43 tax write off worksheet

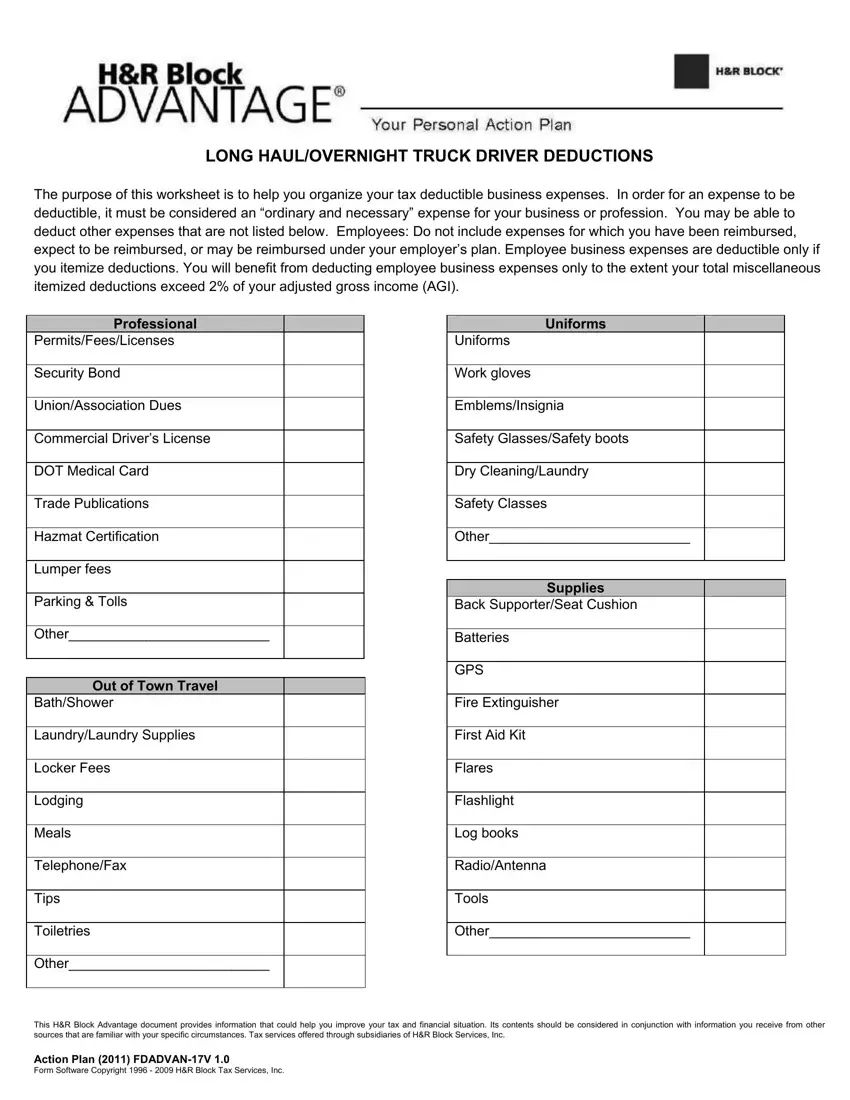

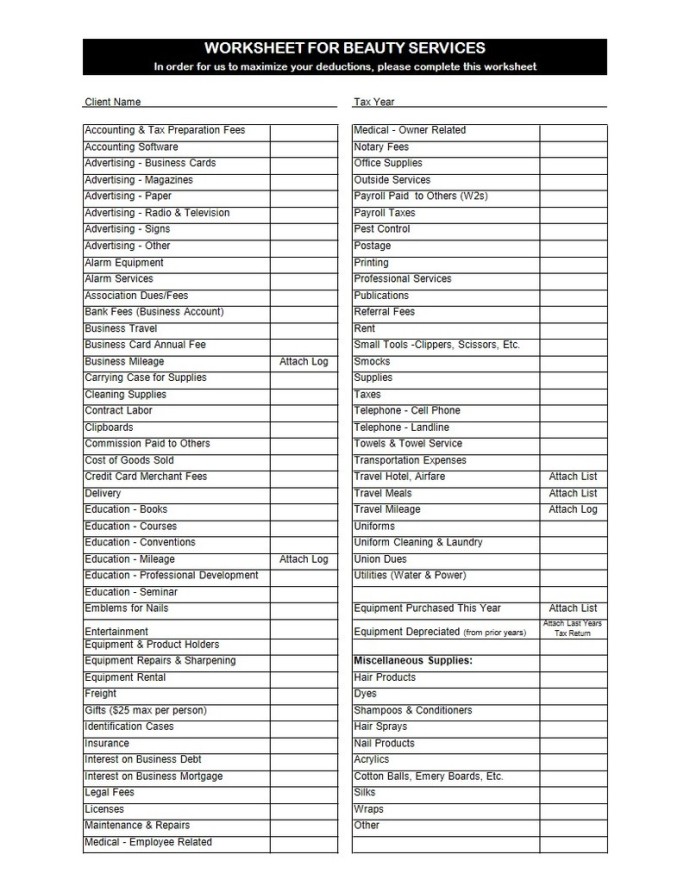

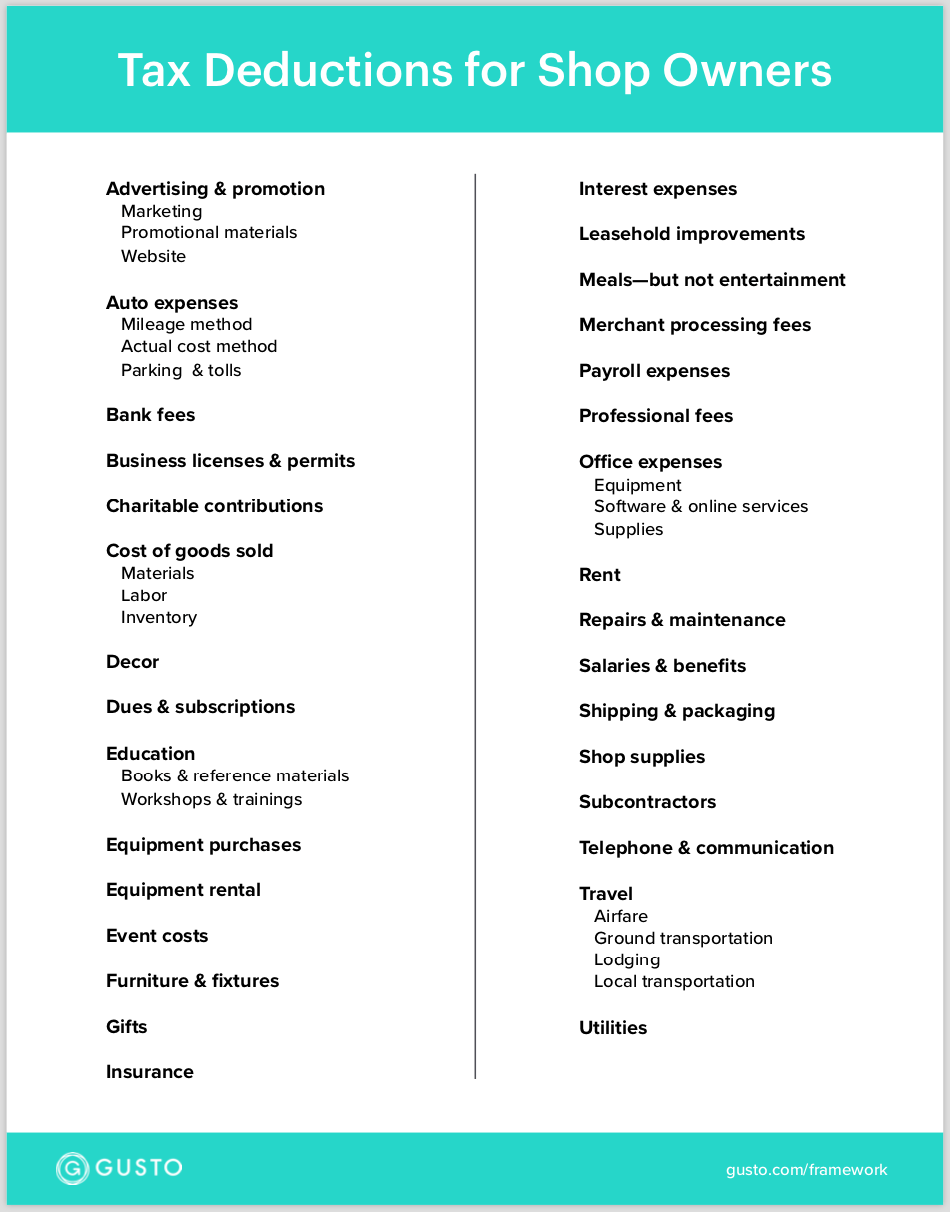

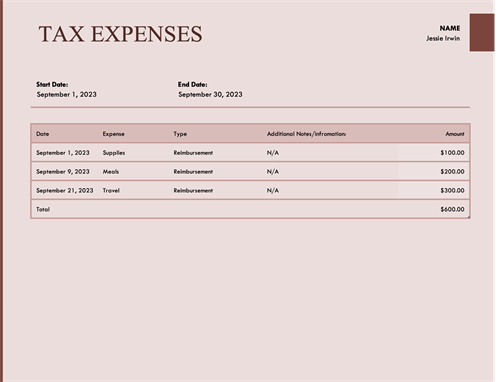

TAX ORGANIZERS - Riley & Associates: Certified Public Accountants Teachers Expense Worksheet (.xlsx) Tradesmen Annual Expense Spreadsheet Tradesmen Expense Worksheet (.pdf) Tradesmen Expense Worksheet (.xlsx) House Cleaning (.pdf) Web Designer (.pdf) Massage Therapist (.pdf) Mechanic (.pdf) Online Sales (.pdf) Other Tax Checklists Annual Rental Property Worksheet (.pdf) Non-Cash Contributions (.pdf) Tax Deduction | Excel Templates 1. Use the checklist provided for ideas on what tax deductions would make sense for you. Simply read the different titles to which one is going to make the most sense for yourself. If you find you do not need certain categories, feel free to remove them or change them into something else that works better for your home or business taxes. 2.

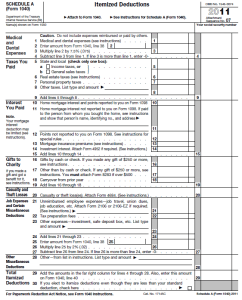

› tax › irsHow Itemizers Can Calculate Sales Tax Write-Offs - AccountingWEB Apr 15, 2021 · They can’t write off both in the same year (line 5a of 2020’s Schedule A for itemized deductions). Part two discussed breaks on deductions for sales taxes for residents of states with low rates for income taxes and for seniors who live in states that authorize lower rates, exemptions and other kinds of special breaks for retirement income.

Tax write off worksheet

Free 1099 Template Excel (With Step-By-Step Instructions!) - Bonsai How to Use this 1099 Template. There are 6 basic steps to using this 1099 Template. Step 1. Enter all expenses on the "All Business Expenses" tab of the free template. Step 2. Identify the total amount of each expense type by using the filter option on the "All Business Expenses" tab. Step 3. Tax Worksheet | Etsy $3.99 (15% off) Taxes Made Easy, Multi-Year Photography Tax Spreadsheets, Tax Write Offs, Audit Prep Guide BP4UPhotoResources (335) $4.00 $9.99 (60% off) Tax Prep Checklist Tracker Printable, Tax Prep 2022, Tax Checklist, Tax List, Tax Tracker ModernFunTemplates (5) $1.12 $1.49 (25% off) PDF Worksheet for Firefighters TAX YEAR 201 - Juda Kallus Worksheet for Firefighters PLEASE TRANSFER ALL YOUR SUBTOTALS TO SHEET #2 NAME_____ 201 TAX YEAR. F EQUIPMENT & REPAIRS Generally, to be deductible items must be ordinary and ... reading at both the beginning and end of the tax year. Keep receipts for all car operating expenses - gas, oil, repairs, insurance, etc., and of any reimbursement ...

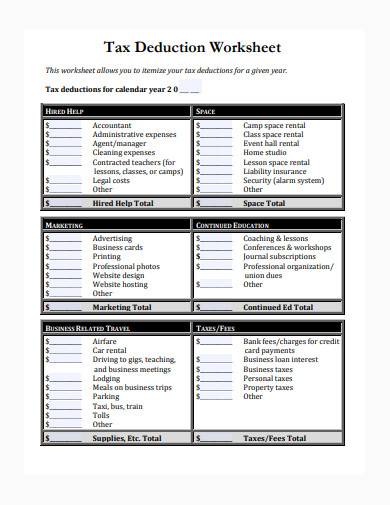

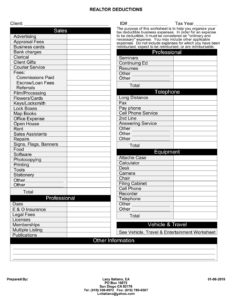

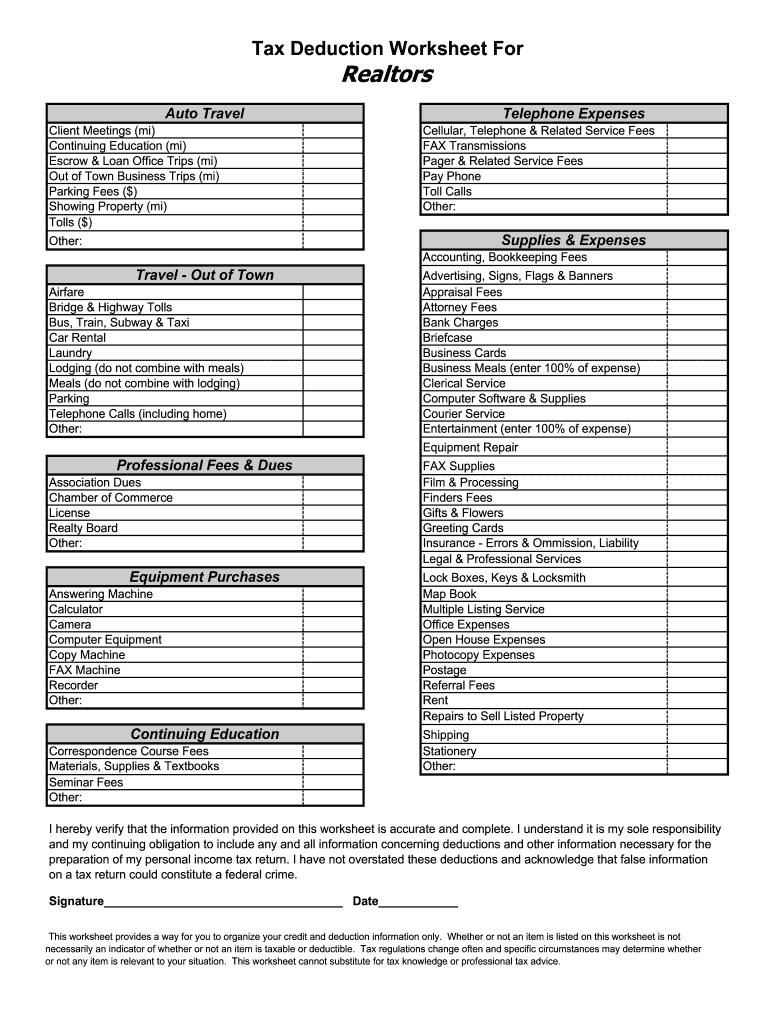

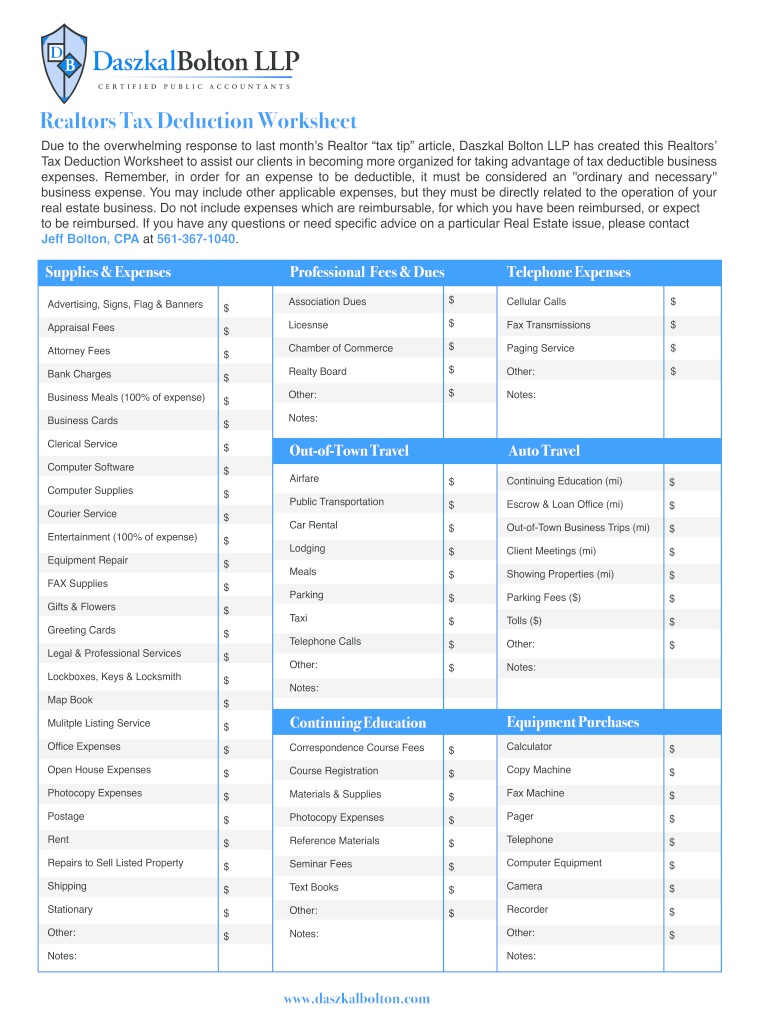

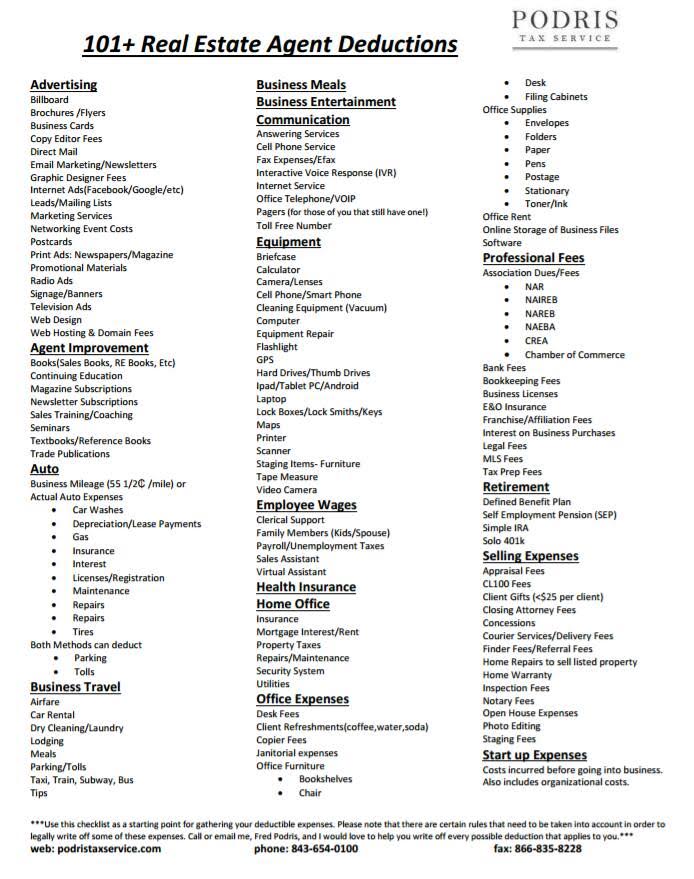

Tax write off worksheet. PDF REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET - Tax Goddess Tax strategy fees Retirement 401(K) Solo 401(k) SEP SIMPLE Defined Benefit Plans Fees associated with setup & maintenance Selling Expenses Appraisal fees Client gifts (<$25/client) Closing attorney fees Concessions Courier services/delivery ... PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... make sure I have your last year's tax return so I can follow it. Otherwise, answer the following: Date you purchased the property ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Fax: 206-736-0982 Email: taxes@demoretaxservice.com Email: demoretaxservice@gmail.com . Real Estate Professional Expense Worksheet - atmTheBottomLine 1711 Woodlawn Ave., Wilmington, DE 19806 (302-322-0452) - - - - 118 Astro Shopping Center, Newark DE 19711 - - - - PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

Free Clothing Donation Tax Receipt - PDF | Word - eForms Donating clothes can be a great tax write-off for any individual that pays income tax at the end of the year. It may not be much but commonly an organization that does take used clothing will "round up" or estimate the clothes to be at a higher price than they may actually be sold. Step 1 - Gather Usable Clothes Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax See write-offs 1. 🟩 Schedule C Expense Categories This first tab is your bread and butter. All you need to do here is customize it with your name, and fill in your business-use percentages. (Those boxes are in yellow — hover over the cell for notes!) Everything else here will show up automatically, based on what you enter in the other two tabs. What Can Teachers Write Off on Taxes in 2022? A Dive Into Deductions The decision of how much teachers can deduct from their income taxes lies with the Internal Revenue Service, and in 2022 the answer is a total of $250 can come off a teacher's taxes for expenses. But hold on a second! There are some rules and regulations that you're going to have to keep in mind! First off, the figure only applies to ...

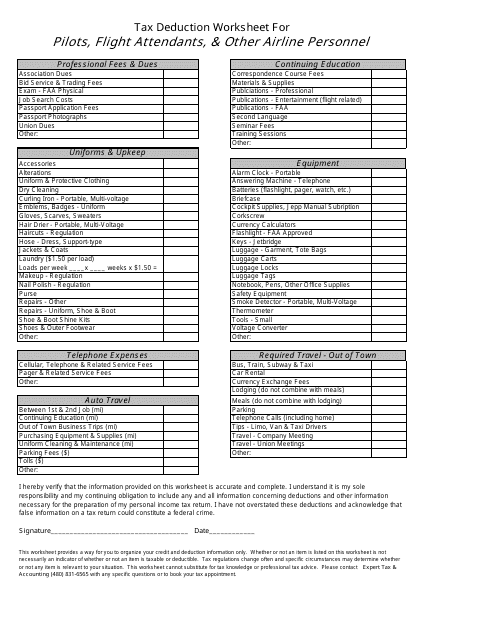

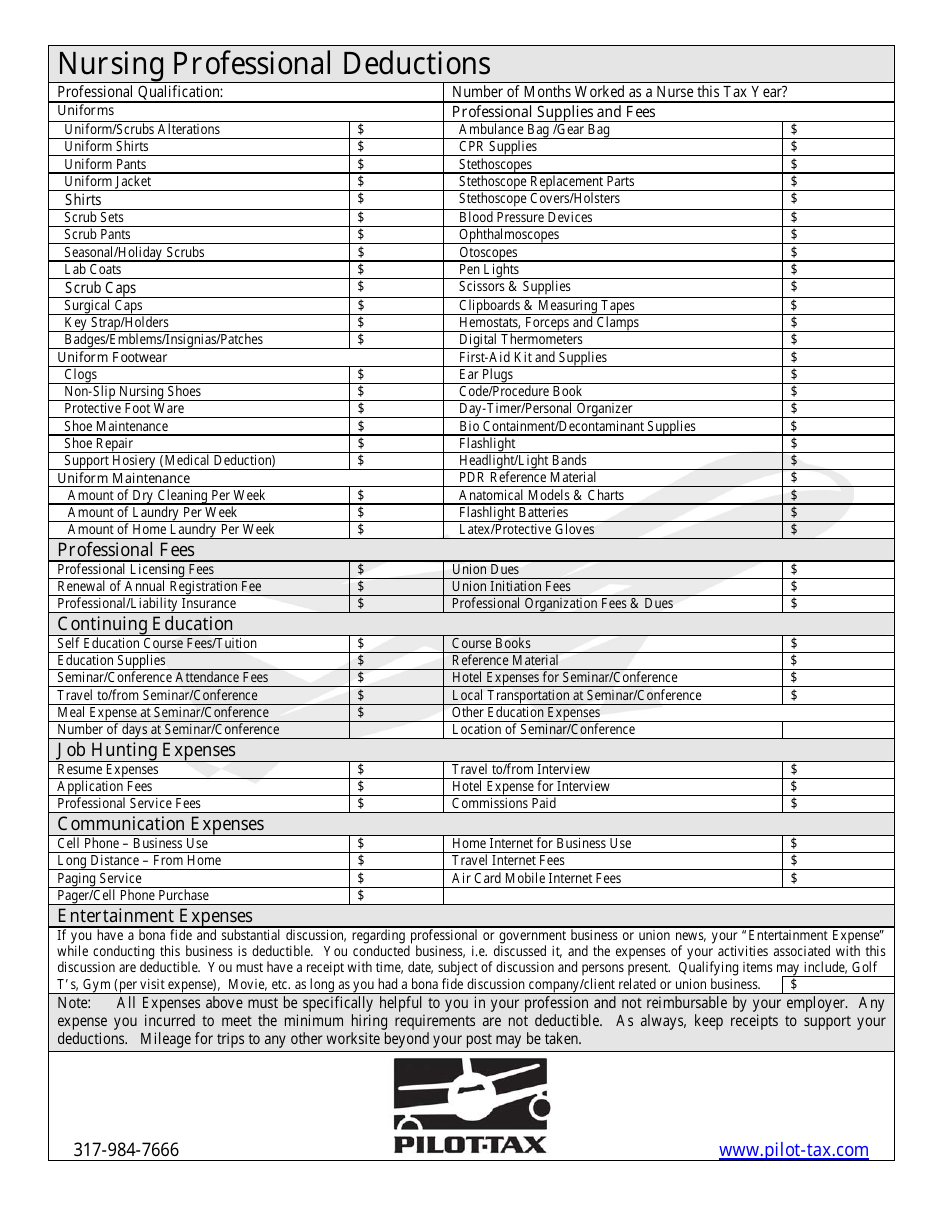

PDF Tax Deductions for FIREFIGHTERS/PARAMEDICS Tax Deductions for FIREFIGHTERS/PARAMEDICS Name: 1. Communication Expenses Cellular Phone purchase Monthly Cellular expenses used for Business Private Practice Tax Write-Offs | Free PDF Checklist Here are some examples of items you can write off in the "supplies" category: Cleaning supplies Postage Pens, paper, stapler, clipboard, etc. Books & magazines in the waiting room File cabinet and any affiliated filing supplies Printed paperwork Printer ink Smaller furniture pieces (under $2,500 - more on this later) Office Expenses The Epic Cheat Sheet to Deductions for Self-Employed Rockstars You can write off anyone you pay for professional consultation or work for your business. This is one of those categories that overlaps with others (Consultation, Professional Development, Subcontractor). The most common deductions here are legal consult and fees, accounting, bookkeeping, and tax preparation fees. Meals: › tax-write-offs › real-estate-agent21 Tax Write-Offs for Real Estate Agents - Keeper Tax Keeper helps real estate agents with 21 tax write-offs by monitoring everyday expense and help lower tax bills. Don't miss out most valuable business tax deductions.

Rental Property Deductions: 21 Tax Deductions for Landlords in 2022 Pay $5,000 in interest payments, write off that on taxes get $1,250 back at 25% rate = net cash flow LOSS of $3,750. Mortgage paid off so $5,000 is recognized as income. Pay taxes of $1,250 at 25% rate = net cash flow GAIN of $3,750. Reply. G. Brian Davis on March 6, 2018 at 11:48 PM

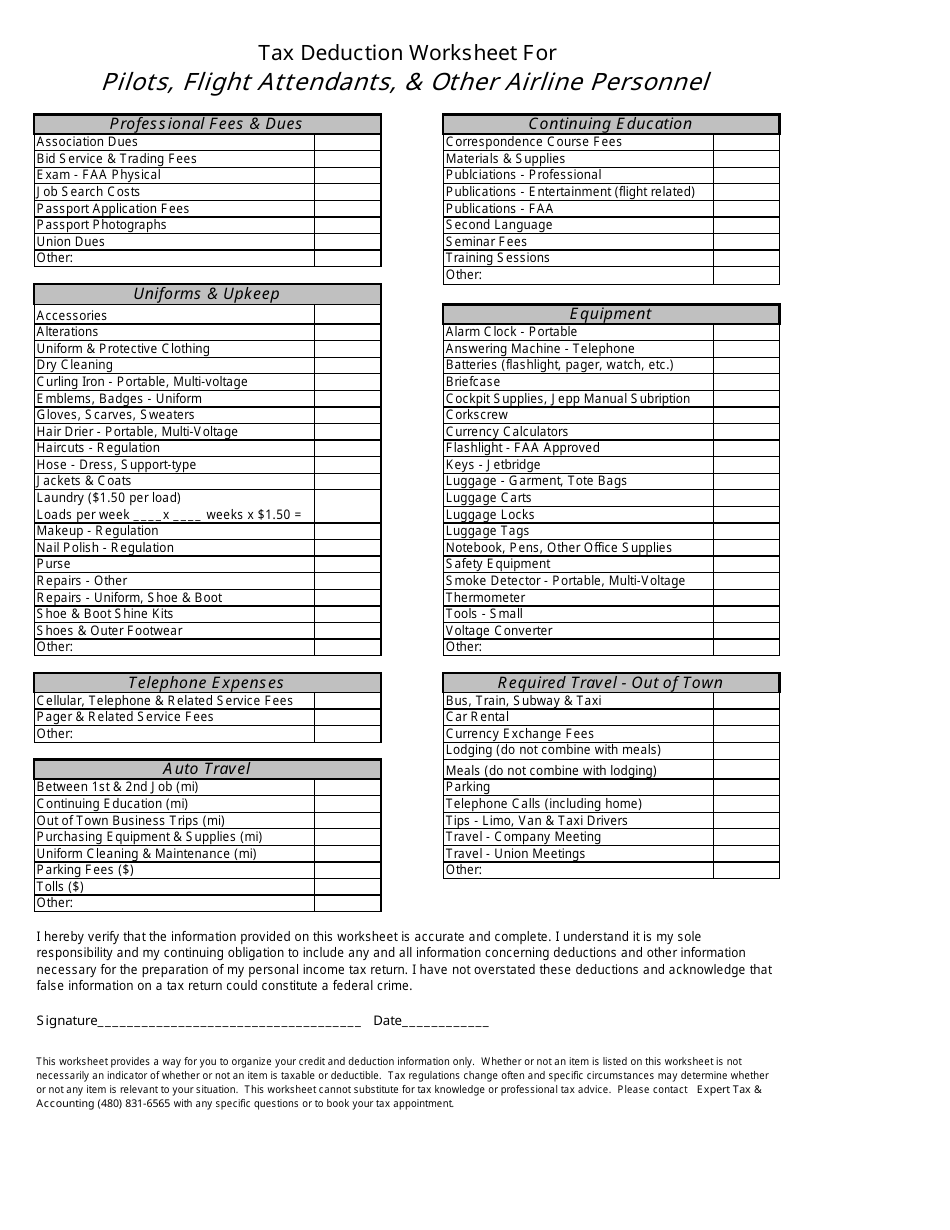

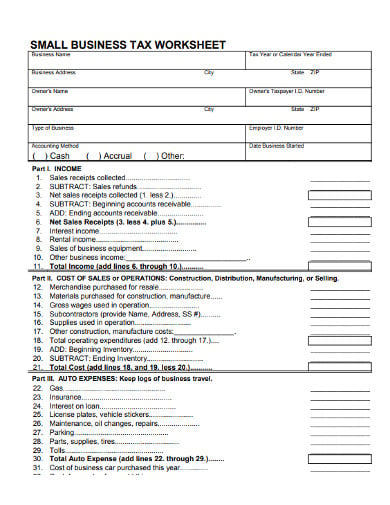

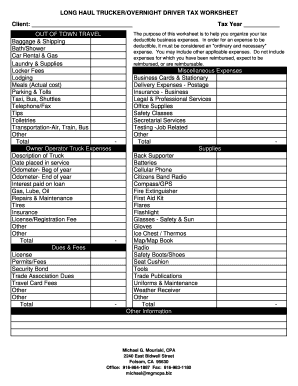

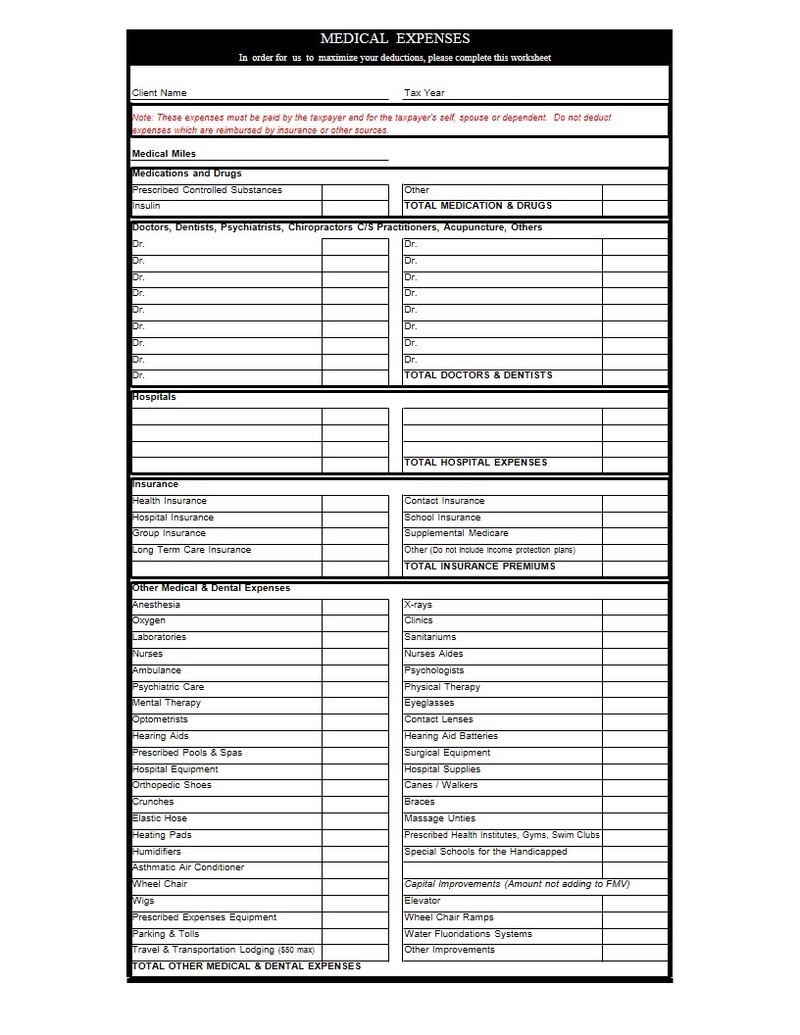

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms If you are a fiscal year filer using a tax year other than January 1 through December 31, 2021, write “Tax Year” and the beginning and ending months of your fiscal year in the top margin of page 1 of Form 1040 or 1040-SR.

pjike.mainshishashop.de › range-rover-tax-writeRange rover tax write off reddit - pjike.mainshishashop.de Big Tax Write-Off. Big tax deduction. Say you buy a $47,000 crossover vehicle that tax law classifies as a truck. Say further that you use the crossover truck 100 percent for business. If the GVWR is 6,001 pounds or more, tax law allows you to deduct $47,000 (or a lesser amount if you would like—in this case, you use Section 179 expensing)..

FREE Home Office Deduction Worksheet (Excel) For Taxes - Bonsai Our tax software scans your bank/credit card statements to find tax write-offs that may qualify as a deduction at the push of a button. Users typically save $5,600 from their tax bill by using our app. Try a 14-day free trial today. You can make a copy of the excel sheet here. Do You Qualify for the Home Office Deduction?

Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com Hairstylist Tax Write Offs Checklist. 20 JAN 2022. For a self employed hair stylist, tax write offs can be a game changer. If you track your business expenses and put together a hairstylist tax write off list, you could save hundreds (or maybe thousands) of dollars when filing your taxes.

› donating › IRS-guidelinesIRS Guidelines and Information | Donating to Goodwill Stores Consult a local tax advisor who should be familiar with market values in your region; Review the following tax guides available from the IRS; Determining the Value of Donated Property — defines "fair market value" and helps donors and appraisers determine the value of property given to qualified organizations. It also explains what kind of ...

writeitoff.com.auWrite It Off - Property Depreciation Report | Quantity ... With years of experience, we are a specialist company preparing property depreciation reports to maximise your depreciation deductions. Click here to know more! Or call 1300 883 760 for your quantity surveyor depreciation report.

2021 Tax Return Preparation and Deduction Checklist in 2022 - e-File This is for the simple reason that all 2021 Forms need to be mailed to you before February 1, 2022. If an employer (s) do not provide you your W-2 forms or the issuer (s) of a 1099 Form does not mail them to you on time, contact them and request it. Step 2: View these important pre-eFile considerations; taxstimate your taxes, use simple tax ...

PDF SMALL BUSINESS WORKSHEET - cpapros.com SMALL BUSINESS WORKSHEET Client: ID # TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Books & Magazines expense to be deductible, it must be considered an Business Cards "ordinary and necessary" expense. You may include

tax write off worksheet tax write off worksheet Small Business Tax Deductions Worksheet. 11 Pics about Small Business Tax Deductions Worksheet : Small Business Tax Deductions Worksheet, Self Employed Truck Driver Deductions - Best Image Truck Kusaboshi.Com and also Small Business Tax Deductions Worksheet. Small Business Tax Deductions Worksheet briefencounters.ca

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula

How To Write Off Taxes For MLM Business | Tax Relief Center Though you cannot deduct personal trips, you can write off expenses for business trips and maintenance costs. You can even deduct the costs of meals and supplies for sales presentations. You can easily write off taxes for MLM business. Take these deductions, so you can survive and thrive in the market. They will save you a lot of money and will ...

Tax Deductions for Photographers - FreshBooks - FreshBooks If you operate a home office, you can typically write off a portion of your rent as an expense. This is calculated by dividing the square footage of your home office space you use exclusively for business by the total square footage of your home. If you have a home office, this tax deduction is one you don't want to miss.

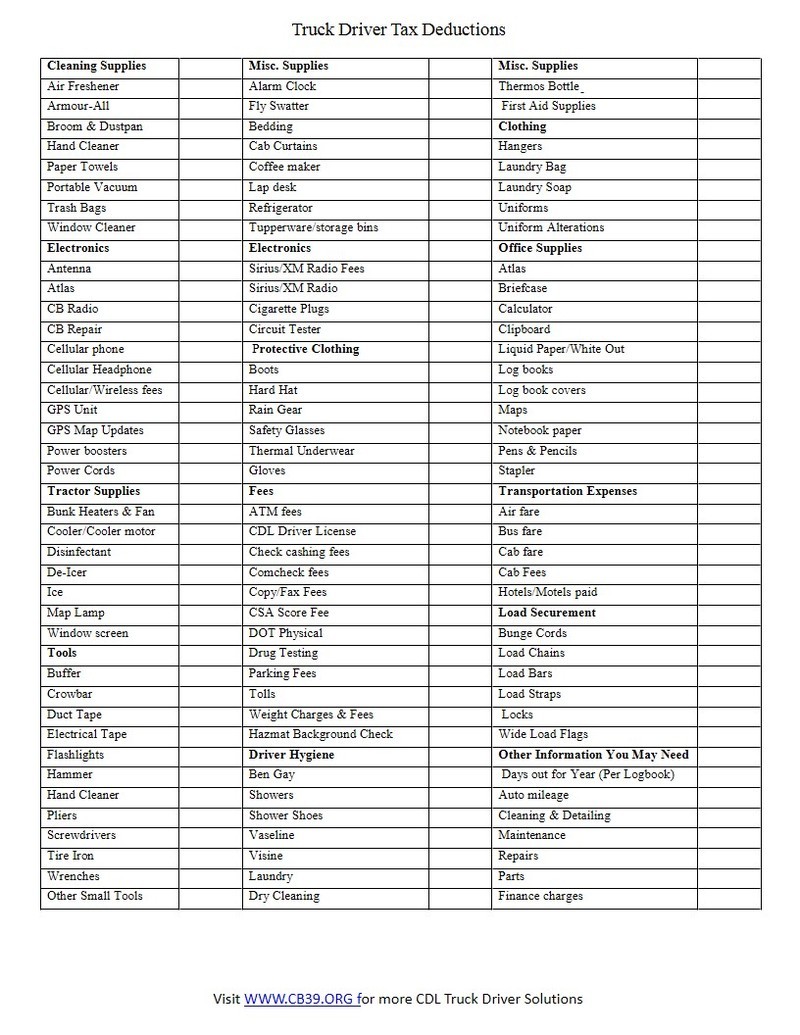

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services amounts—during this tax year? OTHER INCOME Sales of Equipment, Machinery, Land, Buildings Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES (personal vehicle) VEHICLE 1 VEHICLE 2 BUSINESS MILES (examples) Year and Make of Vehicle ____ Job seeking miles

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Or you can write to: Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW, IR-6526 Washington, DC 20224. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments as we revise our tax forms, instructions, and publications.

PDF Police Officer - Tax Deduction Worksheet Tax regulations change often and specific circumstances may determine whether or not any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax & Accounting (480) 831-6565 with any specific questions or to book your tax appointment. Professional Fees & Dues

PDF Worksheet for Firefighters TAX YEAR 201 - Juda Kallus Worksheet for Firefighters PLEASE TRANSFER ALL YOUR SUBTOTALS TO SHEET #2 NAME_____ 201 TAX YEAR. F EQUIPMENT & REPAIRS Generally, to be deductible items must be ordinary and ... reading at both the beginning and end of the tax year. Keep receipts for all car operating expenses - gas, oil, repairs, insurance, etc., and of any reimbursement ...

Tax Worksheet | Etsy $3.99 (15% off) Taxes Made Easy, Multi-Year Photography Tax Spreadsheets, Tax Write Offs, Audit Prep Guide BP4UPhotoResources (335) $4.00 $9.99 (60% off) Tax Prep Checklist Tracker Printable, Tax Prep 2022, Tax Checklist, Tax List, Tax Tracker ModernFunTemplates (5) $1.12 $1.49 (25% off)

Free 1099 Template Excel (With Step-By-Step Instructions!) - Bonsai How to Use this 1099 Template. There are 6 basic steps to using this 1099 Template. Step 1. Enter all expenses on the "All Business Expenses" tab of the free template. Step 2. Identify the total amount of each expense type by using the filter option on the "All Business Expenses" tab. Step 3.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-01.jpg)

.png)

0 Response to "43 tax write off worksheet"

Post a Comment