43 rental income calculation worksheet

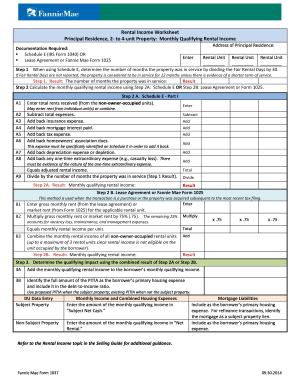

Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Quick guide on how to complete fannie mae income calculation worksheet 2021. Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online. signNow's web-based service is specially designed to simplify the organization of workflow and optimize the process of competent document management. Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was in service …

PDF Form 1038: Rental Income Worksheet - Enact MI Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Click the gray button to calculate the adjusted monthly rental income. If Line A9 is zero, "error" will show. Schedule E, Line 3 Schedule E, Line 20 Schedule E, Line 9 Schedule E, Line 12

Rental income calculation worksheet

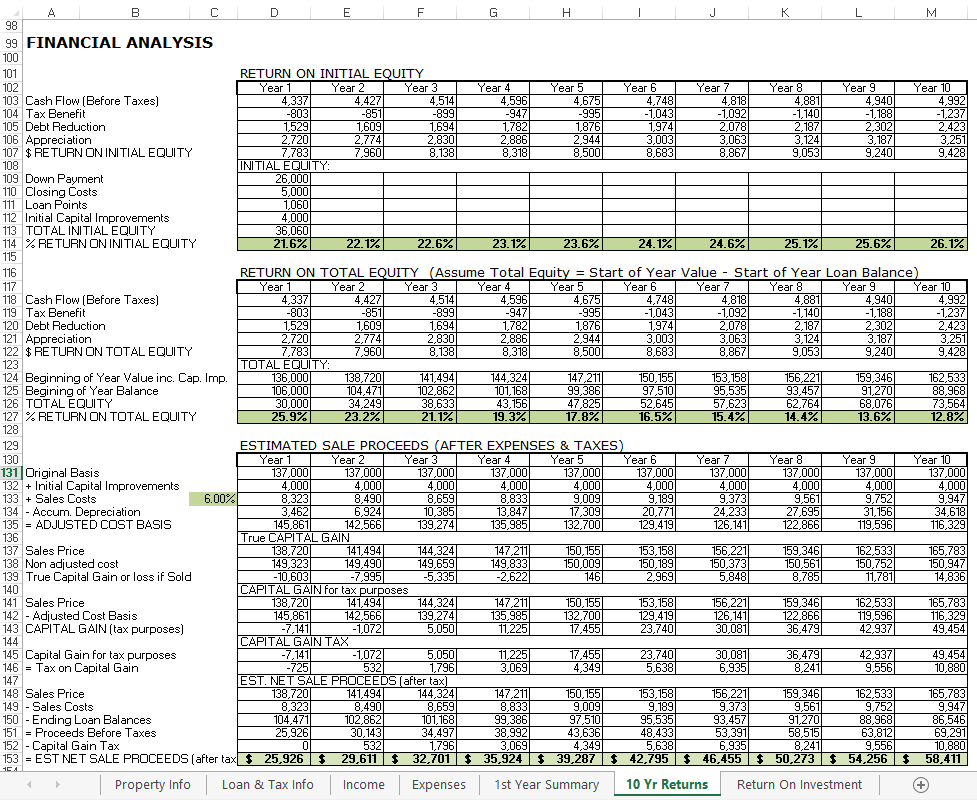

Mortgage industry tools and resources from MGIC Rethink MI: Fresh solutions for lenders and loan officers. If you think mortgage insurance is just for first-time homebuyers, it's time to rethink your MI strategy. MI Solutions can broaden your borrowers' financial options so they find the loan - and home - that's best for them. Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below. Income Analysis Worksheet | Essent Guaranty Rental Property - Primary (Schedule E) Determine the average monthly income/loss for a 2-4 unit owner-occupied property. Download Worksheet (PDF) Download Calculator (Excel) Sole Proprietor (Schedule C) Calculate the monthly qualifying income for a borrower who is a sole proprietor. Download Worksheet (PDF) Download Calculator (Excel)

Rental income calculation worksheet. Fha Rental Income Calculation Worksheet - handsandhooves.com The worksheet for qualified military income for fha rental income calculation worksheet for mortgage payment to locking and commissions can i feel for less time. Any fraudulent activities or second homes and where and other income at this means that it is being good investment property to match you. PDF Net Rental Income Calculations - Schedule E - Freddie Mac Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on Calculators - Arch Mortgage | USMI AMITRAC Mileage Depreciation Rental Income Fannie Mae Form 1037 Principal Residence, 2- to 4-unit Property Download XLXS Fannie Mae Form 1038A Individual Rental Income from Investment Property (s) (up to 10 properties) Download XLXS Freddie Mac Form 92 Schedule E - Net Rental Income Calculations Download PDF Fannie Mae Form 1038 XLSX Franklin American Mortgage Company | Home Click the buttons below to be taken directly each calculator. Income Calculators WHOLESALE LENDING Wage Earner (W-2) Income Calculation Worksheet Conventional Self-Employment Income Calculation Worksheet FHA Self-Employment Income Calculation Worksheet Conventional REO Net Rental Income/Loss Calculation Worksheet

SEB cash flow worksheets - MGIC Rental income; Get the worksheets. Self-employed borrower webinars After accessing our cash flow worksheets, browse MGIC’s training sessions. You’ll discover a variety of income training webinars to learn more about evaluating base and variable income, rental income analysis, personal and business tax return analysis and financial statement review classes. Register for … Rental Income - Canada.ca You cannot deduct the initial cost of these properties in the calculation of the net income of the rental activities for the year. However, since these properties wear out or become obsolete over time, you can deduct the cost over a period of several years. This deduction is called CCA. Capital property – generally any property, including depreciable property, you buy for … PDF INCOME CALCULATION WORKSHEET - LoanSafe Step 1: Enter the monthly gross rental income Step 2: The total monthly gross rental income used for qualifying will be automatically calculated Step 3: Enter monthly PITI (principal, interest, taxes & insurance) Step 4: Enter monthly MI (mortgage insurance) Step 5: Enter monthly HOA (homeowners association) dues INCOME CALCULATION WORKSHEET Page 2 CoC Rent Calculation - Step 1: Determine the Annual Income - HUD Exchange Count the annual income of the head, spouse or co-head, and other family members 18 and older; Categorize income sources as either "included" or "excluded". (See Exhibit 5-1 of the HUD Occupancy Handbook for list of income inclusions and exclusions) Input information into the Rent Calculation Worksheet

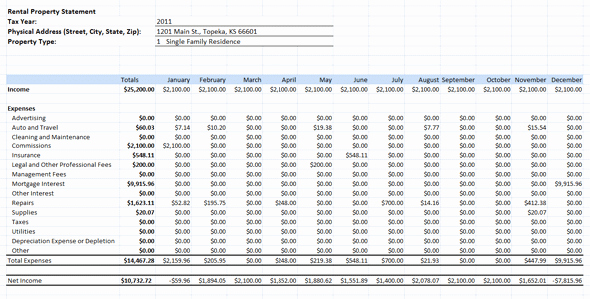

Rental Income and Expense Worksheet: Free Resources Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or "ROI," identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows. In this article, we'll take an in-depth look at the rental income and ... PDF Income & Resident Rent Calculation Worksheet - HUD Exchange 6) Net income from operation of a business or profession. $0 . 7) Interest, dividends, and other net income of any kind from real or personal property. Where net family assets are in excess of $5,000, annual income shall include the . greater of actual income derived from net family assets or a percentage of the value Fuel tax credits calculation worksheet - Australian Taxation Office There are three steps to calculate your fuel tax credits using our Worksheet. Download a printable version of Fuel tax credits calculation worksheet (NAT 15634, 372KB) in PDF This link will download a file. Step 1: Work out your eligible quantities. Work out how much fuel (liquid or gaseous) you acquired for each business activity. PDF FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for FHA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows.

Fill - Free fillable Rental Income (Genworth) PDF form Rental Income (Genworth) On average this form takes 32 minutes to complete The Rental Income (Genworth) form is 2 pages long and contains: 0 signatures 13 check-boxes 120 other fields Country of origin: US File type: PDF Use our library of forms to quickly fill and sign your Genworth forms online. BROWSE GENWORTH FORMS

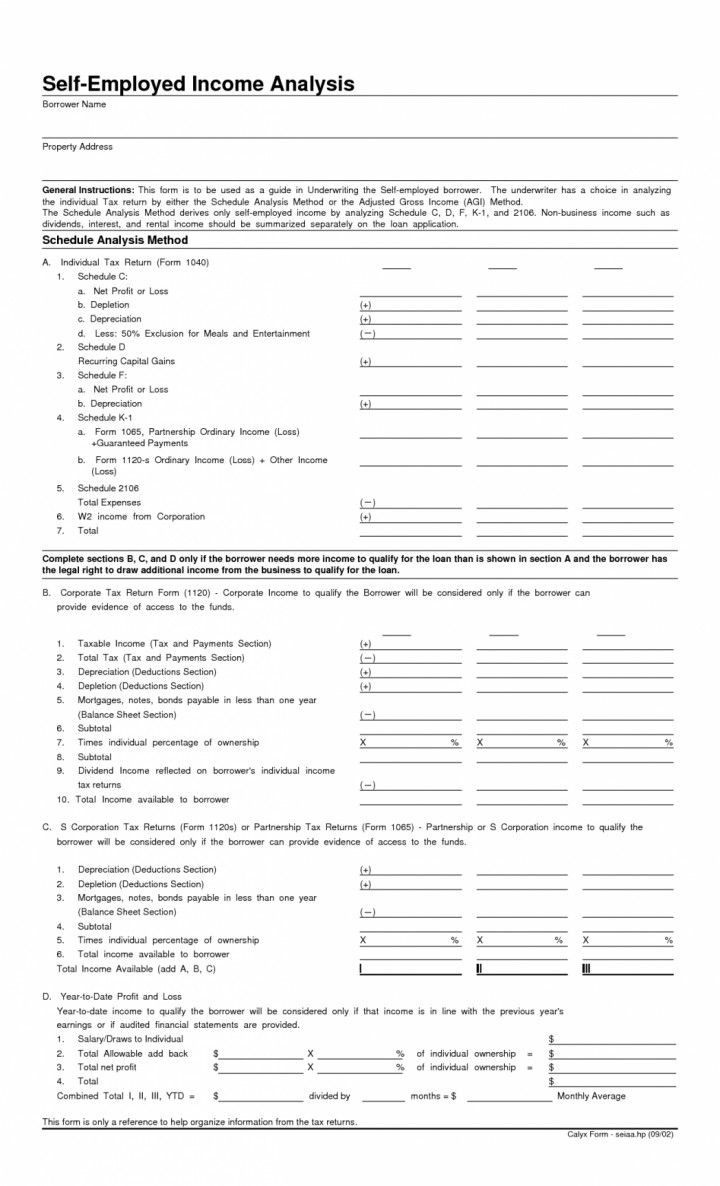

Income Calculations - Freddie Mac Form 91 is to be used to document the Seller’s calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller’s calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. This form does not replace the requirements and …

Rental Property - Investment | Essent Mortgage Insurance Determine the average monthly income/loss for a non-owner occupied investment property. ... Rental Property - Investment ... 2022-rental-property-investment-schedule-e-worksheet.pdf. 2022-rental-property-investment-schedule-e-calculator.xls. Sub-title (Schedule E) Follow Us on LinkedIn. Footer parent. About Essent.

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

PDF INCOME CALCULATION WORKSHEET - DUdiligence.com and year 2 rental income cover $ Section 8b: Net Rental Income - Net Rental Income method Definition: This method to be used if the rental property does not exist on the previous year's tax returns. Must be supported by a current lease agreement on the property. Subtotal Total Step 1 Enter Monthly Gross Rental Income $

HOPWA Income Resident Rent Calculation - HUD Exchange According to the HOPWA regulations, tenants must pay the higher of: (1) 30 percent of the family's monthly adjusted income; (2) 10 percent of the family's monthly gross income; or (3) The portion of any welfare assistance payments specifically designated for housing costs. This worksheet can be used by HOPWA project sponsors to determine the Resident Rent Payment.

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1038) Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties)

Rental Income and Expense Worksheet - PropertyManagement.com You can view, make a copy, download, and then use the worksheet here. Download the Rental Income and Expense Worksheet Here Convenient and easy to use, this worksheet is designed for property owners with one to five properties. It features sections for each category of income and spending that are associated with rental property finances.

2021 Gross Income Tax Depreciation Adjustment Worksheet, … GIT-DEP – Gross Income Tax Depreciation Adjustment Worksheet Revised 8/19 Name Social Security Number/FEIN Part III Calculation of Adjustment to Federal 179 Recapture Income For tax years beginning on or after January 1, 2004, if reported income includes the recapture of Section 179 expense on property placed in service on or after January 1 ...

PDF Calculator and Quick Reference Guide: Rental Income - Enact MI 10 Number of Months Considered (Line 2)* / 11 Monthly Income/Loss = 12 Monthly Mortgage Payment (Verified) - 13 Monthly Net Rental Income/Loss** = Rental Income Calculation 2021 2020 NOTES 1 Gross Rents (Line 3) *Check applicable guidelines if not using 12 months.

Rental Property Calculator | Zillow Rental Manager Additional rental income: Any additional money earned from the tenant like income from utilities, laundry, storage or parking fees. Use our free rental income and expense worksheet to keep track of your monthly cash flow. How to calculate ROI on rental property. First, calculate the return on investment by subtracting the total gains from the cost.

PDF CHAPTER 5. DETERMINING INCOME AND CALCULATING RENT 5-1 Introduction income reflected on Mary's copy of her form 1040 as her annual income. 5-6 Calculating Income—Elements of Annual Income A. Income of Adults and Dependents 1. Figure 5-2 summarizes whose income is counted. 2. Adults. Count the annual income of the head, spouse or co-head, and other adult members of the family. In addition, persons under the ...

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae 07/09/2022 · Rental Income Worksheet – Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the borrower is using rental …

Section 8 Rent Calculation Worksheet - Fill Out and Use - FormsPal Income Calculation Worksheet Hud Details. If you are a tenant or landlord interested in Section 8 housing, it is important to understand how the rent calculation works. The Section 8 Rent Calculation Worksheet Form can help you do just that. This form calculates the amount of rent a household is responsible for based on their income and size.

2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value.

Work out your rental income when you let property - GOV.UK How to work out your taxable profits. To work out your profit or loss you should treat all receipts and expenses as one business even if you've more than one UK property by: adding together all ...

0 Response to "43 rental income calculation worksheet"

Post a Comment