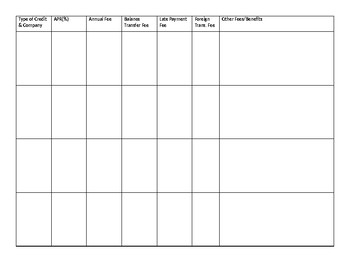

41 credit card comparison worksheet

What's Up In Finance? . For Educators . Lesson 3 - THIRTEEN Print out the Student Organizers: "Credit Score," "Credit History," "Credit Card Offers," and "Credit Card Comparison," and make enough copies so that each student has one copy of each organizer. Compare Credit Cards - Credit Card Comparison Calculator Use this credit card calculator to compare the long-term costs of credit cards that ...show more instructions. have varying interest rates, annual fees, introductory rates and compounding intervals. Just enter your balance, payment, and the terms for each card, then click the "Compare Credit Cards" button. The calculator does the rest!

Credit Card Comparison Spreadsheet - FlyerTalk Forums very solid and thorough analysis! however if you change the "typical benefits" to $400 (2 x $200 per calendar year for airline reimbursement) - the value of this card increases quite a bit. however the long term analysis (beyond 1 year) is a bit trickier to calculate bc it depends on how many annual fees you pay and how many $200 reimbursements …

Credit card comparison worksheet

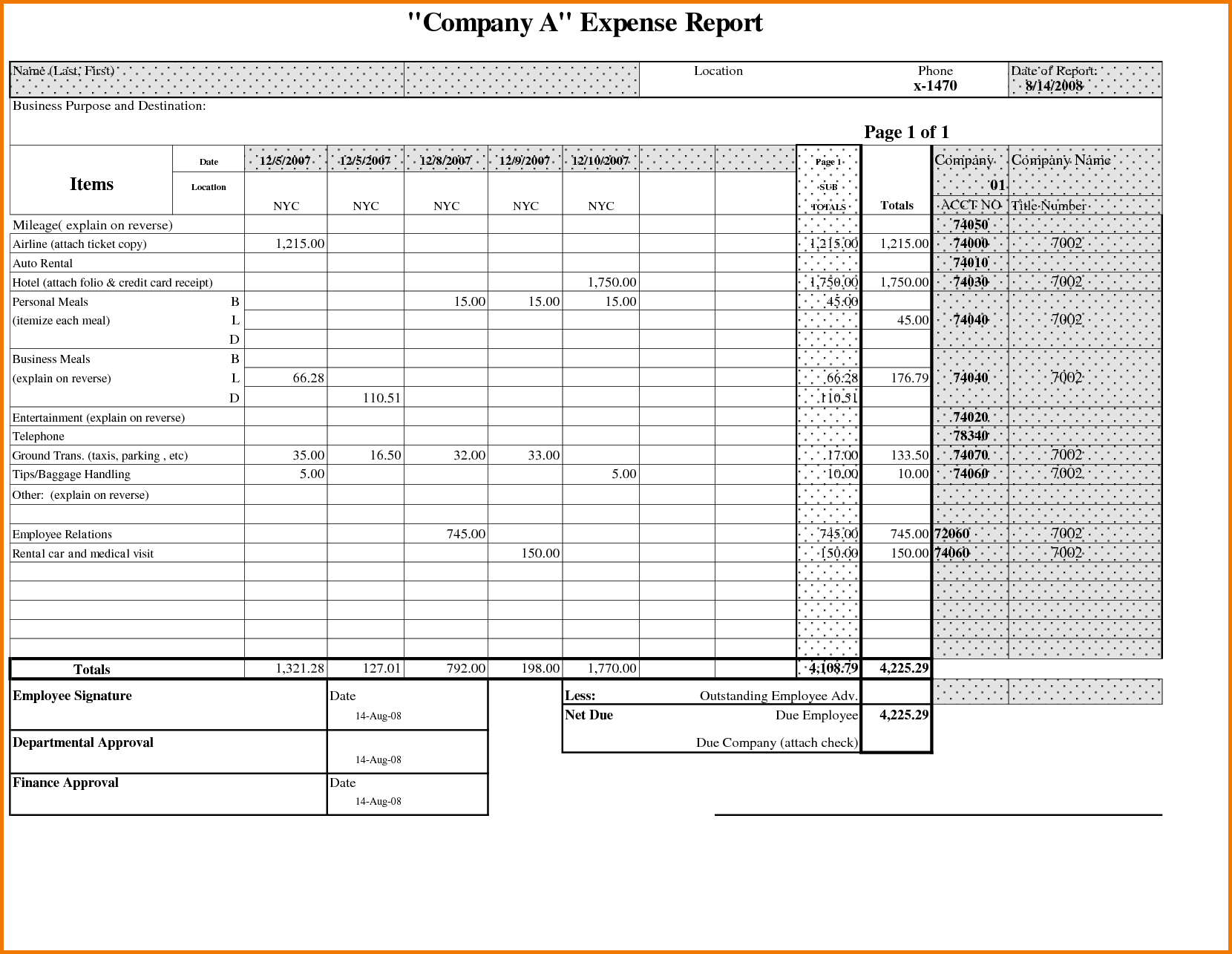

The Ultimate Spreadsheet To Track Credit Card Churning Credit Card Rewards and churning Excel spreadsheet. The spreadsheet I created focuses specifically on credit card bonuses and churning. As I've written before, it's not about spending money on the credit card, as much as it is about pocketing the sign on bonuses when it comes to abundant and free travel. The spreadsheet is simple, yet effective. I made a spreadsheet to find out which credit card gives you the most ... I made a spreadsheet to find out which credit card gives you the most rewards (X-Post personalfinance) Credit card offerings are not "one size fits all". The rewards will differ based on the type of expenses you have and the type of rewards you want (some people want airfare miles, some prefer points or cash back). 4 Credit Card Comparison Charts (Rewards, Fees, Rates & Scores) Capital One VentureOne Rewards Credit Card AIR MILES RATING ★★★★★ 4.9 OVERALL RATING 4.8/5.0 $0 annual fee and no foreign transaction fees Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel Earn unlimited 1.25X miles on every purchase, every day

Credit card comparison worksheet. Side by Side Credit Card Comparison - NerdWallet Our card comparison tool identifies the things each card is great for, such as rewards, balance transfers or bad credit. In general, there are three types of credit cards: Cards that earn rewards... PDF CREDIT CARD COMPARISON - Finance in the Classroom 3. What techniques do the credit companies use to market their credit? 4. Find three pieces of information that is in the "fine print" that you, the consumer, would need to know. a. b. c. 5. Name three things that consumers need to be aware of when applying for a credit card. a. b. c. 6. What did you learn from this exercise? PDF Debit & Credit Cards Extension Activity for Money & Payment Options ... • define debit and credit card through classroom discussions and worksheets • identify whether a debit or credit card transaction occurred based on given information • identify some of the advantages/disadvantages of using debit and credit cards Materials Needed: • whiteboard • whiteboard marker • Debit or Credit? worksheet (1 per student) • Credit Card Comparison Spreadsheet Credit Card Comparison Spreadsheet. This video was made for free! Create your own. Credit Card Comparison Spreadsheet. Created: 06/09/2022. Loaded 0%. 1x.

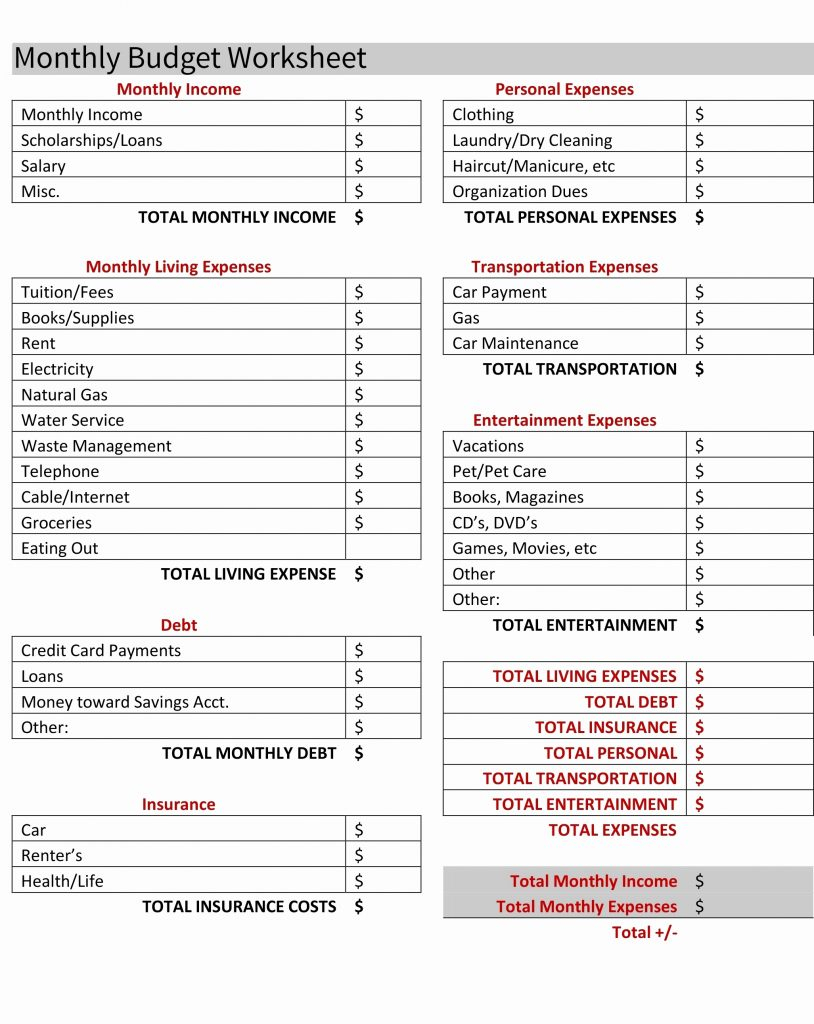

Credit and Credit Card Lesson Plans, Consumer Credit, Teaching Worksheets CREDIT AND Credit Cards. This section includes lessons on consumer credit cards, credit, and paying interest. Learn about credit with an introduction to credit cards, reading a credit card statement, and advanced lessons regarding incorrect credit card transactions. Also, see our spending money category for more consumer related material. PDF Comparison Shopping for a Credit Card - Weebly Directions : Compare at least three sample credit card offers. Identify which credit card you would choose and why. Card 1 Capital One® VentureOne® Rewards Credit Card Card 2 Quicksilver From Capital One Card 3 Discover It What is the Annual Percentage Rate (APR) for Purchases 0% 0% 0% PDF Personal Financial Workbook - Consumer Credit Bank Account Comparison Worksheet 14. Investment Options Worksheet 15. Creditworthiness Worksheet 16. Debt-to-Income Ratio Worksheet 17. Credit Card Options Worksheet 18. Annual Credit Report Request Form 19. Resources American Consumer Credit Counseling (ACCC) is a nonprofit 501(c)(3) organization. Founded in 1991, ACCC Credit card log - templates.office.com Log charges, transaction fees, and payments to your credit card account with this accessible credit card log template. This credit card receipts template automatically calculates the running balance. This professionally designed credit card tracking spreadsheet will help you keep track and monitor your finances. Excel Download Share

16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) Worksheets include: Bank Comparison Chart; Bank Reconciliation; Interest Rates and the Rule of 72; 5. FDIC's Money Smart Worksheet. Suggested Age: 9-12 grades. Under Lesson 5, you'll find a worksheet all about the various banking options teens can choose from. They'll learn things like: Difference between a checking and savings account Credit Card List/Comparison Spreadsheet : personalfinance Credit Card List/Comparison Spreadsheet. Budgeting. Hello! Forgive me if this has been posted before but I was curious about cash back credit cards and couldn't find any type of comparison chart. A lot of the information was pulled off Nerdwallet or the card's respective page. . Teacher Printables - FITC - Finance in the Classroom A spin-free guide to reading the fine print on credit car offers and agreements. 10-12 Grades Credit Card Comparison (pdf) Practice choosing the right credit card for you! Credit Masquerade Activity (pdf) Credit Scores: The SATs of Adulthood (pdf) Learn About Your Offer (pdf) Understand Your Credit Card Offer Understand Your Statement (pdf) Copy_of_Credit_Card_Comparison_Worksheet.docx - Credit Card Comparison ... Credit Card Comparison Worksheet American Express Platinum Card APR (Fixed or Varied) 15.88% to 22.99% variable Introductory APR APR Cash Advances Grace Period/Paying Interest Annual Fee Cash Advance Fee Balance Transfer Fee Late Payment Fee Returned Payment Fee Rewards

PDF Lesson Five Credit Cards - Practical Money Skills Does the first major credit card charge a fee for late payments? If so, how much is it? 8. What is the grace period on the credit card from the local department store? 9. Rafael wants to buy a new CD player that costs $450. According to his budget, he can afford payments up to $62.00 per month. Which of the three credit cards you've found would you

EconEdLink - Your Credit Card Select a credit card that fits your preference and explain why you chose the card you did. Assessment 1. Assign the credit card worksheet. This worksheet is rigorous and may take two days for the students to complete. 2. Check the students' answers and reteach on an individual basis. Subjects: Economics, Mathematics, Personal Finance

Compare Card Offers Spreadsheet @ Moneyspot.org Too bad for them that you can download my Card Offer Comparison Spreadsheet below: I tried to keep the spreadsheet as simple as possible. However, a few more words of guidance might be in order. Spreadsheet Versions When you extract the ZIP file, you'll actually find three spreadsheets. One is for Excel 2007 (.xlsx).

Our Credit Card Tracking Excel Sheet (Plus All Of Our Data!) I have my own spreadsheet for cards, and I assign a valuation (cents/point) to various points in different programs. There are some well-known travel blogs which publish their own valuations, but I prefer to make my own by looking at trips I want to take and researching how I would save by using various points compared to paying for a similar itinerary using cash.

PDF Credit Card Comparison Shopping Worksheet Publisher Credit Card Comparison Shopping Worksheet. Things to consider when choosing a credit card: • If you're going to pay the bill in fullevery month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer grace period so you don't get hit with a finance charge. • If you're going to carry a balance, you want ...

Compare 25+ Cash Back Credit Cards in This Free Spreadsheet Get the spreadsheet and compare cash back rewards for yourself Compare cash back offers from over 25 credit cards in this Google spreadsheet. Things to keep in mind: The data is current as of March 28, 2019. We will update the spreadsheet with new cards and offers every quarter. Use this spreadsheet as a place to begin.

PDF Introducing the Credit Card - Credit Cards | Compare The Best Credit ... How many digits are in a standard credit card number? A: 16 B: 17 C: 18 D: 19 E: A credit card number can be 16 to 19 digits long. 4. What happens after the expiration date on a credit card? A: The card no longer works B: The cardholder has to get a new card C: The card blows up D: Both A and B 5. How many numbers are in a CVV code? A: 1 B: 2 C: 3 D: 4 E: 3 or 4

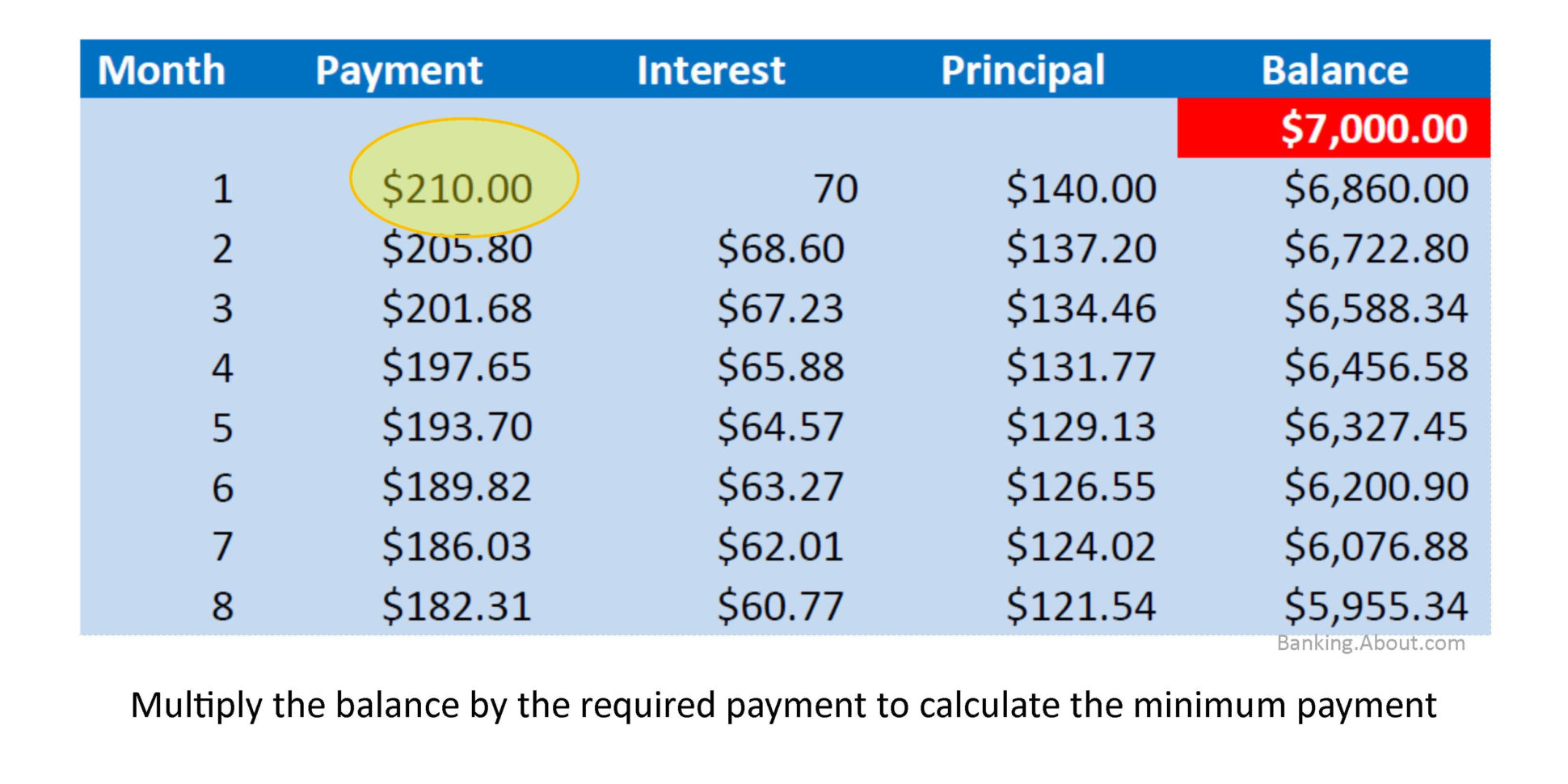

Credit Card Payment Amortization Schedule: Printable ... - Pigly In the snowball method, you list down all your credit card debt from the lowest balance to the highest. Regardless of interest rate, you prioritize paying the one with the lowest balance. If we use the same credit card details above, your list will look like this: American Express - $2,200 balance ; Visa - $3,000 balance; Mastercard ...

Credit Card Comparison & Rewards Calculator Tool Use this tool to calculate rewards and the cash value of one or more credit cards side by side based on spend, card benefits, and annual fees. You can choose to calculate rewards for a single combination of credit cards or build two combinations of credit cards and compare the value of both combos side by side to see which is best for you.

Compare Credit Cards: Compare & Apply Online Instantly Capital One VentureOne Rewards Credit Card 4,912 Reviews Purchase Intro APR → 0% for 15 months Transfer Intro APR → 0% for 15 months | Transfer Fee: 3% Regular APR → 15.24% - 25.24% (V) Annual Fee $0 Rewards Rate 1.25 - 5 miles / $1 Rewards Bonus 20,000 miles Minimum Credit Good Apply Now Show Details Citi® Secured Mastercard® 1,003 Reviews

Loans and credit. Perecntage worksheet. | Teaching Resources This is a good functional worksheet which requires students to answer questions about loan and credit card repayments, it brings in percentages and division and would really help to develop financial awareness. This would be a good resource to use when studying percentages at GCSE. Thank you for sharing.

4 Credit Card Comparison Charts (Rewards, Fees, Rates & Scores) Capital One VentureOne Rewards Credit Card AIR MILES RATING ★★★★★ 4.9 OVERALL RATING 4.8/5.0 $0 annual fee and no foreign transaction fees Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel Earn unlimited 1.25X miles on every purchase, every day

I made a spreadsheet to find out which credit card gives you the most ... I made a spreadsheet to find out which credit card gives you the most rewards (X-Post personalfinance) Credit card offerings are not "one size fits all". The rewards will differ based on the type of expenses you have and the type of rewards you want (some people want airfare miles, some prefer points or cash back).

The Ultimate Spreadsheet To Track Credit Card Churning Credit Card Rewards and churning Excel spreadsheet. The spreadsheet I created focuses specifically on credit card bonuses and churning. As I've written before, it's not about spending money on the credit card, as much as it is about pocketing the sign on bonuses when it comes to abundant and free travel. The spreadsheet is simple, yet effective.

0 Response to "41 credit card comparison worksheet"

Post a Comment