40 self employment expenses worksheet

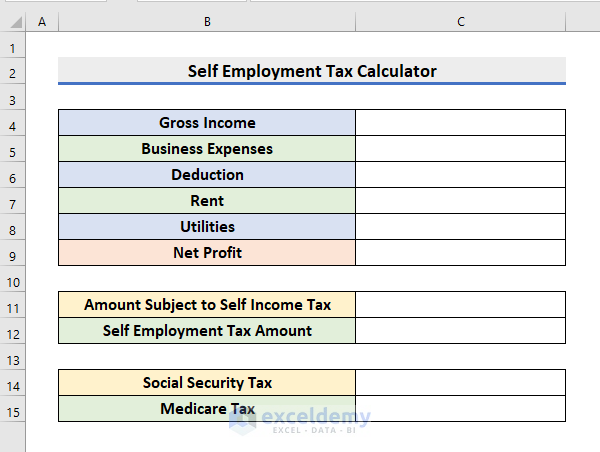

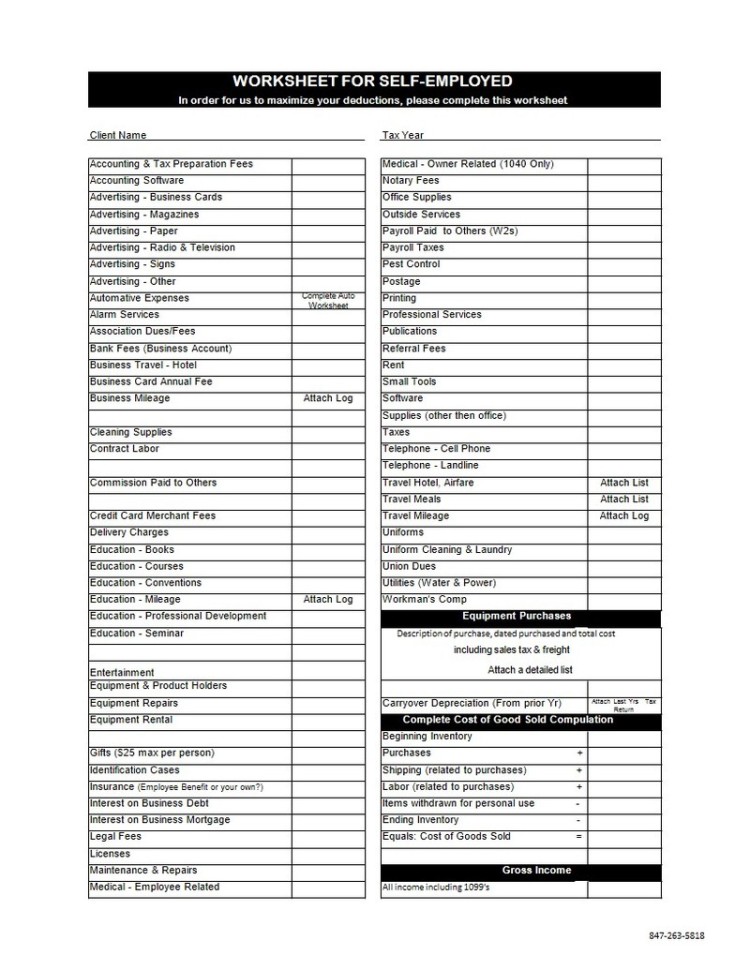

Self-Employment Tax Deductions (2021-2022): Worksheets, Tax Calculator ... Tax worksheet for self-employed, independent contractors, sole proprietors, single LLC LLC's & 1099-MISC with box 7 income listed. Clifford & Associates Deductions Worksheet (PDF) (Schedule C) self-employed business expenses worksheet for single member LLC and sole proprietors. 15 Tax Deductions and Benefits for the Self-Employed - Investopedia The self-employment tax refers to the Medicare and Social Security taxes that self-employed people must pay. This includes freelancers, independent contractors, and small-business owners. The...

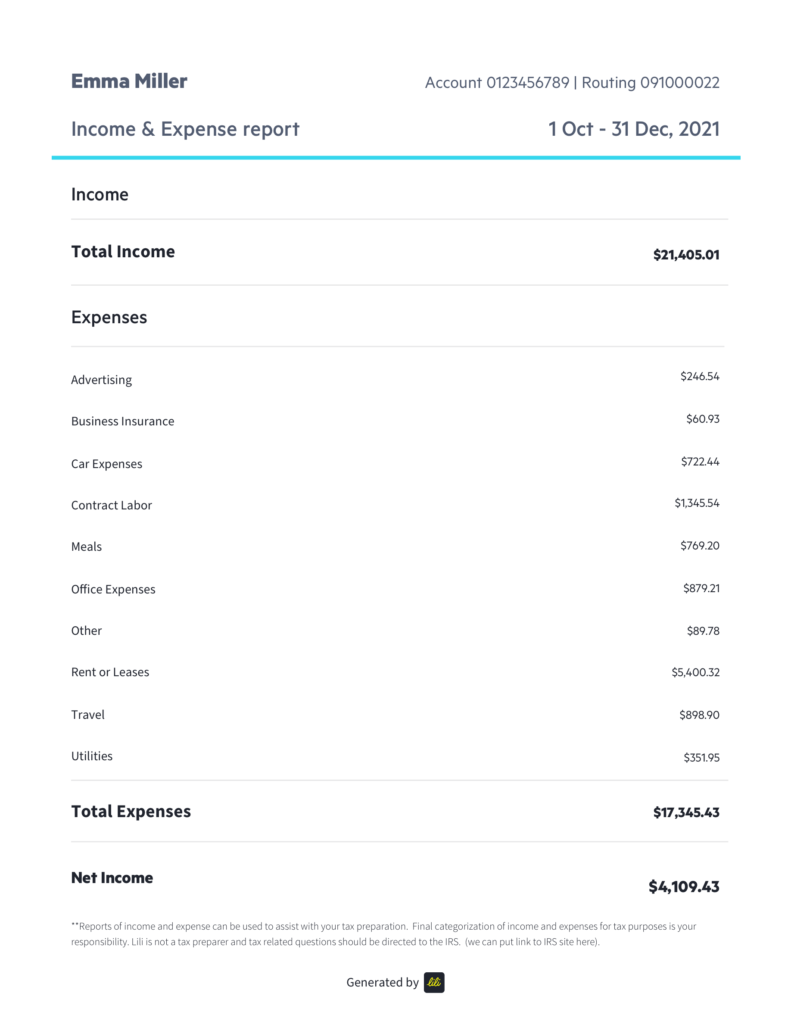

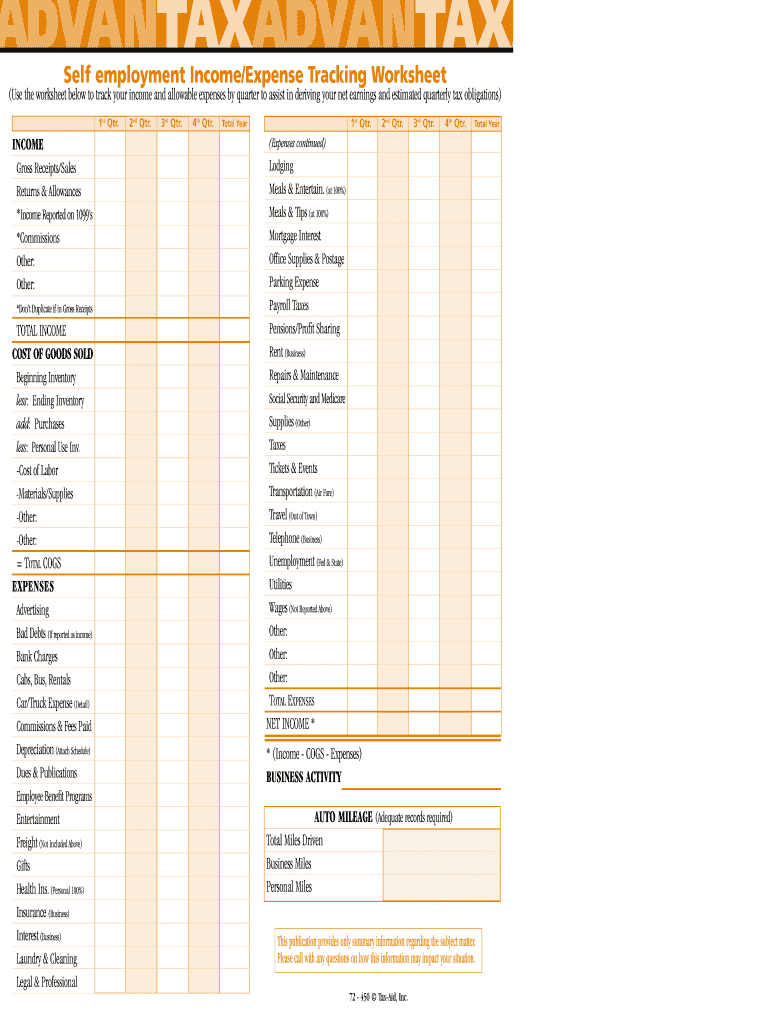

PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

Self employment expenses worksheet

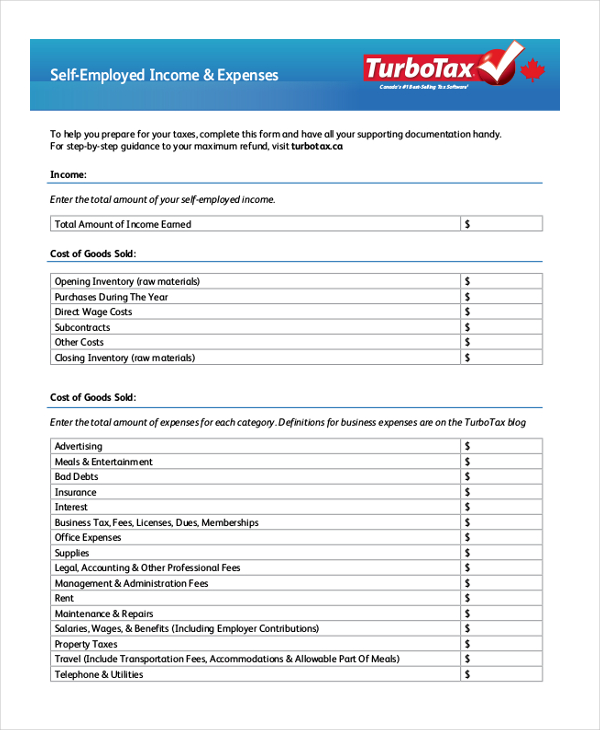

Self-Employment Tax: Everything You Need to Know - SmartAsset Jan 07, 2022 · This tax paid by self-employed individuals is known as the SECA, or more simply, the self-employment tax. Self-Employment Tax Calculation. The second portion of your self-employment tax funds Medicare. The rate for Medicare lands at 2.9%. Unlike with Social Security tax, the Medicare tax. Self-Employment Tax: Who Needs to Pay. As a rule, you ... Self Employed - VITA Resources for Volunteers Well, per IRS rules-- A self-employed individual is required to report all income and deduct all expense s. Revenue Ruling 56-407, 1956-2 C.B. 564, ... Rev. Rul. 56-407 held that under §1402 (a), every taxpayer (with the exception of certain farm operators) must claim all allowable deductions in computing net earnings from self-employment for ... Tracking your self-employed income and expenses Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

Self employment expenses worksheet. Publications and Forms for the Self-Employed Instructions for Schedule F (Form 1040 or 1040-SR), Profit or Loss from Farming PDF Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Instructions for Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Schedule K-1 (Form 1065), Partner's Share of Income, Credits, Deductions, etc. PDF Topic No. 554 Self-Employment Tax | Internal Revenue Service May 19, 2022 · Reporting Self-Employment Tax. Compute self-employment tax on Schedule SE (Form 1040). When figuring your adjusted gross income on Form 1040 or Form 1040-SR, you can deduct one-half of the self-employment tax. You calculate this deduction on Schedule SE (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF). PDF Self-employment Income and Expense Worksheet All expenses should be totaled from actual receipts that can be presented to the CRA in the event of an audit. Need more info? Call or email us, or visit our website at lorennancke.com. Title: Microsoft Word - Worksheet - Self employment income and expenses 2017 (brand typeface).docx Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The ... A self-employed borrower's share of Partnership or S Corporation earnings can only be considered if the lender obtains ... expense associated with nonrecurring casualty loss.- Line 8f - Mortgage or Notes Payable in Less ...

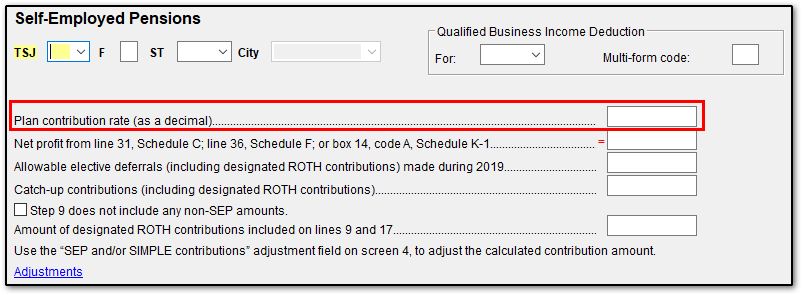

Publication 560 (2021), Retirement Plans for Small Business To do this, use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed, whichever is appropriate for your plan's contribution rate, in chapter 5. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 5. Dpss Self Employed Income Worksheets - K12 Workbook Dpss Self Employed Income Displaying all worksheets related to - Dpss Self Employed Income. Worksheets are Calfresh work and forms, Income and expenses report form, What is welfare to work why is it important for you to be, 2016 2017 verification work dependent, Base pay only bonusovertime income bonusovertime income, Class purpose, Pa1663 sg 8 18. 1099 Taxes Calculator | Estimate Your Self-Employment Taxes You’ll file a 1040 or 1040 SR to report your Social Security and Medicare taxes. Filing quarterly taxes: First, calculate your adjusted gross income from self-employment for the year. (The more deductions you find, the less you’ll have to pay!) Use the IRS’s Form 1040-ES as a worksheet to determine your estimated tax payments. Employment Expense Worksheet - C & V Income Tax Services Employment Expense Worksheet - C & V Income Tax Services Employment Expense worksheet Would you prefer to print this form? You can download and fill out our print-ready PDF version Download PDF Version Name * Email * Phone * Social Insurance Number * T2200 Completed from Employer Attached Yes No If Yes Upload T2200

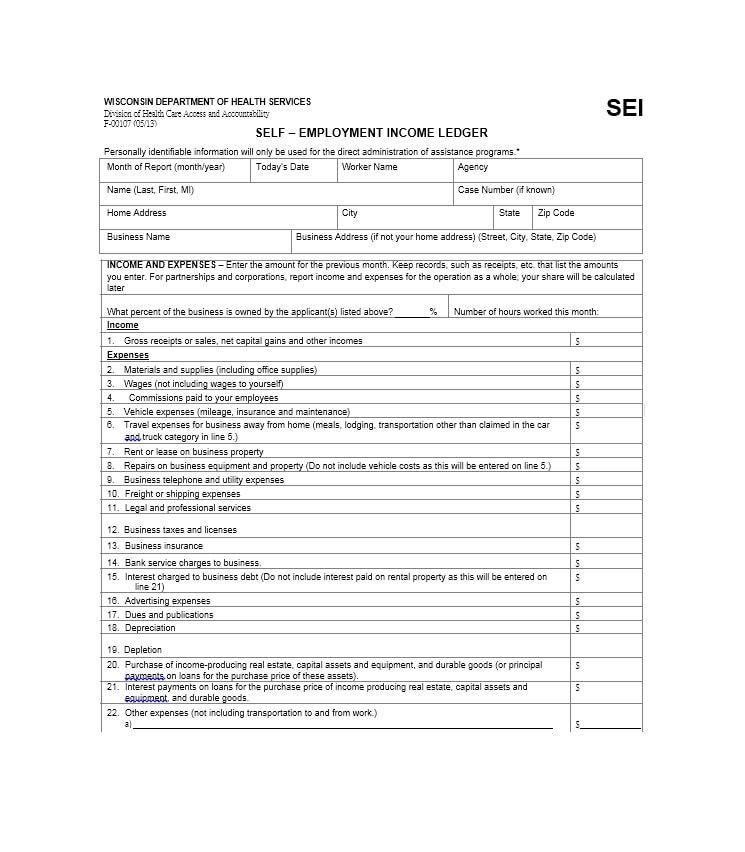

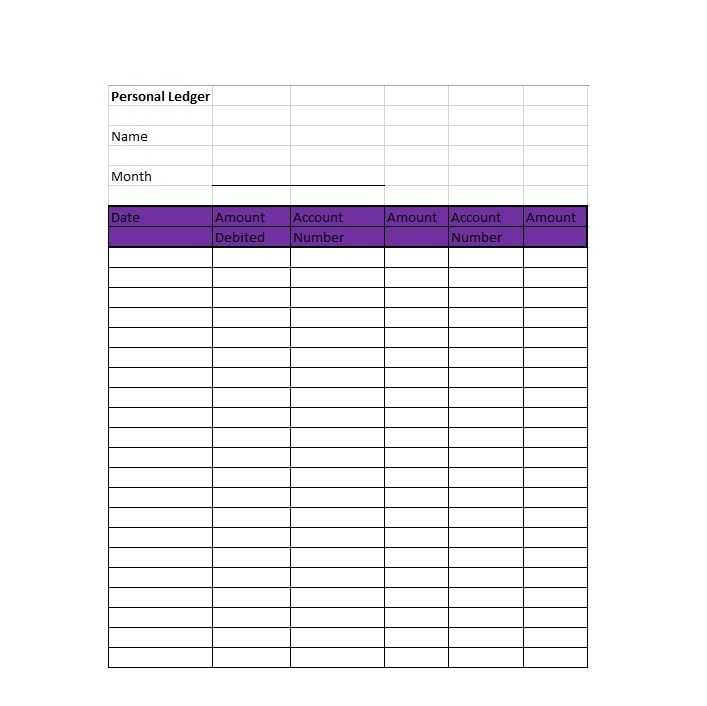

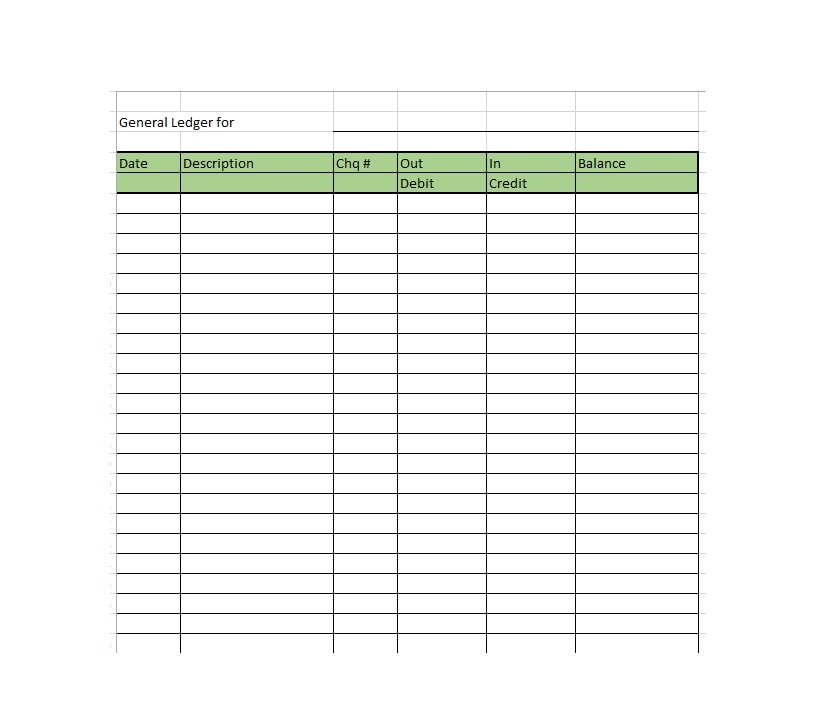

Self-Employment Ledger: 40 FREE Templates & Examples - TemplateArchive self employment ledger template 12 (82 KB) Self-employment contracts Privileges gained by individuals who are employed have a massive difference compared to those gained by individuals who are self-employed. One main difference is that a self-employed individual is accountable for his or her own tax and national insurance deductions. PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... 15 Self-Employment Tax Deductions in 2022 - NerdWallet The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income... PDF SE Income Worksheet Self-Employment Income Worksheet For Agency Use Only: Dear [Primary Applicant Name], You told us that you or someone in your household is self-employed. We need more information from you to process your application. We need proof of your self-employment income. Please fill out the attached worksheet, sign it, and return it to us by the due date.

Form H1049, Client's Statement of Self-Employment Income The worker must document verification or computations on Page 3 of Form H1049 or on the Food Stamp or TANF Worksheet. Section I — Calculate annual or seasonal self-employment income. Document the projection period in Section IV. Section II — Calculate all other self-employment frequencies except annual or seasonal.

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai After all, a self-employed taxpayer will owe 15.3% on their earnings from self-employment or Social Security and Medicare taxes. After you calculate your net earnings from self-employment, multiply it by the self-employed tax rate and you'll see how much you'll owe Uncle Sam. If you are concerned with how much you'll owe, don't worry.

PDF Self Employment Income Worksheet - Kcr - Personal (non-business) Work-Related Expenses INCOME: 1. Gross Business Revenue - Depreciation, Depletion, and Amortization (for medical plans established under this business) 8. Professional Fees 9. Office Supplies 10. Equipment 4. Cost of Goods Sold 5. Advertising 6. Business Insurance, Licenses, and Permits 7. Medical Insurance Premiums

Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan. This also includes your spouse's plan.

Self Employment - Government of Nova Scotia If you are interested in this program, the first step is visit a Nova Scotia Works Employment Services Centre in your local area who will advise you on your options and help you with your Self-Employment application process. Forms. Self-Employment Worksheet; Forms for Self-Employment Providers. SE Entrepreneurial Needs Assessment

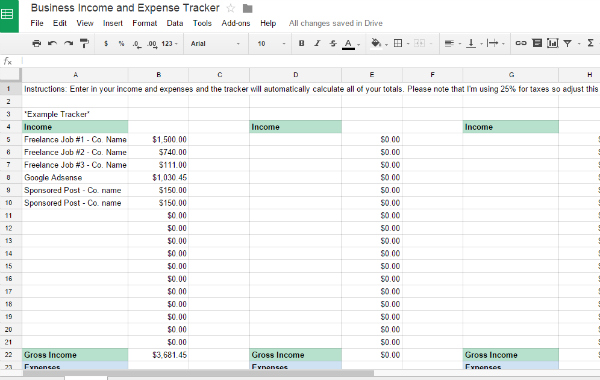

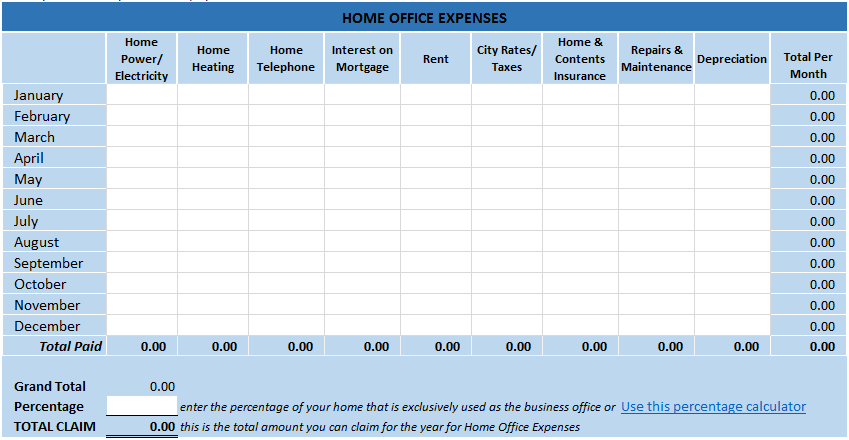

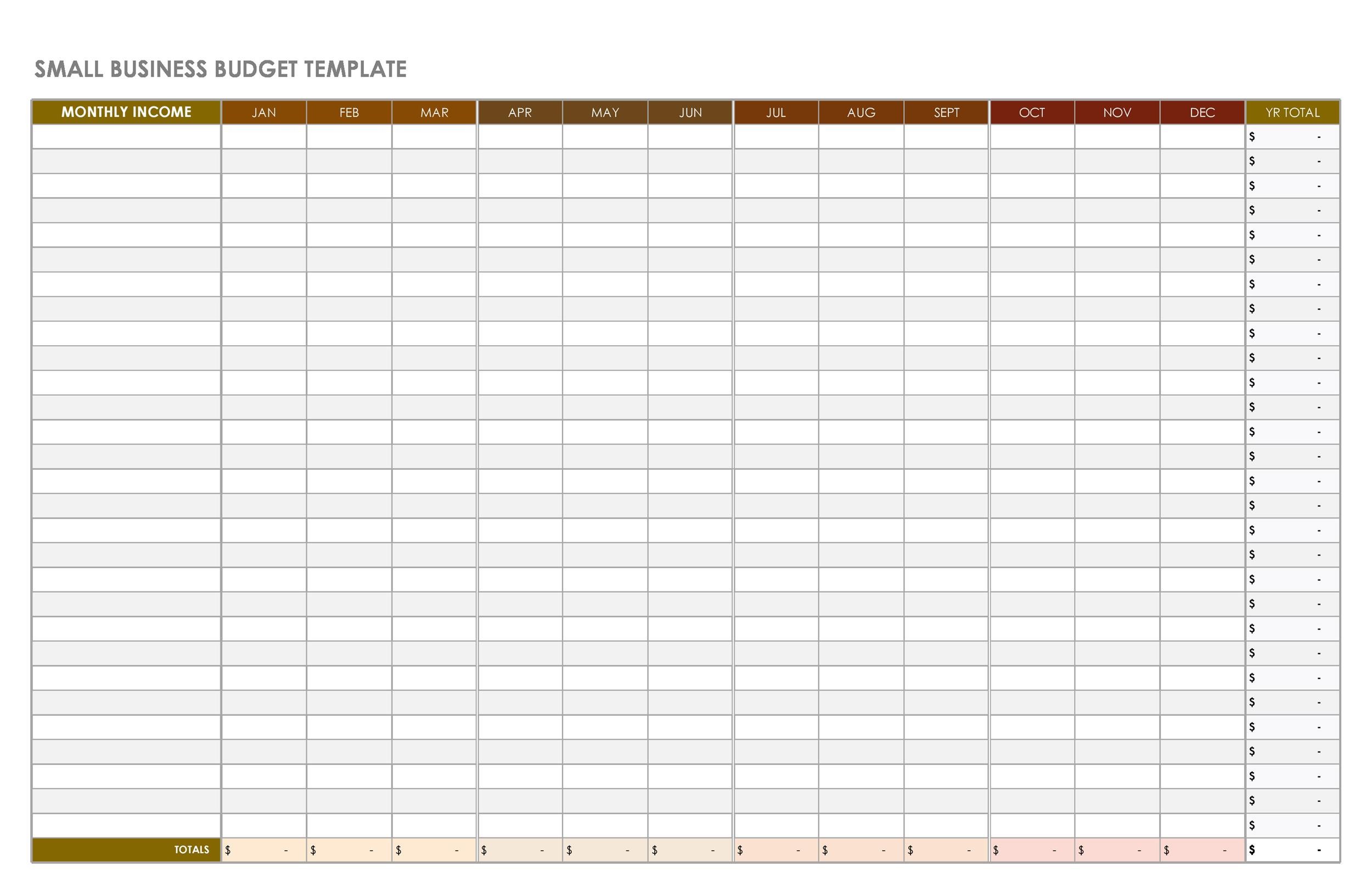

Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

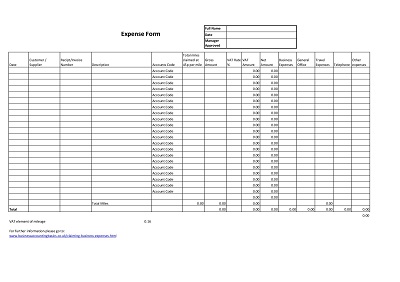

PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. ... Employee Benefits such as health insurance, not pension $_____ Equipment, software, computers, tools less than $500,000 $_____ Insurance: Business & liability, not health. ...

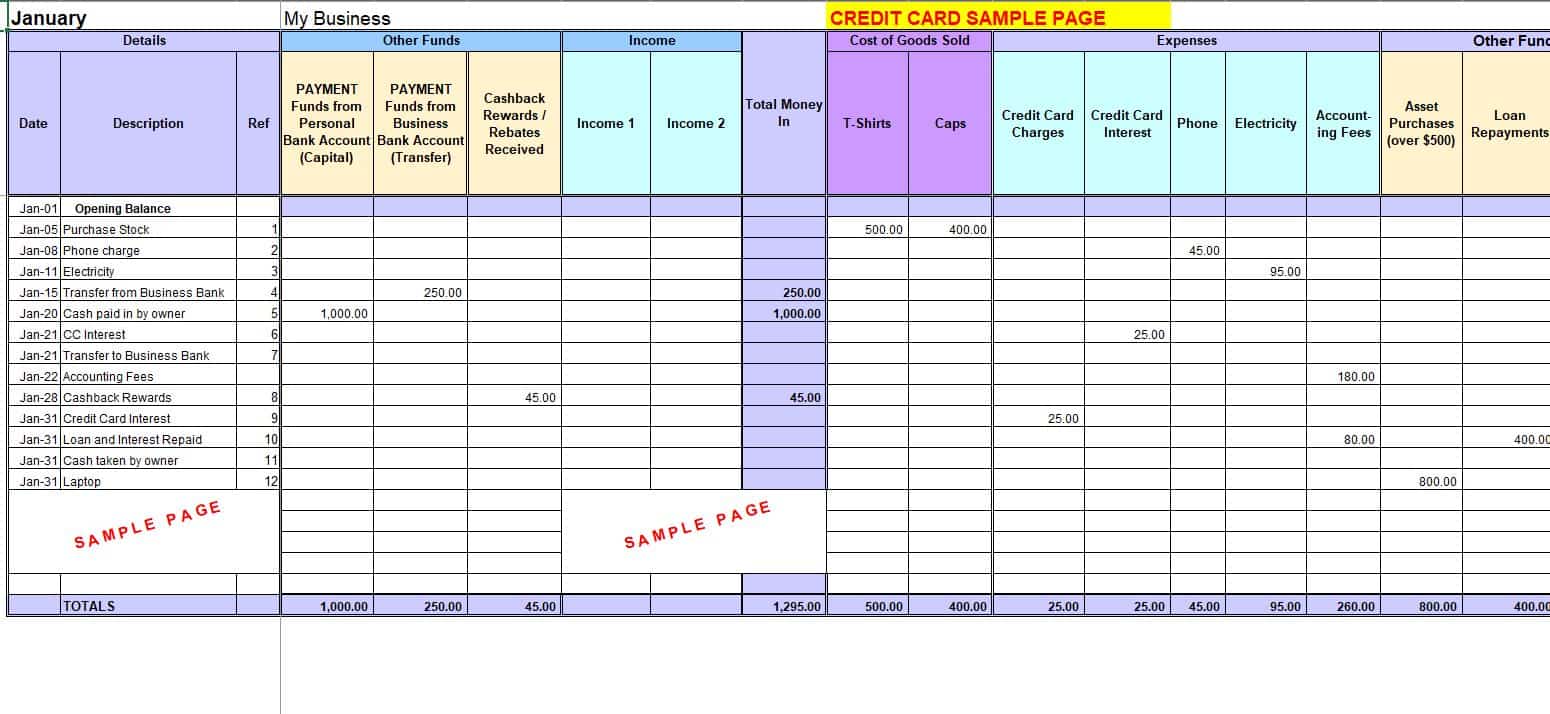

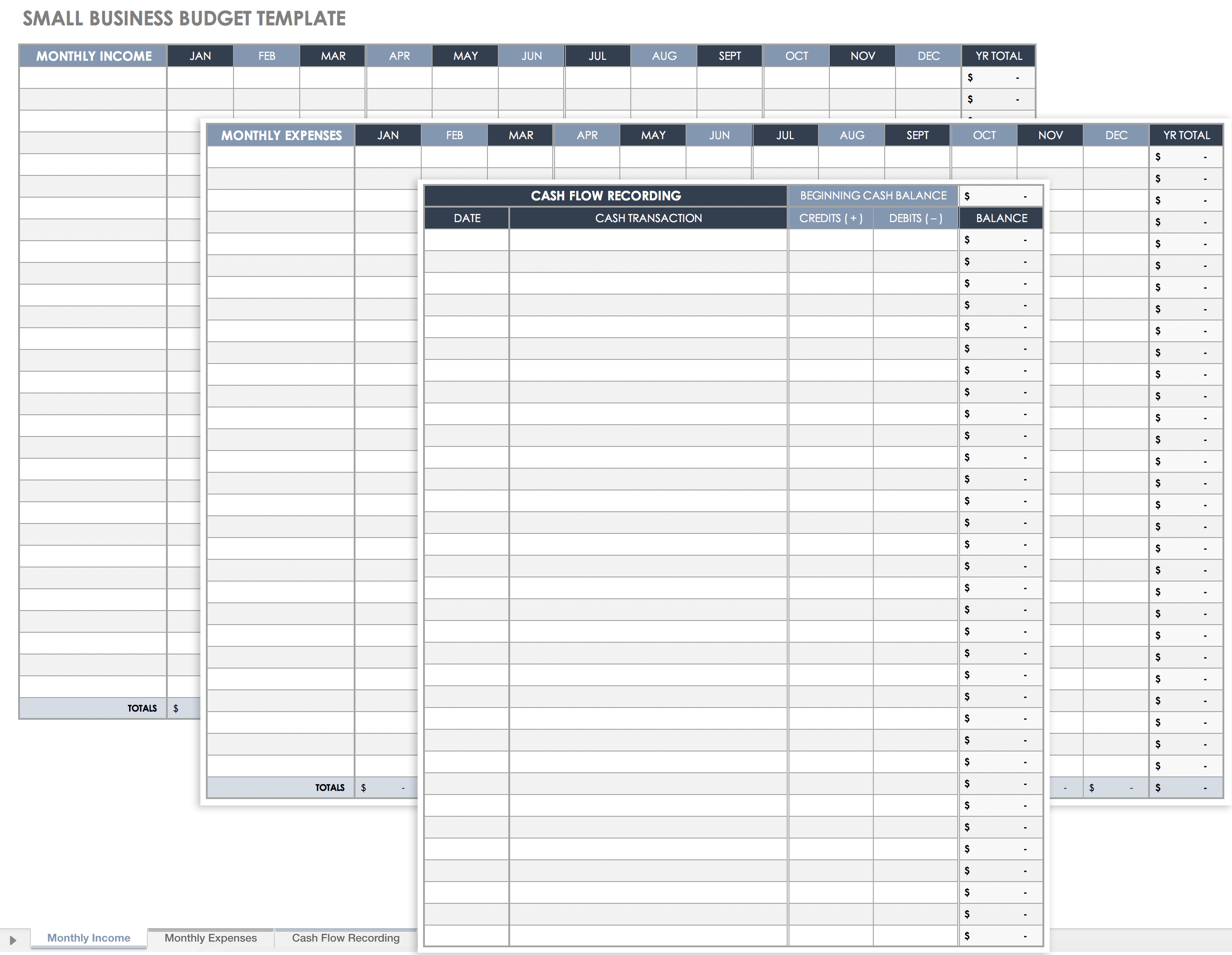

Free Expense Tracking Worksheet Templates (Excel) Expense Tracking Sheet This template is perfect for both personal use, as well as small business use. It comes with two sheets. The first sheet is dedicated to tracking your expenses in various categories throughout weeks, months or years. The second sheet is a streamlined summary chart of your budget vs. the money you spent in this time period.

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

12+ Business Expenses Worksheet Templates in PDF | DOC Self-Employed Business Expenses Worksheet. polarengraving.com. Details. File Format. PDF; Size: 12.5 KB. Download. The business and the self-employed business expenditure are the worksheets that the business organization either might be the expenses or the expenditure in the business should also be maintained and taken care of. The business ...

PDF FHA Self-Employment Income Calculation Worksheet Job Aid the worksheet is also being used for any other type of self -employment (ex. Schedule C). a. W-2 Income from Self -Employment Input the gross earnings directly from the borrower's W-2 issued by the business being evaluated. (Form 1040 > Line 1) b. Subtotal The W-2 income will be reiterated as a subtotal for the purpose of future calculation.

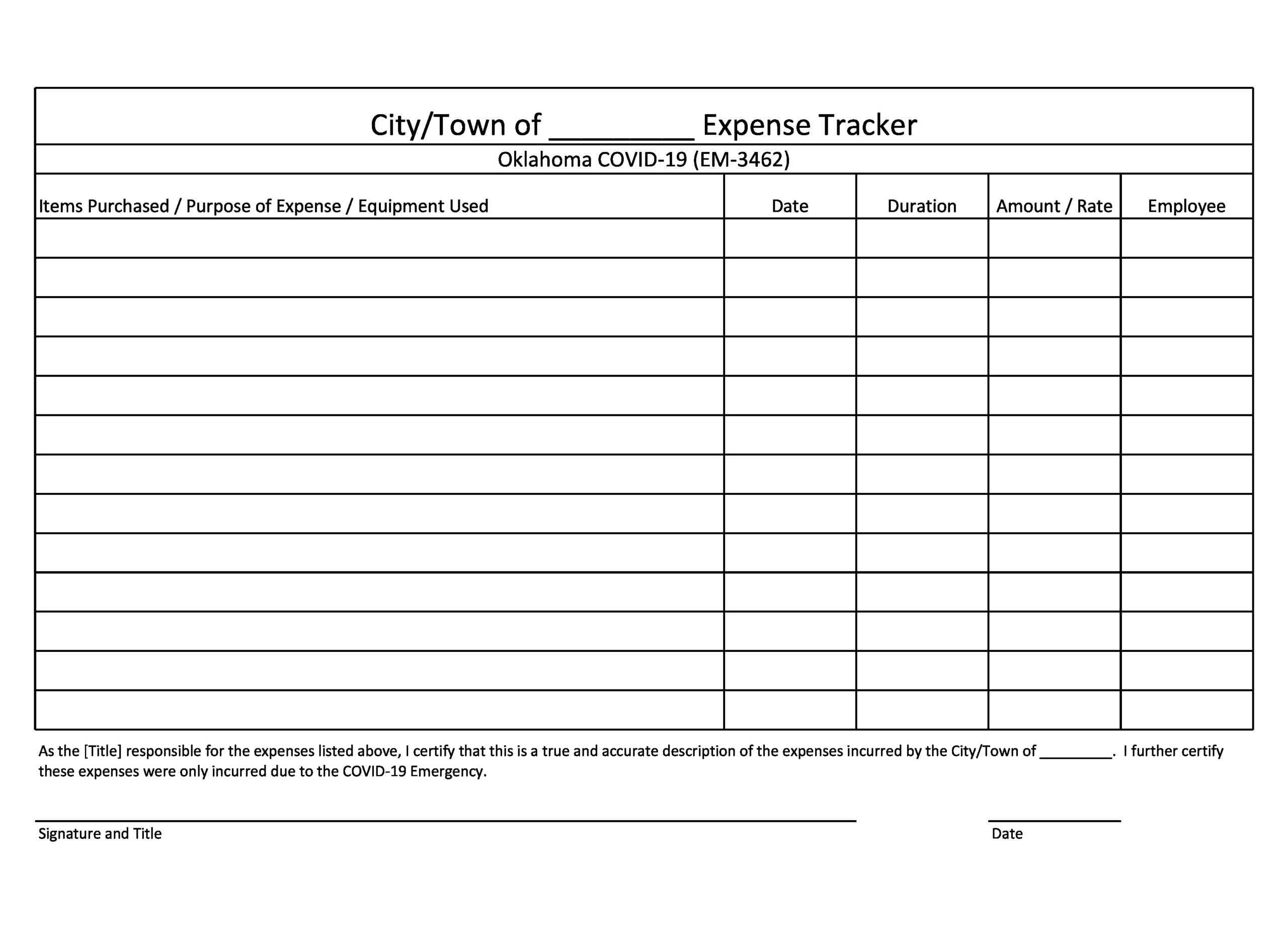

PDF Self Employment Monthly Sales and Expense Worksheet - Washington SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) 3. Expenses List your business expenses for the month. See instruction on page 1 for information on business expenses and what we do not count as a business expense. List additional expenses on a separate sheet of paper if needed. DATE PAID TO EXPENSE TYPE

How self-employment income is counted and what business expenses can be ... Self-employment income is calculated by taking the gross earned income from self-employment and deducting either the actual costs of self-employment or 40 percent of the gross earned income from self-employment. [MPP § 63-503.413 .] The recipient chooses whether to deduct actual costs or 40 percent of gross earned income. [Id.]

PDF Schedule C Worksheet for Self Employed Businesses and/or ... - Kristels Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... Open your spreadsheet or worksheet application. Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Once you do that, click on the "Available Templates" option and choose "Blank Workbook". You can include both your income and expense spreadsheets in the same workbook.

PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $

Tracking your self-employed income and expenses Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

Self Employed - VITA Resources for Volunteers Well, per IRS rules-- A self-employed individual is required to report all income and deduct all expense s. Revenue Ruling 56-407, 1956-2 C.B. 564, ... Rev. Rul. 56-407 held that under §1402 (a), every taxpayer (with the exception of certain farm operators) must claim all allowable deductions in computing net earnings from self-employment for ...

Self-Employment Tax: Everything You Need to Know - SmartAsset Jan 07, 2022 · This tax paid by self-employed individuals is known as the SECA, or more simply, the self-employment tax. Self-Employment Tax Calculation. The second portion of your self-employment tax funds Medicare. The rate for Medicare lands at 2.9%. Unlike with Social Security tax, the Medicare tax. Self-Employment Tax: Who Needs to Pay. As a rule, you ...

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/623904ff7e759b4bc31836a2_all-business-expenses-tab.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

0 Response to "40 self employment expenses worksheet"

Post a Comment