39 student loan interest deduction worksheet 1040a

Chapter 4 - Student Loan Interest Deduction - Uncle Fed Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 4-1. Student Loan Interest Deduction - jdunman.com Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 3-1 in this publication.

Form 1040: Your Complete 2021 & 2022 Guide - Policygenius Dec 22, 2021 · Line 2 has two parts, one for tax-exempt interest (mainly municipal bonds) and one for taxable interest. Taxable interest includes income from a 1099-INT or 1099-OID. You will need to attach Schedule B if you had $1,500 or more of taxable interest. Line 3 is where you list income from dividends. Line 3a is for qualified dividends and 3b is for ...

Student loan interest deduction worksheet 1040a

Virginia Tax Form 760 Instructions | eSmart Tax CODE: Description: 10 : Interest on federally exempt U.S. obligations Enter the amount of interest or dividends exempt from federal income tax, but taxable in Virginia, less related expenses.: 11 : Accumulation distribution income Enter the taxable income used to compute the partial tax on an accumulated distribution as reported on federal Form 4970.: 12: Lump-sum distribution income … Topic No. 456 Student Loan Interest Deduction - IRS tax forms It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status. Modified Adjusted Gross Income (MAGI) - Your Roth IRA First, start with your adjusted gross income (AGI) as shown on your tax return. This is line 21 on IRS Form 1040A (U.S. Individual Income Tax Return). ... Student loan interest deduction c) Tuition and fees deduction d) ... Don't worry. If you find it too hard to follow those directions, you can use Worksheet 2-1 to figure out your MAGI ...

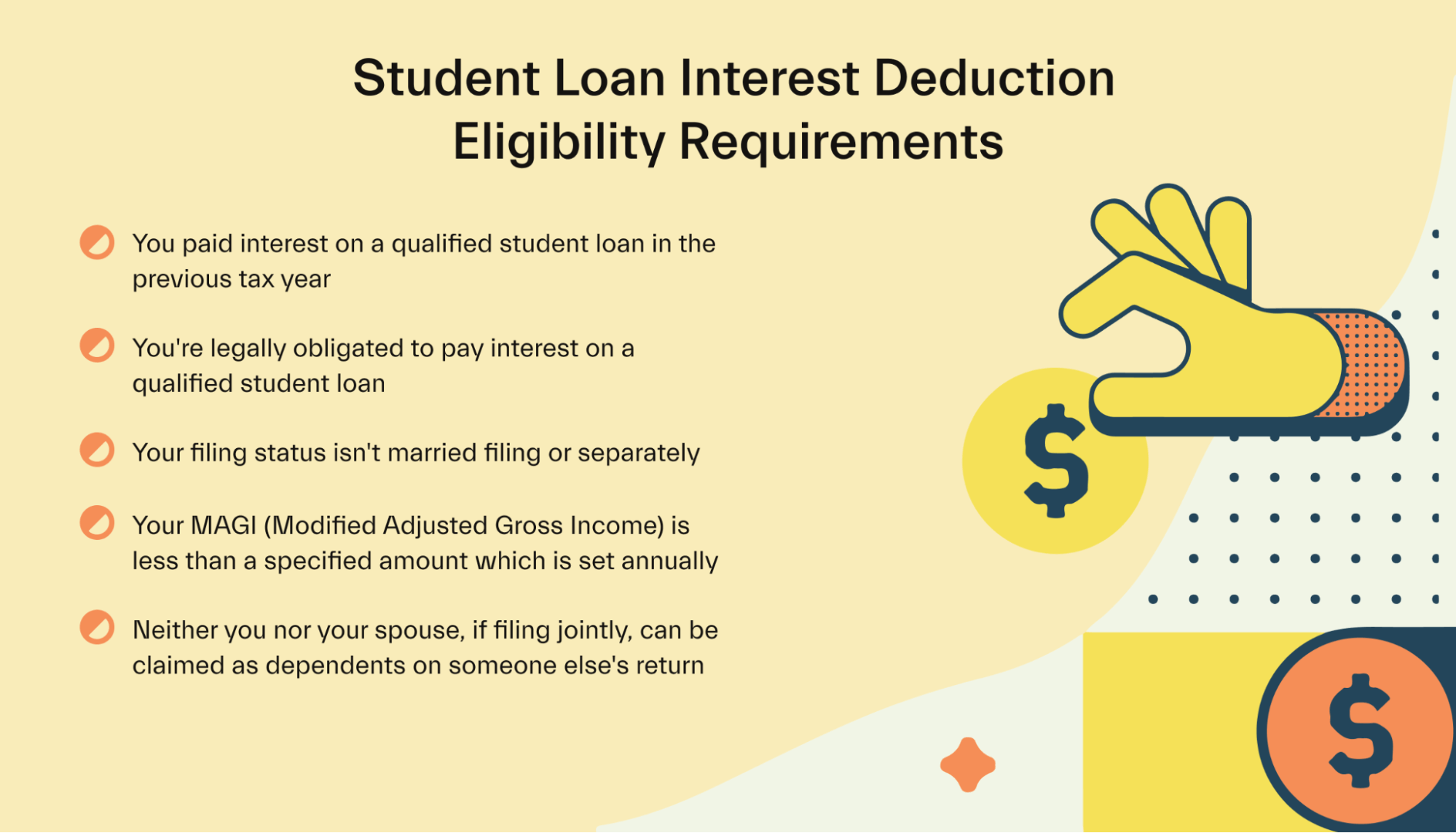

Student loan interest deduction worksheet 1040a. 6+ Creative Student Loan Interest Deduction Worksheet Average student loan interest deduction worth 188. Deduction can reduce the amount of your income subject to tax by up to 2500 in 2009. Do not enter more than 2500 Enter the amount from Form 1040 line 22 or Form 1040A line 15. Taxable income less than 100000. You have successfully completed this document. How to Deduct Student Loan Interest - Tax Guide - 1040.com You paid interest during the tax year on a qualified student loan. Your filing status is not married filing separately. Your modified adjusted gross income (MAGI) must be less than $70,000 if filing single, head of household, or qualifying widow (er) (the deduction phases out at $85,000). Student Loan Interest Deduction Worksheet - TaxAct To view the Student Loan Interest Deduction Worksheet: Online Navigation Instructions From within your TaxAct Online return, click Print Center down the left, then click Custom Print. Click Federal Form 1040 Student Loan Interest - $X.XX Deduction. You may need to scroll down in the section to locate the item. Click Print, then click the PDF link. Student Loan Tax Forms - Information & Tax Deductions | Sallie Mae Please be aware that the amount of student loan interest paid may be different from the amount of accrued interest that appears on monthly billing statements. ... Refer to IRS Pub 970, Tax Benefits for Education, or review the Student Loan Interest Deduction Worksheet in your 1040 or 1040A instructions. Contact your tax advisor.

2021 Instruction 1040 - IRS tax forms Have any deductions to claim, such as student loan inteest, r self-employment tax, or educator expenses. Can claim a efundable cr redit (other than the eaned income r credit, American opportunity cedit, refundable child tax credit, r additional child tax cedit, or recovery rebate credit), such as the r Fillable Form 1040 2018 Student Loan Interest Deduction Worksheet All forms are printable and downloadable. Form 1040 2018 Student Loan Interest Deduction Worksheet On average this form takes 3 minutes to complete The Form 1040 2018 Student Loan Interest Deduction Worksheet form is 1 page long and contains: 0 signatures 2 check-boxes 12 other fields Country of origin: US File type: PDF H&R Block Income Tax Course Flashcards | Quizlet The bonus is an additional deduction for 30% or 50% of the unadjusted basis of the asset for property acquired between Sep. 10, 2001, and Jan. 1, 2005. ... Student Loan Interest Statement. Form 3903. Moving Expenses. 2 Requirements for Moving Expenses (1) Distance ... Schedule D Tax Worksheet. Taxpayers must use if they have: Gains from the ... Solved: Student Loan Deduction - Intuit I used the "Student Loan Interest Deduction Worksheet" from IRS.gov and confirmed the 1040 was correct. View solution in original post. 0 2,719 Reply. 4 Replies Lisa995. ... (Line 21 of the 1040 or Line 15 of the 1040A) ♪♫•*¨*•.¸¸♥Lisa♥ ¸¸.•*¨*•♫♪ 0 1 2,723 Reply. zmclell. Returning Member March 27, 2018 11:16 AM.

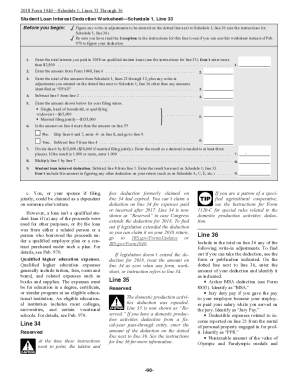

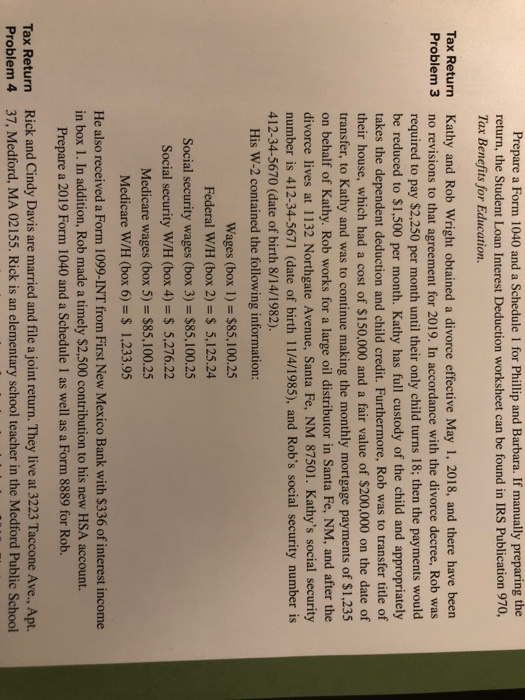

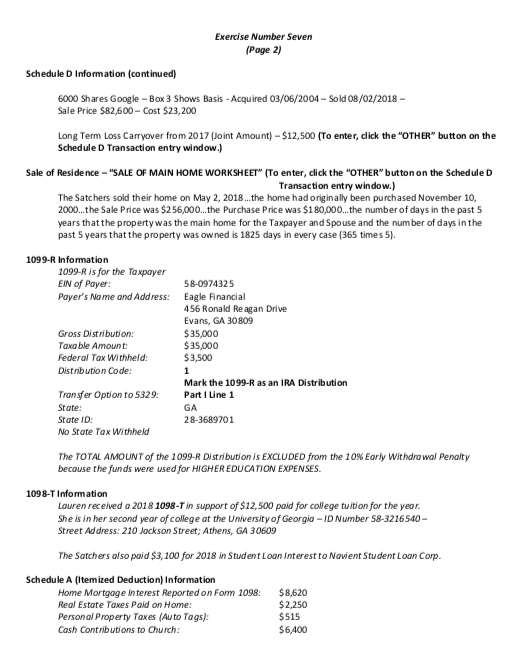

About Form 1040, U.S. Individual Income Tax Return Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses. Schedule 1 PDF Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an excess advance premium tax credit ... PDF Student Loan Interest Deduction Worksheet - IRS tax forms Enter the amount from Form 1040, line 6 2. 3. Enter the total of the amounts from Schedule 1, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to Schedule 1, line 36 other than any amounts identified as "DPAD" 3. 4. Subtract line 3 from line 2 4. 5. Enter the amount shown below for your filing status. OLT Free File Supported Federal Forms Student Loan Interest Deduction Worksheet: Worksheet Form 6251-Schedule 2, Line 1: Exemption Worksheet for Form 6251 line 5: ... (Form 1040 or 1040A) Top: The following forms are not supported ~ Tax Year 2021: Form Number Form Name 970: Application To Use LIFO Inventory Method: 5713 ... How Student Loan Interest Deduction Works | VSAC Here's how to calculate your student loan interest tax deduction: Get your 1098-E. If you paid $600 or more in interest on a qualified student or parent loan over the course of the year, your lender or servicer should send you an IRS Form 1098-E. They should also submit a copy of your 1098-E to the IRS. This form reports the amount of ...

Student Loan Interest Deduction Worksheet | TaxAct Support Double click Form 1040 Student Loan Interest - Student Loan Interest Deduction Worksheet Click on the Printer Icon above the worksheet to print. You are able to choose if you wish to send the output to a printer or a PDF document. This worksheet mirrors the IRS calculations as explained in IRS Publication 970 Tax Benefits for Education.

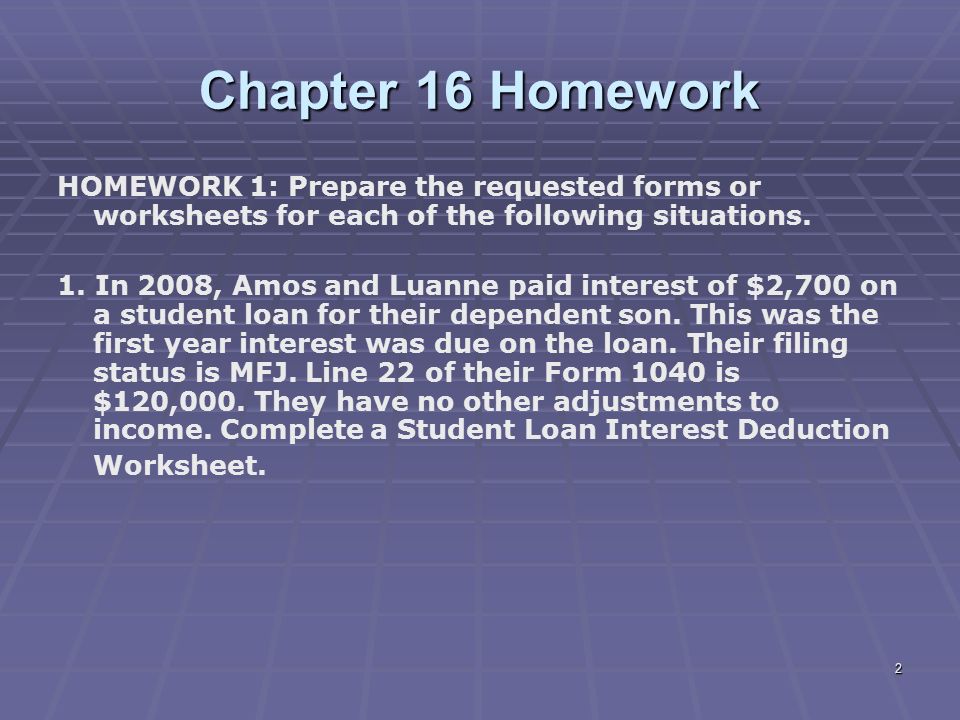

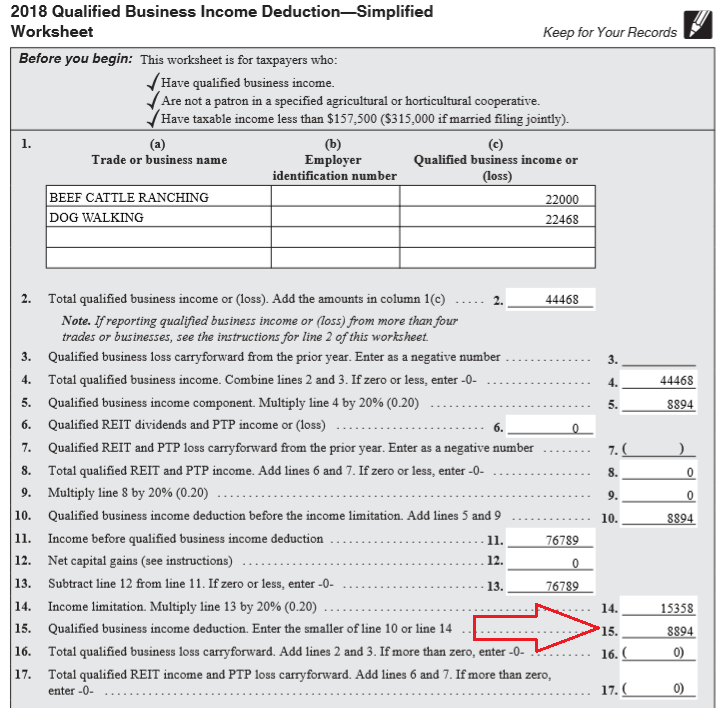

Student loan interest deduction worksheet form 1040 Student Loan Interest Deduction Worksheet Form 1040 Line 33 1 Total qualified from ACTG 67 at Foothill College

Publication 970 (2021), Tax Benefits for Education | Internal Revenue ... Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. Reporting ...

Student Loan Interest Deduction - Uncle Fed Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 4-1 below.

Maryland Tax Form 502 Instructions | eSmart Tax 1040A: 1040EZ: line 1: line 37: line 21: line 4: line 1a: line 7: line 7: line 1: line 1b: See Below: line 7: ... Do not include adjustments to income for Educator Expenses or Student Loan Interest deduction. p: ... with minimums of $1,500 and $3,000 and maximums of $2,000 and $4,000, depending on your filing status. Use STANDARD DEDUCTION ...

PDF WHICH FORM --1040, 1040A, or 1040EZ - IRS tax forms Only IRA or student loan adjustments to your income You do NOT itemize deductions 1040 Income or combined incomes over $50,000 Itemized Deductions Self-employment income Income from sale of property If you cannot use form 1040EZ or Form 1040A, you probably need a Form 1040. You can use the 1040 to report all types of income, deductions, and ...

PDF for Education Tax Benefits - IRS tax forms Student loan interest deduction. • For 2021, the amount of your student loan interest de-duction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can't claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). •

Section 2300: Student Loan Interest Deductions | NACUBO Tax The instructions to Form 1040, Form 1040A, and Form 1040NR include a Student Loan Interest Deduction Worksheet. However, if the taxpayer is filing Form 2555 or 2555-EZ, Foreign Earned Income, or Form 4563, excluding income from American Samoa, or is excluding income from sources within Puerto Rico, he must complete Worksheet 4-1 in Pub. 970 .

2021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Student Loan Interest Deduction Worksheet Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes.

Student Loan Interest Deduction Worksheet - TaxAct In the Documents and Worksheets section, scroll down and click the checkbox next to Federal Form 1040 Student Loan Interest - $X.XX Deduction. Click Print, then click the PDF link that is provided for printing. Click the Print icon, then click Print in the dialog box that appears. Note.

How do I calculate my student loan interest deduction for ... - Intuit Second, look at your federal tax return using the preview steps above. Locate your federal student loan interest amount, and any other numbers you need, and use them to fill out your California worksheet. Third, return to the TurboTax California program and input the amount from Line 10 (or Line 11, if any) into the question field asking for ...

PDF Student Loan Interest Deduction Worksheet Form 1040, Line 33, or Form ... Enter the total interest you paid in 2016 on qualified student loans (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 or from Form 1040A ...

Modified Adjusted Gross Income (MAGI) - Your Roth IRA First, start with your adjusted gross income (AGI) as shown on your tax return. This is line 21 on IRS Form 1040A (U.S. Individual Income Tax Return). ... Student loan interest deduction c) Tuition and fees deduction d) ... Don't worry. If you find it too hard to follow those directions, you can use Worksheet 2-1 to figure out your MAGI ...

Topic No. 456 Student Loan Interest Deduction - IRS tax forms It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status.

Virginia Tax Form 760 Instructions | eSmart Tax CODE: Description: 10 : Interest on federally exempt U.S. obligations Enter the amount of interest or dividends exempt from federal income tax, but taxable in Virginia, less related expenses.: 11 : Accumulation distribution income Enter the taxable income used to compute the partial tax on an accumulated distribution as reported on federal Form 4970.: 12: Lump-sum distribution income …

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

0 Response to "39 student loan interest deduction worksheet 1040a"

Post a Comment