40 mortgage credit analysis worksheet

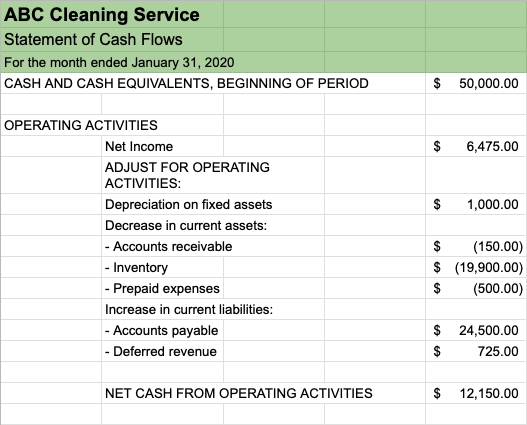

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. IRS Form 1040 – Individual Income Tax Return Year_____ Year_____ 1. W-2 Income from Self … FREE Spreadsheet Downloads - mortgage-investments.com Real Estate & Mortgage FREE Microsoft ®Excel Spreadsheets You may also be interested in our online calculators Security Our spreadsheets do not use Macros and have been used for years without any problems. Please ensure you only download these spreadsheets from our site. Our spreadsheets are locked and formulas are hidden.

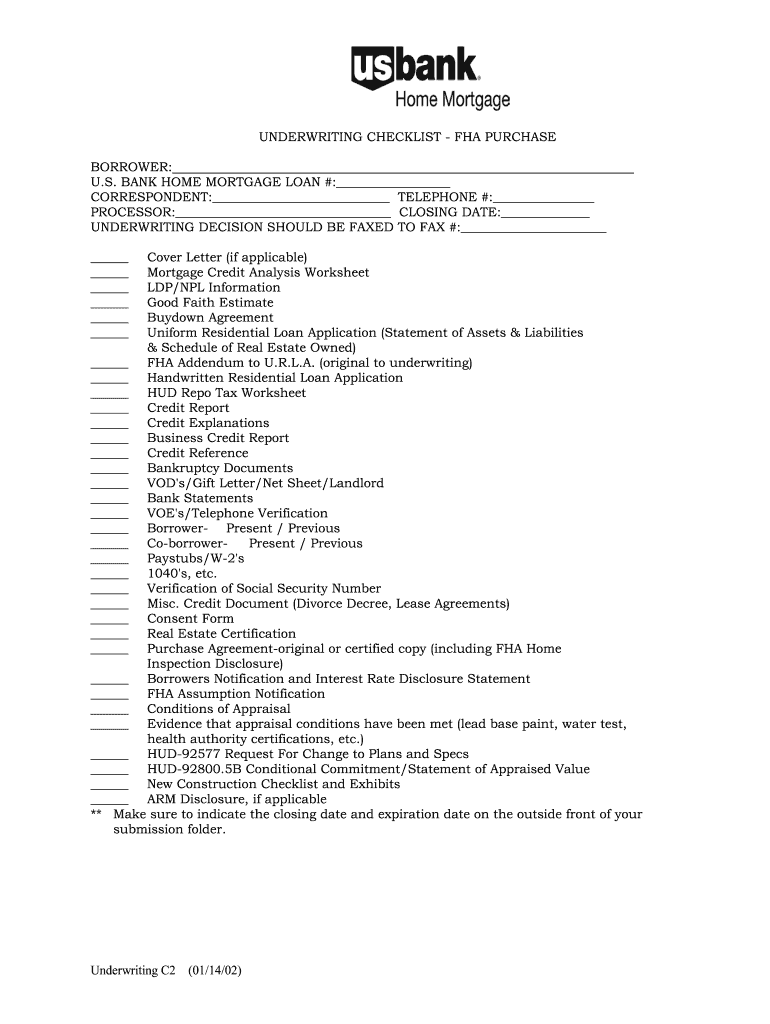

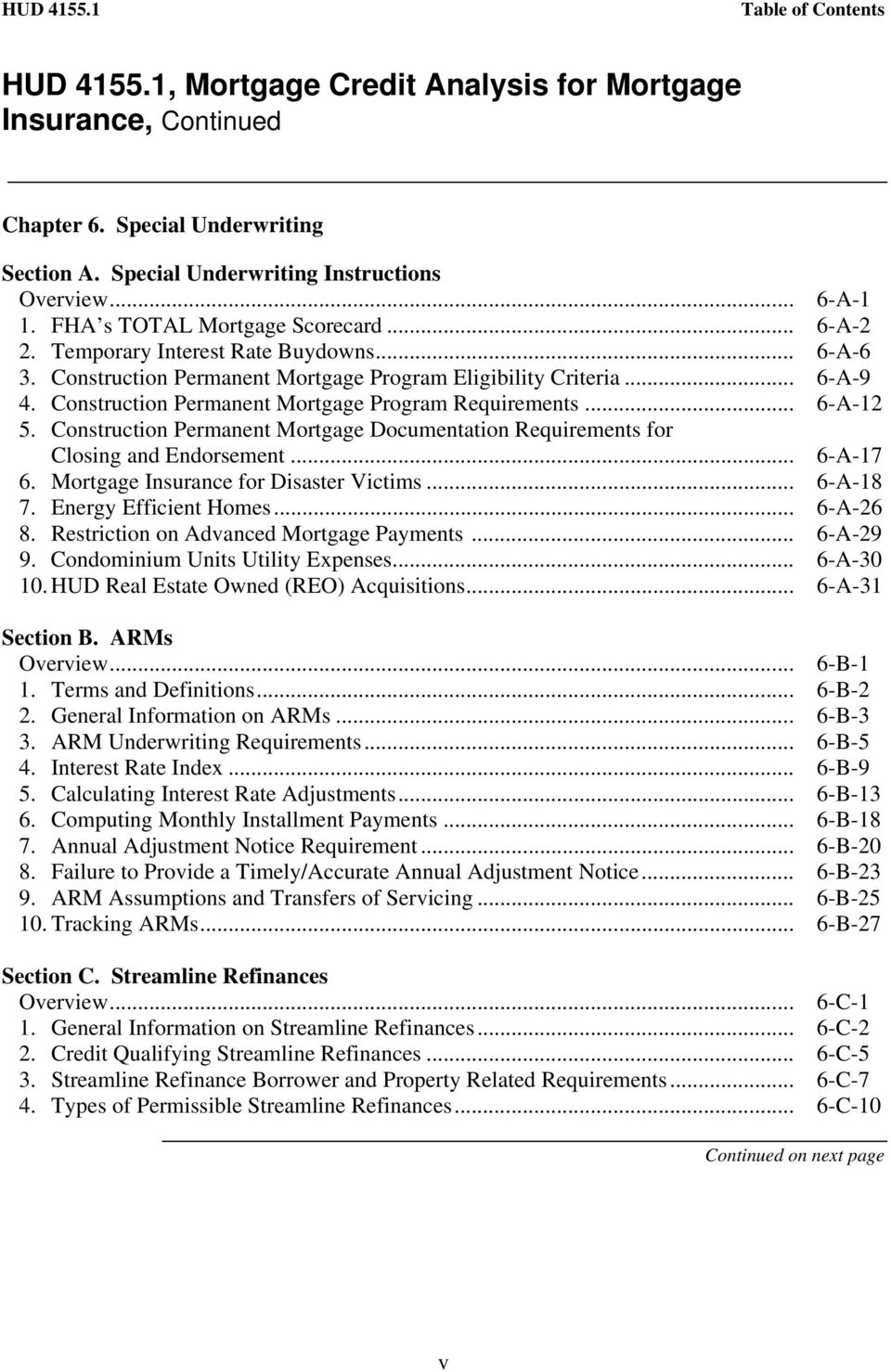

PDF Mortgage Credit Analysis for Mortgage Insurance on One- to Four-Unit ... Mortgage Credit Analysis Worksheet Purchase Money Mortgage 2502-0059 HUD 92900-WS Mortgage Credit Analysis Worksheet 2502-0059 HUD-1 Settlement Statement 2502-0265 GFE Good Faith Estimate HUD 92300 Mortgagee Assurance of Completion 2502-0189 URAR (FNMA 1004 / FHLMC 70) Uniform Residential Appraisal Report N/A ...

Mortgage credit analysis worksheet

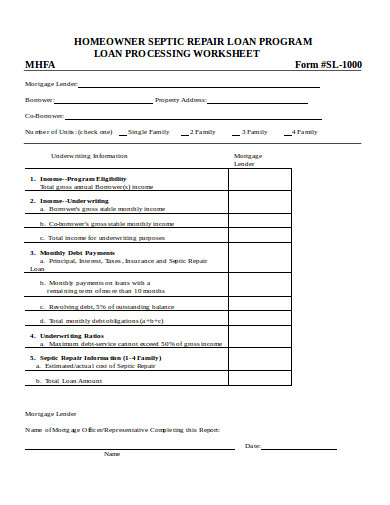

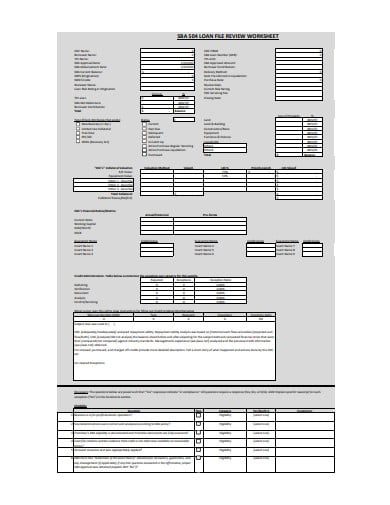

Commercial Mortgage Loan Analysis Model (Updated Jun 2022) Download the Commercial Mortgage Loan Analysis Model To make this model accessible to everyone, it is offered on a "Pay What You're Able" basis with no minimum (enter $0 if you'd like) or maximum (your support helps keep the content coming - typical real estate Excel models sell for $100 - $300+ per license). PDF Mortgage Credit U.S. Department of Housing Analysis Worksheet and Urban ... The Mortgage Credit Analysis Worksheet (MCAW) (HUD-92900-PUR) has been revised to reflect changes to FHA's treatment of closing costs. Line 10c Unadjusted Acquisition: This reflects the amount the buyer has agreed to pay for the property as well as any closing c osts to be paid by the borrower from Line 5c. DOC Filling out the Mortgage Credit Analysis Worksheet The following is a description of the steps to be taken when completing any of the Section 184 Mortgage Credit Analysis Worksheets (MCAWs). Determine the type of transaction you are working with. Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction.

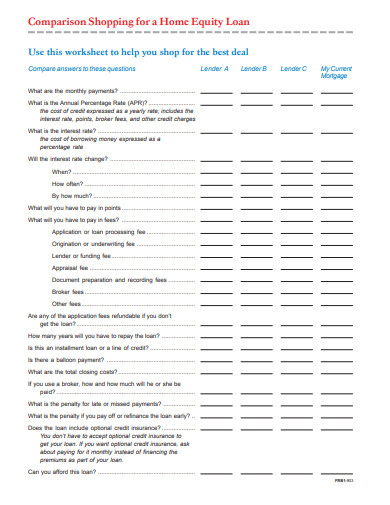

Mortgage credit analysis worksheet. Microsoft Excel Mortgage Calculator with Amortization Schedule Our Excel mortgage calculator spreadsheet offers the following features: works offline easily savable allows extra payments to be added monthly shows total interest paid & a month-by-month amortization schedule Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions The calculator updates results automatically when you change any input. PDF Mortgage Comparison Worksheet - Freddie Mac Use this worksheet to help you identify the mortgage option that is best for your situation and financial goals. Lender 1 Lender 2 Name of Lender Name of Contact Date of Contact Mortgage Amount Mortgage 1 Mortgage 2 Mortgage 1 Mortgage 2 Basic information on the loans Type of mortgage: fixed-rate, adjustable rate, other? If adjustable, see below Credit Analysis | What Credit Analyst Look for? 5 C's | Ratios Credit Analysis Definition. Credit analysis is a process of concluding available data (both quantitative and qualitative) regarding the creditworthiness of an entity and making recommendations regarding the perceived needs and risks. Credit Analysis is also concerned with identifying, evaluating, and mitigating risks associated with an entity ... The Best Free Debt-Reduction Spreadsheets - The Balance The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet. 1. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest ...

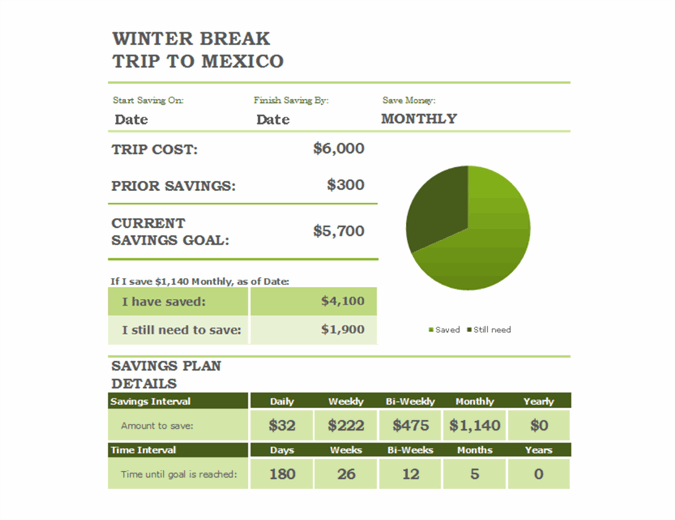

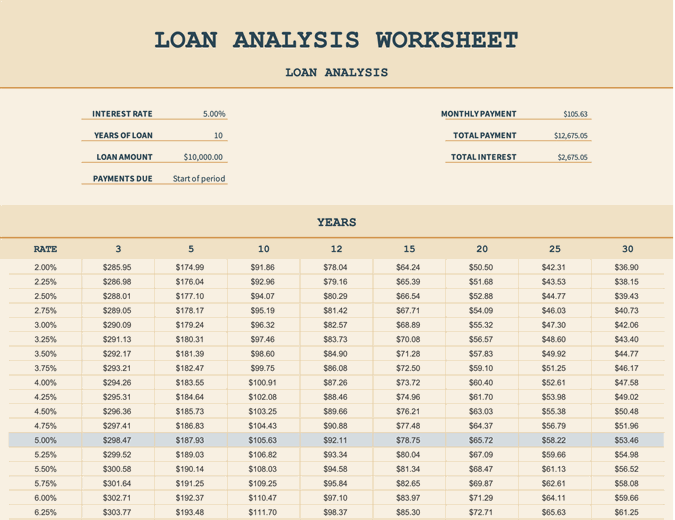

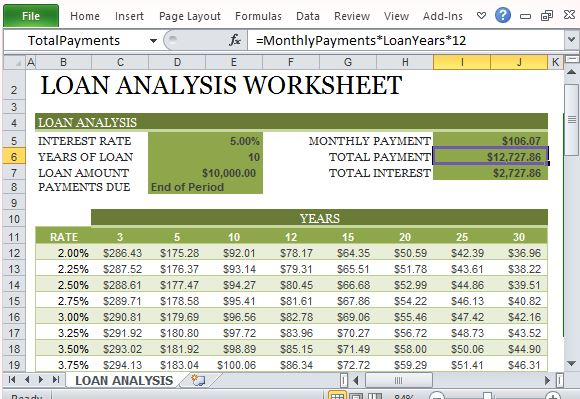

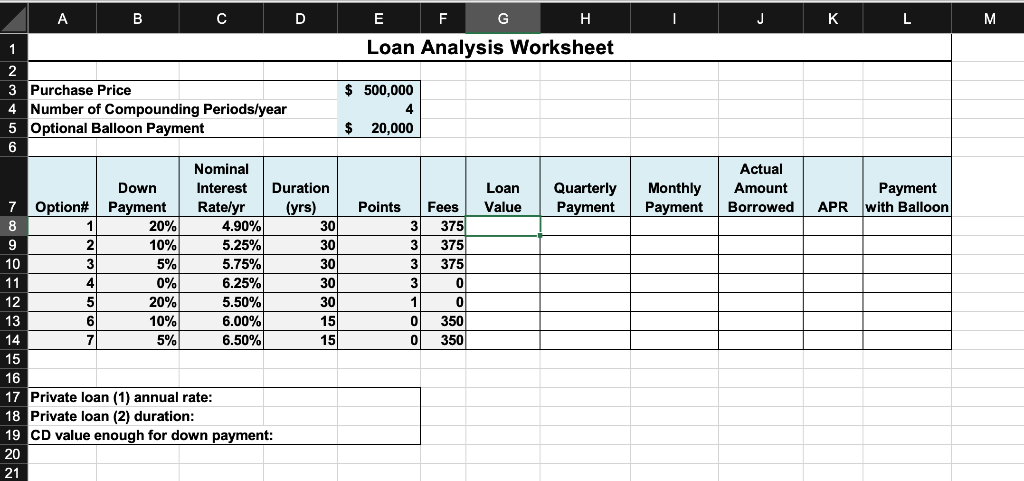

Budgeting, Worksheets, Lesson Plans, Teaching Household … CREDIT CARDS : Credit Cards. Credit cards, credit, and paying interest. A fundamental understanding of credit cards is important since people often exceed their budget by overspending on their credit card. Use these lessons to help with your understanding of credit and credit cards. REAL WORLD BUDGETING - COTTAGE BUDGET : Cottage Budget Lesson MCAW - Mortgage Credit Analysis Worksheet (US Department of Housing and ... Metavante's Loan Origination Studio supports the EHA Loan Transmittal, the Maximum Mortgage Worksheet for 203 (k) and 203 (k) Streamline Loans and the Mortgage Credit Analysis worksheets, according to Cy Brinn, president of Metavante Lending Solutions. Metavante offers tech support for new FHA loan requirements Loan analysis worksheet - templates.office.com Loan analysis worksheet Use this accessible template to analyze various loan scenarios. Enter the interest rate, loan term, and amount, and see the monthly payment, total payments, and total interest calculated for you. Other interest rates and loan terms are provided for comparison to help you make the choice that's right for your situation. Excel PDF Calculator and Quick Reference Guide: Fannie Mae Cash Flow Analysis Note: IRS Form 4797 (Sales of Business Property) is not included on this worksheet due to its infrequent use. If applicable, a lender may include analysis of the sale and related recurring capital gains. Page 1 of 4 Borrower(s) Name(s) Property Address Loan Number For full functionality, download and save PDF first before entering data.

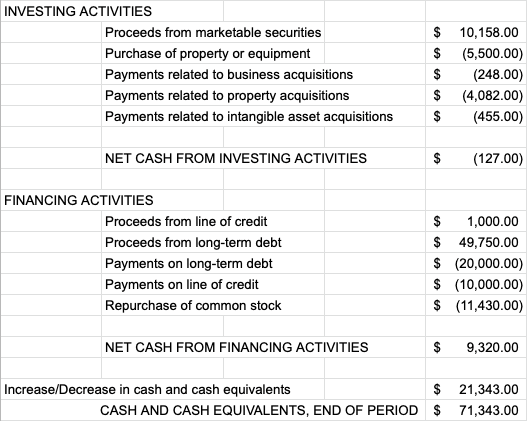

PDF Global Cashflow Worksheet - Lender's Online Training Schedule Analysis Method: Enter Net Profit AGI Method: Do not enter net profit. It is already in AGI. LOC (Line of Credit): Line of Credit (LOC) interest-only payments are simply 'rent' on a short-term use of credit. 1) Three common methods a) Subtract annual interest-only payments. b) Subtract the annual interest payments that would occur ... XLSX United States Department of Housing and Urban Development Mortgage Credit Analysis Worksheet c. Sales Concession (subtract this amount) d. Acquisition costs (sum of lines 14a + b - c) Form HUD-50132 (1/01/14) Streamline with Appraisal Refinances b. Interest Due to payoff d. Subordinate Mortgage(s) Interest Due b. Interest Due to payoff d. Subordinate Mortgage(s) Interest Due (1.5% of max. mortgage) PDF LOAN ANALYSIS - Veterans Affairs 45. PAST CREDIT RECORD 48A. VALUE. 48B. EXPIRATION DATE €47. REMARKS€ (Use reverse or attach a separate sheet, if necessary) 48C. ECONOMIC LIFE YRS. CRV DATA (VA USE) €46. DOES LOAN MEET VA CREDIT STANDARDS?€ (Give reasons for decision under "Remarks," if € necessary, e.g., € borderline case) SATISFACTORY UNSATISFACTORY. YES AMOUNT ... EconEdLink - All Grades No Credit? No worries! This webinar introduces the latest innovations in the world of credit. Learn about the pros and... Key Concepts: Credit. 60 mins . Oct 04 5:00-6:00pm ET. Webinar . Save Lesson. See On-Demand Webinar . Grades 9-12. Teaching Personal Finance in the 21st Century: TikTok and Personal Finance. In this webinar, teachers will learn how social media …

Top 10 Reverse Mortgage Counseling Agencies (Free & Online … 15/03/2022 · Search our free list of reverse mortgage counseling agencies including cost & availability (Phone, online or in-person). Instant Quote by ARLO™. Get Real-Time Rates, Counseling Docs + Built-In Program Advice! Menu (800) 565-1722. ARLO™ Calculator. America’s #1 rated reverse mortgage lender. Your instant quote includes eligibility, real-time rates + built …

Credit Analysis Excel Template - PropertyMetrics Download your free credit analysis Excel template today. Use this free credit analysis template to "spread" several years of financial statements for a company and then automatically calculate several helpful credit analysis ratios. This free template is designed to help you: Spot trends over time in financial statements for a single business.

Quiz & Worksheet - Title Insurance | Study.com The following quiz and worksheet have been created to help you review title insurance and its purpose. You will be quizzed on terms, such as encumbrance and involuntary encumbrance.

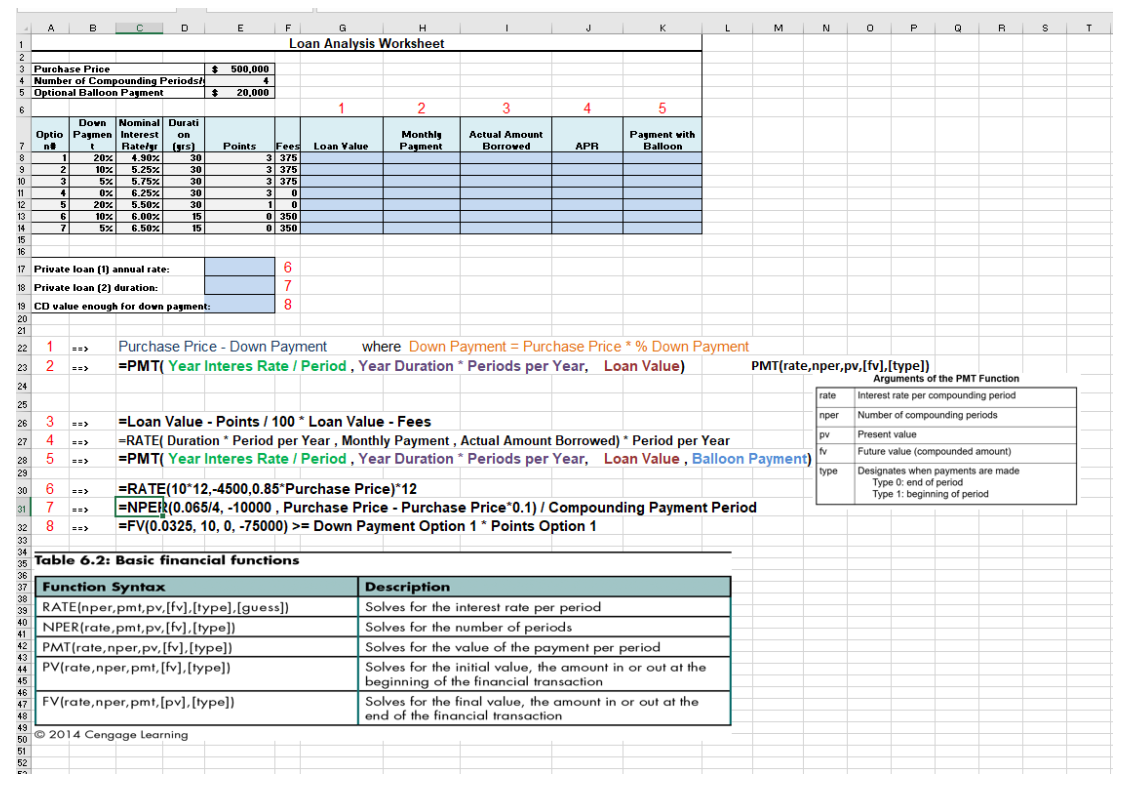

How To Create A Loan Analysis Worksheet in Excel - FPPT Aside from this, the loan analysis worksheet template can help you determine how much of your monthly payments go towards your loan and how much goes towards the interest. This will help you set your own financial goals, especially when it comes to budgeting your monthly expenses to accommodate loan or mortgage payments.

PDF HUD 4155.1, Mortgage Credit Analysis for Mortgage Insurance HUD 4155.1, Mortgage Credit Analysis for Mortgage Insurance, Continued 6. Eligibility Requirements for Nonprofit Organizations and State and Local Government Agencies ..... 4-A-18 7. Using CAIVRS to Determine Eligibility for FHA Insured Mortgage Transactions 4-A-21

PDF MPF Quality Control Review Documentation Worksheet Proof mortgage being refinanced is current at the time of the new loan closing (e.g., payoff statement, VOM, or credit supplement). Verification of Mortgage or other documentation to verify mortgage payment history not on the credit report. Miscellaneous Credit Documentation Proof of sale of previous residence to confirm previous mortgage paid off

Mortgage Loan Calculator - templates.office.com Mortgage Loan Calculator. Get a quick and clear picture of what it will take to pay off your mortgage with this accessible mortgage loan calculator template. This professional mortgage loan calculator template includes loan details, key statistics, and an amortization table. Excel. Download Open in browser.

Mortgage Analysis Worksheet Below is a worksheet you can use to start to do some economic analysis to compare mortgages. The first seven lines set the basis for the analysis and the remaining lines track the balance of the mortgage from the initial loan balance until the loan is paid off, a process known as amortization. Note: Payments 4 through 359 are not shown.

PDF CREDIT ANALYSIS WORKSHEET OMB Approval No. 2502-0059 SALES ESCROW ... The Mortgage Credit Analysis Worksheet has been revised to reflect changes to the percentage of financeable closing costs. Several of the more important changes are discussed below: Line 5 Closing Costs: On line 5a, show the total buyer's closing costs of the transaction. On line 5b, subtract any amount of buyer's closing costs paid by the seller.

Mortgage Credit Analysis Worksheet - How is Mortgage Credit Analysis ... MCAW - Mortgage Credit Analysis Worksheet. Looking for abbreviations of MCAW? It is Mortgage Credit Analysis Worksheet. Mortgage Credit Analysis Worksheet listed as MCAW. Mortgage Credit Analysis Worksheet - How is Mortgage Credit Analysis Worksheet abbreviated?

Canadians and their Money: Key Findings from the 2019 … Executive summary. This report highlights results from the 2019 Canadian Financial Capability Survey (CFCS). The CFCS is designed to shed light on Canadians’ knowledge, abilities and behaviours as they relate to making financial decisions (Keown, 2011; FCAC, 2015).A key objective is to assess how Canadians are doing on indicators of financial well-being and inform …

PDF 203(k) and Streamlined (k) U.S. Department of Housing Maximum Mortgage ... Mortgage Basis (Sum of 10a+b+c minus 10d) Leave Blank. f. (1) Multiply Mort. Basis (10e) by 97/95/90%. (if $50,000 or less, multiply by 97%.) Leave Blank (2) Multiply the Value (line 4) by 97.75%. (if $50,000 or less, multiply by 98.75%) D4, or E1 g. Mortgage (without UFMIP) Note:this may not exceed the lesser of 10f(1) or 10f(2). D5 h.

PDF Loan Transmittal 1st Mortgage - mnhousing Mortgage Credit Analysis Worksheet (HUD Form 92900) Copy Notice to Buyers (Minnesota Housing Form) Copy FHA Conditional Commitment and Specific Conditions Copy Federal Housing Administration (FHA) 203 K Streamlined (in addition to all documents required for FHA loans) Maximum Mortgage Worksheet (HUD-92700) Copy

Free Home Mortgage Calculator for Excel - Vertex42.com 03/12/2021 · Mortgage Loan at Wikipedia.org; Home Mortgage Calculator at Bankrate.com - For an online mortgage calculator, this is a pretty good one. Using a Calculator to Prepay ARM at mtgprofessor.com - Explains what happens if you make extra payments with an adjustable-rate mortgage. Home Equity Lines of Credit (PDF) at FederalReserve.gov - an excellent ...

MS Excel Loan Analysis Worksheet Template | Excel Templates Loan Analysis Worksheet offers a thorough set of tables of rates of a loan through the years for different standings of loans; mortgage, installment, and etc. Our template gives an assortment of little and huge tables for comparison. Make use of this worksheet format to dissect different loan situations.

Help - FHA Connection Single Family Origination This number is entered by the lender (underwriter) on the Mortgage Credit Analysis Worksheet, form HUD-92900-PUR (or form HUD-92900-WS). FHA claim information is reported to CAIVRS for 36 months after a claim is paid. If the borrower has a delinquent Federal debt or has had a claim paid on a Federally insured loan, use the telephone referral ...

Reverse mortgage - Wikipedia A reverse mortgage is a mortgage loan, ... government recording, tax stamps (where applicable), credit reports, etc. Initial mortgage insurance premium (IMIP): The vast majority of closing costs typically can be rolled into the new loan amount (except in the case of HECM for purchase, where they're included in the down payment), so they don't need to be paid out of …

PDF 4240.4 Rev-2 Chapter 4. Mortgage Credit Procedures Complete Form HUD 92700, Section 203(k) Maximum Mortgage Worksheet (Appendix 11), to determine the maximum insurable mortgage amount; make this form a part of the firm commitment. In addition, Form HUD-92900WS (Mortgage Credit Analysis Worksheet) is used to determine the mortgagor's required cash investment and credit worthiness.

Mortgage Credit U.S Department of Housing OMB Approval No. 2577-0200 ... Mortgage Credit U.S Department of Housing OMB Approval No. 2577-0200 Analysis Worksheet and Urban Development Native American Loan Guarantee Program 1a. Borrower's Name xxx-xx- 1b. Co-borrower's Name xxx-xx- $0.00 $0.00 $0.00 8. Current housing expense $0.00 11. First-time homebuyer (yes or no) Monthly Payment Unpaid Balance $0.00 $0.00 $0.00

DOC Filling out the Mortgage Credit Analysis Worksheet The following is a description of the steps to be taken when completing any of the Section 184 Mortgage Credit Analysis Worksheets (MCAWs). Determine the type of transaction you are working with. Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction.

PDF Mortgage Credit U.S. Department of Housing Analysis Worksheet and Urban ... The Mortgage Credit Analysis Worksheet (MCAW) (HUD-92900-PUR) has been revised to reflect changes to FHA's treatment of closing costs. Line 10c Unadjusted Acquisition: This reflects the amount the buyer has agreed to pay for the property as well as any closing c osts to be paid by the borrower from Line 5c.

Commercial Mortgage Loan Analysis Model (Updated Jun 2022) Download the Commercial Mortgage Loan Analysis Model To make this model accessible to everyone, it is offered on a "Pay What You're Able" basis with no minimum (enter $0 if you'd like) or maximum (your support helps keep the content coming - typical real estate Excel models sell for $100 - $300+ per license).

:max_bytes(150000):strip_icc()/GettyImages-181214619-5771ccb05f9b585875175759.jpg)

![Advisor Tool] Survivor Income and Cash Needs Analysis ...](https://i.pinimg.com/originals/ef/04/5a/ef045a90787223bf94713853a2f0087f.jpg)

0 Response to "40 mortgage credit analysis worksheet"

Post a Comment