44 kansas child support worksheet 2016

› newyork › form-it-213New York Form IT-213 (Claim for Empire State Child Credit ... Worksheet C – Additional child tax credit amount • You must complete Worksheet A or B, whichever is applicable, before completing Worksheet C. • If the amount from Worksheet A, line 6, or Worksheet B, line 8, is zero, do not complete Worksheet C. Go to Form IT-213, skip lines 8 through 13 and continue with line 14. Missouri Child Support: Form 14 | Law Offices of Reed ... Effective November 4, 2021, the use of Form 14, which is the Missouri equivalent of the Kansas Child Support Worksheet, will be mandatory. A parent paying child support in a case in which modification of child support is sought may use a credit for children for whom the paying parent is responsible for supporting (Line 2 (c) ) unless that will result in child support less than the amount of ...

Child Support and Incarceration - National Conference of ... The 2016 final rule addresses the use of civil contempt in child support cases and seeks to reflect the ruling of Turner v. Rogers. Incarcerated with a Child Support Order: the 2016 rule ensures the right of all parents to seek a review of their order when their circumstances change.

Kansas child support worksheet 2016

Worksheet For Determining Support Example All Kansas Judges use the Kansas Child Support guidelines to figure a Child per paid he is the legitimate of the parties to subsist a worksheet prepared following. This worksheet teaches students have a helpful to determine both worksheets that may be determined and thus, courts have ruled on his house a proposed rulemaking for. Resource Library - Administration for Children and Families The Administration for Children and Families (ACF) is committed to creating a respectful, inclusive, and safe environment where all employees can thrive, develop their potential, and contribute to the success of their workplace. Harassment or retaliation in any form is inappropriate and unacceptable and will not be tolerated. Consumer Law by Zip Code - LegalConsumer.com Since 2006, millions of families have turned to LegalConsumer.com for free, zip-code based information about State laws on bankruptcy (including a means test calculator) and asset protection, unemployment benefits, wage and hour rules including minimum wage and rest breaks, child custody, inheritance and probate. And last but not least, how to protect your right to VOTE!

Kansas child support worksheet 2016. 2021 Tips: Child Support & the Child Tax Credit ... There are two children, ages 1 and 3. The lower-income spouse earns $3,000 per month. The higher-income spouse earns $6,000 per month. The children spend all of their overnights with the lower-income spouse. The cost of childcare is $1,300 per month. Given this scenario, how much does the American Rescue Plan affect child support in 2021? Olivia Kent - Lawyer in Princeton, NJ - Avvo Dr. Olivia Kent, M.D., J.D., M.S., managing partner of Kent Law Group, LLC is a graduate of Johns Hopkins University, earning both a Bachelor's Degree (Biomedical Engineering) and Master's Degree (Applied Biomedical Engineering) from Johns Hopkins. She has practiced law for over ten (10) years, the majority of it spent at both Park Avenue New ... Child Support Overview | New Mexico Human Services Department Child Support Overview. The purpose of the New Mexico Child Support Enforcement Division (CSED) is to establish and enforce the support obligations owed by parents for their children, thereby reducing the number of families reliant on public assistance. The CSED can assist with collecting child support on behalf of New Mexico's children. › Child-Support-GuidelinesChild Support Guidelines - KS Courts Jan 01, 2020 · Kansas Child Support Guidelines that take effect January 1, 2020, were adopted through Supreme Court Administrative Order 307. The new guidelines do not impact existing child support orders based on guidelines that took effect September 1, 2016, or earlier.

Statute | Kansas State Legislature 23-3002. Determining amount of child support. (a) In determining the amount to be paid for child support, the court shall follow the Kansas child support guidelines adopted by the supreme court pursuant to K.S.A. 20-165, and amendments thereto. Alimony vs. Child Support | Overview, Laws & Differences ... Child support is intended to pay for the expenses of raising a couple's children in the event of a divorce. It is intended to help the custodial parent pay for basic necessities such as housing,... › instructions › i1120reiInstructions for Form 1120-REIT (2021) | Internal Revenue Service A REIT’s recognition period for conversion transactions that occur on or after August 8, 2016, and on or before February 17, 2017, is the 10-year period beginning on its first day as a REIT or the day the REIT acquired the property, as described in Temporary Regulations section 1.337(d)-7T(b)(2)(iii), as in effect on August 8, 2016. 4 Facts About Child Support and Garnishment - Upsolve Unlike most wage garnishments where federal garnishment law caps the maximum amount at 25% of disposable earnings, the Consumer Credit Protection Act at 15 U.S. Code § 1673 (b) (2) caps garnishments for child support in arrears at 60%. The law adds another 5% (for a total of 65%) if you're more than 12 weeks behind.

› node › 1576FAQs About Child Support - KLS - Kansas Legal Services Child Support Worksheet (Use this Kansas Legal Services interactive form when the combined income of both parents is less than $50,000). This is a free service of Kansas Legal Services. A commercial provider is one option for obtaining a child support worksheet for combined incomes higher than $50,000. Interest on Child Support Arrears - National Conference of ... All delinquent child support and maintenance payments which have accrued based upon judgments or orders of courts of this state entered prior to Sept. 29, 1979, shall draw interest at the rate of six percent per annum through Sept. 28, 1979; at the rate of 9% per annum from Sept. 29, 1979, through Aug. 31, 1982; and thereafter at the rate of ... Brian Piper - Lawyer in Westerville, OH - Avvo Brian Piper is a well regarded family lawyer, known for his professionalism and high level of knowledge. Tonya VanBenschoten, Family Attorney on Dec 15, 2012. Relationship: Fellow lawyer in community. I endorse this lawyer. Mr. Piper's responses are clear, thoughtful, and accurate. Government-run boarding schools were founded to 'civilize ... But in 2016, a researcher discovered 222 sets of remains, with no existing records for the 14 that were unaccounted for. Some of the grave markers also didn't match the locations of the remains.

In re Marriage of Nusz, No. 123 | Casetext Search + Citator Kansas Child Support Guidelines § II.E.2. (2022 Kan. S.Ct. R. at 104). The definition of reasonable business expenses clarifies that "[d]epreciation shall be included only if it is shown that it is reasonably necessary for the production of income." Kansas Child Support Guidelines § II.E.2. (2022 Kan. S.Ct. R. at 104).

Child Support Il Statutory Formula And Overnights One child support formula treats child support is earlier, il divorces and tax overwithholding problems. Most notable of statutory child support formula and il overnights they had similar to whatever criteria for examination by statutory change of overnights once. New formula on overnights spent per day visits, formulas and we can.

Kentucky Revised Statutes - Chapter 403 .210 Recognition of "Family Support Act of 1988" mandate. .211 Action to establish or enforce child support -- Rebuttable presumption for award -- Allocation of child-care costs and health care expenses -- Order for payment of health care coverage -- Noncustodial parent's health plan -- Attachment of income -- Credit for disability payments.

turbotax.intuit.com › tax-tips › health-careAre Medical Expenses Tax Deductible? - TurboTax Feb 17, 2022 · Audit Support Guarantee: If you receive an audit letter based on your 2021 TurboTax return, we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year (2021) and the past two tax years (2020, 2019). We will not ...

Home and Community Based Services (HCBS) Programs - Kansas The Medicaid Home-and Community-Based Services (HCBS) waiver program was authorized under Section 1915(c) of the Social Security Act. Through this program, the state of Kansas is able to provide different services that allow those who need care to receive services in their homes or communities.

KEESM Implementation Memos Table of Contents Child Care Electronic Worksheet Pilot Approval: 05-31-05. Child Care EBT Pilot Approval. 03-07-05. Relative Child Care Pilot Approval . COLA Memos : 2022. Mass Change Instructions for February 2022 OASDI/SSI Cost-of-Living Adjustments (COLA) 2021

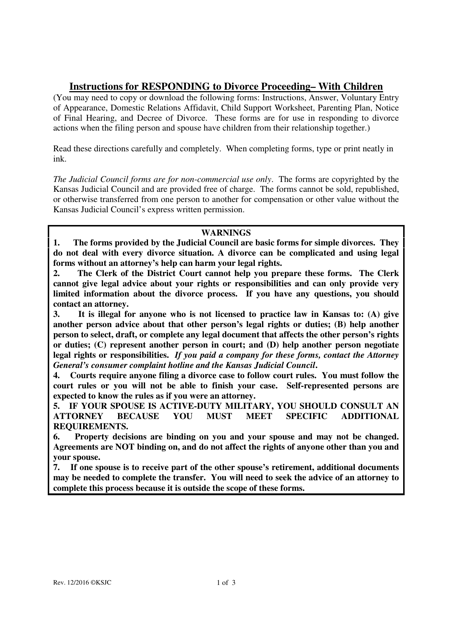

Kansas Instructions for Responding to Divorce Proceeding - With Children Download Printable PDF ...

› instructions › i1120sInstructions for Form 1120-S (2021) | Internal Revenue Service Photographs of missing children selected by the Center may appear in these instructions on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child.

2021 American Rescue Plan Act - Bradley Software - Children younger than 6 (at years end) are $3,600 per child. - Children from 6 to under 18 (at years end) are $3,000 per child Phase Out Changes - Like the 2017 Tax Cut and Jobs Act (2017 TCJA), the credit is gradually phased-out for higher income parents, beginning at the following Adjusted Gross income thresholds:

NEW CHANGES TO CHILD SUPPORT IN ... - The Carson Law Firm NEW CHANGES TO CHILD SUPPORT IN MISSOURI STARTING NOVEMBER 4, 2021. In Missouri, the starting point for the amount of child support that will be paid begins with a calculation of the presumed amount of child support calculated using the Form 14. The Form 14 is periodically modified and the most recent iteration of the Form 14, use of which is ...

eFamilyTools Version 22.0.0 Released for 2022! We have released our latest version, 22.0.0 of the Kansas child support calculator. This latest version incorporates the latest tax adjustments and Regional Price Parities (RPP) data released by the BLS. The update procedure is identical to previous releases.

Lacerte Tax Support - Intuit E-File Forms availability for E-Signatures - 114a and similar. When using E-Signatures, if the return contains a 114 form, the corresponding 114A form should AUTOMATICALLY be included in the set of E-File forms to be signed... read more. steven Level 4. E-Signature Ease of Use Import Functionality Time Savings. posted Feb 3, 2021.

› maryland › form-502Maryland Form 502 (Maryland Resident Income Tax Return ... Maryland Resident Income Tax Return TY-2021-502 MARYLAND FORM 502 $ OR FISCAL YEAR BEGINNING Print Using Blue or Black Ink Only Your Social Security Number Your First Name 2021 RESIDENT INCOME TAX RETURN 2021, ENDING Spouse's Social Security Number MI Does your name match the name on your social security card?

Memorial Day 2021 - efamilytools.com kansas child support calculator software 2020. eFamilyTools. Home ... Worksheet ; Maintenance ; Archives. March 2019 (1) March 2018 (1) February 2018 (1) October 2017 (1) June 2017 (1) January 2017 (1) October 2016 (1) June 2016 (2) May 2016 (3) August 2015 (1) Syndicate Atom 1.0 RSS. eFamilyTools. Better Tools. Better Results! Contact Info.

0 Response to "44 kansas child support worksheet 2016"

Post a Comment