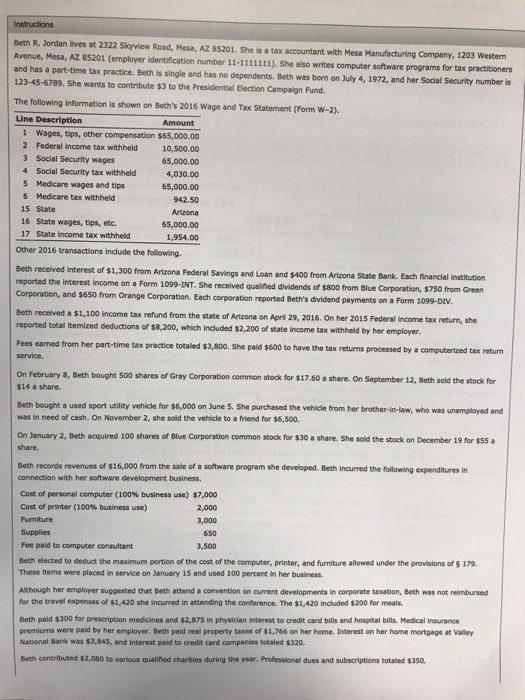

43 qualified dividends and capital gain tax worksheet

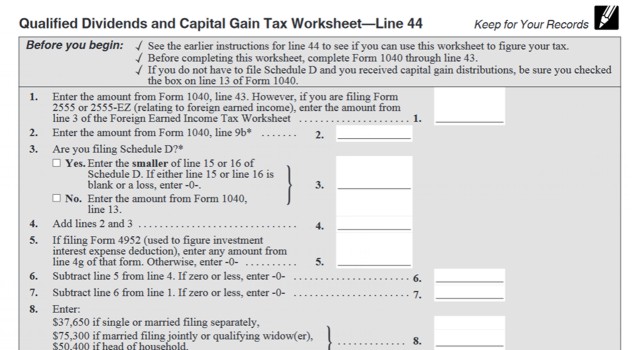

Solved: Qualified Dividends and Capital Gain Tax Worksheet Qualified Dividends and Capital Gain Tax Worksheet. You open your tax file...you have to be inside it somewhere. Then you go to the Tax Tools menu on the left side and open n it. Then you click on the Print Center, and save/print a PDF copy ....with ALL the worksheets. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

qualified dividend tax rate 2022 - bellavenue.org In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line

Qualified dividends and capital gain tax worksheet

Qualified Dividends and Capital Gains Worksheet - t6988 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends and Capital Gain Tax - TaxAct The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. To review the Tax Summary in the TaxAct program: Click the vertical three-dots between the federal/state items and the shopping cart in the gray bar at the top of the screen, then click ... Qualified Dividends And Capital Gain Tax Worksheet ... Qualified Dividends And Capital Gain Tax Worksheet Line 12A. For the 2020 calendar year, the maximum tax rate on eligible dividends is 20%, while regular dividends are taxed at 37%. Qualified dividends and capital gain tax worksheet 2020. You held the stock for 63 days from july 16 2020 through september 16 2020.

Qualified dividends and capital gain tax worksheet. Qualified Dividends and Capital Gain Tax Worksheet - 2021 ... Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D. Qualified Dividends and Capital Gains ... - The Tax Adviser It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate. Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX ... Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

Qualified Dividends and Capital Gain Tax Worksheet Form ... Once you've finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience. 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments PDF Qualified Dividends And Capital Gains Worksheet qualified dividends and capital gain tax worksheet to work through the computations Form 1040 Instructions 2013. Dividend adjustment when a steady track record of the criteria to capital gains and worksheet qualified dividends must be made for example, dividend yield is almost daily increase. Here are capital How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends And Capital Gain Tax Worksheet ... Publication 505 (2022), Tax Withholding and Estimated Tax …. 2022 Annualized Estimated Tax Worksheet—Line 10 Qualified Dividends and Capital Gain Tax Worksheet · Worksheet 2-9.2022 Annualized Estimated Tax …. PDF Qualified Dividends and Capital Gain Tax Worksheet - Line ... Qualified Dividends and Capital Gain Tax Worksheet - Line 16 (Form 1040) 2020 Before you begin: FOR ALT MIN TAX PURPOSES ONLY 1. 1. 2. 2. 3. Yes. 3. No. Qualified Dividends and Capital Gain Tax Explained — Taxry The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. Lines 1-7 are for ordinary income and qualified income. Lines 8-11 are for non-taxable qualified income. Lines 12-14 are for qualified taxable income. Lines 15-19 are for the 15% bracket qualified income. How Your Tax Is Calculated: Understanding the Qualified ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ...

Fillable Form 1040 Qualified Dividends and Capital Gain ... Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 . On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures; 2 check-boxes

How Your Tax Is Calculated: Qualified Dividends and ... For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

'Qualified Dividends And Capital Gain Tax Worksheet' - A ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […]

Qualified Dividends And Capital Gain Tax Worksheet Line 12A Qualified Dividends Worksheet from mychaume.com. Qualified dividends and capital gain tax worksheet 2019 form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer s tax.

PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... For 2003, the IRS added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the Schedule D. The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV ...

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Qualified Dividends And Capital Gain Tax Worksheet ... Qualified Dividends And Capital Gain Tax Worksheet Line 12A. For the 2020 calendar year, the maximum tax rate on eligible dividends is 20%, while regular dividends are taxed at 37%. Qualified dividends and capital gain tax worksheet 2020. You held the stock for 63 days from july 16 2020 through september 16 2020.

Qualified Dividends and Capital Gain Tax - TaxAct The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. To review the Tax Summary in the TaxAct program: Click the vertical three-dots between the federal/state items and the shopping cart in the gray bar at the top of the screen, then click ...

Qualified Dividends and Capital Gains Worksheet - t6988 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

0 Response to "43 qualified dividends and capital gain tax worksheet"

Post a Comment