40 1040ez worksheet for line 5

Screen FAFSA - Federal Student Aid Application Information (1040) The income earned from work is used in Table A2 of the EFC Formula to determine the Social Security tax allowance which is more accurate when using W-2 box 5 + line A.4 or B.6 of Schedule SE to calculate how much is earned from working. UltraTax CS provides the option to calculate the income earned from work using either method. PDF 2016 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,350 if . single; $20,700 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

Line Worksheet - Learning Line Worksheet Here Where Is Line F On The 1040ez Worksheet May 14, 2022 1040ez Worksheet Line F Charleena Emna September 16 2021 worksheet No matter what materials you choose it is most important that you supervise your child...

1040ez worksheet for line 5

PDF 2017 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,400 if . single; $20,800 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ... 2021 Schedule 8812 Form and Instructions (Form 1040) On page two of the IRS Form 1040, line 19 and line 28, the taxpayer is asked to add the amounts from Schedule 8812. Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents, can be used with the redesigned Form 1040. You can also file IRS Schedule 8812 with the older 1040 series forms such as Form 1040A and Form 1040EZ. PDF 2006 - tax.state.oh.us Amount you owe (if line 16 is less than line 15, subtract line 16 from line 15).Check hereand enclose form IT 40P (see page 41) on the front of return if you are enclosing a payment (payable to Ohio Treasurer of State).i17.18.

1040ez worksheet for line 5. IRS Form 1040EZ - See 2020 Eligibility & Instructions - SmartAsset Jan 07, 2022 · On Line 6, subtract Line 5 from Line 4. If line 5 is larger than line 4, enter 0. The number you enter on Line 6 is your taxable income. Claiming Credit. The next section of the form is called Payments, Credits and Tax. On Line 7, write the federal income tax withheld from Form(s) W-2 and 1099. Line 8a is where you put the amount you are ... What Is Line 5a on IRS Form 1040? - The Balance Line 5a on Form 1040 or 1040-SR is for the total amount of pension and annuity payments you received during the tax year. You calculate that figure by adding up the amounts in box 1 of any Forms 1099-R you received from financial service providers. Leave line 5a blank if your pension and annuity payments were fully taxable. Line Worksheet - Page 346 of 352 - Learning Line Worksheet Here 1040ez Worksheet For Line 5 Instructions May 1, 2022 Line 3-2 Properties Of Parallel Lines Worksheet Answers Form G May 1, 2022 Line Linear Addition Worksheets May 1, 2022 Line Line Graph Worksheet Answers May 1, 2022 Line Number Line 1 20 Worksheet January 20, 2022 How to Fill Out a US 1040EZ Tax Return - wikiHow Subtract line 5 from line 4 and enter that amount on line 6. If line 5 is larger than line 4, enter 0 (zero) on line 6. This is your taxable income. If the amount is more than $100,000, you can't use the 1040EZ and must file either form 1040 or 1040A. Part 4 Completing the Payments, Credits and Tax Section Download Article 1

What Line Of My 2015 1040 Can I Find Federal Earned Income Credit Apr 1, 2015 — filers - use the 1040EZ line 5 worksheet & enter 00, 01, … 2014 income earned from work … Where do I find Earned Income Tax Credit? (30) What is the earned income tax credit? | Tax Policy Center Prior to the ARP, childless workers could receive a maximum credit of only $543 in 2021 and the credit phased out at lower income levels. PDF Sample - Do not submit On the 1040EZ, if a person checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,500 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. Notes for questions 42 and 43 (page 4) and 92 and 93 (page 7) About Form 1040, U.S. Individual Income Tax Return Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends-- 06-APR-2021. Filing Extension and Other Relief for Form 1040 Filers PDF. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible. IRS Statement - American Rescue Plan Act of 2021 PDF 2017 Form 1040EZ - classroomtools.com 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,400 if single; $20,800 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ...

How to Fill Out Form 1040EZ | 1-800Accountant Line 5 For line 5, refer to the worksheet on page 2 of your Form 1040EZ if someone can claim you or your spouse as a dependent. The worksheet will tell you what amount you should put down on line 5. Otherwise, enter $12,200 if you're a single filer or $24,400 if you're a joint filer. This is the standard deduction. 1040Ez Worksheet Line F - Balancing Equations Worksheet Worksheet for Line 5 Dependents Who Checked One or Both Boxes keep a copy for your records Use this worksheet to figure the amount to enter on line 5 if someone can claim you or your spouse if married filing jointly as a dependent even if that person chooses not to do so. Irs Form 1040 Line 59 Form Resume. 1040ez Line 5 Worksheet Instructions 2014. Form 1040 Line 4 and Line 5: IRA Distributions, Pensions, and Annuities ... Line 4 and line 5 of your 1040 is for retirement distributions and it can be the source of expensive mistakes, a reflection of trying financial times, or evidence of a retirement that has been prepared for well. There are many people that will be using their retirement accounts as a lifel Schedule 8812 Line 5 Worksheet There is no Line 5 worksheet to be found anywhere. The worksheet is used to determine the child tax credit amount based on income limitations, so it's a key worksheet to have available. 0 11 2,628 Reply 11 Replies JohnB5677 Employee Tax Expert March 14, 2022 10:32 AM I agree that I cannot find the "Line 5 Worksheet" in TurboTax.

Pennsylvania (PA) Tax Forms | H&R Block Offer valid for returns filed 5/1/2020 - 5/31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

IRS 1040 2007 - Fill out Tax Template Online | US Legal Forms IRS Form 1040 Use Line: 6d. IRS Form 1040EZ, and didn't check either box on line 5, enter 01 if you are single, or 02 if you are married. IRS Form 1040EZ, and checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,050 equals one exemption).

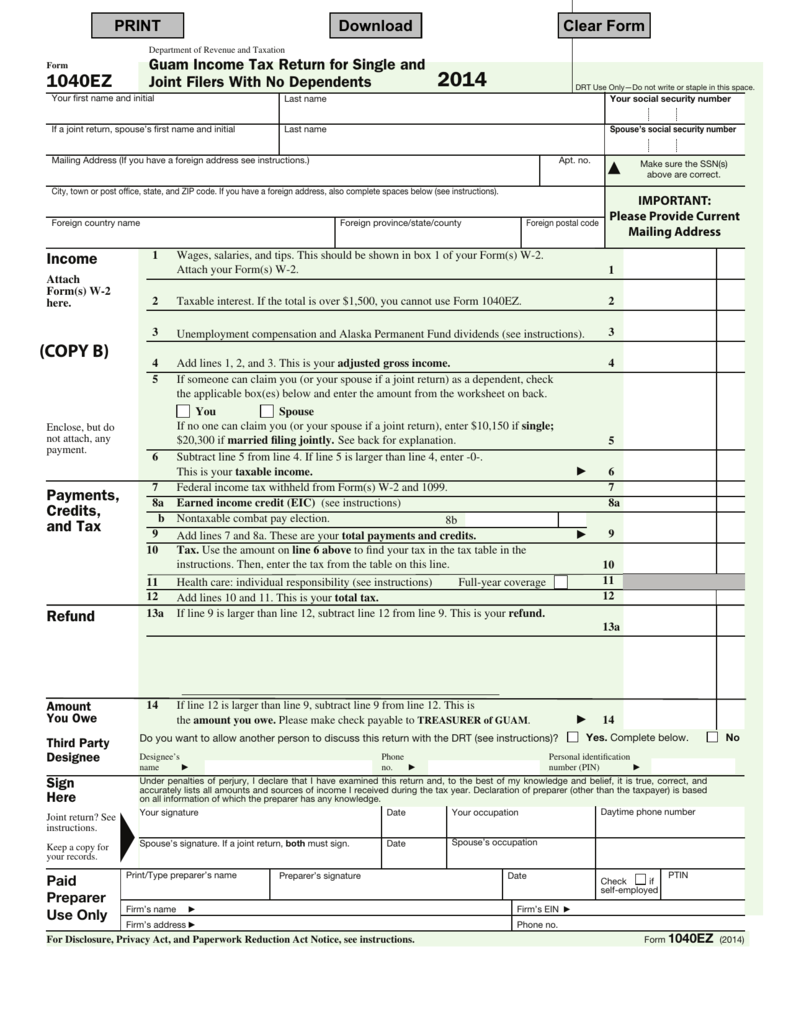

Federal Income Tax 1040EZ Taxes Worksheet, Lesson Plan FEDERAL INCOME TAX 1040EZ WORKSHEET LESSON. Practice filling out the Federal Income Tax 1040EZ tax form. Anyone who wants to learn and practice filling out a simple tax form. Give an introductory lesson about paying taxes to your students. Hand out the 1040EZ form to the students and explain to them each of the lines on the form.

2021 1040EZ Form and Instructions (1040-EZ, Easy Form) Prior year 1040EZ tax forms and instructions may still be printed using the links below on this page. File Form 1040EZ if you meet these requirements: Filing status is single or married filing jointly. No dependents to claim. You and your spouse were under age 65 and not blind. Taxable interest income of $1,500 or less.

1040EZ Tax Form Calculator - Bankrate The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Simply select your tax filing status and enter a few other ...

Deduction | Iowa Department Of Revenue Line 21: Enter other expenses as allowed on federal Schedule A. List the type and amount. Line 22: Add lines 19 to 21. Enter the total here. Line 23: Multiply the amount on federal form 1040, line 38 (federal 1040A, line 21 or 1040EZ, line 4) by 2% (.02). The federal adjusted gross income used to determine these deductions is the taxpayer’s ...

16 Best Images of Federal 941 Worksheet - 2013 1040EZ Worksheet Line 5, 2013 Federal Income Tax ...

Ohio Form IT 1040EZ (Ohio Individual Income Tax EZ Return ... Note that from tax year 2015 onward, there is no separate Form 1040EZ for Ohio. We last updated the Ohio Individual Income Tax EZ Return in January 2022, so this is the latest version of Form IT 1040EZ , fully updated for tax year 2021.

PDF DRAFT AS OF - IRS tax forms 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,150 if single; $20,300 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ...

PDF Do not use staples. 2012 - Ohio Department of Taxation IRS form 1040A or 1040EZ. Complete this worksheet to determine if you are entitled to a deduction on line 2 of Ohio form IT 1040EZ. a. Did you fi le a . 2012 IRS form 1040A or 1040EZ? Yes. STOP. and enter -0- on line 2 of Ohio form IT 1040EZ. No. Complete line b below. b. Enter here and on line 2 of Ohio form IT 1040EZ the amount from line 10 ...

PDF CT-1040EZ, Connecticut Resident EZ Income Tax Return 24. Enter the Lesser of Line 22 amount or $350 (If $100 or less, enter this amount on Line 26. If greater than $100, go to Line 25). 25. Limitation - Enter 0 or the result from the Property Tax Credit Limitation Worksheet. (See note below) 26. Subtract Line 25 from Line 24. Enter Here and on Form CT-1040EZ, Line 5.

9 Best Images of EZ Math Worksheets - 2013 1040EZ Worksheet Line 5, IRS 1040EZ Worksheet Line F ...

EconEdLink - All Grades Apr 11 5:00-6:00pm ET. Webinar . Save Lesson. See On-Demand Webinar . Content Partner. Grades 6-8, 9-12. Inflation 101. In this lesson, you will learn about what ...

PDF 2006 - tax.state.oh.us Amount you owe (if line 16 is less than line 15, subtract line 16 from line 15).Check hereand enclose form IT 40P (see page 41) on the front of return if you are enclosing a payment (payable to Ohio Treasurer of State).i17.18.

2021 Schedule 8812 Form and Instructions (Form 1040) On page two of the IRS Form 1040, line 19 and line 28, the taxpayer is asked to add the amounts from Schedule 8812. Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents, can be used with the redesigned Form 1040. You can also file IRS Schedule 8812 with the older 1040 series forms such as Form 1040A and Form 1040EZ.

PDF 2017 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,400 if . single; $20,800 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

0 Response to "40 1040ez worksheet for line 5"

Post a Comment