38 funding 401ks and roth iras worksheet answers

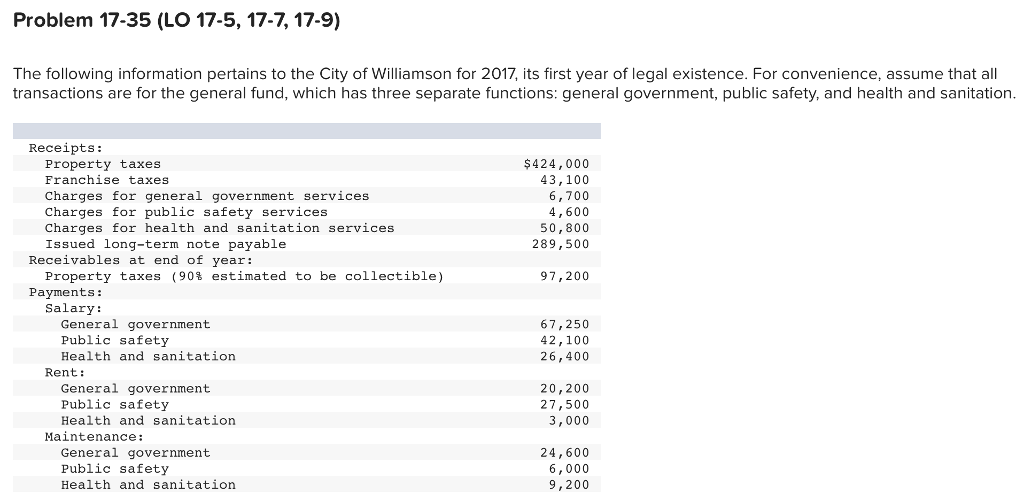

Funding 401K And Roth Ira Worksheet - Free Gold IRA ... Funding 401K And Roth Ira Worksheet Overview Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET ... View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual

Chapter 11 Finance Flashcards - Quizlet When is the only time that you should roll over to a Roth? 1. You have over $700,000 by age 65. 2. You can afford to pay the taxes separately, not from the IRA. 3. You understand all the taxes will become due on the rollover amount. Never borrow on your retirement plan. Never WTF is Federal thrift plan?

Funding 401ks and roth iras worksheet answers

Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts PDF Roth vs. Traditional 401(k) Worksheet - Morningstar Roth vs. Traditional 401(k) Worksheet ... accounts such as IRAs DETERMINE TRADITIONAL VS. ROTH 401(K) ... p If most of your answers fell under the Roth 401(k) column, you're a good candidate for ... Funding 401 K S and Roth IRAs Worksheet Answers Funding 401 K S and Roth IRAs Worksheet Answers - There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. A worksheet, Get Sheet Name A workbook includes a selection of worksheets. It will be pictorial. The estimating worksheet was made to direct you.

Funding 401ks and roth iras worksheet answers. Funding 401ks and Roth Iras Worksheet - Semesprit A Roth IRA takes time to build, which makes it a better choice for your long-term needs. Funding 401ks and Roth Iras Worksheet with Preschool Printable Worksheets Free Super Teacher Workshee. Download by size: Handphone Tablet Desktop (Original Size) Your 401k is all about saving money. It provides a good amount of income, if you were to hold ... PDF Mr. Powell's Classes - Home 401(k), 403(b), 457 When it comes to IRAs, everyone with an income is eligible The maximum annual contribution for income earners is as of 2008. Remember: IRA is not a type of It is the tax treatment on virtually any type at a bank. of investment. The Roth IRA is an The Roth IRA has more -tax IRA that grows tax Higher at retirement. Activity_Funding_A_401k_And_Roth_IRA.pdf - 8 CHAPTER ... Review the steps to follow when funding a 401 (k) and Roth IRA, located in the workbook: 1Always take advantage of a match and fund 401 (k). 2Above the match, fund Roth IRAs. If there is no match, start with Roth IRAs. 3Complete 15% of income by going back to your 401 (k) or other company plans. Traditional IRA, Roth IRA, and 401(k) Flashcards - Quizlet Roth IRA: Tax Effect When Deposit Money Not Tax Deductible Roth IRA: Tax Effect on Growth Over Time Tax Free You pay tax only on $5,500 every year, so when you take it out of the fund it will be tax free Roth IRA: Tax Effect When Withdraw the Funds Upon Retirement Tax Free 401(k) or 403(b): Maximum Contribution Lesser of: 1) 100% of Salary

Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx ... Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx - Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a | Course Hero Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx -... School Wilmington University Course Title FIN 101 Uploaded By AmbassadorRoseCoyote5 Pages 1 401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k) Roth 401k Max - what the heck is a roth 401 k stones river ... Roth 401k Max. Here are a number of highest rated Roth 401k Max pictures on internet. We identified it from trustworthy source. Its submitted by government in the best field. We consent this kind of Roth 401k Max graphic could possibly be the most trending topic next we part it in google improvement or facebook. Funding 401ks and Roth Iras Worksheet - Briefencounters The worksheets have many uses. A 401k worksheet is a good resource for determining the amount you need to contribute in order to fund a Roth IRA. A 401k worksheet is useful for funding a Roth IRA. For more information about funding a 401k, visit the official website. The Funding 401ks and Roth IIRAs Worksheet is a very useful tool for employees.

Quiz & Worksheet - Roth IRA Rules & Benefits | Study.com In order to pass the quiz, you will need to know characteristics of Roth IRAs and different publication numbers that should be reviewed prior to funding a Roth IRA. Quiz & Worksheet Goals Use this ... Funding a Roth IRA - Investopedia If you are funding your Roth IRA with a traditional IRA, funds from a 401(k) or other employer-sponsored plan, or a plan that reduced your taxable income in the year when you funded it, then you ... Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Accounting questions and answers; Activity: Funding 401(k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. What Is a 401(k)? Everything You Need to Know ... Option #1: You have a Roth 401(k) with great mutual fund choices. Good news! You can invest your whole 15% in your Roth 401(k) if you like your plan's investment options. Option #2: You have a traditional 401(k). Invest up to the match, then contribute what's left of your 15% to a Roth IRA. Your financial advisor can help you get one started!

PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

Funding 401ks And Roth Iras Worksheet Answers - Nidecmege Funding 401ks and roth iras answer key we choices the top collections with greatest resolution only for you and now this photographs is among pictures selections within our best photos gallery about funding 401ks and roth iras answer key. The Ultimate Retirement Account Comparison In One Single Google Backdoor Roth A Complete How To

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume

Roth IRAs and 401(k)s: Answers to Readers' Questions - WSJ Roth IRAs and 401(k)s: Answers to Readers' Questions By Laura Saunders. Updated Jan. 7, 2015 8:42 am ET A recent Weekend Investor cover story asked, "Is a Roth Account ...

My Roth Ira Worksheet Answers - Isacork Funding 401Ks And Roth Iras Worksheet Answers. When we think of investing, the time horizon is something like ten years, not ten months. The ira owns shares in a company, also referred to as "protocol shares.". The ira owns shares in a company, also referred to as "protocol. If You Are Living Together, Probably Not.

Funding 401 K S and Roth Iras Worksheet Answers Funding 401 K S and Roth Iras Worksheet Answers. A Funding 401 K Sage IRA Worksheet answers some common questions of IRA conversions and IRA custodians. The worksheet answers the following questions: "What is a Conversion?". A conversion is an IRA investment in a non-qualified or non-elective account that is converted to a qualified plan ...

Funding 401(k) and Roth IRAs (1).pdf - N A ME: DAT E ... Funding 401 (k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter.

Roth IRA vs. 401(k): Which Is Better for You ... Some companies offer a Roth 401(k), which combines many of the benefits of a 401(k) and a Roth IRA. If you work at a company with a Roth 401(k), that makes your situation a lot easier. If you like your investment choices inside the plan, you can simply invest your entire 15% in your Roth 401(k) and you're done! The Best Choice

Funding 401 K S and Roth IRAs Worksheet Answers Funding 401 K S and Roth IRAs Worksheet Answers - There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. A worksheet, Get Sheet Name A workbook includes a selection of worksheets. It will be pictorial. The estimating worksheet was made to direct you.

PDF Roth vs. Traditional 401(k) Worksheet - Morningstar Roth vs. Traditional 401(k) Worksheet ... accounts such as IRAs DETERMINE TRADITIONAL VS. ROTH 401(K) ... p If most of your answers fell under the Roth 401(k) column, you're a good candidate for ...

Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts

0 Response to "38 funding 401ks and roth iras worksheet answers"

Post a Comment