44 self employed business expenses worksheet

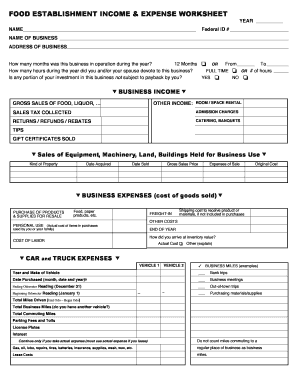

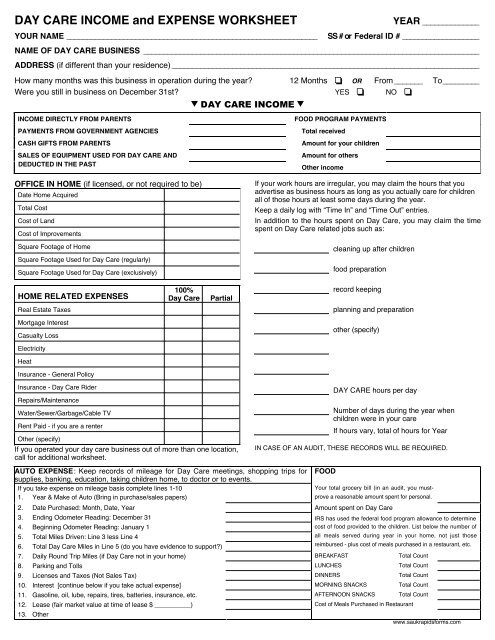

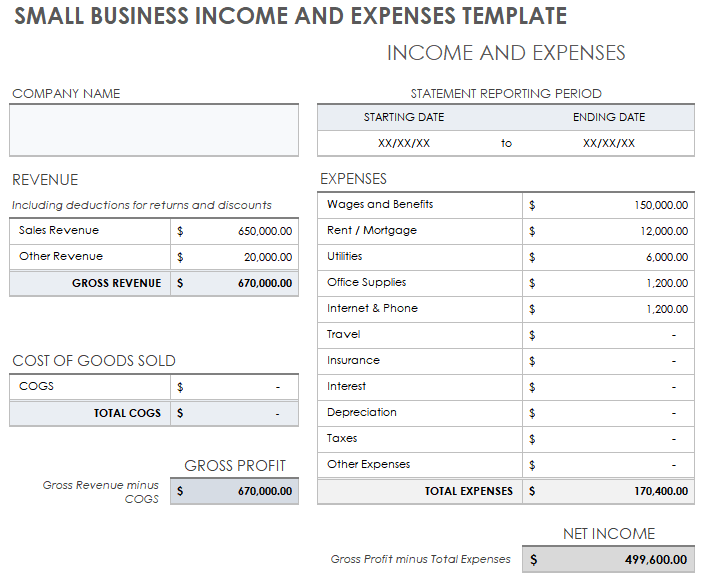

PDF Self-employed Income and Expense Worksheet INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ $ OTHER BUSINESS INCOME COMMISSIONS $ $ OTHER BUSINESS INCOME INSURANCE (Other Than health) $ COST OF GOODS SOLD INTEREST (Business Loans) $ COST OF INVENTORY AT THE BEGINNING OF THE YEAR $ INTEREST (Business Loans) $ Income Statement Template for Excel - Vertex42.com 11.05.2020 · This income statement template was designed for the small-business owner and contains two example income statements, each on a separate worksheet tab (see the screenshots).The first is a simple single-step income statement with all revenues and expenses lumped together.. The second worksheet, shown on the right, is a multi-step income statement …

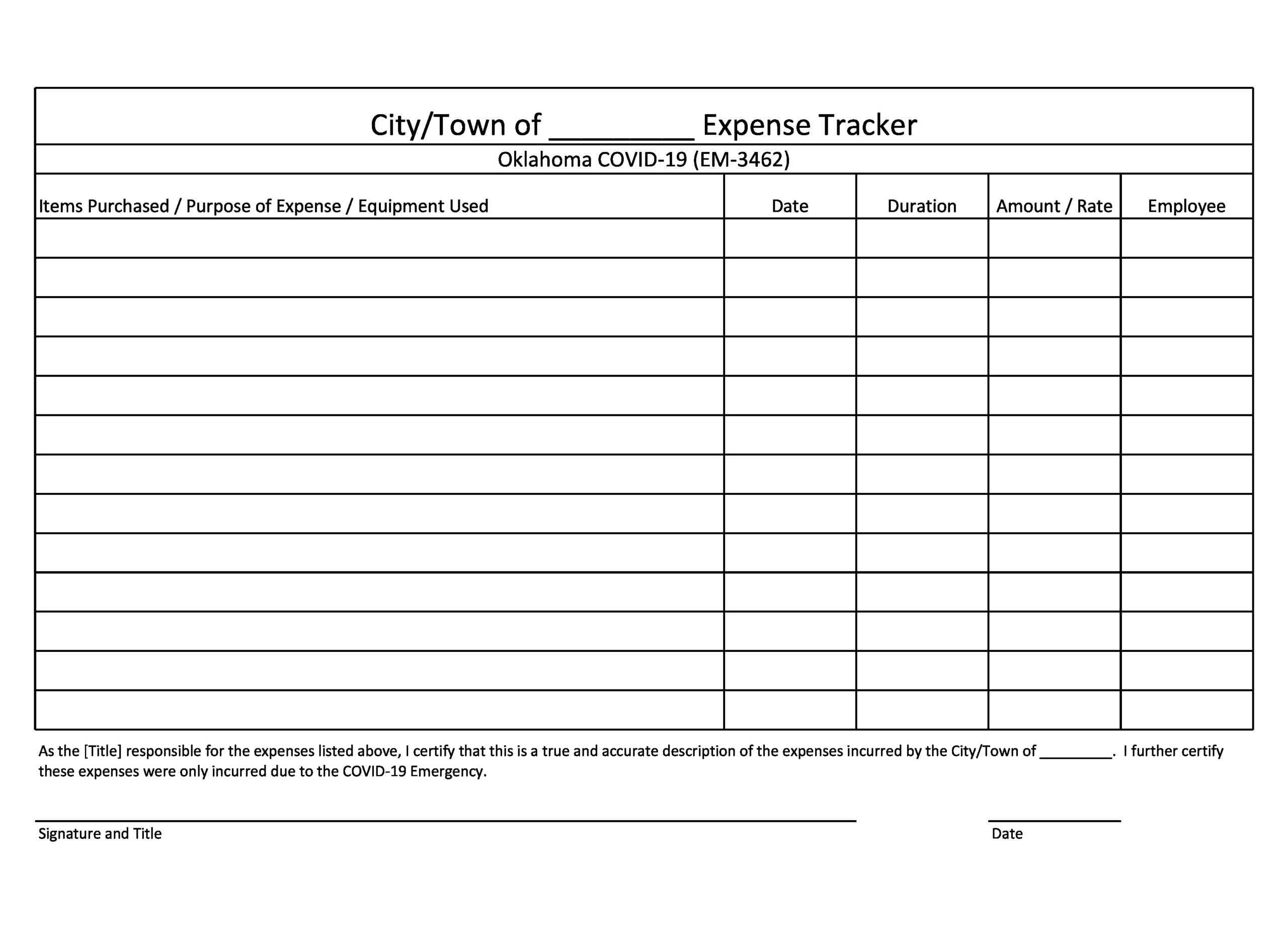

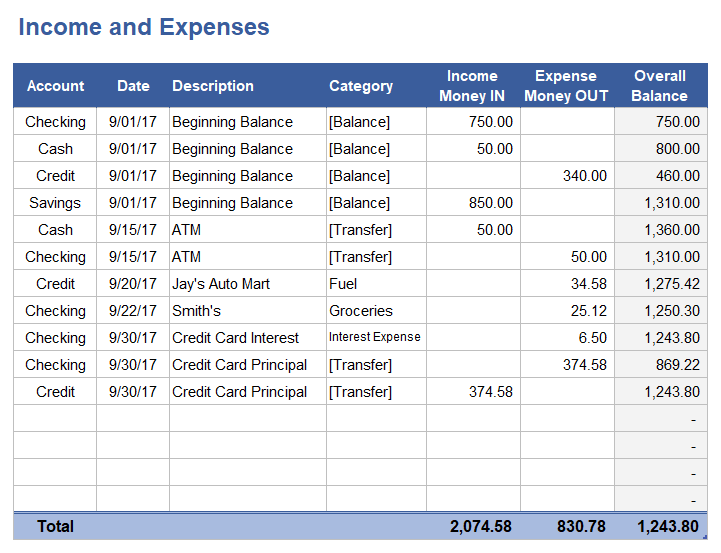

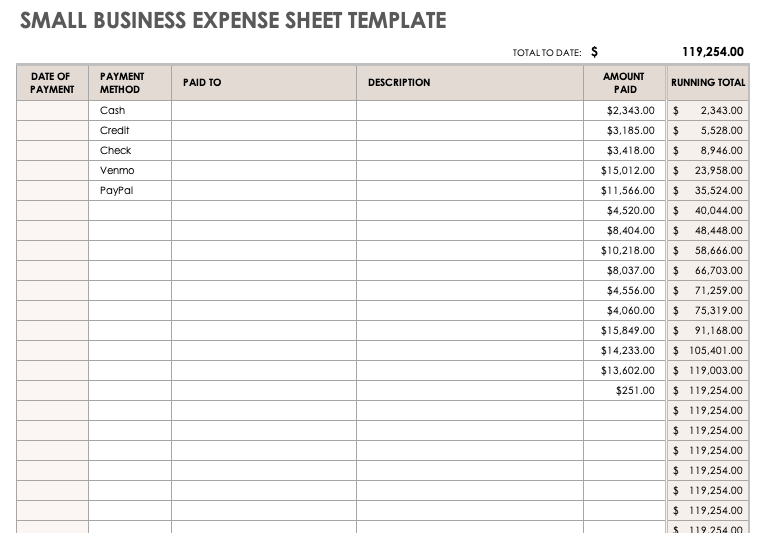

Free Expense Tracking Worksheet Templates (Excel) Expense Tracking Sheet This template is perfect for both personal use, as well as small business use. It comes with two sheets. The first sheet is dedicated to tracking your expenses in various categories throughout weeks, months or years. The second sheet is a streamlined summary chart of your budget vs. the money you spent in this time period.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Self employed business expenses worksheet

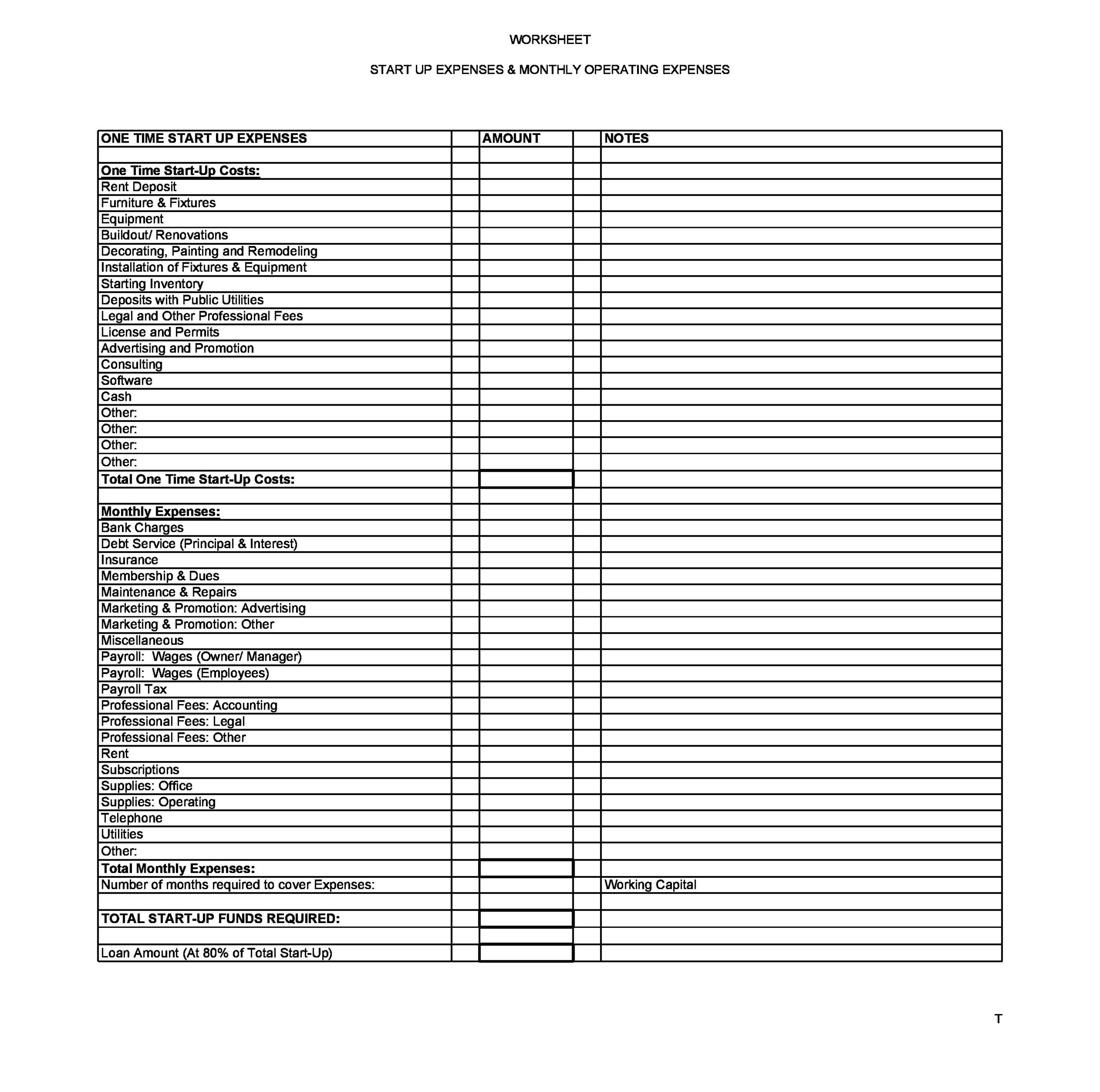

PDF Schedule C Worksheet for Self Employed Businesses and/or ... - Kristels Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ... Self-Employed Business Expense Worksheet - Cimpress Business Cards Bank Char es CD, DVD Blanks Client Gifts BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses. Publication 535 (2021), Business Expenses - IRS tax forms Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

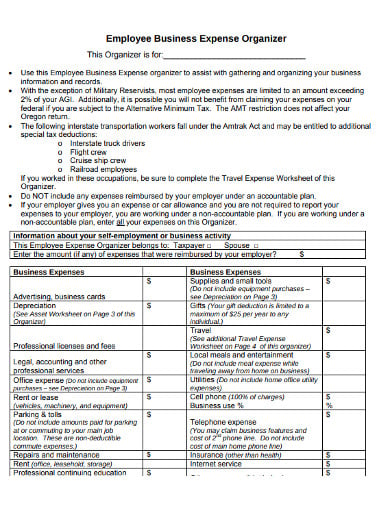

Self employed business expenses worksheet. Self-Employment Tax: Everything You Need to Know - SmartAsset 07.01.2022 · To ensure that self-employed individuals still contribute toward Social Security and Medicare, the federal government passed the Self-Employed Contributions Act (SECA) in 1954. SECA established that self-employed individuals would be responsible to pay the whole 15.3% FICA. This tax paid by self-employed individuals is known as the SECA, or more simply, the self … 12+ Business Expenses Worksheet Templates in PDF | DOC self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair. 8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... So, here are the steps that will help you create your own sample expense report and income statement spreadsheet: Open your spreadsheet or worksheet application Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Small Business, Self-Employed, Other Business - IRS tax forms 07.09.2022 · Each spouse files with the Form 1040 or Form 1040-SR a separate Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), Schedule F (Form 1040), Profit or Loss From Farming, or Form 4835, Farm Rental Income and Expenses, accordingly, and if required, a separate Schedule SE (Form 1040), Self-Employment Tax to pay self-employment tax.

1099 Taxes Calculator | Estimate Your Self-Employment Taxes Other Business Expenses Estimate your non-car work expenses for the whole year (cell phone bill, health insurance, etc) $ Estimate my taxes *Please select a valid state. Your Results. You will owe: of your self-employed income. Expect to owe around in taxes (of your income) Tax Breakdown. Federal. State. Social Security and Medicare (aka Self-Employment Tax) Total. Maximize your … What Is the Self-Employed Health Insurance Deduction? 06.06.2022 · The remaining deduction may not be lost—you can claim any premiums you can't deduct as self-employed health insurance as out-of-pocket medical expenses on Schedule A, Itemized Deductions. However, you'll have to itemize deductions to get a benefit, and you only get to deduct out-of-pocket medical expenses that exceed 7.5% of your adjusted gross income (AGI). Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work. Self-Employed Individuals – Calculating Your Own Retirement … 05.11.2021 · If you are self-employed (a sole proprietor or a working partner in a partnership or limited liability company), you must use a special rule to calculate retirement plan contributions for yourself.. Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each participant's …

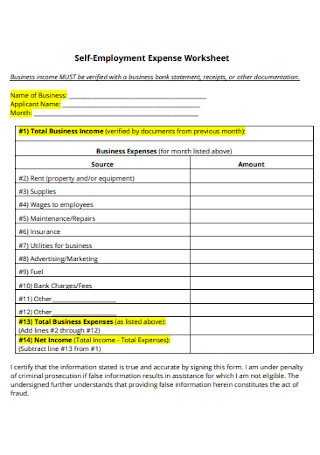

PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). DOC Self Employment Monthly Sales and Expense Worksheet - Washington Monthly Total Self Employment Income $ Deducting Business Expenses If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page. Self Employment Worksheet - First Choice Tax Service Our goal is to make tax filing as simple as possible. Directions: 1. Click on the button below to get the Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person. Download Here Don't Wait Contact Us Here

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 04.07.2022 · Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2020.

PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... BUSINESS EXPENSES Advertising (Website, Business cards, Marketing, etc.) Commissions & fees you paid Contract labor Insurance Health Insurance if not covered by spouse or employer plan ... Microsoft Word - Self Employed and 1099 Worksheet Author: Jenya Rose Created Date:

Free Printable Business Expense Spreadsheet - Excel TMP In conclusion, a business expense spreadsheet helps you to keep track of your business expenses by updating your financial information. Sharing is caring! exceltmp Exceltmp.com is here for your convenience and to save time. It's a source of providing a good range of excel, word, and pdf templates designs and layouts.

Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your...

The Home Office Deduction - TurboTax Tax Tips & Videos 18.07.2022 · Key Takeaways • You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis. a home can include a house, apartment, condominium, mobile home, boat or similar structure. • Generally, your home office must be either the principal location of your business or a place where you regularly meet with customers or …

self employed deduction worksheet 16 Best Images Of Budget Worksheet Self-Employed - Make A Budget Worksheet, Hair Salon Business. . salon hair worksheet spreadsheet expense budget income stylist business beauty expenses excel self employed sheet list db bookkeeping template templates.

Cash Flow Analysis (Form 1084) - Fannie Mae A self-employed borrower’s share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation, such as Schedule K-1, verifying that the income was actually distributed to the borrower, or the business has adequate liquidity to support the withdrawal of earnings. If the Schedule K-1 provides this confirmation, no further …

Free Income and Expense Tracking Templates (for Excel) Step 2: Run the Excel program and select a pre-installed template for tracking personal expenses or spreadsheet. Pre-installed templates can be obtained by clicking the "File" tab and selecting "New" and then select "Sample templates" and choose "Personal Monthly Budget" and finalize by clicking "Create.". Step 3: Indicate ...

IRS Business Expense Categories List [+Free Worksheet] Mar 19, 2020 · 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040, Schedule 1, line 16 as an adjustment to income. 12.

15 Tax Deductions and Benefits for the Self-Employed - Investopedia The self-employment tax refers to the Medicare and Social Security taxes that self-employed people must pay. This includes freelancers, independent contractors, and small-business owners. The...

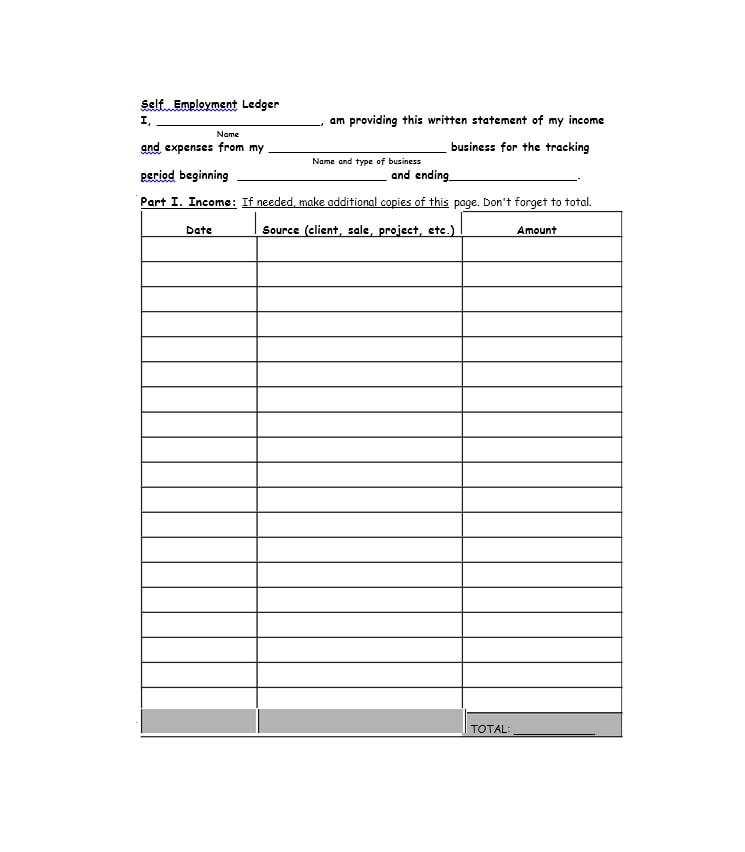

Self-Employment Ledger: 40 FREE Templates & Examples - TemplateArchive Examples of self-employed individuals are self-sufficient contractors, sole proprietors of businesses and those with partnerships in businesses. A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledger. This is an error-free, detailed record showing self-employment cash returns ...

Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan. This also includes your spouse's plan.

PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

The Best Home Office Deduction Worksheet for Excel [Free Template] Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it's usually better to just track your actual home expenses. Hopefully, this free worksheet — and the Keeper Tax app — can take the hassle out of expense tracking. {filing_upsell_block}

Business Income and Expense Worksheet Form - signNow How to create an eSignature for the self employment income worksheet Speed up your business's document workflow by creating the professional online forms and legally-binding electronic signatures. Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create.

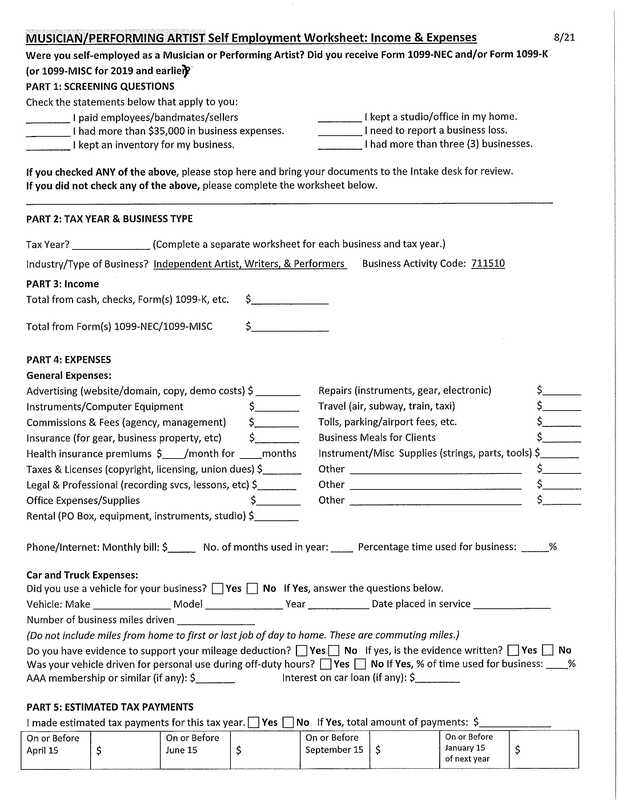

PDF 2021 Self-Employed (Sch C) Worksheet - cotaxaide.org 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) ... I had more than $35,000 in business expenses I received a Form 1095-A I kept an inventory for my business I need to report a business loss I have assets to depreciate (any > $2,500) I don't use the cash method of accounting ...

The Epic Cheat Sheet to Deductions for Self-Employed Rockstars It's pretty simple- keep track of your business mileage and you get to deduct those miles multipled by the standard rate (usually around 58 cents per mile). If you are taking the standard mileage deduction, there are still a few car related expenses you get to write off: Parking & Tolls.

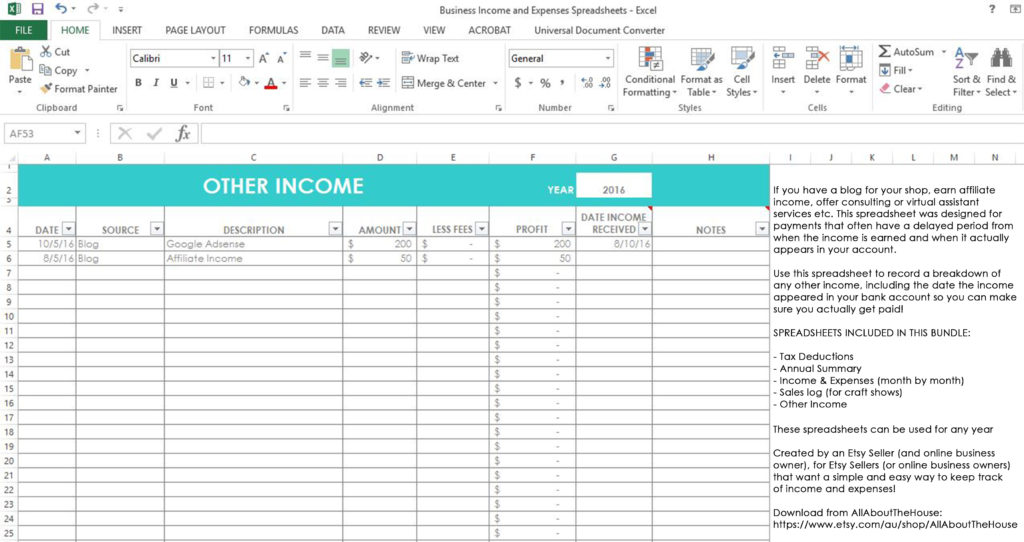

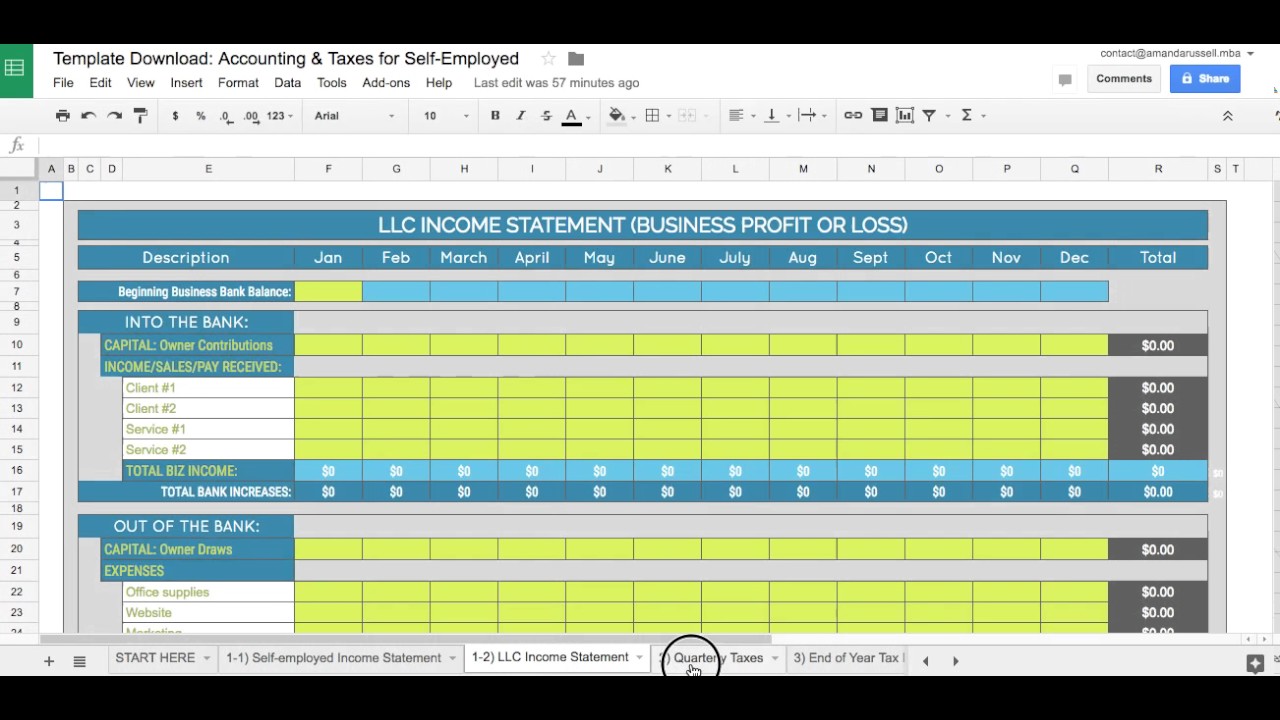

Self-employed Individuals - Tax Guide and Template Self-employed Individuals - Tax Guide and Template. As mentioned a few weeks ago, I have prepared an Excel template for self-employed individuals to use to keep better track of their income and expenses. Use of this template will allow tax time to go by much smoother, as all of your expenses will be summarized in a manner that your tax preparer ...

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

PDF Self-Employed/Business Monthly Worksheet - mirtocpa.com Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

Publication 535 (2021), Business Expenses - IRS tax forms Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Self-Employed Business Expense Worksheet - Cimpress Business Cards Bank Char es CD, DVD Blanks Client Gifts BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses.

PDF Schedule C Worksheet for Self Employed Businesses and/or ... - Kristels Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "44 self employed business expenses worksheet"

Post a Comment