44 va residual income worksheet

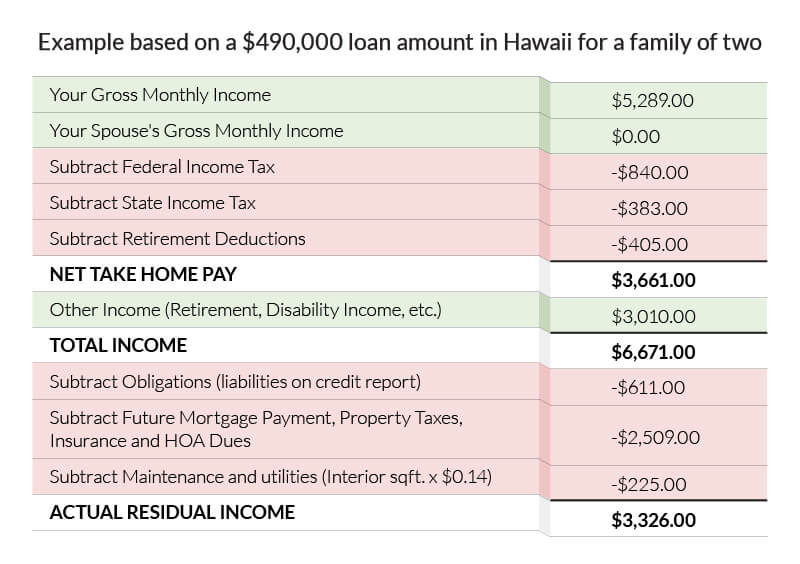

VA Residual Income Calculator | Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense. PDF FHA Office of Single Family Housing Financial Assessment Worksheet that was included in the HECM Financial Assessment and Property Charge Guide, which was an attachment to Mortgagee Letter 14-22, dated November 10, 2014. ... SECTION J Residual Income Shortfall Added a section for documenting calculation of Residual Income Shortfall. RESULTS OF FINANCIAL ASSESSMENT

PDF CBC Residual Income Worksheet - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11.

Va residual income worksheet

Getting A VA Loan Using Self-Employed Income VA Self-Employed Income Calculation If your business made $100,000 last year, but you wrote off $50,000 in losses or expenses, lenders will only count the remaining $50,000 as effective income toward a mortgage. Needless to say, that can come as a shock to many prospective borrowers. PDF Va Underwriting Checklist ___ Deductions through paycheckcity.com included in residual income calculation and uploaded ___ Residual income guideline met (120% required if DTI over 41%) ___ Income worksheet completed and uploaded ** ____ Assets ___ 2 months current consecutive bank statements for all accounts ___ Source and paper trail any and all large deposits Residual Income - Blueprint Rental Income Loss (cumulative total) Child Care Expenses: Total Monthly Debt: $0.00: Total All Debt (Total Monthly Debt + Total Monthly Housing Expense + Monthly Estimated Maint & Uitl) $0.00: Monthly Estimated Mainteanance & Utilities: $0.00: Monthly Income Taxes - Taxable Income Amount: $0.00; Suggested Federal Rate: Federal Income Tax: $0.00

Va residual income worksheet. DOC Chapter 4 f. Item 45, Debt-to-Income Ratio VA's debt-to-income ratio is a ratio of total monthly debt payments (housing expense, installment debts, and other debt) to gross monthly income. Add: Items 15 + 16 + 17 + 18 +20 +40 = Debt. Add: Items 31 + 38* = Income. Divide: Debt Income = Debt-to-Income Ratio. Round: To the nearest two digits PDF Working with Ability-to-Repay (ATR/QM) and HOEPA Regulations mortgage-related obligations, income or assets, employment status, simultaneous loans, debt, alimony, child support, DTI or Residual Income, and credit history.' • Appendix B, "Bona Fide Discount Point Assessment Quick Entry Field Definitions", provides field IDs for the fields in the Bona Fide Discount Point How To Calculate VA Residual Income | 2022 Charts How do I calculate VA residual income? To find your approximate residual income, add up your regular monthly living expenses and subtract the total — along with your debt payments — from your gross monthly income. The money leftover after paying living expenses and debt is your residual income, which is also known as your discretionary income. VA Residual Income Chart And Requirements | Quicken Loans The chart also illustrates the income conditions that the VA requires, including residual income requirements for loans below $80,000. Table of Residual Income by Region for Loan Amounts of $79,999 and Below Over 5 Add $75 for each addional member up to a family of seven. If you have a loan amount higher than $80,000, things break down as follows.

Va Residual Income Worksheet Pdf Excel Details: Now, check the VA residual income chart that applies to your mortgage, whether you're planning to borrow above or below $80,000. Each table shows the residual income requirement based on the region and family size. For families over 5, add $75 for each additional family member up to seven. va residual income worksheet pdf VA Mortgage: Residual Income Guidelines For All 50 States For applicants whose residual income exceeds the VA's minimum residual income guidelines by 20% or more, debt-to-income ratios can be a non-factor. >A VA loan borrower in Ohio, then, with a family... XLS Veterans Affairs Veterans Affairs PDF VA Residual Income Calculation Charts VA Residual Income Calculation Charts Table of Residual Incomes by Region For loan amounts of $80,000 and above Family Size Northeast Midwest South West 1 $450 $441 $441 $491 2 $755 $738 $738 $823 3 $909 $889 $889 $990 4 $1,025 $1,003 $1,003 $1,117 5 $1062 $1,039 $1,039 $1,158

Residual Income (Definition, Formula) | How to Calculate? Equity Charge = US$4,800,000. Residual Income can be calculated using the below formula as, Residual Income = Net Income of the firm - Equity charge: = US$4,700,500 - US$4,800,000. As seen from the negative economic profit, it can be concluded that AEW has not to earn adequate to cover the equity cost of capital. New Technologies, Education for Sustainable Development ... change from passive recipients of climate change information to active ... income paid at a flat rate to all irrespective of their employment status or ...629 σελίδες How to Calculate Maintenance & Utilities on a VA Loan - sapling The VA appraiser that appraises the home can verify this information for you in an appraisal report. Multiply the square footage by the VA's predetermined allowance of 14 cents per square foot to find maintenance and utilities cost. For example, if your home is 1,600 square feet, your maintenance and utilities cost is $224 per month. VA Residual Income Chart - How to Calculate Residual Income Residual income is a major reason why VA loans have such a low foreclosure rate, despite the fact that about 9 in 10 people purchase without a down payment. The heart of this is discretionary income. Residual income looks at how much money you have leftover each month after all of your major expenses are paid.

Residual Income Formula | Calculator (Examples With Excel Template) Residual Income of the company is calculated using the formula given below Residual Income = Operating Income - Minimum Required Rate of Return * Average Operating Assets Residual Income = $80,000 - 12% * $500,000 Residual Income = $20,000 Therefore, the residual income of the company during the year is $20,000. Residual Income Formula - Example #3

Get Va Residual Income Calculator - US Legal Forms Now, creating a Va Residual Income Calculator takes at most 5 minutes. Our state online blanks and clear guidelines eliminate human-prone errors. Adhere to our simple steps to have your Va Residual Income Calculator prepared rapidly: Find the web sample from the library. Type all necessary information in the required fillable areas.

VA Residual Income Calculator and Chart - Loans101.com Income verification for VA loans also uses something called residual income. A VA residual income calculator can help you understand how the chart applies. CHECK RATES

PDF VA Home Loan Prequalification Worksheet - Learning Library VA Home Loan Prequalification Worksheet . Residual Incomes by Region For loan amounts of $79,999 and below Family Size Northeast Midwest South West 1 $390 $382 $382 $425 2 $654 ... adequate by two considerations: residual income and the debt-to-income ratio If a loan analysis

PDF LOAN ANALYSIS - Veterans Affairs This information is needed to help determine a veteran's qualifications for a VA guaranteed loan. Title 38, USC, section 3710 authorizes collection of this information. We estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot

VA Residual Income Guidelines - Veteran.com The VA might also refer to your residual income as your "balance available for family support." VA Residual Income Charts Here are the residual income charts for VA loans under $80,000 and VA loans over $80,000. We've further broken each chart down by family size and location. Finance your Dream Home $0 Down and No PMI.

VA Residual Income Chart Shows How Much You Need to be VA Eligible One of the key factors, actually requirement, is that the borrower (s) meet the VA residual income chart. Better yet, exceeding the minimum VA residual income by 120% is considered a major compensating factor. In the end, it could turn a denial into a VA loan approval.

Residual Income - Blueprint Rental Income Loss (cumulative total) Child Care Expenses: Total Monthly Debt: $0.00: Total All Debt (Total Monthly Debt + Total Monthly Housing Expense + Monthly Estimated Maint & Uitl) $0.00: Monthly Estimated Mainteanance & Utilities: $0.00: Monthly Income Taxes - Taxable Income Amount: $0.00; Suggested Federal Rate: Federal Income Tax: $0.00

PDF Va Underwriting Checklist ___ Deductions through paycheckcity.com included in residual income calculation and uploaded ___ Residual income guideline met (120% required if DTI over 41%) ___ Income worksheet completed and uploaded ** ____ Assets ___ 2 months current consecutive bank statements for all accounts ___ Source and paper trail any and all large deposits

Getting A VA Loan Using Self-Employed Income VA Self-Employed Income Calculation If your business made $100,000 last year, but you wrote off $50,000 in losses or expenses, lenders will only count the remaining $50,000 as effective income toward a mortgage. Needless to say, that can come as a shock to many prospective borrowers.

0 Response to "44 va residual income worksheet"

Post a Comment