43 home daycare tax worksheet

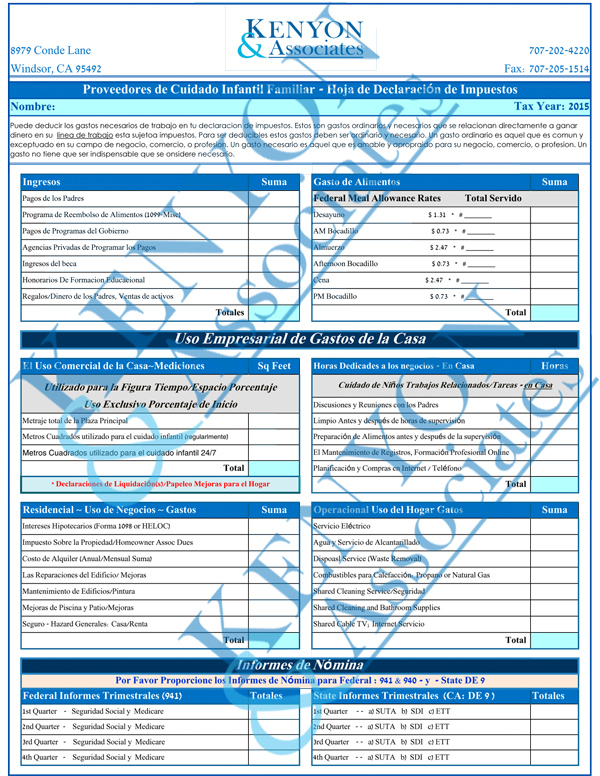

Home Daycare Providers - Pride Tax Preparation Look at my Recording Keeping page for helpful information and worksheets. Tax returns for home businesses such as childcare can be complicated and time consuming. Pride Tax Preparation has the knowledge and experience preparing taxes for home day care / child care providers. Daycare returns for new clients are prepared for around $800. Maryland Child Support Calculator | AllLaw Intercept state and federal tax refunds; Report the delinquent payer to the credit bureau; Report parent owing past due payments to the Motor Vehicle Administration for driver's license suspension; Intercept lottery winnings ; Bring Contempt …

Topic No. 509 Business Use of Home | Internal Revenue Service Feb 18, 2022 · Request for Transcript of Tax Return Form W-4 ; Employee's Withholding Certificate ... For more information, see Publication 587, Business Use of Your Home (Including Use by Daycare Providers). Deductible expenses for business use of your home include the business portion of real estate taxes, mortgage interest, rent, casualty losses, utilities ...

Home daycare tax worksheet

PDF Page 1 of 35 18:11 - 10-Feb-2022 of Your Home Business Use - IRS tax forms If you used your home for business and you are filing Schedule C (Form 1040), you will use either Form 8829 or the Simplified Method Worksheet in your Instructions for Schedule C. The rules in this publication apply to individuals. If you need information on deductions for renting out your property, see Pub. 527, Residential Rental Property. List of Tax Deductions for an In-Home Daycare Provider The IRS uses the time and space formula to determine the deductible portion of any shared expenses for a daycare in your home. This is based on the number of hours you spend operating the daycare and the percentage of space the daycare takes up in your home compared to the home's total square footage. Printable Day Care Forms - To Use In Your Home Daycare, Center Or ... Starting A Daycare Business? You will need daycare business forms to keep track of your income and expenses, or some type of business program to track your income. You will also need daycare forms to give to the parents to sign such as a parents contract, and you may find you want to have a parents handbook to explain all your policy's and procedure, other daycare forms you may need are ...

Home daycare tax worksheet. PDF DAY CARE INCOME AND EXPENSE WORKSHEET - Haukeness Tax & Accounting Inc Total count Day care license, association AFTERNOON SNACKS Total count REPAIRS- Other than your home, related to damage by day care children. Document with photos and how it happened. & PUBLICATIONS - dues, day care magazines for you or day care children. DOCUMENT THESE NUMBERS DAILY OTHER EXPENSES - not listed elsewhere Home Daycare Tax Deductions for Child Care Providers Furniture and appliance purchases can be written off as home daycare tax deductions. Some items you can write off the whole cost while others will need to have your T/S% applied. Any furniture or appliance that you use in the daycare and for personal use needs to have the T/S% applied. Microwave Washer & dryer Refrigerator Stove Dishwasher Tables Daycare Record Keeping | Pride Tax Preparation Square feet of your house separated into three categories: Space used ONLY for daycare, Space used PARTLY for daycare, and Space NOT used for daycare. Include your garage space. Amount spent for daycare licenses and training. Keep receipts! Amount spent for items that are used 100% for daycare. Keep items over $200 separately. Keep all receipts! Daycare Tax Statement Daycare Tax Statement A daycare tax statement must be given to parents at the end of the year. You will use it to claim all income received. The parents will use it to claim a deduction if they are eligible. The amount that you claim must match exactly with the amount parents are claiming. Keep track during the year of all payments made to you.

Publication 587 (2021), Business Use of Your Home Additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of the deduction limit. Page 1 of 35 18:11 - 10-Feb-2022 of Your Home Business Use … to the IRS Interactive Tax Assistant page at IRS.gov/ Help/ITA where you can find topics by using the search feature or viewing the categories listed. Getting tax forms, instructions, and publications. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. Ordering tax forms, instructions, and publications. PDF Tax Organizer—Daycare Provider - Thomson Reuters Telephone—other than home phone Tickets and fees—field trips Toys and games Travel Wages to employees Other: Other: 1 If standard rates used, complete Standard Meal and Snack Rate Log Annual Recap Worksheet. PART 5—Vehicle Expenses Vehicle 1 Vehicle 2 Vehicle description Date acquired Cost Miles this year: Business Commuting Personal Total PDF DAY CARE INCOME and EXPENSE WORKSHEET YEAR If you take expense on mileage basis complete lines 1-10Your total grocery bill (in an audit, you must- 1. Year & Make of Auto (Bring in purchase/sales papers)prove a reasonable amount spent for personal. 2. Date Purchased: Month, Date, Year Amount spent on Day Care 3.

Tax Worksheets - David M. Huston and Sons To download the worksheets, right click the link and click "Save Target As". Automobile Sales Expenses. Business Expenses Schedule. Business Use of Home - Day Care. Corporate Client Worksheet. Military Tax Worksheet Personal Income and Deductions. Police Officers Expenses. Rental Property Expenses. Trucker Expenses. Sales Expenses. Stock ... Home Daycare Tax Worksheet | Daycare business plan, Starting a daycare ... Home Daycare Tax Worksheet. Preparers say their audience generally acquisition new deductions or old deductible costs aloof by combing through their day planners, arrangement calendars, and analysis registers. You ability remember, for example, active to the abutting canton to advice a alms clean a house. PDF Day Care Tax Organizer DAY CARE TAX ORGANIZER Prepare + Prosper, 2610 University Ave. West, Suite 450, St. Paul MN 55114, ... worksheets, tips on making estimated tax payments, and a cheat sheet for filling out the ... nd2 line into home only Day care liability insurance Cell phone - annual charges Interest - business loan or ... 2020 Tax Changes Affecting Family Child Care Providers Here are the major tax changes affecting providers in 2020. The standard meal allowance rate is $1.33 for breakfast; $2.49 for lunch and suppers; and $.74 for snacks. You can deduct up to one breakfast, one lunch, one supper and three snacks per day, per child. The standard mileage rate is $.575 per business mile.

PDF Tax Organizer—Daycare Provider uickinder® Supplemental Tax Organizers Family Daycare Provider—Standard Meal and Snack Rate Log Annual Recap Worksheet Name of Provider: TIN/SSN Tax Year: Wk Week of Break-fasts Lunches Dinners Snacks Wk Week of Break-fasts Lunches Dinners Snacks 1 27 2 28 3 29 4 30 5 31 6 32 7 33 8 34 9 35 10 36 11 37 12 38 13 39 14 40 15 41 16 42 17 43 18 ...

Louisiana Child Support Calculator | AllLaw Louisiana Child Support. In Louisiana, child support cases are generally divided into three categories: intake, collections, or parent locate. Through Support Enforcement Services (SES), a division of the Office of Family Support, you can receive assistance in locating a non-custodial parent, ordering a paternity test, establishing a child support order, and enforcing child support …

Home Daycare Tax Deductions for Child Care Providers Feb 09, 2017 · The big list of home daycare tax deductions for family child care businesses! A checklist of tax write-offs that all child care providers should know about! ... Regardless of if you paid by check or cash you can claim all payments made to your provider (the IRS has a worksheet that tells you how much of that is actually deductible based on your ...

30 Home Daycare Tax Worksheet | Education Template Home Daycare Tax Worksheet Briefencounters Expense. 13 févr. 2021 - Home Daycare Tax Worksheet. 30 Home Daycare Tax Worksheet. Home Daycare Tax Worksheet Briefencounters Expense. Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with ...

Income Tax Preparation | Bookkeeping | Fair Tax Inc Sioux Falls, SD Fair Tax Inc 1727 S Cleveland Ave Sioux Falls, SD 57103 (605) 336-1669

PDF Daycare Income and Expense Worksheet - SUN CREST TAX SERVICE NOTES: 1. Make, Model and Year of Auto 2. Purchase Date (mm/dd/yy) 3. Beginning Odometer Reading - Jan 1 4. Ending Odometer Reading - Dec 31 5. Total Miles Driven(Personal & Business) 6. Total Business Miles 7. Interest (Acquire from Banking Inst.) 8. Licenses 9. Gas, oil, repairs, insurance, wash, etc. 10. Lease (Lease start date)

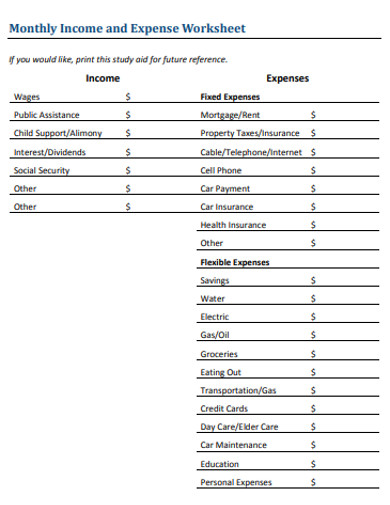

Free Business Income and Expense Tracker + Worksheet | Business expense tracker, Expense tracker ...

Filing a Tax Return for Your In-Home Daycare - TurboTax® Canada Filing Your Tax Return. Report the income from your daycare business on line 162 of your general income tax return. Then, deduct your business expenses to arrive at your net self-employment income on line 162. One of the easiest ways to calculate your daycare income and expenses is by using the CRA's Form T2125, Statement of Business Activities.

Daycare Expense Worksheet - atmTheBottomLine HOME Return Home; TAX BASICS About Your Business. TYPE OF BUSINESS Business or Hobby? SOLE PROPRIETORSHIPS; DEDUCTIONS What you need to know; EXPENSE FORMS Keep Track of Your Expenses. Clergy Expense Worksheet; Daycare Expense Worksheet; Outside Sales Expense Worksheet; Real Estate Professional Expense Worksheet; ABOUT US and Contact Info ...

0 Response to "43 home daycare tax worksheet"

Post a Comment