41 amt qualified dividends and capital gains worksheet

understanding taxes worksheet answers Amt Qualified Dividends And Capital Gains Worksheet - Worksheet List nofisunthi.blogspot.com. dividends amt qualified gains deduction. Taxes Worksheet . Calculating Your Paycheck Worksheet - Worksheet List nofisunthi.blogspot.com. paycheck worksheet calculating calculate teachers ella pay. 33 Chapter 2 Section 4 Creating ... How Do Capital Gains Affect AMT? | The Motley Fool On top of the $150 in capital gains tax, the $1,000 of capital gains income would reduce your exemption by $250. You'd end up paying AMT on that $250. At a 28% rate, that would incur...

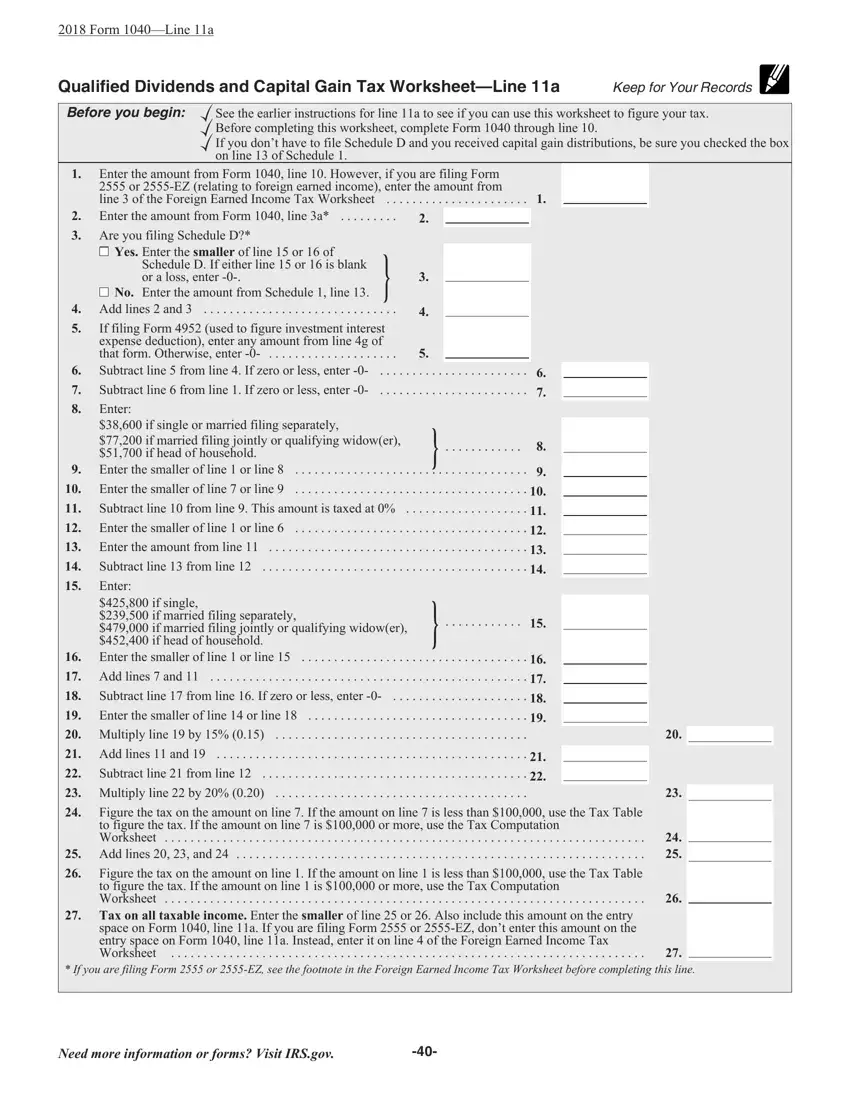

PDF Page 40 of 117 - IRS tax forms See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1.

Amt qualified dividends and capital gains worksheet

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... What is the Qualified Dividends and capital gain Tax Worksheet? The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts. 2021 Instructions for Schedule D (2021) | Internal Revenue Service Enter on Schedule D, line 13, the total capital gain distributions paid to you during the year, regardless of how long you held your investment. This amount is shown in box 2a of Form 1099-DIV. Learn About Alternative Minimum Tax - Fidelity If you have qualified dividends and long-term capital gains, they are taxed at federal rates no higher than 20% for purposes of both the ordinary income tax and the AMT. However, the extra income could reduce or even eliminate the amount of income you can exempt from the AMT. For tax year 2021, the AMT exemption amounts are:

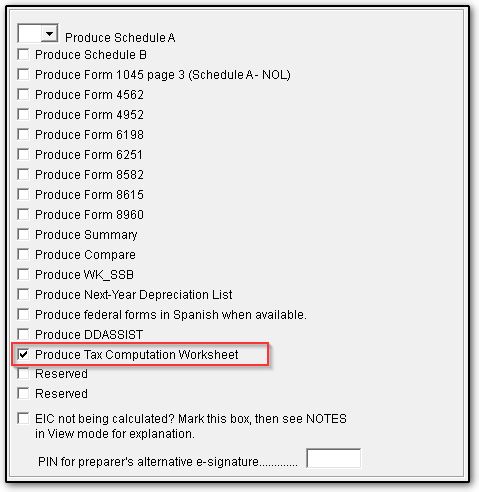

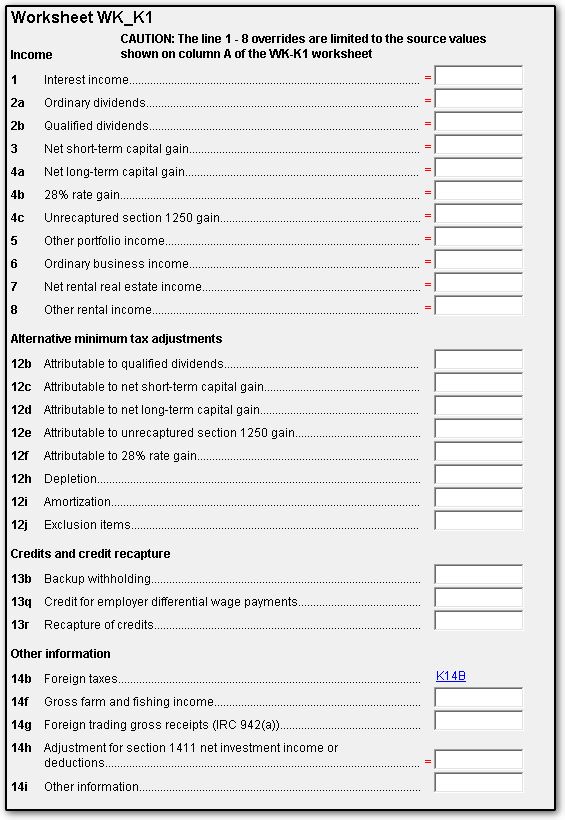

Amt qualified dividends and capital gains worksheet. 1040-US: Estate / Trust K-1 Box 12B - AMT adjustments attributable to ... To enter AMT adjustments reported in Box 12B, access Screen K1T-2, located in the K1 1041 folder, and enter the adjustments in the Qualified dividends field. Amounts entered in this field are added to line 2 of an AMT Qualified Dividends and Capital Gain Tax Worksheet or an AMT Schedule D Tax Worksheet, whichever applies per Form 6251 Instructions. Qualified Dividends And Capital Gains Worksheet ? - 50.iucnredlist qualified-dividends-and-capital-gains-worksheet 2/15 Downloaded from 50.iucnredlist.org on October 20, 2022 by guest requirements, exemptions, income, deductions, tax credits, shelters, and tax law. J.K. Lasser's Your Income Tax 2013 J.K. Lasser Institute 2012-10-05 America's number one bestselling tax guide offers the best balance of Amt Qualified Dividends And Capital Tax 2017 - K12 Workbook Displaying all worksheets related to - Amt Qualified Dividends And Capital Tax 2017. Worksheets are 2017 form 6251, Capital gain tax work pdf, Specific to, Prepare and e file your federal tax return for, And losses capital gains, Tax deduction locator irs trouble minimizer, I 335, Calculations not supported in the 2017 turbotax individual. 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gains Flowchart - The Tax Adviser It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations ( Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate. 2022 Download Qualified Dividends Worksheet - WRKSHTS Qualified Dividends And Capital Gain Tax Worksheet (2020). A qualified dividend is a type of dividend to which capital gains tax rates are applied. The irs added several lines to schedule d, capital gains and losses, to capture the different rates that apply during 2003 and. By anura gurugeon february 24, 2022 this is not sophisticated or fancy. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Here are the tax rates for Qualified Dividends and Capital Gain: 2021 Qualified Dividend Tax Rate: For Single Taxpayers: For Married Couples Filing Jointly: For Heads of Households: 0%: ... No taxpayer entitled to the dividend income on stocks or mutual funds held is exempt from filing the Qualified Dividends and Capital Gain Tax Worksheet.

AMT and Long-Term Capital Gain - Fairmark.com But the capital gain also reduces your AMT exemption by $25,000 (25 cents on the dollar). The exemption was shielding income that would otherwise be taxed at 28% under the AMT rules. So now, in addition to $20,000 in capital gains tax, the AMT calculation increases by another $7,000 (28% times $25,000). Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit How to calculate the total adjustment amount on Form 1116 Basically, the 5% ratio is the amount from the Qualified Dividends & Capital Gain Tax Worksheet, Line 10/Qualified Dividends & Capital Gain Tax Worksheet, Line 6. The 15% ratio is 1 minus the just-calculated 5% ratio as shown in the preceding line. 2021 Qualified Dividends And Capital Gains Worksheet * Enter the amount from line 3 above on line 1 of the Qualified Dividends and Capital Gain Tax Worksheet or Schedule D Tax Worksheet if you use either of those worksheets to figure the tax on line 4 above. Complete the rest of that worksheet through line 4 (line 10 if you use the Schedule D Tax Worksheet). Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon May 16, 2017 · So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7 ), so they can be taxed at their different rates. Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 (don't do that).

Amt Qualified Dividends And Capital Gains Worksheet All groups and messages ... ...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who've already experienced the key benefits of in-mail signing.

AMT qualified dividends and capital gains workshee... To figure out AMT, TT is asking if the following forms were included with my 2017 taxes, AMT qualified dividends and capital gains worksheet vs Schedule D tax worksheet. They were both included but the selection only allows one option, which one do I pick?

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) ... • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is checked. 1) Enter the amount from Form 1040, line 15. However, if filing Form 2555 (relating to foreign earned income), enter the ...

Qualified Dividends and Capital Gains Worksheet - StuDocu Business Law: Text and Cases Forecasting, Time Series, and Regression Voices of Freedom Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year 2021/2022 Helpful? 7 5 Comments

Learn About Alternative Minimum Tax - Fidelity If you have qualified dividends and long-term capital gains, they are taxed at federal rates no higher than 20% for purposes of both the ordinary income tax and the AMT. However, the extra income could reduce or even eliminate the amount of income you can exempt from the AMT. For tax year 2021, the AMT exemption amounts are:

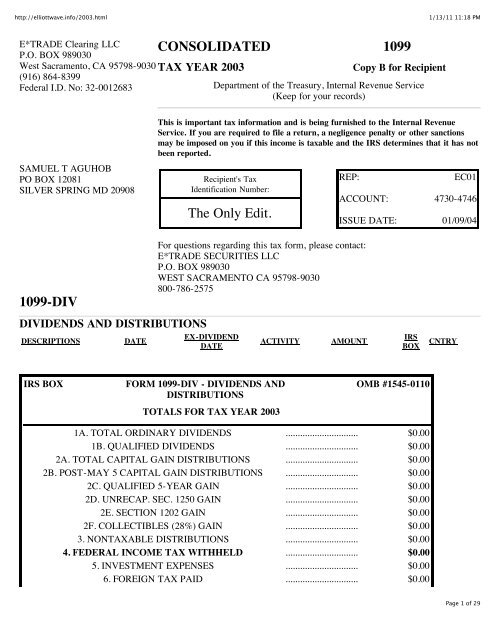

2021 Instructions for Schedule D (2021) | Internal Revenue Service Enter on Schedule D, line 13, the total capital gain distributions paid to you during the year, regardless of how long you held your investment. This amount is shown in box 2a of Form 1099-DIV.

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... What is the Qualified Dividends and capital gain Tax Worksheet? The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts.

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/tax_diagram.gif?strip=all&lossy=1&w=2560&ssl=1)

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

0 Response to "41 amt qualified dividends and capital gains worksheet"

Post a Comment