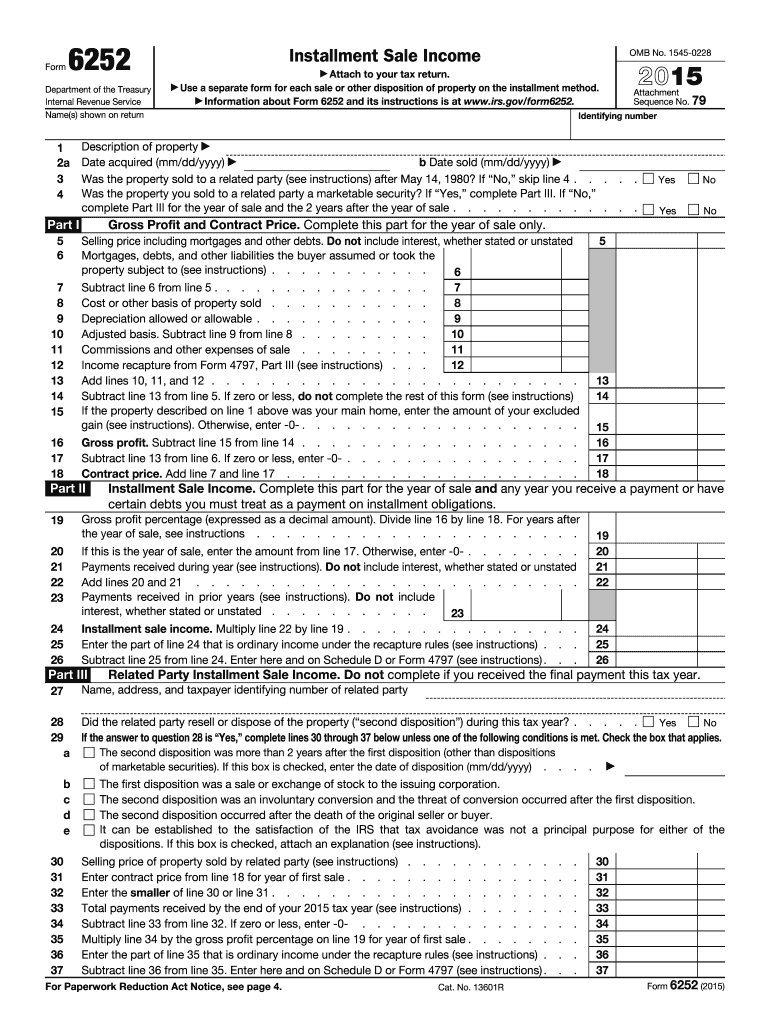

42 capital gain worksheet 2015

Instructions for Form 6251 (2021) | Internal Revenue Service To adjust your foreign source capital gain distributions, multiply your foreign source capital gain distributions in each separate category by 0.5357 if the foreign source capital gain distributions are taxed at a rate of 15%, and by 0.7143 if they are taxed at a rate of 20%. Include the results on line 1a of the applicable AMT Form 1116. How to Calculate Capital Gains Tax | H&R Block If you sold your assets for more than you paid, you have a capital gain. If you sold your assets for less than you paid, you have a capital loss. Learn how you can use capital losses to offset capital gains tax. Review the descriptions in the section below to know which tax rate may apply to your capital gains.

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet Aug 10, 2022 · In 2021 and 2022, the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax ...

Capital gain worksheet 2015

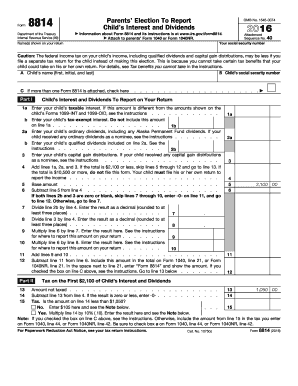

1040 (2021) | Internal Revenue Service - IRS tax forms Standard Deduction Worksheet for Dependents—Line 12a; Line 12b; Line 13. Qualified Business Income Deduction (Section 199A Deduction) Line 16. Tax Yes. No. Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Capital gains tax in the United States - Wikipedia The capital gain that is taxed is the excess of the sale price over the cost basis of the asset. The taxpayer reduces the sale price and increases the cost basis (reducing the capital gain on which tax is due) to reflect transaction costs such as brokerage fees, certain legal fees, and the transaction tax on sales. Depreciation Do You Have to Pay Capital Gains Tax on a Home Sale? Mar 02, 2022 · For single tax filers, up to $250,000 of the capital gains can be excluded, and for married tax filers filing jointly, up to $500,000 of the capital gains can be excluded.

Capital gain worksheet 2015. When Does Capital Gains Tax Apply? - TaxAct Blog The taxpayer will have to recognize a capital gain from the sale of the land. If the capital gain is $50,000, this amount may push the taxpayer into the 25 percent marginal tax bracket. In this instance, the taxpayer would pay 0 percent of capital gains tax on the amount of capital gain that fit into the 15 percent marginal tax bracket. Do You Have to Pay Capital Gains Tax on a Home Sale? Mar 02, 2022 · For single tax filers, up to $250,000 of the capital gains can be excluded, and for married tax filers filing jointly, up to $500,000 of the capital gains can be excluded. Capital gains tax in the United States - Wikipedia The capital gain that is taxed is the excess of the sale price over the cost basis of the asset. The taxpayer reduces the sale price and increases the cost basis (reducing the capital gain on which tax is due) to reflect transaction costs such as brokerage fees, certain legal fees, and the transaction tax on sales. Depreciation 1040 (2021) | Internal Revenue Service - IRS tax forms Standard Deduction Worksheet for Dependents—Line 12a; Line 12b; Line 13. Qualified Business Income Deduction (Section 199A Deduction) Line 16. Tax Yes. No. Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet.

0 Response to "42 capital gain worksheet 2015"

Post a Comment