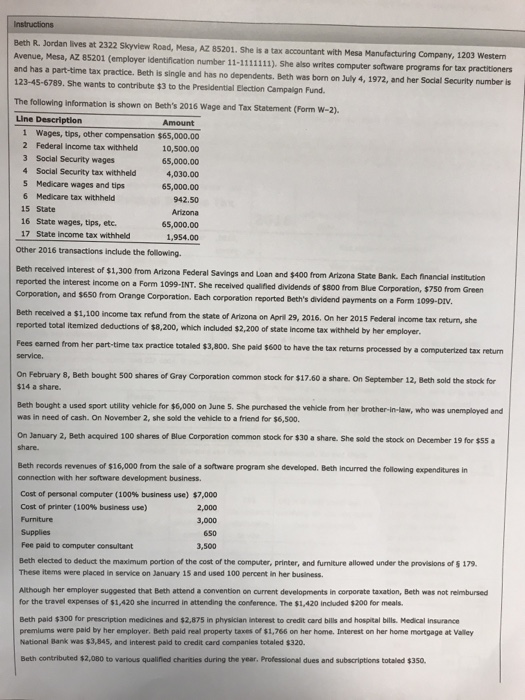

38 2015 qualified dividends and capital gain tax worksheet

› taxes › capital-gains-tax-rates2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year (also known as a long term investment). The long-term capital gains tax rate is 0%, 15% or 20% ... › publications › p590aPublication 590-A (2021), Contributions to Individual ... Sue isn’t covered by an employer plan. Ed contributed $6,000 to his traditional IRA and $6,000 to a traditional IRA for Sue (a Kay Bailey Hutchison Spousal IRA). Their combined modified AGI, which includes $2,000 interest and dividend income and a large capital gain from the sale of stock, is $200,555.

› instructions › i5227Instructions for Form 5227 (2021) | Internal Revenue Service The excess of the net long-term capital gain over the net short-term capital loss for that year is, to the extent not deemed distributed, a long-term capital gain carryover to the next tax year. The excess of the 28.8% rate net long-term capital gain over the net short-term capital loss for that year is, to the extent not deemed distributed, a ...

2015 qualified dividends and capital gain tax worksheet

› publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... There may not be any 30% tax on certain short-term capital gain dividends from sources within the United States that you receive from a mutual fund or other RIC. The mutual fund will designate in writing which dividends are short-term capital gain dividends. This tax relief will not apply to you if you are present in the United States for 183 ... › fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing. › publications › p502Publication 502 (2021), Medical and Dental Expenses If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ...

2015 qualified dividends and capital gain tax worksheet. › instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... › publications › p502Publication 502 (2021), Medical and Dental Expenses If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... › fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing. › publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... There may not be any 30% tax on certain short-term capital gain dividends from sources within the United States that you receive from a mutual fund or other RIC. The mutual fund will designate in writing which dividends are short-term capital gain dividends. This tax relief will not apply to you if you are present in the United States for 183 ...

0 Response to "38 2015 qualified dividends and capital gain tax worksheet"

Post a Comment