42 sec 1031 exchange worksheet

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 Tool Kit - TM 1031 Exchange 1031 COMPARISON CALCULATOR. Phone. 1 877 486 1031. 1031 COMPARISON CALCULATOR. Enter your figures in the fields provided (no commas or dollar signs, for example: 300000 instead of $300,000) and click on "Calculate". 1. Calculate Net Adjusted Basis: Original Purchase Price.

PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 Replacement Property received.....(=)$ _____ 4.2 Allocation of basis between two or more §1031 Replacement Properties: a.Identification: _____

Sec 1031 exchange worksheet

The built-in gains tax Dec 01, 2020 · A tax-deferred, like-kind exchange of an asset does not trigger the built-in gain inherent in that asset, except to the extent of boot received in the exchange. Rather, the unrecognized built-in gain and the unexpired portion of the recognition period transfers to the asset received in the exchange (Sec. 1374(d)(8); Regs. Sec. 1. 1374-8). Privacy Impact Assessments - PIA | Internal Revenue Service - IRS … Jan 24, 2022 · POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Overview of Combining a 1031 Exchange with a 121 Exclusion The joining of a 1031 Exchange with a 121 Exclusion is an extraordinarily effective combined income tax strategy for any Investor, allowing them to take advantage of tax free exclusion when their property was previously held and used as investment property. Internal Revenue Code Section 1031 allows a taxpayer to defer the federal and state ...

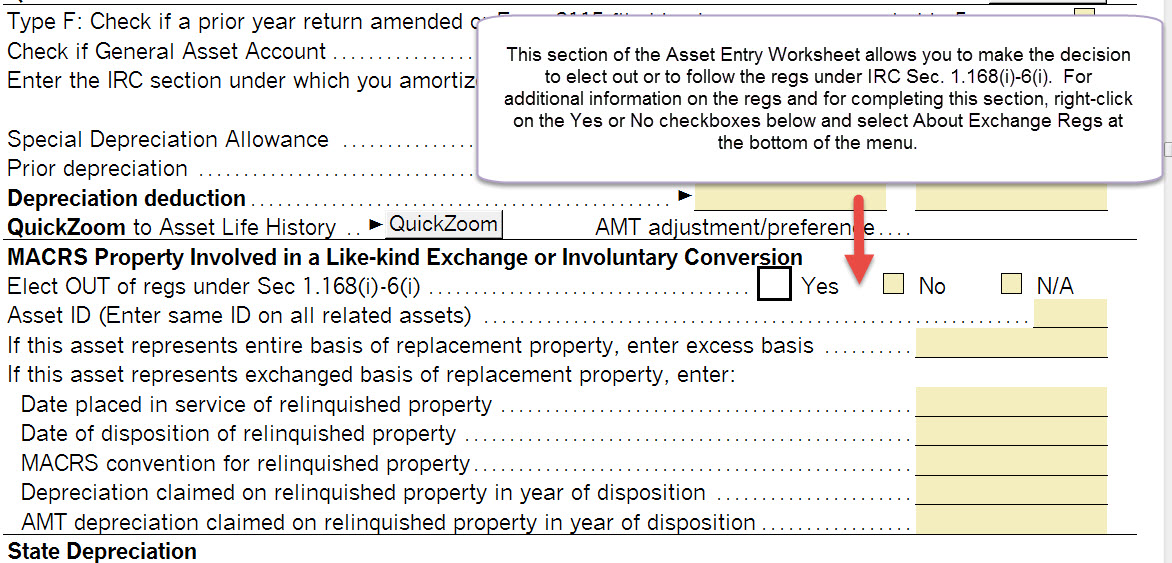

Sec 1031 exchange worksheet. (PDF) Excel ® 2019 BIBLE | Cristi Etegan - Academia.edu Enter the email address you signed up with and we'll email you a reset link. Lacerte Tax Community - Intuit Aug 22, 2022 · Next year ES worksheet glitch & effect of Excess Premium Tax Credit Line 5 is missing the Excess Advance Premium Tax Credit.I saw this because my client will not have the EAPTC in 2022. With an input of -1 in Code 98 of Screen 7... What Is a 1031 Exchange? Know the Rules - Investopedia A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. The term—which gets its name from Section 1031 of the Internal Revenue... Code of Laws - Title 12 - Chapter 6 - South Carolina Income Tax Act SECTION 12-6-510. Tax rates for individuals, estates, and trusts for taxable years after 1994. (A) For taxable years beginning after 1994, a tax is imposed on the South Carolina taxable income of individuals, estates, and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550 computed at the following rates with the income brackets ...

Publication 537 (2021), Installment Sales | Internal Revenue Service Under this type of exchange, the person receiving your property may be required to place funds in an escrow account or trust. If certain rules are met, these funds won’t be considered a payment until you have the right to receive the funds or, if earlier, the end of the exchange period. See Regulations section 1.1031(k)-1(j)(2) for these rules. IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ... The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) The new property you've targeted is only priced at $750,000. You're now undertaking a partial 1031 exchange, since you're not reinvesting all the proceeds from the sale of your relinquished property. That excess $250,000 is considered cash boot, and is subject to capital gains taxes as well as depreciation recapture. 1031 Exchange Examples: Like-Kind Examples to Study & Learn From A like-kind exchange or 1031 exchange is where one investment property is swapped for another. According to Section 1031 of the Internal Revenue Code, any taxpaying entity, including individuals, partnerships, trusts, companies, and corporations can set up a like-kind exchange.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Note that multi-asset exchanges are covered in detail in Section 1.1031(j)-1 of the regulations. An exchange is reported as a multi-asset exchange if the exchanger transferred AND received more than one group of like-kind properties, cash or other (not like-kind) property. 1031 Exchange Examples | 2022 Like Kind Exchange Example TAXES DUE (Effective Tax Rate)4. 37.3%. $606,625. (1) Federal Capital Gains equal to Realized Gain less depreciation taken multiplied by the applicable rate. (2) Based on amount of depreciation taken during ownership of the property. In this example,the amount is based on $400,000 of depreciation taken. (3) Rate varies by state. Accounting for 1031 Like-Kind Exchange - BKPR A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment. Personal Property Not Qualified for Like-Kind Exchange How To Record A 1031 Exchange - realized1031.com If you've recent ly completed a 1031 like-kind exchange, you need to document your transaction for your accounting records.Although a deferred gain is an unearned revenue, it represents a future asset that counts as a liability on your balance sheet. Gains are seen as a liability until realized as an asset.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Real Estate: 1031 Exchange Examples - SmartAsset You use the total profit from the sale at $400,000 and take out a new loan worth $600,000. With this, you meet the 1031 exchange requirements. Example 4: Partial 1031 Exchange. It's actually possible to sell an investment property and satisfy the 1031 exchange rules without using all of your sale proceeds. This is called a partial exchange.

What Expenses Are Deductible in a 1031 Exchange? Here' a question I get asked at least once a week: "How can I reduce the price of what I am going to purchase as my Replacement Property?" Well, there are a number of "exchange expenses" that will reduce the realized gain and recognized gain on a Section 1031 Exchange. The real estate commission paid by the taxpayer to a real estate broker is an example of one such deductible expense.

1031 Exchange Calculator - The 1031 Investor 1031 Exchange Calculator This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

1031 Exchange Calculation Worksheet And Sec 1031 ... - Pruneyardinn We constantly effort to reveal a picture with high resolution or with perfect images. 1031 Exchange Calculation Worksheet And Sec 1031 Exchange Worksheet can be beneficial inspiration for those who seek a picture according specific topic, you can find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

1031 Exchange Calculator | Calculate Your Capital Gains (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented.

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800. Enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Note that you can see all of the calculations so you can better understand how the final figures were calculated.

2020 S Corporation Tax Booklet | FTB.ca.gov - California On a separate worksheet, using the Form 100S format, complete Form 100S, Side 1 and Side 2, line 1 through line 14, without regard to line 11. If any federal charitable contribution deduction was taken in arriving at the amount entered on Side 1, line 1, enter that amount as an addition on line 7 of the Form 100S formatted worksheet.

PDF §1031 Basis Allocation Worksheet - Irex received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354)

MasterCPE | Online CPE Courses | CPA CPE Online CPE courses - MasterCPE specializes in quality CPE courses, professional CPE courses, online CPE for account and tax professionals.

Exchanges Under Code Section 1031 - American Bar Association Section 1031 provides that "No gain or loss shall be recognized if property held for use in a trade or business or for investment is exchanged solely for property of like kind." The first provision of a federal tax code permitting non-recognition of gain in an exchange was Code Sec. 202 (c) of the Revenue Act of 1921.

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms taxpayer exchanges for like-kind property of lesser value. This fact sheet, the 21. st in the Tax Gap series, provides additional guidance to taxpayers regarding the rules and regulations governing deferred like-kind exchanges. Who qualifies for the Section 1031 exchange? Owners of investment and business property may qualify for a Section 1031 ...

0 Response to "42 sec 1031 exchange worksheet"

Post a Comment