40 cancellation of debt worksheet

Entering canceled debt in ProSeries - Intuit Follow these steps to link Form 1099-C to Schedule C, E, F, or Form 4835: Press the F6 key on your keyboard to view the Open Forms window. Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart ... Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

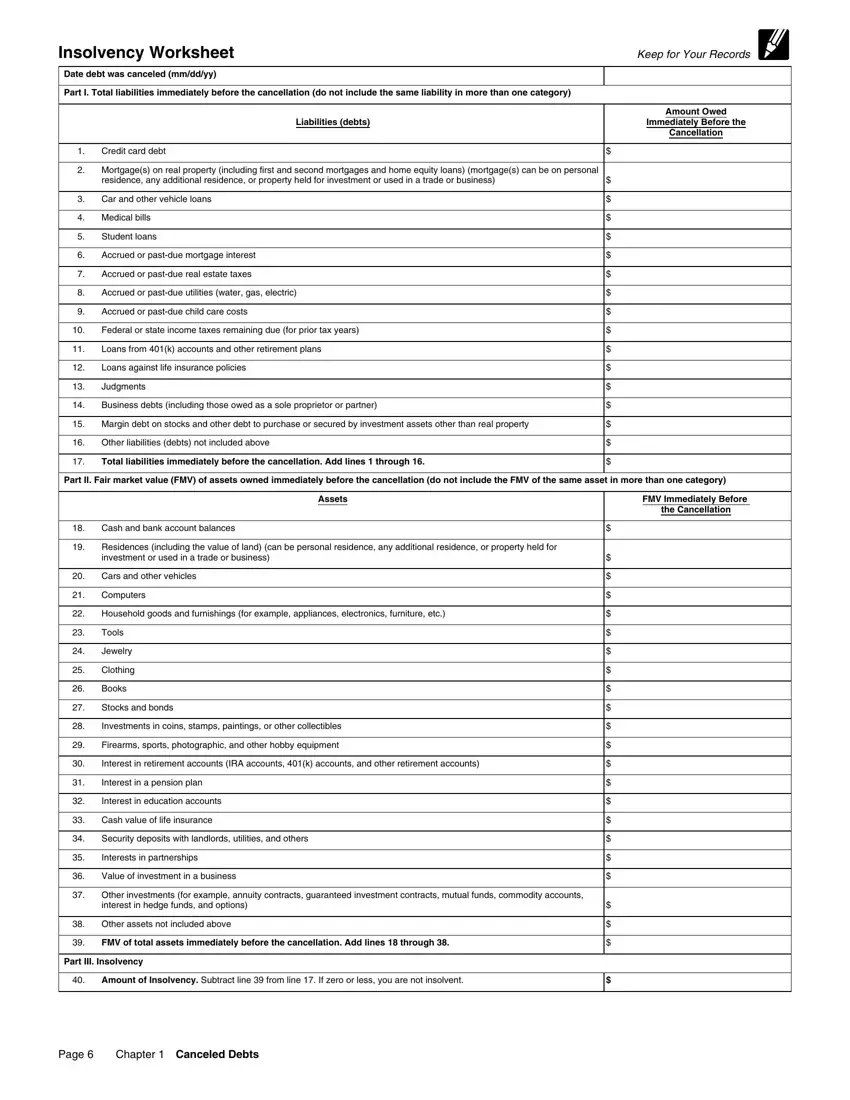

Publication 4681 (2021), Canceled Debts, Foreclosures, … Dec 31, 2020 · Robin completes a separate Insolvency Worksheet and determines she was insolvent to the extent of $4,000 ($9,000 total liabilities minus $5,000 FMV of her total assets). She can exclude her entire canceled debt of $2,500. ... Ordinary income from the cancellation of debt upon foreclosure or repossession.* Subtract line 2 from line 1. If less ...

Cancellation of debt worksheet

successessays.comSuccess Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. 1040-US: Calculation of canceled debt to be included in income UltraTax CS produces a Cancellation of Debt Worksheet to show how the net amount of canceled debt included in income was calculated. The worksheet also reports the exception or exclusion to the canceled debt to be excluded from income. Canceled debt income is reported on the form or schedule selected in the Form/Schedule field in Screen 1099C. The following table lists where the amount is reported on the applicable form or schedule. › publications › p908Publication 908 (02/2022), Bankruptcy Tax Guide | Internal ... At the time of the debt cancellation, he was considered insolvent by $20,000. He can exclude from income the entire $10,000 debt cancellation because it was not more than the amount by which he was insolvent. Among Tom's assets, the only depreciable asset is a rental condominium with an adjusted basis of $50,000.

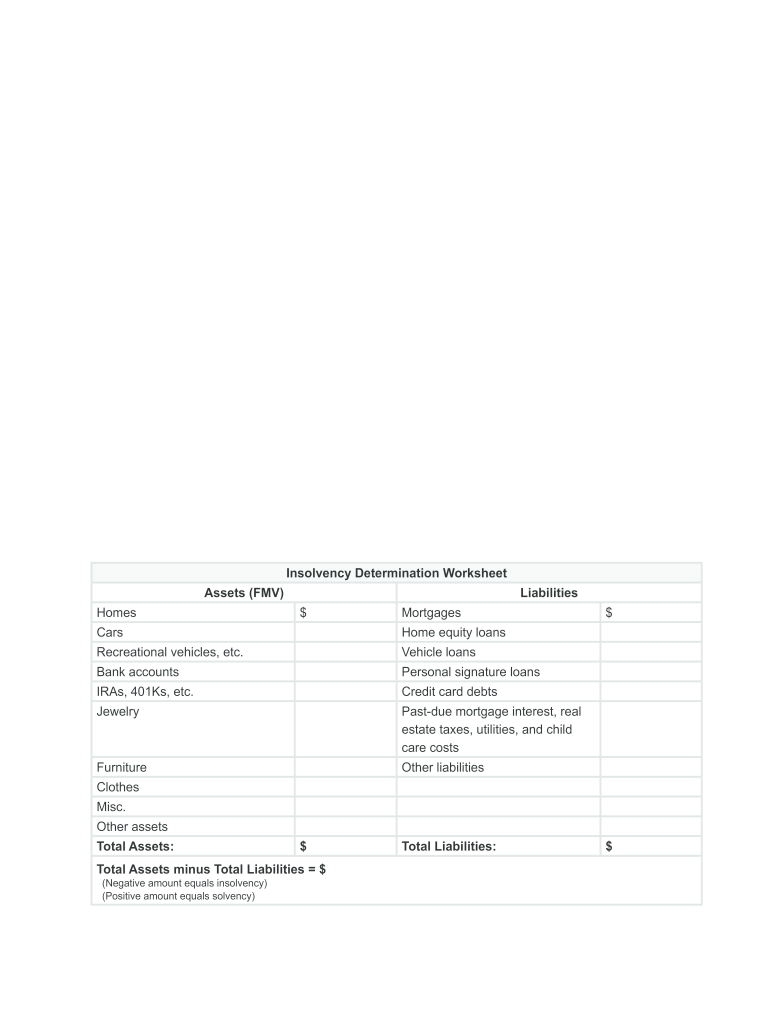

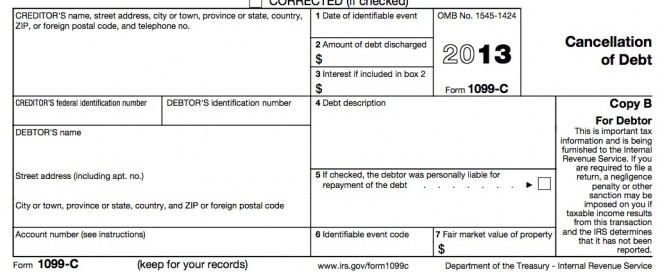

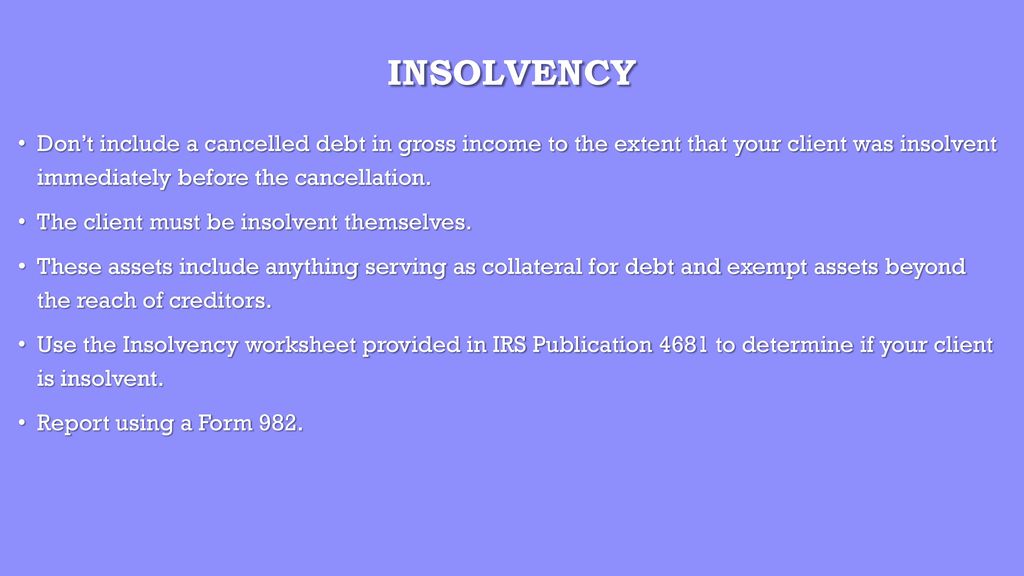

Cancellation of debt worksheet. Cancellation of Debt - Intuit The Federal Information Worksheet will display and all the forms in your return will be listed on the left side. Then click on Open Form and type in the search box : Form 982. To make sure its excluded within your return, you will need to fill out the following forms: Form 1099-C (Cancellation of Debt), fill out accordingly consumer.ftc.gov › articles › home-equity-loans-andHome Equity Loans and Home Equity Lines of Credit Dec 17, 2021 · They may be willing to give you a deal on the interest rate or fees. Ask friends and family for recommendations of lenders. Then do some research into the lenders’ offerings and prepare to negotiate a deal that works best for you. Use the Shopping for a Home Equity Loan Worksheet. Ask each lender to explain the loan plans available to you. › publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · By completing the Insolvency Worksheet, James determines that, immediately before the cancellation of the debt, he was insolvent to the extent of $5,000 ($15,000 total liabilities minus $10,000 FMV of his total assets). He can exclude $5,000 of his $7,500 canceled debt. Cancellation of Debt - Insolvency — 1 Tax Financial Cancellation of Debt - Insolvency It includes a worksheet for a taxpayer to determine if he or she is insolvent and it explains the tax implications of cancelled debt. HIGHLIGHTS: Tax treatment of cancelled debt. Form 1099-C, Cancellation of Debt. Taxpayer insolvency and insolvency worksheet. Reduction of tax attributes due to discharge of debt.

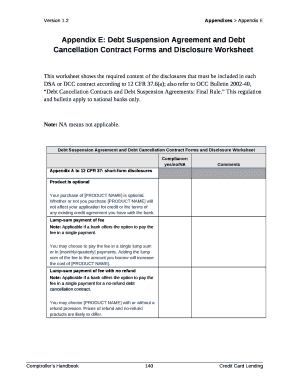

PDF Asheville Tax Service | Asheville area since 1989 Serving the Asheville area since 1989. For over 30 years, our knowledgeable tax professionals have provided clients with premium service for a reasonable preparation fee! We believe that having your taxes prepared should be a pleasant and understandable experience, personalized to meet your specific needs. We value establishing and maintaining ... Publication 225 (2021), Farmer's Tax Guide | Internal Revenue … See Cancellation of Debt in chapter 3 for more information. Deferred payment contract. If you sell an item under a deferred payment contract that calls for payment in a future year, there is no constructive receipt in the year of sale. However, if the sales contract states that you have the right to the proceeds of the sale from the buyer at ... PDF Abandonments and Repossessions, Canceled Debts, - IRS tax forms debt that is canceled, forgiven, or discharged for less than the full amount of the debt as "can-celed debt." Sometimes a debt, or part of a debt, that you don't have to pay isn't considered canceled debt. These exceptions are discussed later un-der Exceptions. Sometimes a canceled debt may be exclu-ded from your income. But if you do exclude Cancellation of Debt - Qualified Real Property Business Debt Worksheet Cancellation of Debt - Qualified Real Property Business Debt Worksheet. This tax worksheet determines if a taxpayer is qualified to exclude income from the discharge of qualified real property business debt and to calculate the amount of excludable income. For further assistance: Click the Tax Forms item group button to view Form 982 - Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment).

Home Equity Loans and Home Equity Lines of Credit Dec 17, 2021 · They may be willing to give you a deal on the interest rate or fees. Ask friends and family for recommendations of lenders. Then do some research into the lenders’ offerings and prepare to negotiate a deal that works best for you. Use the Shopping for a Home Equity Loan Worksheet. Ask each lender to explain the loan plans available to you. Cancellation of Debt Insolvency Worksheet - Thomson Reuters Cancellation of Debt Insolvency Worksheet. This tax worksheet calculates a taxpayer's insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. A debt includes any indebtedness whether a taxpayer is personally liable or liable only to the extent of the property securing the debt. Cancellation of all or part of a debt that is secured by property may occur because of a foreclosure, a repossession, a voluntary return of the property to the lender, abandonment of the ... Publication 908 (02/2022), Bankruptcy Tax Guide Joan completes the Schedule D Tax Worksheet to figure the capital loss carryover. Because $70,000 of debt was canceled, Joan must reduce the tax attributes of the estate by the amount of the canceled debt. ... See Corporations under Debt Cancellation, later, for information about a corporation's debt canceled in a bankruptcy proceeding. . Tax ... Abandonments and Repossessions, Canceled Debts, - IRS tax … Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....14 Chapter 4. How To Get Tax Help....14 Future Developments ... 1099-C Cancellation of Debt 1099-DIV Dividends and Distributions 3800 General Business Credit. 225 334 523 525 536 542 544 551 908 982 1099-C 1099-DIV 3800. Common Situations Covered in This

Get Insolvency Worksheet Canceled Debts - US Legal Forms Turn on the Wizard mode in the top toolbar to acquire extra recommendations. Complete every fillable field. Ensure the data you add to the Insolvency Worksheet Canceled Debts is up-to-date and correct. Include the date to the document using the Date tool. Select the Sign tool and make an electronic signature.

Publication 523 (2021), Selling Your Home | Internal Revenue Service Report as ordinary income on Form 1040, 1040-SR, or 1040-NR applicable canceled or forgiven mortgage debt. If you went through a mortgage workout, foreclosure, or other process in which a lender forgave or canceled mortgage debt on your home, then you must generally report the amount of forgiven or canceled debt as income on your tax return.

Knowledge Base Solution - How do I enter a cancellation of debt in a ... If the cancellation of debt should be reported as a Gain, enter information the appropriate D-Series Interview form (D-1/D-1A for capital transactions or D-2 for 4797 gains/losses). Click here if you need to fill out the Form 982 - Reduction of Tax Attributes Due to Discharge of Indebtedness. Click her to see this solution using worksheet view.

Knowledge Base Solution - How do I enter cancellation of debt in ... - CCH There is not a specific IRS 1099-C input form to fill in. Instead, depending how the cancellation of debt is to be treated, there are a few methods to get this to flow correctly to your return. Method 1: To have the amounts from the IRS 1099-C flow to the 1040 line 21 as other income.

PDF Cancellation of debt - Center for Agricultural Law and Taxation 5/26/2016 4 Foreclosure Worksheet #1 Figuring Cancellation of Debt Income The amount on line 3 will generally equal the amount shown in box 2 of Form 1099‐C. This amount is taxable unless you meet one of the exceptions Enter it on line 21, Other Income, of your Form 1040 Foreclosure Worksheet # 2 Figuring Gain from Foreclosure

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Report as ordinary income on Form 1040, 1040-SR, or 1040-NR applicable canceled or forgiven mortgage debt. If you went through a mortgage workout, foreclosure, or other process in which a lender forgave or canceled mortgage debt on your home, then you must generally report the amount of forgiven or canceled debt as income on your tax return.

Course Help Online - Have your academic paper written by a … 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

PDF Cancellation of Debt Insolvency Worksheet - RH Tax Services Cancellation of Debt -Insolvency Worksheet. Taxpayer(s): SSN: Tax Year: Date of Cancellation: Total Cancelled Debt A $. Assets as of the day before the debt was cancelled. Cash - checking accounts Cash - savings accounts Certificates of deposit Fair Market Value of stocks, bonds, mutual funds Notes and contracts receivable Life insurance (cash surrender value) Personal property (art, jewelry, furniture, boats, snowmobiles, computers, etc.) ...

› pub › irs-pdfAbandonments and Repossessions, Canceled Debts, - IRS tax forms debt that is canceled, forgiven, or discharged for less than the full amount of the debt as "can-celed debt." Sometimes a debt, or part of a debt, that you don't have to pay isn't considered canceled debt. These exceptions are discussed later un-der Exceptions. Sometimes a canceled debt may be exclu-ded from your income. But if you do exclude

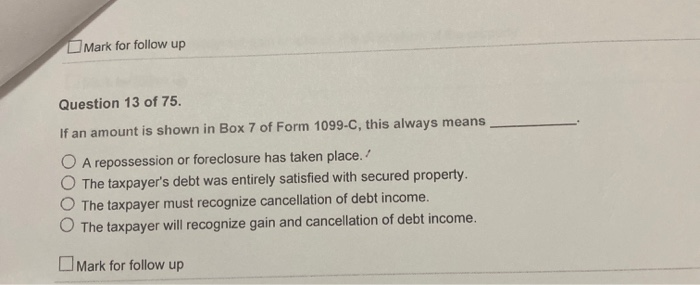

Topic No. 431 Canceled Debt – Is It Taxable or Not? In general, you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return as "other income" if the debt is a nonbusiness debt, or on an applicable schedule ...

Knowledge Base Solution - How do I report Cancellation of debt ... - CCH Due to this, Form 1099-C for cancellation of debt is not currently in the TaxWise system. We recommend that the preparer visit the IRS website and research when and how to report cancellation of debt based on each taxpayer situation. Generally, data from a Form 1099-C, Cancelled debt (box 2) is reported on Form 1040, line 21 for 2017 and prior.

Screen 1099C - Cancellation of Debt, Abandonment (1040) Completion of Form 1099-C Facsimile and Cancellation of Debt data entry sections will produce the Cancellation of Debt Worksheet. Completion of Form 1099-A Facsimile or Abandoned, Foreclosed, Repossessed Property data entry sections will produce the Foreclosure and Repossessions Worksheet.

Cancellation of Debt: What it Means to You - Financial Solution Advisors Second, the debt that was canceled may be excludable from taxable income to the extent that you are considered "insolvent" immediately prior to the cancellation of the debt. The Internal Revenue Service has provided an Insolvency Worksheet to assist taxpayers in determining whether they are considered insolvent.

NOW on PBS | PBS Appearance. Adjust the colors to reduce glare and give your eyes a break.

› taxtopics › tc431Topic No. 431 Canceled Debt – Is It Taxable or Not? In general, you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return as "other income" if the debt is a nonbusiness debt, or on an applicable schedule ...

Instructions for Form 982 (12/2021) | Internal Revenue Service If you made an election under section 108(i) to defer income from the discharge of business debt arising from the reacquisition of a debt instrument in 2009 or 2010, ... For details and a worksheet to help calculate insolvency, see Pub. 4681. Example. You were released from your obligation to pay your credit card debt in the amount of $5,000 ...

Screen 1099C - Cancellation of Debt, Abandonment (1040) Completion of Form 1099-C Facsimile and Cancellation of Debt data entry sections will produce the Cancellation of Debt Worksheet. Completion of Form 1099-A Facsimile or Abandoned, Foreclosed, Repossessed Property data entry sections will produce the Foreclosure and Repossessions Worksheet. General Information

› publications › p908Publication 908 (02/2022), Bankruptcy Tax Guide | Internal ... At the time of the debt cancellation, he was considered insolvent by $20,000. He can exclude from income the entire $10,000 debt cancellation because it was not more than the amount by which he was insolvent. Among Tom's assets, the only depreciable asset is a rental condominium with an adjusted basis of $50,000.

1040-US: Calculation of canceled debt to be included in income UltraTax CS produces a Cancellation of Debt Worksheet to show how the net amount of canceled debt included in income was calculated. The worksheet also reports the exception or exclusion to the canceled debt to be excluded from income. Canceled debt income is reported on the form or schedule selected in the Form/Schedule field in Screen 1099C. The following table lists where the amount is reported on the applicable form or schedule.

successessays.comSuccess Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

/1099-C-69a52b42698048d68609c2c79946530d.jpg)

0 Response to "40 cancellation of debt worksheet"

Post a Comment