42 1120s other deductions worksheet

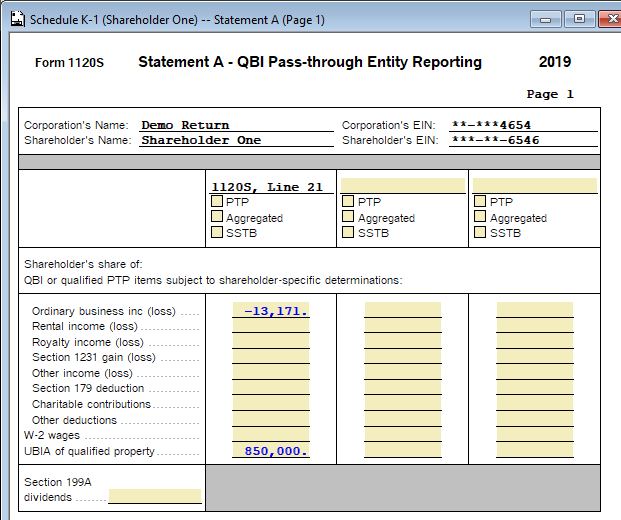

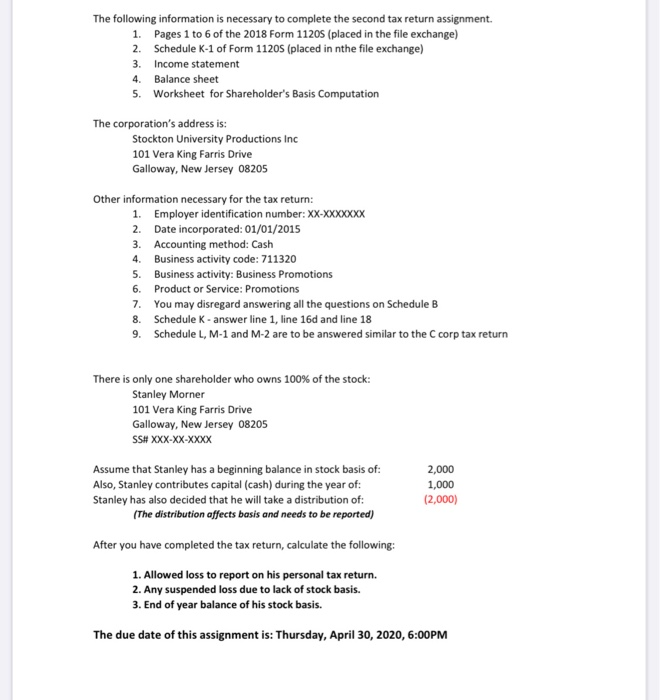

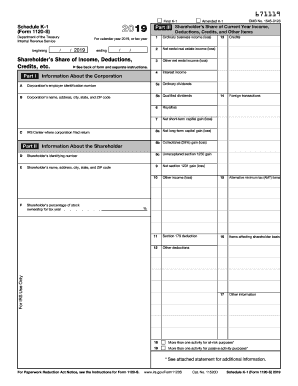

2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your records. Don't file ...18 pages Shareholder's Instructions for Schedule K-1 (Form 1120-S ... 13 Jan 2022 — The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your ...

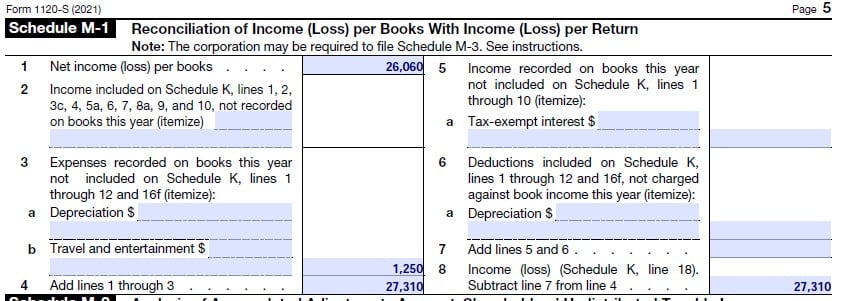

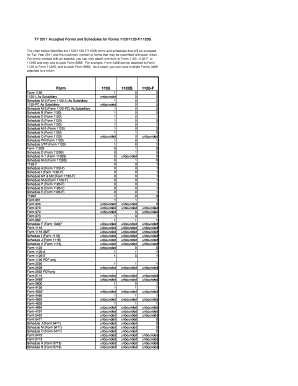

2021 Instructions for Form 1120-S - IRS 22 Dec 2021 — Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity ...52 pages

1120s other deductions worksheet

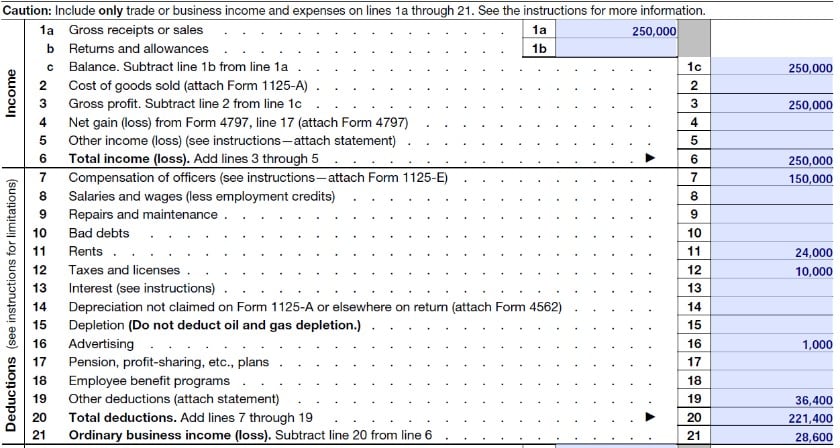

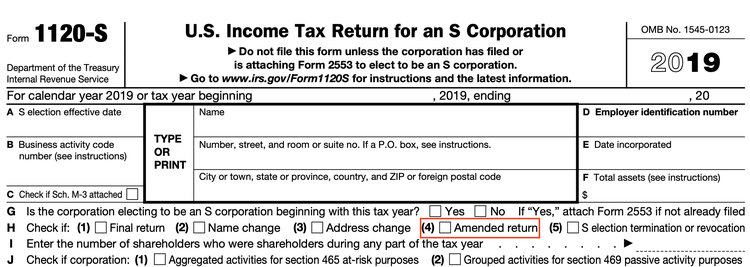

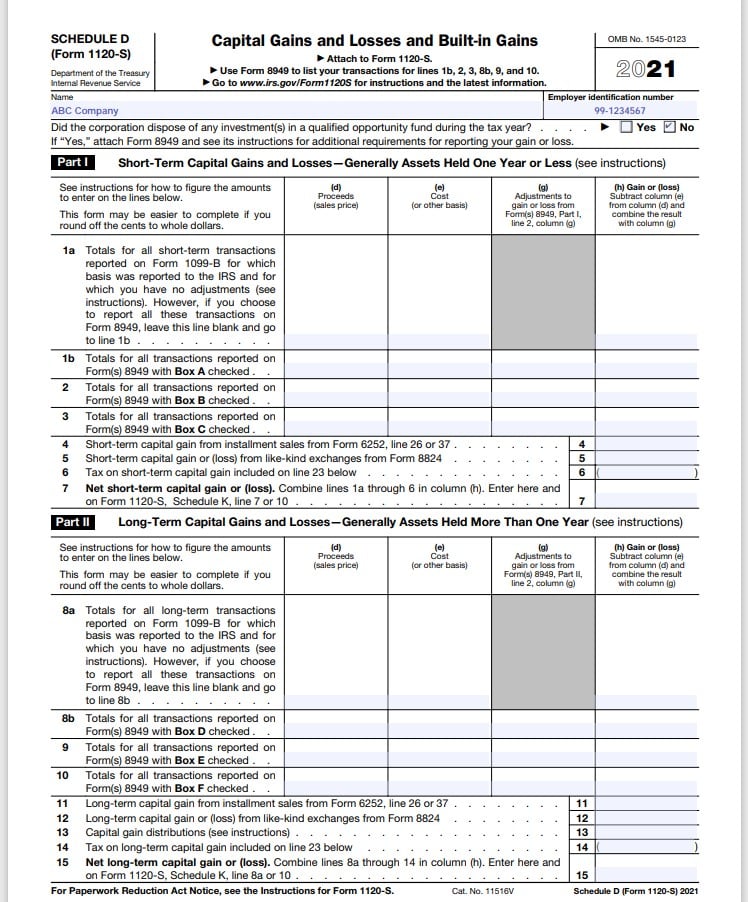

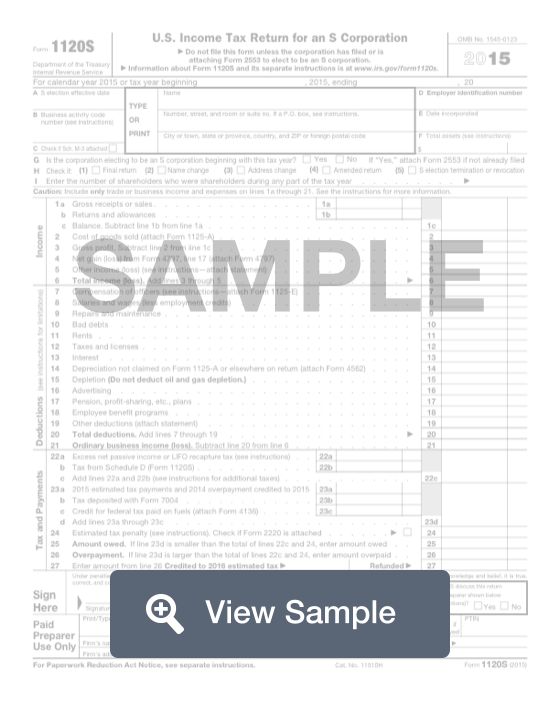

2021 Instructions for Form 1120-S - IRS Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year.51 pages U.S. Income Tax Return for an S Corporation - IRS is attaching Form 2553 to elect to be an S corporation. ... Depletion (Do not deduct oil and gas depletion.) . ... Other deductions (attach statement) .5 pages Instructions for Form 1120 (2021) | Internal Revenue Service 24 Jan 2022 — Election to deduct business start-up and organizational costs. Time for making an election. ... Contributions of property other than cash.

1120s other deductions worksheet. About Form 1120-S, U.S. Income Tax Return for an S ... - IRS Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an ... Instructions for Form 1120-S (2021) | Internal Revenue Service 20 Jan 2022 — For rules on allocating income and deductions between an S corporation's short year and a C corporation's short year and other special rules ... U.S. Income Tax Return for an S Corporation - IRS Do not file this form unless the corporation has filed or ... Depletion (Do not deduct oil and gas depletion.) . ... Other deductions (attach statement) .5 pages Instructions for Form 1120 (2021) | Internal Revenue Service 24 Jan 2022 — Election to deduct business start-up and organizational costs. Time for making an election. ... Contributions of property other than cash.

U.S. Income Tax Return for an S Corporation - IRS is attaching Form 2553 to elect to be an S corporation. ... Depletion (Do not deduct oil and gas depletion.) . ... Other deductions (attach statement) .5 pages 2021 Instructions for Form 1120-S - IRS Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year.51 pages

0 Response to "42 1120s other deductions worksheet"

Post a Comment