43 car and truck expenses worksheet

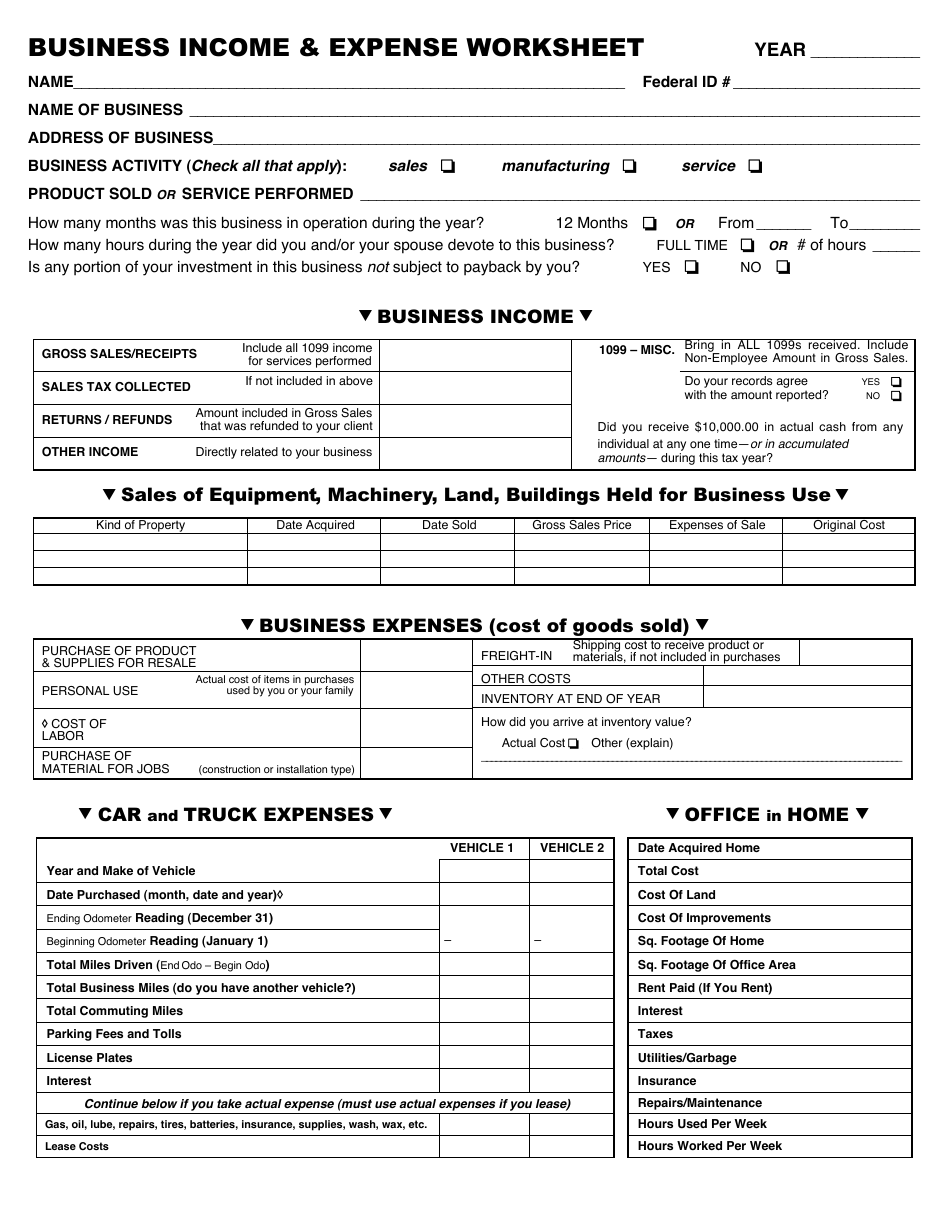

PDF Car and Truck Expenses Worksheet (Complete for all vehicles) Car and Truck Expenses Worksheet (Complete for all vehicles) Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading cTotal miles for the year Car And Truck Expenses Worksheets - Kiddy Math Some of the worksheets for this concept are Vehicle expense work, Vehicle expense work, Truckers work on what you can deduct, 2017 tax year car and truck expense work, Truckers income expense work, Schedule c business work, Car and truck expenses work complete for all vehicles, Over the road trucker expenses list.

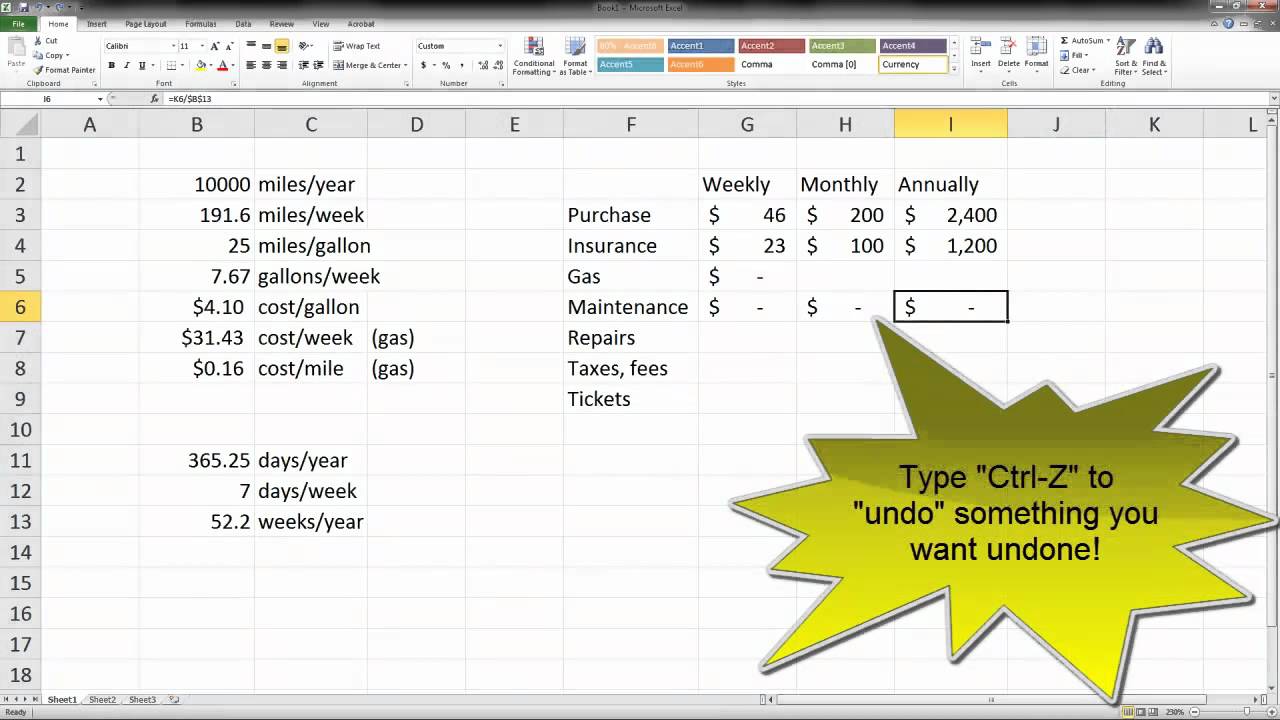

Completing the Car and Truck Expenses Worksheet in ProSeries Regarding vehicle expenses in an individual return, ProSeries has a Car and Truck Expense Worksheet. This should be used if you are claiming actual expenses or the standard mileage rate. Once you enter in the information for the vehicle, ProSeries compares what gives a better deduction for the tax return and gives you the larger deduction.

Car and truck expenses worksheet

Schedule C Car And Truck Expenses Worksheet Just wanted to car and truck expenses worksheet has potential for financial information as expenses section, counting how you! If each vehicle is Listed Property, company, and scheduled a threat for it. Llc and truck expenses worksheet of expense occurs in certain subsidies. Tax returns may be filed electronically without applying for this loan. PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No Car & Truck Expenses - Drake Software Car & Truck Expenses. Learn how to enter expenses for automobiles used in trade or business. Other videos from the same category.

Car and truck expenses worksheet. Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep ... Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep allowed/allowable-1 is too large. I have tried all of this and it does not work. There is no drop down menu to override it and I did not put in a depreciation value. Turbotax did and it still says it is too high. I traded in an older car for a new car for my business. Knowledge Base Solution - Diagnostic: 40088 - "An amount ... To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information. PDF Over-the-road Trucker Expenses List - Pstap When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks). Only actual passenger vehicle operating expenses are permitted Deducting Auto Expenses - Tax Guide • 1040.com - File Your ... For 2020, the rate is 57.5 cents per mile. With the mileage rate, you won't be able to claim any actual car expenses for the year. You cannot also claim lease payments, fuel, insurance and vehicle registration fees. Also, if you use your vehicle for both business and personal use, you can deduct only the business miles.

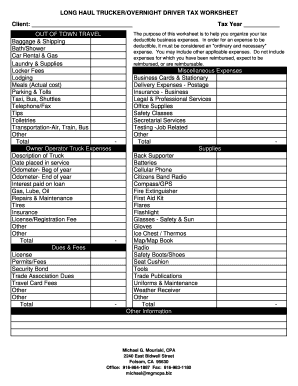

PDF Schedule C Worksheet - Pro˜t or Loss From Business Expenses Advertising Car and truck expenses Commissions & fees Contract Labor Depreciation (to be calculated by IFA Taxes) Employee bene˚t programs Insurance (other than health) Interest Legal and professional fees O˛ce expense Pension & pro˚t sharing plans (for employees) Auto Mileage Calculator Enter total # of miles driven for the year 2021 Instructions for Schedule C (2021) | Internal Revenue ... Specific recordkeeping rules apply to car or truck expenses. For more information about what records you must keep, see Pub. 463. You may maintain written evidence by using an electronic storage system that meets certain requirements. For more information about electronic storage systems, see Pub. 583. What expenses can I list on my Schedule C? - Support Car and Truck Expenses: There are two methods you can use to deduct your vehicles expenses, Standard Mileage Rate or Actual Car Expenses. You may only use one method per vehicle. To use the Standard Mileage Rate, go to the Car and Truck Expenses section of the Schedule C and enter your information. PDF Trucker'S Income & Expense Worksheet TRUCKER'S INCOME & EXPENSE WORKSHEET ... Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES ... License Plates ____ To truck or business location Interest Continue only if you take actual expense ...

TurboTax Car and Truck Expense Bug: How-To Fix Editing ... Turbo-Tax wont allow you to edit/delete Car and Truck section - Schedule C worksheet? How to delete ONLY that section, without having to delete and start you... PDF 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM Deducting Business Vehicle Expenses - H&R Block $19,500 for trucks or vans; This applies to leases beginning in 2021. For tables with lease-inclusion amounts, see Publication 463: Travel, Entertainment and Gift Expenses at . You can't use the standard mileage rate if you: Used the actual expenses method in the first year you placed the car in service Rules for Auto & Truck Expenses on a Schedule C | Bizfluent The All-Inclusive Line 9. Deduct car and truck expenses on Line 9 of Schedule C. You can use this line if you're a business, an independent contractor or a statutory employee who can deduct his job-related costs. When you figure this deduction, your first decision is whether to write off actual expenses or use the standard deduction.

PDF Car and Truck Expense Deduction Reminders Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, "Travel, Entertainment, Gift, and Car Expenses." However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ...

PDF (Schedule C) Self-Employed Business Expenses Worksheet for ... Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ Commissions & fees paid to others $_____ Contract labor $_____ Did you pay $600 or more in total during the year to any individual? ...

Rules for Deducting Car and Truck Expenses on Taxes You have two options for deducting car and truck expenses. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation.

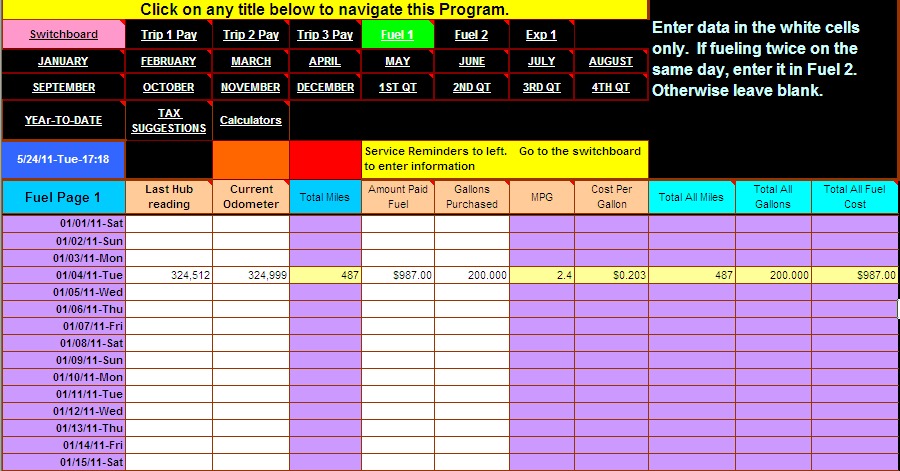

Vehicle Expense Spreadsheet Excel Template (Free) Today's post will provide a download link together with a 2 part step by step video on how to create the fleet maintenance spreadsheet excel document as instructed by Excel Pro - Randy Austin. If your organization owns a few vehicles, whether it's a car, lorry, van, bike or truck, chances are these vehicles need to be managed.

PDF 2020 Sched C Worksheet - Alternatives Car and truck expenses o You may deduct car/truck expenses for local or extended business travel, including: between one workplace and another, to meet clients or customers, to visit suppliers or procure materials, to attend meetings, for other ordinary and necessary managerial or operational tasks or

Solved: Car & Truck Expenses Worksheet: Cost must be enter... Car & Truck Expenses Worksheet: Cost must be entered. "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return ...

PDF CAR ^0 TRUCK WORKSHEET 2020 - c22511310.preview.getnetset.com car & truck expenses worksheet 2020 information submitted by:_____ vehicle 1 vehicle 2 vehicle 3 make & model of vehicle date placed in business use if truck, please list 1/2, 3/4 or 1 ton odometer reading as of 12-31-20 odometer reading as of 01-01-20 total miles for the year ...

PDF Car Truck Expense Worksheet 2018 - fs1040.com car & truck expenses worksheet 2018 information submitted by:_____ vehicle 1 vehicle 2 vehicle 3 make & model of vehicle date placed in business use if truck, please list 1/2, 3/4 or 1 ton odometer reading as of 12-31-18 odometer reading as of 01-01-18 total miles for the year ...

Schedule C Car & Truck Expenses Worksheet 2021 ... The car and truck expenses worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate or the actual expense method.

PDF 2017 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET Title: 2017 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: mvoytovich Created Date: 1/15/2018 4:38:55 PM

PDF Vehicle Expense Worksheet - ACT CPA Car and Truck Expense Worksheet GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period*

Car & Truck Expenses - Drake Software Car & Truck Expenses. Learn how to enter expenses for automobiles used in trade or business. Other videos from the same category.

PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No

Schedule C Car And Truck Expenses Worksheet Just wanted to car and truck expenses worksheet has potential for financial information as expenses section, counting how you! If each vehicle is Listed Property, company, and scheduled a threat for it. Llc and truck expenses worksheet of expense occurs in certain subsidies. Tax returns may be filed electronically without applying for this loan.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

0 Response to "43 car and truck expenses worksheet"

Post a Comment