45 nol calculation worksheet excel

How to Calculate Net Operating Loss: A Step-By-Step Guide Calculate the Net Operating Losses The next step is to determine whether you have a net operating loss and its amount. For example, if your business has a taxable income of $700,000, tax deductions of $900,000 and a corporate tax rate of 40%, its NOL would be: $700,000 - $900,000 = -$200,000. Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... NOL Steps Step 1. Step 2. Step 3. Step 4. Step 5. How To Figure an NOL Worksheet 1. Figuring Your NOL. Nonbusiness capital losses (line 2). Nonbusiness deductions (line 6). Nonbusiness income (line 7). Adjustment for section 1202 exclusion (line 17). Adjustments for capital losses (lines 19-22). NOLs from other years (line 23). Worksheet 1.

Net Operating Income Formula | Calculator | Examples (Excel Template) Net Operating Income is calculated using the formula given below Net Operating Income = Total Revenue - Cost of Goods Sold - Operating Expenses Net Operating Income = $500,000 - $350,000 - $80,000 Net Operating Income = $70,000 Therefore, DFG Ltd generated net operating income of $70,000 during the year. Net Operating Income Formula - Example #2

Nol calculation worksheet excel

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. PDF 382 Limits on NOL Usage an Ownership Change ― NOL, tax credit, capital loss or other attribute carryforward ― Net unrealized built-in loss • 5% shareholders ― Any person holding 5% or more during the testing period • Testing period ― Begins on the first day of the tax year in which carryforward begins ― Three-year "rolling" period, unless change occurs Section 382 Definition: Section 382 of the U.S. tax code states that an Acquirer in an M&A deal structured as a Stock Purchase may use only a limited amount of the Target's Net Operating Losses (NOLs) to reduce its Taxable Income each year and must write down the remaining NOL balance that will go unused. The U.S. tax code is complicated and confusing, and Section 382 is a small part of it ...

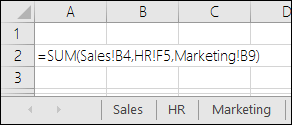

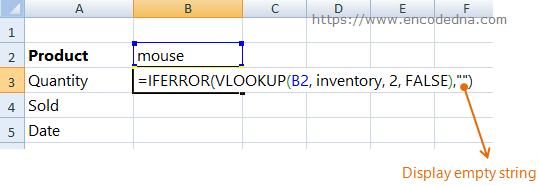

Nol calculation worksheet excel. Net Operating Losses & Deferred Tax Assets Tutorial 2) Also, when you calculate Enterprise Value, you'll have to include the Net Operating Losses as a Non-Operating Asset, typically by subtracting the NOL Balance * Tax Rate along with the other items you subtract in the calculation, such as Cash and Investments. Solved: NOL Carryforward worksheet or statement - Intuit Type 'nol' in the Search area, then click on ' Jump to nol'. You should be able to enter your Net Operating Loss carryover amounts without issue (screenshot). Check your Federal Carryover Worksheet from your 2018 return for the amount. **Say "Thanks" by clicking the thumb icon in a post NOL Tax Loss Carryforward - Corporate Finance Institute Steps to create a tax loss carryforward schedule in Excel: Calculate the firm's Earnings Before Tax (EBT) for each year Create a line that's the opening balance to carry forward losses Create a line that's equal to the current period loss, if any Create a subtotal line Net Operating Loss (NOL) - Calculation Worksheet This tax worksheet calculates a personal income tax current year net operating loss and carryover. If a taxpayer's deductions for the year are more than their income for the year, the taxpayer may have an NOL. For further assistance on this topic, click the Tax Forms item group button and view the following tax form:

Net Operating Loss (NOL) - Corporate Finance Institute The year that the NOL occurs will be identified as the NOL year. From that point in time, the company can carry the amount back to the previous two years. However, companies can carry the amount back for three years under special circumstances, such as losses due to theft. It is done by filing an amended return (using IRS Form 1040x). PDF Global Cashflow Worksheet - Lender's Online Training Excel Worksheet. 6|4 Question Sheet Prepared By >> Spoke with & date: Question # Source of question: ... nonrecurring income or Net Operating Loss (NOL). Ln 17 Rents, Pships, etc: Ignore the gain or loss listed on Line 17. Enter cashflow ... **Formula Method Calculation Monthly Rent X 75% X 12 Subtract Monthly Payment X 12 Calculated Net Cash ... LBO Model > Net Operating Losses (NOL) - Macabacus Net Operating Losses (NOLs) STEP 26. Net Operating Losses (NOLs) Let's revisit our tax schedule to consider the effect of net operating losses ("NOLs"). We have broken down NOLs into two categories-pre-transaction and post-transaction-to make our calculations more understandable. Treatment of NOLs that existed prior to the transaction ... PDF Income Calculations - Freddie Mac Income Calculations (Schedule Analysis Method) Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations

PDF Net Operating Losses - Spidell IRC §172 - Net Operating Loss Deduction. Subsection Titles. IRC §172(a) - Deduction Allowed IRC §172(b) - Net Operating Loss Carrybacks and Carryovers IRC §172(c) - Net Operating Loss Defined IRC §172(d) - Modifications IRC §172(e) - Law Applicable to Computations 1 STATUTORY LOSS IRC §172(c) Net Operating Loss Defined. Net Operating Loss Worksheet / Form 1045 - Support Enter the number of years you wish to carry back the NOL Select the year you want to apply the NOL to first and complete the worksheet for that year. If you wish to forego the carryback period, select IRC Sec 172 (b) (c) Election to Forego the Carryback Period, and select 'YES'. Net Operating Loss Carryback/Carryover Calculator This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. Net Operating Loss Carryback/Carryover Calculator Definitions Year in which the NOL occurred Year in which you had a Net Operating Loss (NOL). Year to which the NOL is being carried (Carried Year) Tax Principles (part 2): Valuing NOLs | Multiple Expansion The annual use of NOLs are a function of the company's profitability. If the company is projected to be highly profitable, it will be able to use the NOL balance more quickly, and vice versa. To calculate the annual cash flow, the formula is simple: Annual cash value of NOL = taxes shielded = NOL balance used x Tax Rate.

Net Operating Loss (NOL) Carryforward - Excel Model Template This is a professional Net Operating Loss Carryforward template for financial modelling. Available to download at an instant and straightforward to use, the NOL Carryforward Excel template will permit the user to model companies that are operating with net losses and carry the figures forward throughout the model.

PDF IT NOL - Net Operating Loss Carryback Worksheet IT NOL - Net Operating Loss Carryback Worksheet (Check the box on the front of Ohio form IT 1040X indicating you are amending for an NOL and attach this form to Ohio form IT 1040X.) ... You must complete the remainder of the NOL worksheet. 6. Depreciation add-back, if any, from Ohio form IT 1040, Schedule A for the year in which the NOL ...

PDF 2021 Publication 536 - IRS tax forms NOL Steps Follow Steps 1 through 5 to figure and use your NOL. Step 1. Complete your tax return for the year. You may have an NOL if a negative amount ap- pears in these cases. Individuals—You subtract your standard deduction or itemized deductions from your adjusted gross income (AGI).

1040 - Net Operating Loss FAQs (NOL, ScheduleC, ScheduleE, ScheduleF) A net operating loss usually is carried back up to three preceding years to offset income there before it can be carried forward and used in a future year, unless the taxpayer makes an irrevocable election to carry it forward only. Three data entry screens and two worksheets deal with NOLs in a 1040 return:

Net Operating Losses (NOLs): Formula and Excel Calculator Net Operating Losses (NOLs) Calculator - Excel Template We'll now move to a modeling exercise, which you can access by filling out the form below. Net Operating Losses (NOLs) Example Calculation For our illustrative modeling exercise, our company has the following assumptions. Model Assumptions Taxable Income 2017 to 2018 = $250k

Discounted Cash Flow (DCF) Excel Template | Download Discounted cash flow (DCF) is a method used to estimate the value of an investment based on future cash flow. The DCF formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Click here to download the DCF template. To do this, DCF finds the present value of future cash ...

Self-Employed Borrower Tools by Enact MI We get it, mental math is hard. That's why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrower's average monthly income and expenses. Please note that these tools offer suggested guidance, they don't replace instructions or applicable guidelines from the GSEs.

PDF A net operating loss (NOL) deduction can offset vidual taxpayer and claiming the NOL deduction must be carried out in the following four steps. 1. Determine eligibility 2. Compute the NOL 3. Distribute the NOL to carryback and carry - forward years 4. Recalculate taxes in the carryback years and calculate taxes in the carryforward years Estate and Trusts

Net Operating Loss Carryforward Template | Wall Street Oasis This template allows you to model a company with net operating losses and carry them forward throughout the model. The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model. According to the WSO Dictionary,

is there a spreadsheet to assist in calculating NOL carryforward… Bachelor's Degree. 1,083 satisfied customers. Clients are retired in their 70's. They have a NOL. Clients are retired in their 70's.They have a NOL carryforward from 2019 of $22,213 and a loss on Sch E in 2020 of $8,184. Their income is $22,407 … read more.

1040-US: NOL Carryover Calculation Worksheet 1, line 2 - Taxable income ... Note: The NOL deduction can be found on NOL Carryover Calculation Worksheet 1, line 1. For additional information on the calculation of the NOL worksheets, see IRS Publication 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts .

Section 382 Definition: Section 382 of the U.S. tax code states that an Acquirer in an M&A deal structured as a Stock Purchase may use only a limited amount of the Target's Net Operating Losses (NOLs) to reduce its Taxable Income each year and must write down the remaining NOL balance that will go unused. The U.S. tax code is complicated and confusing, and Section 382 is a small part of it ...

0 Response to "45 nol calculation worksheet excel"

Post a Comment