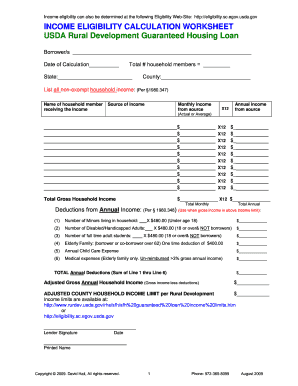

40 usda income calculation worksheet

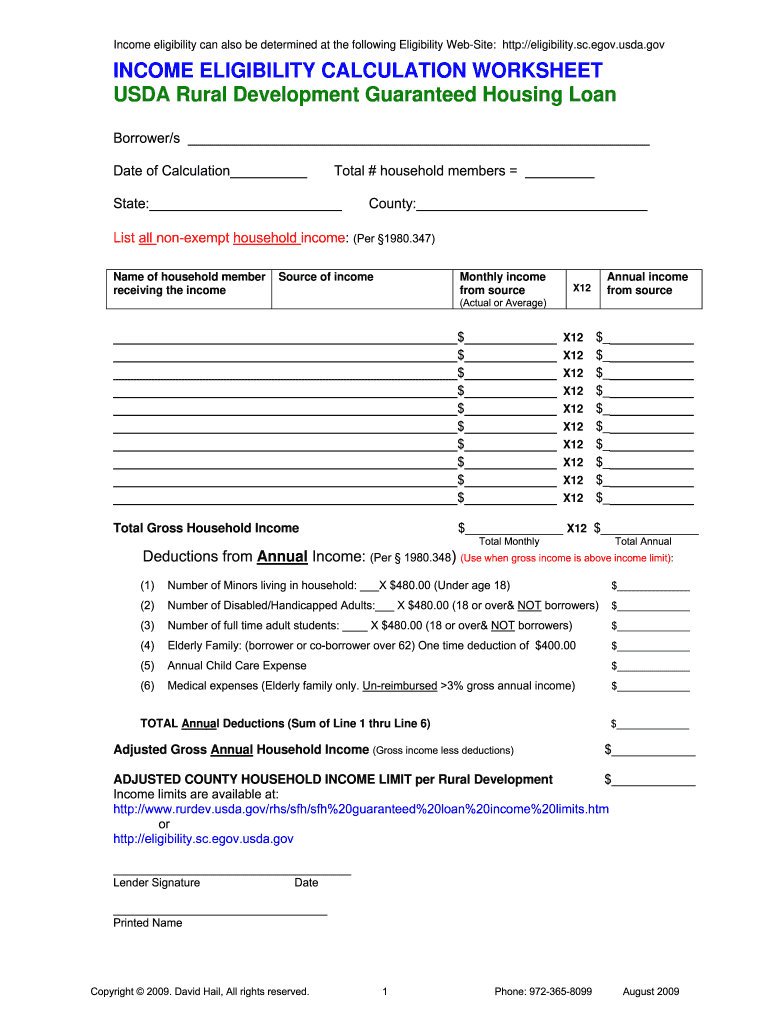

PDF CHAPTER 9: INCOME ANALYSIS - USDA Rural Development verifications. Documentation of income calculations should be provided on Attachment 9-B, or the Uniform Transmittal Summary, (FNMA FORM 1008/FREDDIE MAC FORM 1077), or equivalent. Attachment 9-C provides a case study to illustrate how to properly complete the income worksheet. A public website is available to assist in the SFH Section 502 GLP Eligibility Check Worksheet - USDA Monthly income would be $10*40*52=$20,800/year. The yearly income of $20,800 divided by 12 months=$1,733/month. Overtime Income. Overtime income is income that is more than the base wages. Overtime for Rural Development eligibility purposes should be verifiable and dependable.

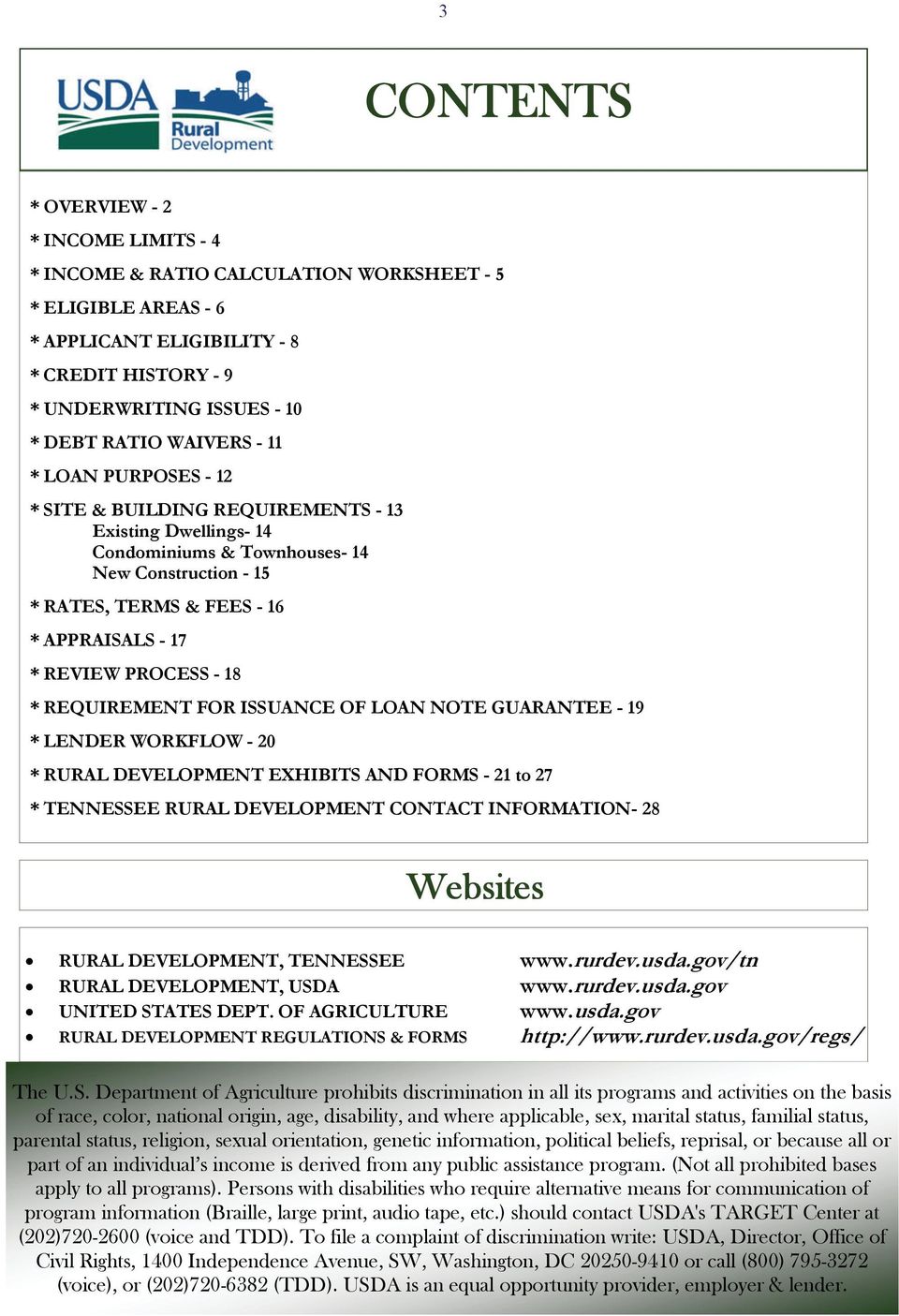

SFH Section 502 GLP Eligibility Check Worksheet - USDA If you are an applicant or an individual interested in learning more about the Single Family Housing Guaranteed Loan Program, please visit our guaranteed housing webpage for further program information and guidance. If you are interested in applying for a guaranteed loan, or have more specific questions not answered by the website, please reach out to any of the program's approved lenders ...

Usda income calculation worksheet

USDA Loan Payment Calculator: Calculate Loan ... - Mortgage Calculator Income Limits. To obtain a USDA loan, you must fall under the required income limit for moderate income. Moderate income is defined as the greater of 115% of the U.S median family income, 115% of the state-wide and state non-metro median family incomes, or 115/80ths of the area low-income limit. Get Usda Income Calculation Worksheet - US Legal Forms Be sure the info you fill in Usda Income Calculation Worksheet is updated and accurate. Indicate the date to the template using the Date tool. Click on the Sign tool and make an e-signature. You can use three available options; typing, drawing, or capturing one. Make sure that each and every field has been filled in correctly. PDF Processing USDA Loans in Encompass - ICE Mortgage Technology Much of the information on the Income Worksheet is populated from information previously entered on pages 2 and 6 of the Rural Assistance URLA tab. 1 Click an Edit icon to edit the value in a field. 2 In the Annual Income Calculation and Adjusted Income Calculation sections, use the Calculate and Record fields to enter the values and formulas ...

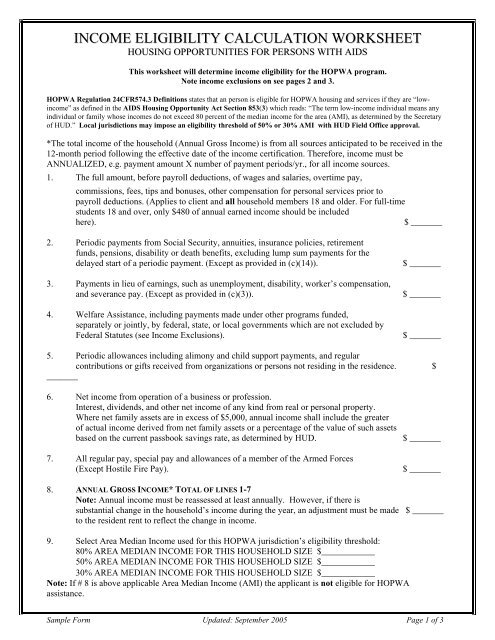

Usda income calculation worksheet. Usda Income Calculation Worksheet - Fill Online, Printable, Fillable ... Instructions and Help about fillable usda income worksheet form. Hi and welcome to loan officer school this is your how to calculate income training session once again I'm Sherman Lane please call me Star because the toilet paper jokes got old by the third grade and done you can always reach me at Charmin out loan officer school comm, and you ... Emergency Relief Program - Farm Service Agency Emergency Relief. To help agricultural producers offset the impacts of natural disasters in 2020 and 2021, Congress included emergency relief funding in the Extending Government Funding and Delivering Emergency Assistance Act (P.L. 117-43). This law targets at least $750 million for livestock producers impacted by drought or wildfires. PDF Understanding your Project Worksheet Printout - USDA PCT of Income (Percent of Income) The percentage of the tenant's adjusted annual income that the tenant uses to cover rent. Tenants already receiving assistance are set to 30 percent. Income Type V - Very Low; L - Low; M - Moderate; A - Above-Moderate Adj Annual Income (Adjusted Annual Income) The tenant's adjusted annual income. PDF Chapter 9: Income Analysis - Usda B. Projecting Annual Income for a 12-Month Period The calculation of annual income is used to determine an applicant's eligibility for the SFHGLP. Income received by the applicant and all adult members of the household is considered in the calculation of annual income. Annual income is the first step in determining program eligible income.

Eligibility To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link. When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. To assess ... PDF USDA Rural Development HOUSEHOLD MEMBER, INCOME and ASSET ... - maibroker LHFS-USDA Household Income7.29.2016 Page 2 of 2 INCOME FROM ASSETS In addition, USDA Rural Development requires that "net family assets" (that amount remaining after loan closing) with a cumulative total of greater than $5,000 must be considered in the "annual income" calculation. PDF Exh 02-091 Worksheet for Documenting Income Exh 02-091 USDA Worksheet for Calc Income Rev. 5-1-13 ADJUSTED INCOME CALCULATION (Consider qualifying deductions as described in §1980.348 of RD Instruction 1980-D) 7. Dependent Deduction ($480 for each child under age 18, or full-time student attending school or disabled family member over the age of 18) - #_________ x $480 8. Income Analysis Worksheet | Essent Guaranty Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. ... Calculate the monthly qualifying income for a borrower who is a sole proprietor. Download Worksheet (PDF) Download Calculator (Excel) Essent Cash Flow Analysis — SAM Method .

2018. 10. 1. - qedvt.formaparent.fr 2018. 10. 1. · Income Calculation Worksheet For Mortgage pdfsdocuments2 e 54 excel fannie mae income calculatio PDF fileExcel Fannie Mae Income Calculat. Example #1. Supp+ose we have taken a home loan for $2,00000 for 10 years at a 6% interest rate. Let's make a table in Excel as below. Now to calculate the monthly payment, we will input all the data points in the function as below: In cell ... PDF Guaranteed Rural Housing Origination Stacking Order Checklist - USDA Income Calculation: Worksheet For Calculating Income - Attachment A FEMA Form 81-93, "Standard Flood Determination Form" Note: Properties located in flood plains will require additional documentation. Confirmation the base flood elevation (BFE) is below lowest habitable floor of subject. Tools | NRCS - USDA Tools. These NRCS Economic Tools are organized by landuse and type of conservation planning analysis. Please contact any of the NRCS State Economists or Center Economists if you have questions on their usage. Handbooks. Economic Case Studies. General Conservation Planning. . NRCS current State Payment Schedules and Conservation Practice Scenarios. PDF HB-1-3555 CHAPTER 9: INCOME ANALYSIS - USDA Rural Development month timeframe. Form RD 3555-21 Income Calculation Worksheet must state: the income source, the number of months receipt remaining for the ensuing 12- month timeframe, and the total amount to be received. The calculation of annual income should be logical based on the history of income and documentation provided.

XLSX Franklin American Mortgage Company | Home Click the buttons below to be taken directly each calculator. Income Calculators WHOLESALE LENDING Wage Earner (W-2) Income Calculation Worksheet Conventional Self-Employment Income Calculation Worksheet FHA Self-Employment Income Calculation Worksheet Conventional REO Net Rental Income/Loss Calculation Worksheet

PDF AGI Pamphlet - Farm Service Agency To file a complaint of discrimination, write USDA, Director, Office of Civil Rights, Room 326-W, Whitten Building, 1400 Independence Avenue, SW, Washington, DC 20250-9410 or call (202) 720-5964 (voice and TDD). USDA is an equal opportunity provider and employer. the FSA web site ( ). Frequently Asked Questions (Continued) 5.

PDF AN Attachment A WORKSHEET FOR DOCUMENTING ELIGIBLE HOUSEHOLD AND ... - USDA Attachment A Page 2 of 3 Rev 1/2013 Applicant(s): ADJUSTED INCOME CALCULATION (Consider qualifying deductions as described in §1980.348 of RD Instruction 1980-D) 7. Dependent Deduction ($480 for each child under age 18, or full-time student attendi ng school or disabled family member over the age of 18) - #_____ x $480 8. Annual Child Care Expenses (Reasonable expenses for children 12 and under).

USDA Mail all completed forms and any attachments to the address printed on the form. Page 3 Worksheet for Documenting Eligible Household and Repayment Income Page 4 - Adjusted Income Calculations Page 5 Monthly Repayment Income Calculation Page 6 Notice to Applicant Regarding Privacy Act Information Initials

PDF USDA Rental Income Worksheet Job Aid - Franklin American USDA RENTAL INCOME WORKSHEET JOB AID Wholesale Lending For calculations to be correct, enter the monthly amount (not the annual amount) for each of these fields. (16-18) 16. Taxes Enter the Property Tax amount for the REO as verified by documentation provided, not the tax return.

PDF Worksheet for Documenting Eligible Household and Repayment Income Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income

FHA Self-Employment Income Calculation Worksheet FHA Self-Employment Income Calculation Worksheet. Previous post: USDA REO Net Rental Income Loss worksheet. Next post: FHA Refinance Worksheets. Recent Posts. Guaranty Home Mortgage Announces New Mortgage Loan Originators; Guaranty Home Mortgage Donates to There With Care & Nashville Children's Alliance;

Certification of Compliance Worksheets: 5-Day Schedule - USDA Lunch Worksheets. Grades K-5. Grades K-8. Grades 6-8. Grades 9-12. 05/06/2022.

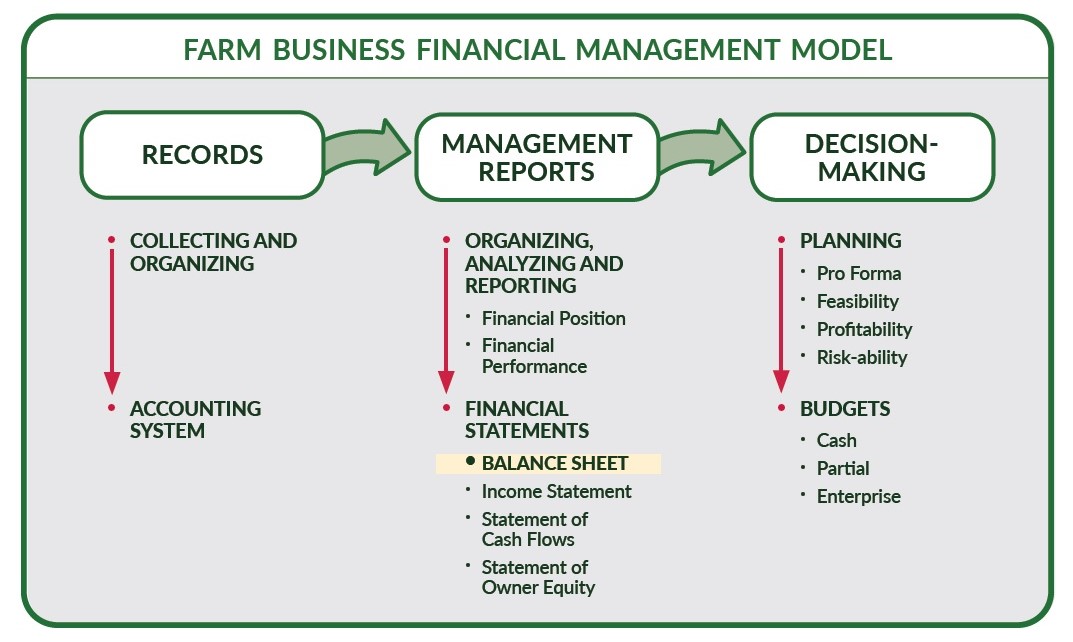

XLS Guaranteed Loan Worksheets - Farm Service Agency Divided by Gross Income = Operating Ratio The formula is +@PMT(Principal,Interest,Term). For example a $100000 loan amortized over 7 years at 10% would be entered as OTHER Net Income Divided by Total Assets = Profit to Assets 52 Ending Cash Balance

PDF Income Limits Worksheet to Figure Your Adjusted Family Income Please use this form to calculate your adjusted family income. DIRECT 504 REPAIR GRANTS AND LOANS ; INCOME LIMITS WORKSHEET TO FIGURE YOUR ADJUSTED FAMILY INCOME VERMONT Applicant's gross income per year (Current gross weekly income x 52) include annual overtime

PDF Single Family Housing Direct Programs Determining Annual, Adjusted, and ... For the Section 502 program,the Worksheet for Computing Income and Maximum Loan Amount Calculator (commonly known as the automated 4‐A) can be found on the program's Forms & Resources site; a link to the site is provided on the slide.

PDF Processing USDA Loans in Encompass - ICE Mortgage Technology Much of the information on the Income Worksheet is populated from information previously entered on pages 2 and 6 of the Rural Assistance URLA tab. 1 Click an Edit icon to edit the value in a field. 2 In the Annual Income Calculation and Adjusted Income Calculation sections, use the Calculate and Record fields to enter the values and formulas ...

Get Usda Income Calculation Worksheet - US Legal Forms Be sure the info you fill in Usda Income Calculation Worksheet is updated and accurate. Indicate the date to the template using the Date tool. Click on the Sign tool and make an e-signature. You can use three available options; typing, drawing, or capturing one. Make sure that each and every field has been filled in correctly.

USDA Loan Payment Calculator: Calculate Loan ... - Mortgage Calculator Income Limits. To obtain a USDA loan, you must fall under the required income limit for moderate income. Moderate income is defined as the greater of 115% of the U.S median family income, 115% of the state-wide and state non-metro median family incomes, or 115/80ths of the area low-income limit.

0 Response to "40 usda income calculation worksheet"

Post a Comment