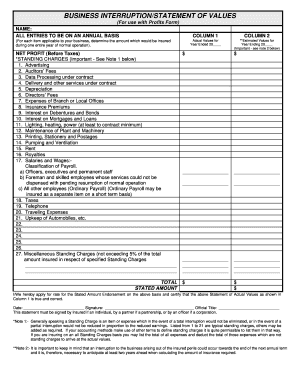

40 business interruption insurance worksheet

› terms › bBusiness Income Coverage Form - Investopedia Oct 03, 2021 · Business Income Coverage Form: An insurance policy that covers a company's loss of income due to a slowdown or temporary suspension of its normal operations stemming from damage to its physical ... › businessBusiness Insurance: Get a Business Insurance Quote | Allstate Business insurance helps protect your business from financial damages caused by accidents, lawsuits and more. Get a free insurance quote today.

content.naic.org › consumer_glossaryConsumer Glossary - National Association of Insurance ... Insurance Holding Company System - consists of two or more affiliated persons, one or more of which is an insurer. Insurance Regulatory Information System (IRIS) - a baseline solvency screening system for the National Association of Insurance Commissioners (NAIC) and state insurance regulators established in the mid-1970s.

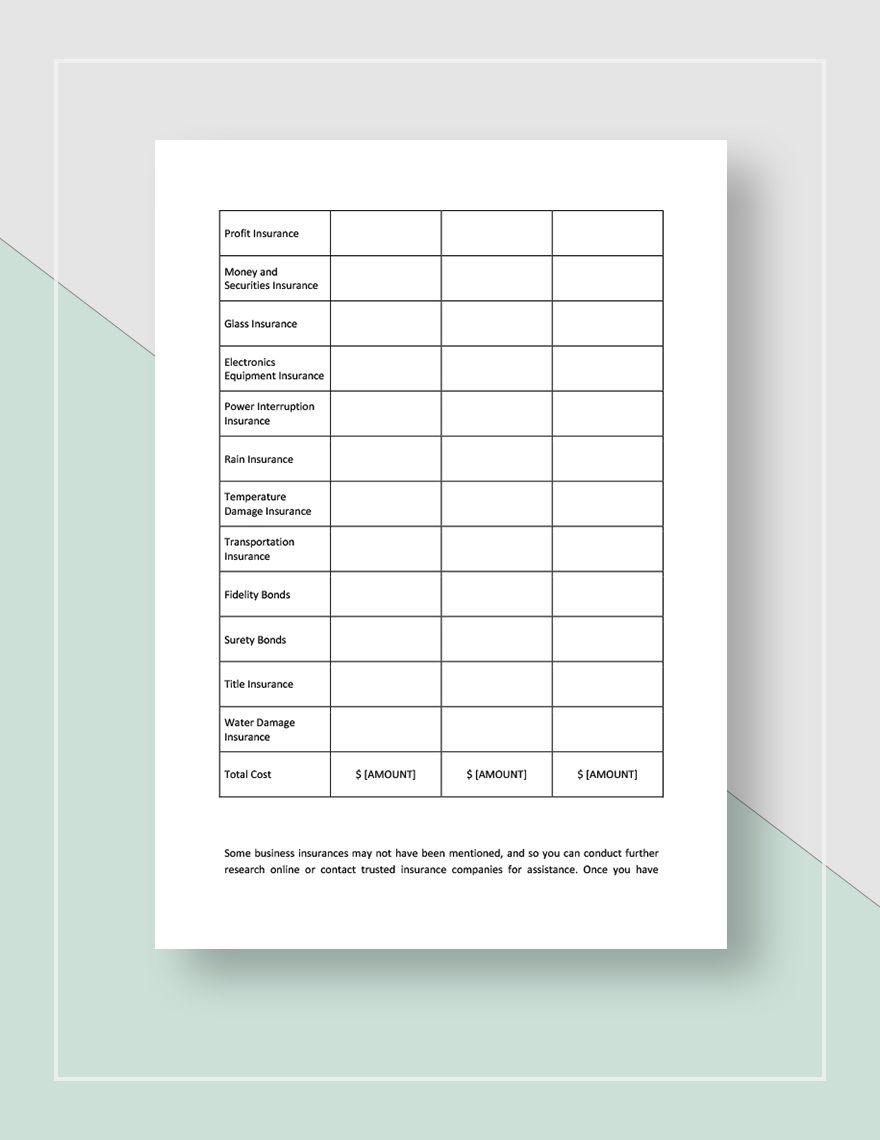

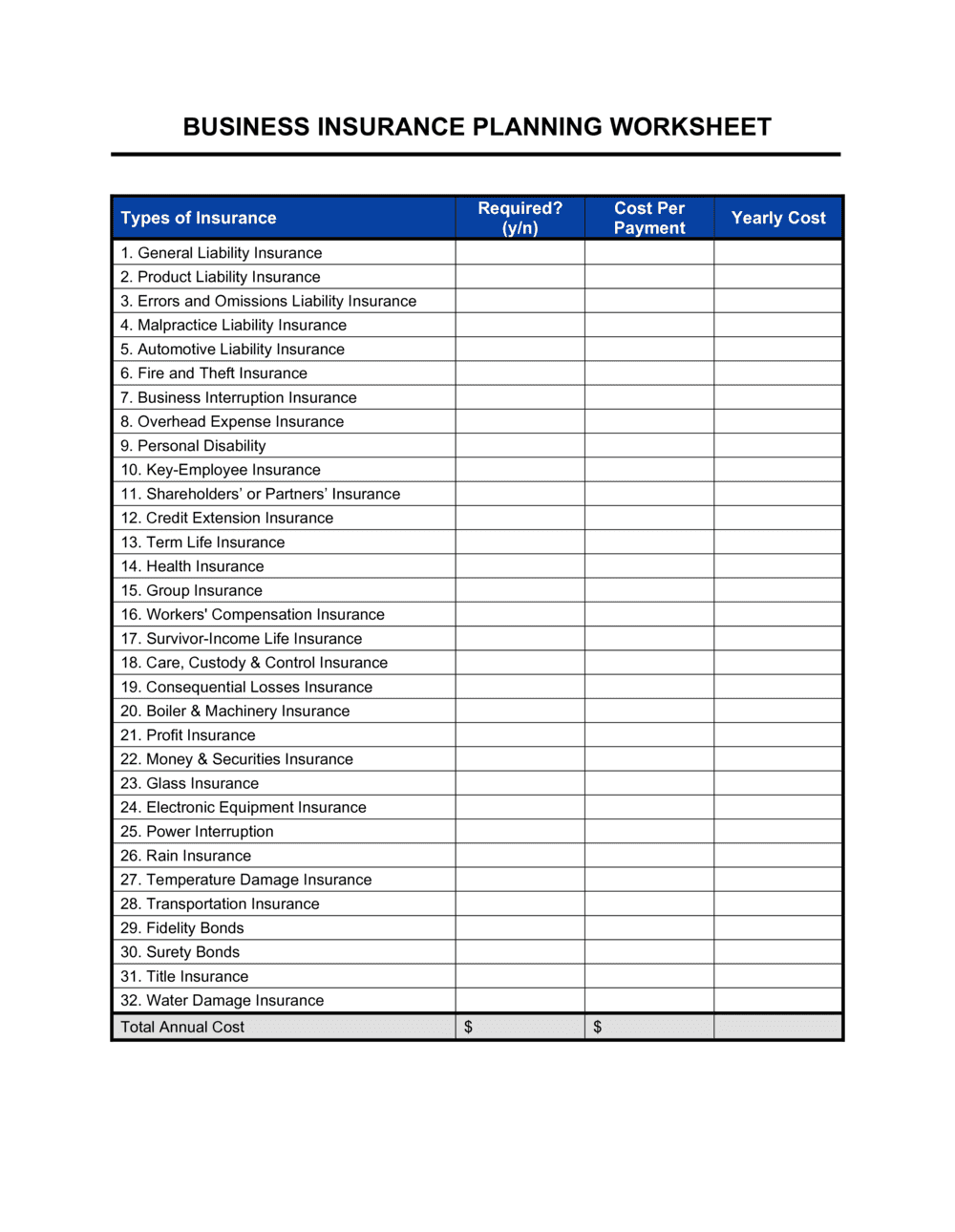

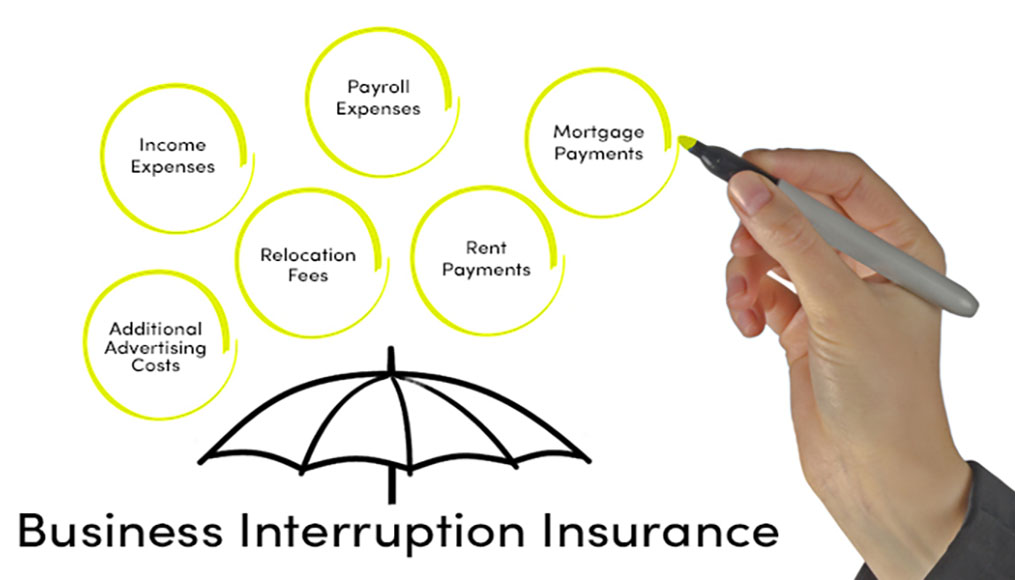

Business interruption insurance worksheet

› publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. › business-continuity-planBusiness Continuity Plan | Ready.gov May 26, 2021 · When business is disrupted, it can cost money. Lost revenues plus extra expenses means reduced profits. Insurance does not cover all costs and cannot replace customers that defect to the competition. A business continuity plan to continue business is essential. Development of a business continuity plan includes four steps: › business-insurance › calculateHow to Calculate Business Income for Insurance | The Hartford Business income insurance can help cover these payroll costs. Utilities. For example, say you need to pay for utilities for the next two months while your business is being repaired. However, you can’t open your operation until after the repairs are finished. Your business income insurance can step in and help pay for your utility bills. Lost ...

Business interruption insurance worksheet. › travel-insurance-plansTravel Insurance Plans | BMO Travel Services Trip Interruption - If there is a death in your family or you or your travel companion becomes ill, get up to $2,000 towards extra cost of a one-way economy airfare to your departure point or destination and any unused non-refundable land arrangements to a maximum of $2,000 per insured person › business-insurance › calculateHow to Calculate Business Income for Insurance | The Hartford Business income insurance can help cover these payroll costs. Utilities. For example, say you need to pay for utilities for the next two months while your business is being repaired. However, you can’t open your operation until after the repairs are finished. Your business income insurance can step in and help pay for your utility bills. Lost ... › business-continuity-planBusiness Continuity Plan | Ready.gov May 26, 2021 · When business is disrupted, it can cost money. Lost revenues plus extra expenses means reduced profits. Insurance does not cover all costs and cannot replace customers that defect to the competition. A business continuity plan to continue business is essential. Development of a business continuity plan includes four steps: › publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200.

0 Response to "40 business interruption insurance worksheet"

Post a Comment