45 what if worksheet turbotax

Worksheet for Form 8949 - TurboTax FAQs | IB Knowledge Base Yes. In addition to the TurboTax .TXF format, IB supports the download of this worksheet in a Comma-Separated Values, or .CSV file format. Files in this format can be opened in applications such as Microsoft Excel, Open Office Calc or Google Docs. The .CSV file format is not supported for purposes of import to TurboTax r/IRS - What is a carryover worksheet help please turbo ... What is a carryover worksheet help please turbo tax keeps asking me this. Tax Question . 1 comment. share. save. hide. report. 100% Upvoted. Log in or sign up to leave a comment. Log In Sign Up. Sort by: top (suggested) level 1. Op · 28 days ago. I recieved unemployment 2020 and 2021 i worked 2019 to march 2020 im confused help me someone ...

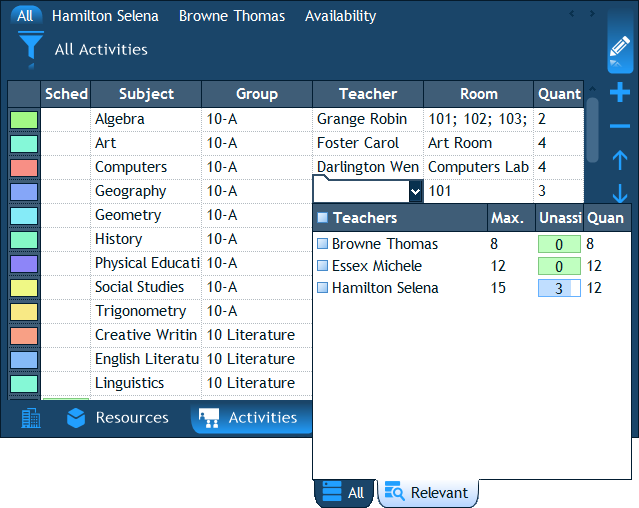

Using the What-If Worksheet in ProSeries - Intuit Opening the What-If Worksheet: Open the tax return. Press F6 to bring up Open Forms. Type Wha and press Enter to open the What-If Worksheet. Using the columns: Column 1 brings the values from the current year tax return, as long as you are using the Forms, Schedules and Worksheets provided.

What if worksheet turbotax

Principal residence designation worksheet: what do... Income Tax rules allow for an automatic rollover of capital property to a spouse for tax purposes when a taxpayer dies. This is often done to make use of a deceased taxpayer's capital gains exemption. So, if your spouse is still alive then the question doesn't really matter much. Home Office Deduction Worksheet Turbotax References ... Home Office Deduction Worksheet Turbotax. A lot of smaller purchases are necessary for life on the road. According to the irs, the deduction applies to the business use of a home and can be claimed whether you rent or own the property.Source : Along with filling out different forms when it's time to file How To Report 2021 Backdoor Roth In TurboTax (Updated) Select "Tools" just as in this guide, then select "Delete a form" This will take you to a page will all the worksheets you have used so for in turbo tax. I deleted all of the "Form 1099-R" forms, the "IRA Contributions Worksheet" and the "IRA Information Worksheet"

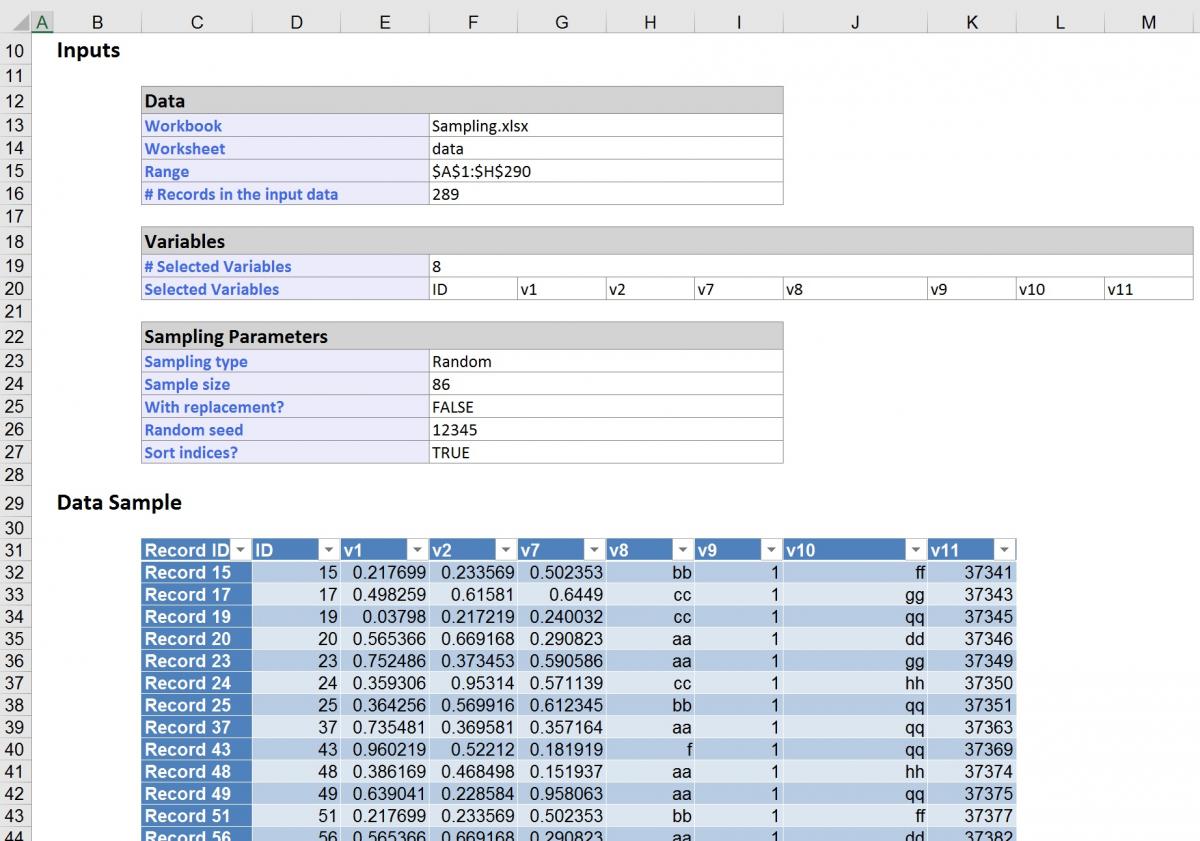

What if worksheet turbotax. How Intuit's TurboTax capitalized on taxpayers' fear. Turbo Tax also capitalized on how much Americans loathe doing our taxes and fear getting in trouble with the IRS. Over the years, I've talked to a lot of engineers and designers at Intuit, and ... Input Jam Parents of children in college, will encounter the "Student Information Worksheet" in TurboTax 2020. This is where TT looks at all the possible ways to deal with your college expenses. It uses the numbers from this worksheet to pick the best tax strategy for your situation. Columns. Part VI is a large table. Think of it as a static spreadsheet. How do I access the Federal Worksheet so I can ... - TurboTax Here are steps to take in TurboTax CD/Download to find a needed form; From Easy Steps in your return, go to the top right corner and choose the Forms icon. At the top left, choose the Forms icon again which opens up a screen. In the Keywords to search for space write Federal Worksheet. Choose Worksheet for Calculating 2020 Installment Payments. Click on OK. PDF Tax Preparation Checklist - Intuit Tax Preparation Checklist Before you begin to prepare your income tax return, go through the following checklist. Highlight the areas that apply to you, and make sure you have that information available.

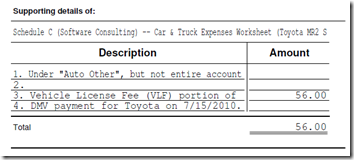

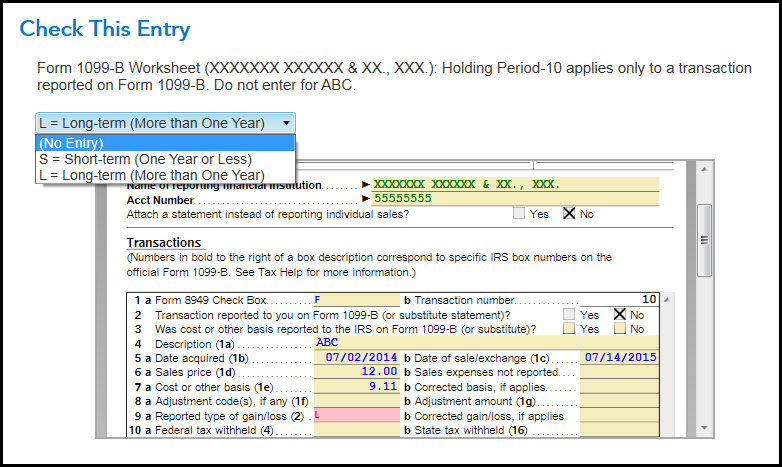

Post View: Use TurboTax What-if Worksheet TurboTax Deluxe has a what-if feature (use "open a form" under forms). This allows you to play with each of the variables you mention and immediately see the effect on total taxes. From this you... Does TurboTax NOT automatically carryover prior year ... Just for Context: In 2016, I had itemized deductions and other expenses and credits that exceeded my wages of roughly $460 (yep), leading to a huge negative AGI. This happened again in 2017, albeit with better income roughly $1800, leading to another negative AGI for 2017. 2021 Foreign Tax Credit Form 1116 in TurboTax and H&R Block You qualify for the adjustment exception if you meet both of the following requirements. 1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn't exceed: a. $329,850 if married filing jointly or qualifying widow (er), b. $164,925 if married filing separately, c. $164,925 if single, or d. $164,900 if head of household. 2. I sold a rental house for $ 200,000 and am ... - JustAnswer Hello, I sold a rental house for $ 200,000 and am having trouble with TurboTax--the Asset Entry Worksheet. I am listing the sales price as "asset sales price" on line 22, and my expense of sale on line 23. Turbo tax wants me to enter data on lines 25 and 26, Land Sales Price and Land expense of sale. I don't know what this means.

PDF Worksheet for Determining Support - IRS tax forms Worksheet for Determining Support Funds Belonging to the Person You Supported 1. Enter the total funds belonging to the person you supported, including income received (taxable and nontaxable) and amounts borrowed during the year, plus the amount in savings and other accounts at the beginning of the year. Don't Tax Deductions - ItsDeductible than you think. Get the most of what you're giving. > Learn More. Your account allows you to access your information year-round to add or edit your deductions. The Age Amount | 2022 TurboTax® Canada Tips If your income is more than $38,508 but less than $89,422 you can calculate your age amount using the formula for line 30100 on the federal tax worksheet. Subtract $38,508 from your income, and multiply the difference by 15 percent. Then, subtract that number from the maximum claim amount to calculate your amount. Estimated Taxes: How to Determine What to Pay ... - TurboTax You can use TurboTax tax preparation software to do the calculations for you, or get a copy of the worksheet accompanying Form 1040-ES and work your way through it. Either way, you'll need some items so you can plan what your estimated tax payments should be: Your previous year's return.

What Is Form 6198: At-Risk Limitations - TurboTax Tax Tips ... To determine the maximum amount you can deduct after suffering a business loss in the tax year, use Form 6198. The four-section form is a worksheet that allows you to: Determine your losses for the current year; Calculate the amount that was at risk in the business; Compute any at-risk deductions from previous years that you can apply in the current year

Are Worksheets Required to Be Turned in With a Tax Return ... Worksheets. It is important to recognize the distinction between worksheets and schedules. A tax worksheet is an IRS guide to assist you in your calculations and are primarily for your records.

Can landlords use TurboTax for their rental properties? TurboTax is used by landlords to prepare year-end federal and state income tax returns using rental property data collected throughout the year with Stessa. TurboTax also can be used to report rental property depreciation and calculate capital gains tax liability when an investment property is sold. Rental property accounting options

PDF Filing Your Taxes: a Turbo Tax Simulation -if boxes 7-14 on your W-2 are blank, leave them blank in TurboTax Personal info: See worksheet simulations with all information needed to "file" your taxes. You'll see occupation, date of birth, SSN, phone number, and more. EINs: Your employer EINs are on the worksheet. ----- When you get to the following screen you have completed ...

Common questions on the Asset Entry Worksheet in ProSeries To change the activity that an asset is associated with: Open the Asset Entry Worksheet you wish to change. From the Forms menu, select Change Activity. Select the new activity from the list and select Next. Select the existing activity, or create a new one to link the asset to. Select Finish.

Irs Form W-4V Printable : Irs Form 575 Pdf Worksheet A Printable Worksheets And Activities For ...

Elizabeth Warren says TurboTax scams taxpayers - Protocol Elizabeth Warren thinks you might be getting scammed. In a letter to Intuit CEO Sasan Goodarzi, Warren, as well as Reps. Katie Porter and Brad Sherman, laid into the company over its TurboTax tax-filing program's fees. According to the lawmakers, TurboTax offers products that "scam American taxpayers into paying for services that should be free."

T5008 Slip - 2021 TurboTax® Canada Tips You can download these for input, or if you are using TurboTax, the information will be brought into your return via the auto-fill my return process. The slip should detail all your securities transactions, whether you bought, sold, or cashed them. For the purposes of this slip, security is: Shares including publicly traded shares

Form 8949 Worksheet - TurboTax Import Considerations | IB ... Step 1: Print your Form 8949 Worksheet from Account Management through the Reports and then Tax Forms menu options. Please review the worksheet for any errors or omissions and verify that it is correct. Step 2: In TurboTax, open your return and select Personal and then select Personal Income menu options. Step 3: Scroll down until you reach the ...

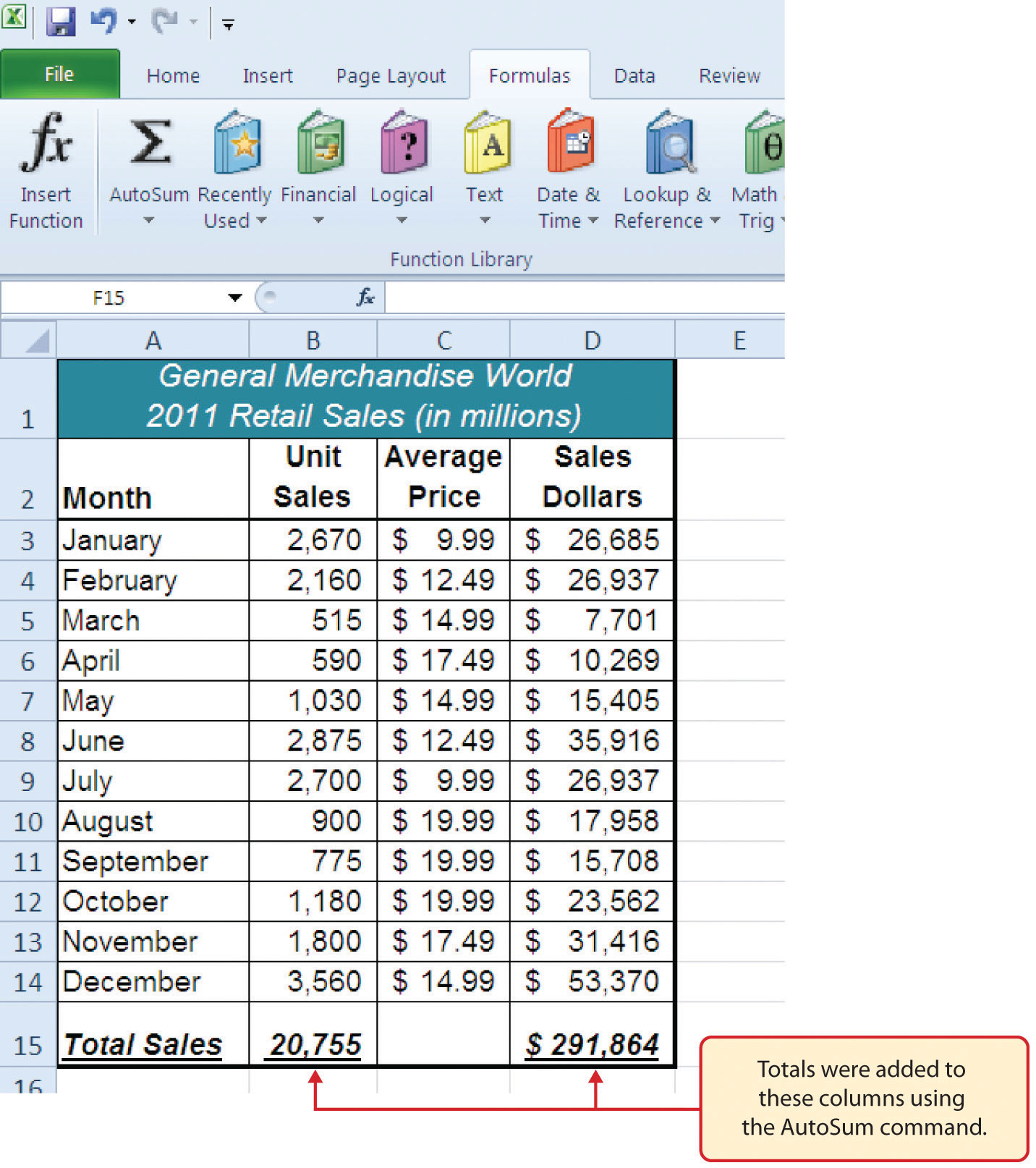

Solved: How do I get the "what-If" worksheet? - Intuit If you have the Desktop program you can do a What-If worksheet. Go to Forms Mode, click Forms in the upper right or on the left for Mac. Then click Open Forms box in the top of the column on the left. Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View.

How To Report 2021 Backdoor Roth In TurboTax (Updated) Select "Tools" just as in this guide, then select "Delete a form" This will take you to a page will all the worksheets you have used so for in turbo tax. I deleted all of the "Form 1099-R" forms, the "IRA Contributions Worksheet" and the "IRA Information Worksheet"

Home Office Deduction Worksheet Turbotax References ... Home Office Deduction Worksheet Turbotax. A lot of smaller purchases are necessary for life on the road. According to the irs, the deduction applies to the business use of a home and can be claimed whether you rent or own the property.Source : Along with filling out different forms when it's time to file

Principal residence designation worksheet: what do... Income Tax rules allow for an automatic rollover of capital property to a spouse for tax purposes when a taxpayer dies. This is often done to make use of a deceased taxpayer's capital gains exemption. So, if your spouse is still alive then the question doesn't really matter much.

0 Response to "45 what if worksheet turbotax"

Post a Comment