Worksheet > Tax Computation Worksheet 2015 In Excel.

PDF Instructions for 2014 Estimated Tax Worksheet 2014 Tax Computation Worksheet Using Maximum Capital Gains Rates (Use this computation if the estate or trust expects a net capital gain or qualified dividends and line 6 of the 2014 Estimated Tax Worksheet is more than zero.) Caution: Do not include any amounts allocable to the beneficiaries of...

PDF TaxYear-2014-Resident_Booklet.pdf 2014 maryland tax table Tax information and assistance PENSION EXCLUSION COMPUTATION WORKSHEET (13A) Review carefully the age and...

2020 Income Tax Forms | Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms . Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2020 Special Capital Gains Election and …

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&ssl=1)

0 Response to "42 2014 tax computation worksheet"

Post a Comment