40 like kind exchange worksheet

Aerocity Escorts & Escort Service in Aerocity @ vvipescort.com Aerocity escort are one of a kind as they do traditional sexual moves that make men go crazy for them. We at our escort agency believe that honesty is the best policy; we carry out our services in a very genuine manner. ... While things like French kissing with tongue are in the grey area, note we only arrange for the meet point, date time and ... Instructions for Form 8824 (2021) | Internal Revenue Service If you made more than one like-kind exchange, you can file a summary on one Form 8824 and attach your own statement showing all the information requested on Form 8824 for each exchange. ... Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for business or investment. Fill out only lines 15 ...

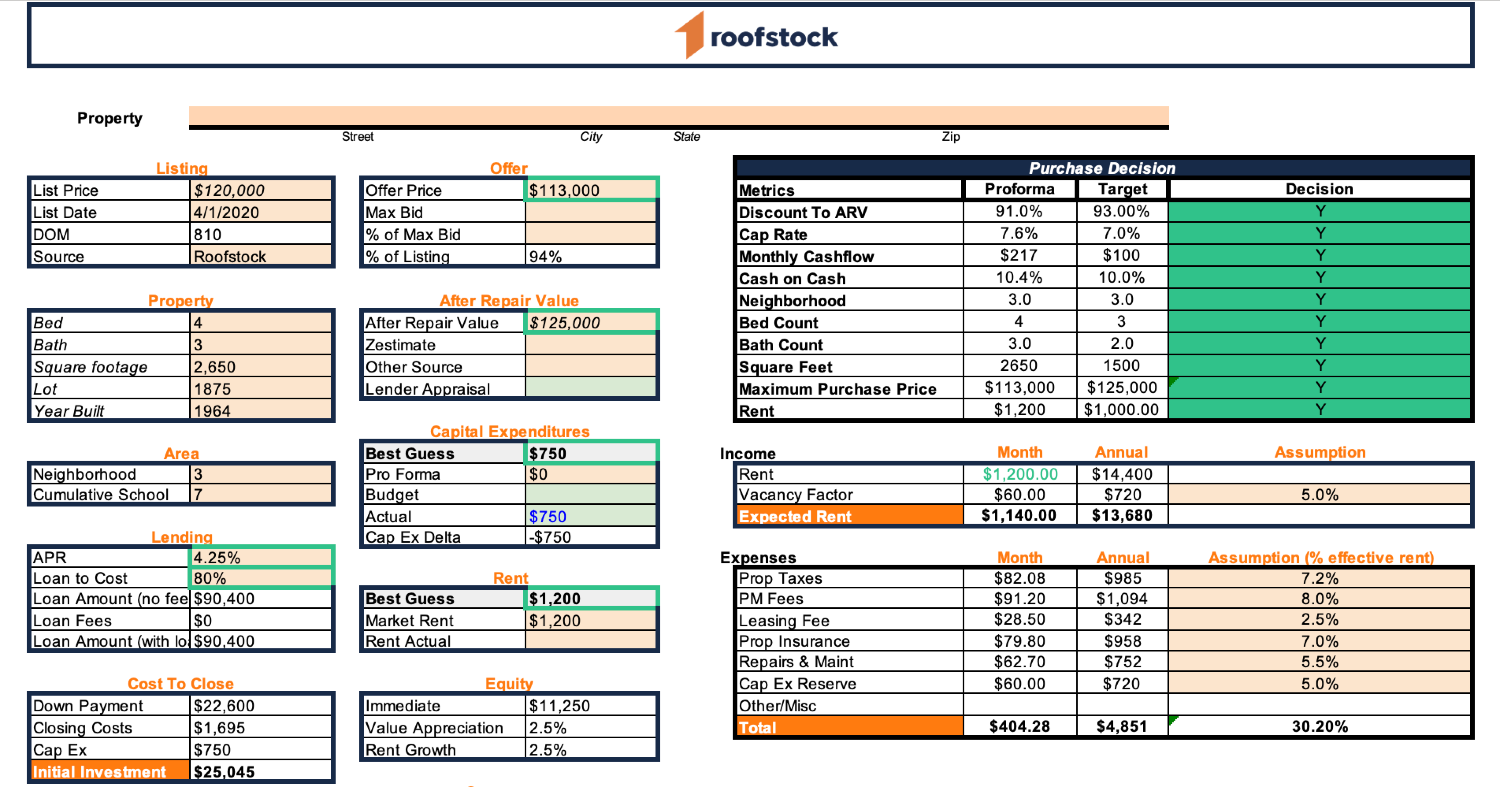

1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements

Like kind exchange worksheet

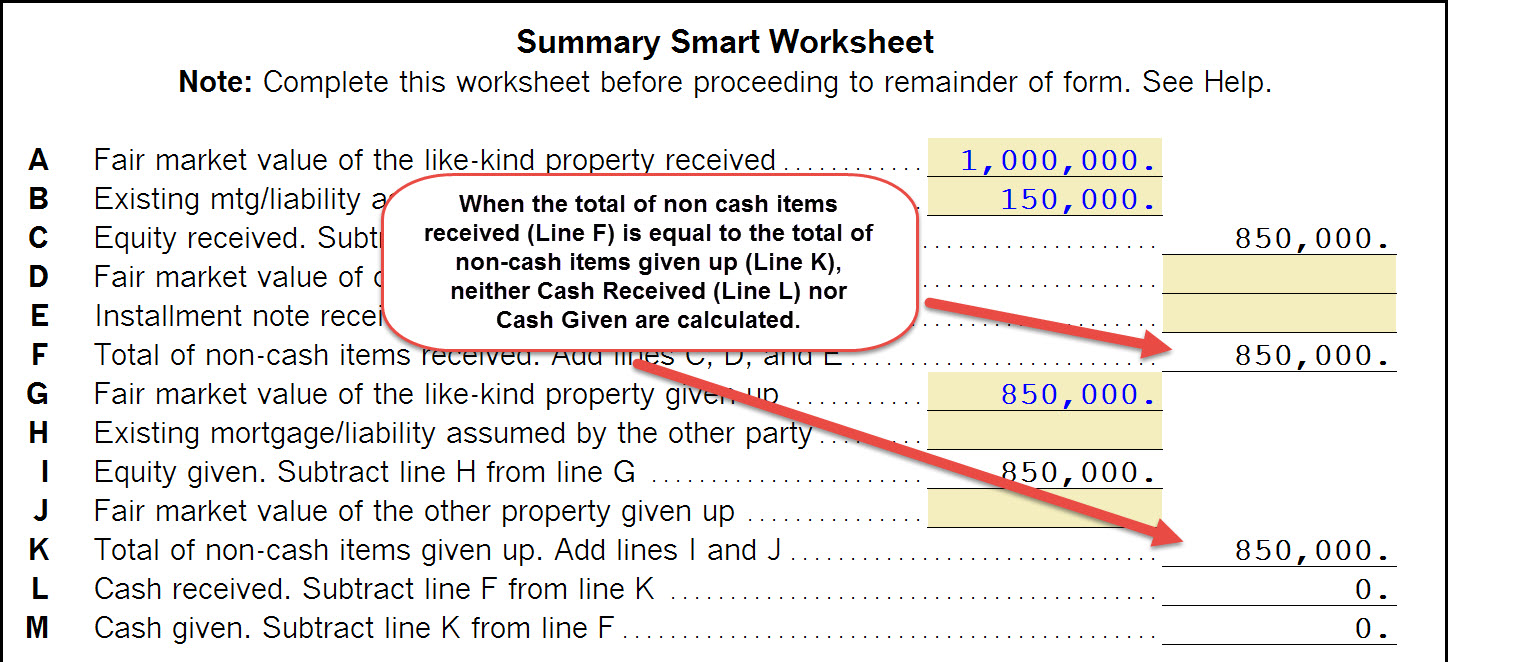

Publication 523 (2021), Selling Your Home | Internal Revenue Service See Like-kind/1031 exchange. You used the entire property as a vacation home or rental after 2008 or you used a portion of the home, separate from the living area, for business or rental purposes. ... For each number, take the number from your “Total” worksheet, subtract the number from your “Business or Rental” worksheet, and enter the ... Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. Mortgage loan - Wikipedia A mortgage loan or simply mortgage (/ ˈ m ɔːr ɡ ɪ dʒ /), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process …

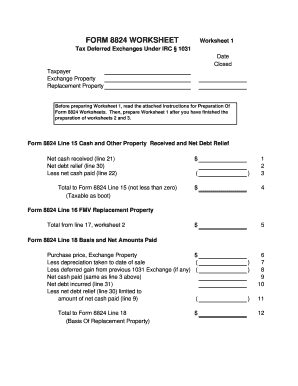

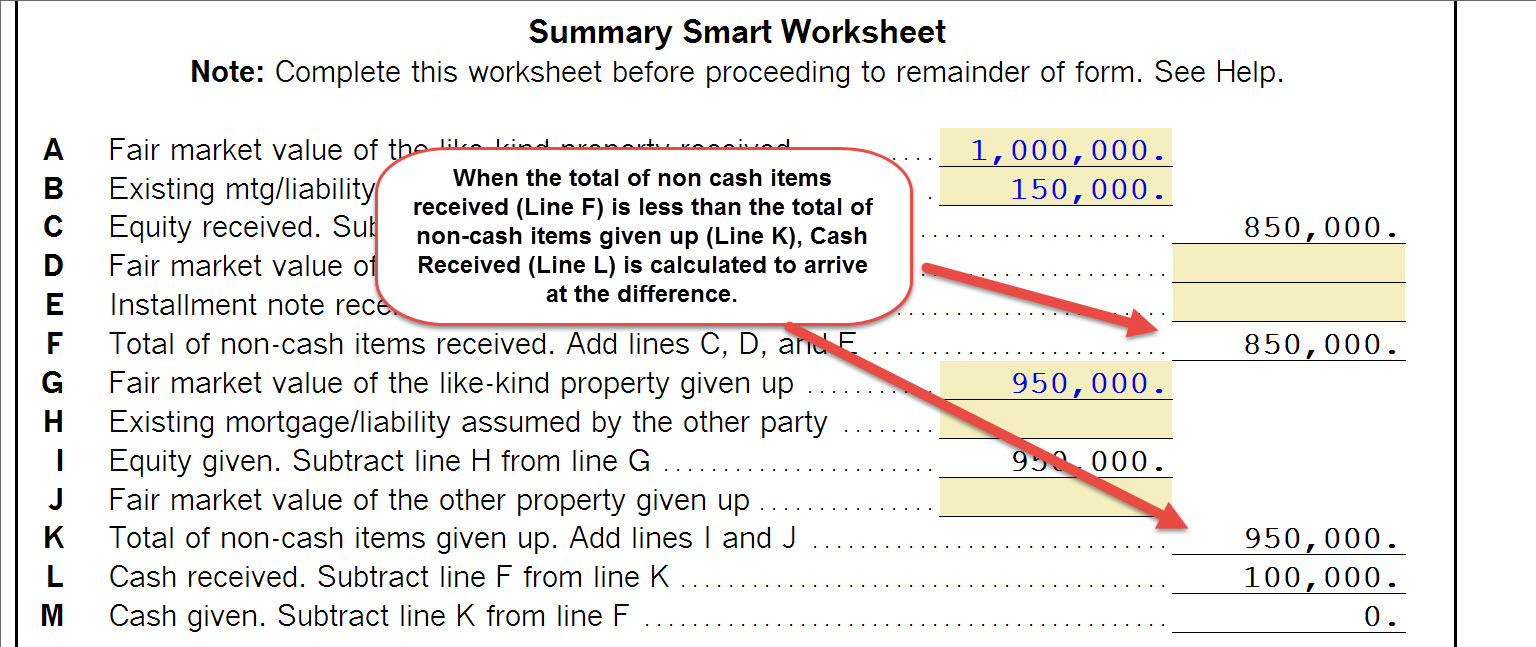

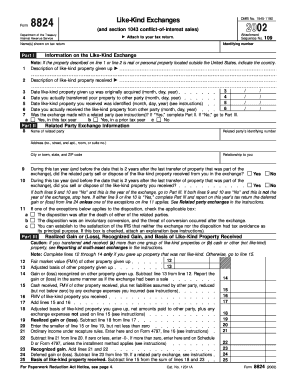

Like kind exchange worksheet. Like Kind Exchange Vehicle Worksheet And Like Kind ... - Pruneyardinn Worksheet April 17, 2018. We tried to get some amazing references about Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) 1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____ Asset Worksheet for Like-Kind Exchange - Intuit Asset Worksheet for Like-Kind Exchange. I have exchanged a rental property, which had Asset Worksheets (for example) for House, Renovation, Roof, and Land. The new property has Building (27.5 yrs), Site Improvements (15 yrs), and Land. I've got the entries in Schedule E for both the relinquished and replacement properties, as well as the 8824 ... Classroom Resources - National Council of Teachers of Mathematics When students become active doers of mathematics, the greatest gains of their mathematical thinking can be realized. Both members and non-members can engage with resources to support the implementation of the Notice and Wonder strategy on this webpage. Publication 334 (2021), Tax Guide for Small Business It is the most common type of nontaxable exchange. To be a like-kind exchange, the property traded and the property received must be both (i) real property, and (ii) business or investment property. Report the exchange of like-kind property on Form 8824, Like-Kind Exchanges. For more information about like-kind exchanges, see chapter 1 of Pub. 544.

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the Dispositions section. Knowledge Base Solution - How do I complete a like-kind exchange in a ... Note the schedule and entity number of the like-kind exchange. Example: Schedule E entity 1 Go to the Income/Deductions > Rent and Royalty worksheet. Select section 7 - Depreciation and Amortizationand select Detail. Select section 1 - General. Line 23 - Sale Number, input the number of the sale. About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales. Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet. This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We always effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for people who seek an image according specific topic, you can find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms taxpayer exchanges for like-kind property of lesser value. This fact sheet, the 21. st in the Tax Gap series, provides additional guidance to taxpayers regarding the rules and regulations governing deferred like-kind exchanges. Who qualifies for the Section 1031 exchange? Owners of investment and business property may qualify for a Section 1031 ...

IA 8824 Like Kind Exchange Worksheet 45-017 | Iowa Department Of Revenue Stay informed, subscribe to receive updates. Subscribe to Updates. Footer menu. About; Contact Us; Taxpayer Rights; Website Policies

1031 Like Kind Exchange Calculator - Excel Worksheet Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Search This Site. Smart 1031 Exchange Investments. We don't think 1031 exchange investing should be so difficult.

EUBAM – EU Border Assistance Mission to Moldova and Ukraine Integrated Border Management, or IBM, may sound like another piece of technical jargon, but is actually the concept the EU has embraced for coherent and coordinated border management systems. It is designed to ensure that Governments maintain secure borders with as little inconvenience to travelers and cross-border trade as possible. It ...

Like Kind Exchange Worksheet - The Math Worksheets Like kind exchange worksheet 1031 exchange calculator excel. Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. It was coming from reputable online ...

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

1031 Exchange Examples | 2022 Like Kind Exchange Example The IRS considers all "Investment Properties" to be "Like-Kind." Properties do not need to be the same type. For example, raw land can be exchanged for an office building, a warehouse can be exchanged for NNN retail property, or a rental house for a Replacement Property Interest in a 300-unit apartment complex.

Mortgage loan - Wikipedia A mortgage loan or simply mortgage (/ ˈ m ɔːr ɡ ɪ dʒ /), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process …

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

Publication 523 (2021), Selling Your Home | Internal Revenue Service See Like-kind/1031 exchange. You used the entire property as a vacation home or rental after 2008 or you used a portion of the home, separate from the living area, for business or rental purposes. ... For each number, take the number from your “Total” worksheet, subtract the number from your “Business or Rental” worksheet, and enter the ...

_(800_x_450_px)_(8).png)

0 Response to "40 like kind exchange worksheet"

Post a Comment