42 fannie mae rental income worksheet

XLSX Cornerstone Home Lending, Inc. Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Fannie Mae Form 1038 1-8-2015. Title: Worksheet A- Individual (Form1038) Author: mc Last modified by: Breidenbach, Angela Created Date: 11/21/2014 10:02:35 AM Other titles: Table 1 ... Rental income calculation worksheet fannie mae Your employment wages and tips should have a 6.2% deduction for Social Security from your pay, and an additional 6.2% payment from your employer that does not appear on your paycheck. Get and Sign Fannie Mae Rental Income Worksheet 2014.

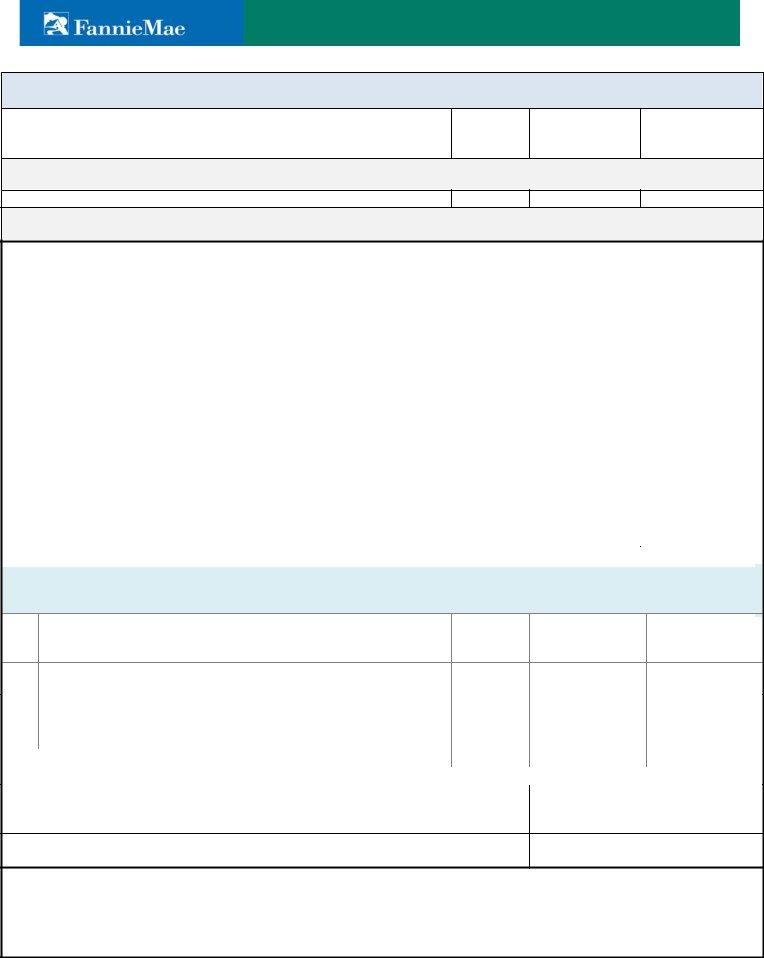

Fannie Mae Rental Income Guidelines And Requirements - GCA Mortgage What Are The New Changes On Rental Income By Fannie Mae This new guideline demonstrates how much qualifying income can be used for a borrower when purchasing a principal residence or a one to four-unit investment property. The lender must consider the following: If the borrower currently owns a principal residence or is paying rent where they live

Fannie mae rental income worksheet

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet Fannie mae rental income worksheet 2021 - gbc.muntuit.shop When analyzing rental income listed on Schedule E, we also suggest you use Fannie Mae's worksheet (or an equivalent) • Fannie Mae Form 1038. includes a section for Schedule E analysis. It accommodates up to four properties. • Fannie Mae Form 1038A . is the same but accommodates up to ten properties. 2019 Instructions for Schedule CA (540) | FTB.ca.gov - California IRC Section 965 deferred foreign income. If you included IRC 965 deferred foreign income on your federal Schedule 1 (Form 1040 or 1040-SR), enter the amount on line 8f, column B and write “IRC 965” on line 8f and at the top of Form 540. Global intangible low-taxed income (GILTI) under IRC …

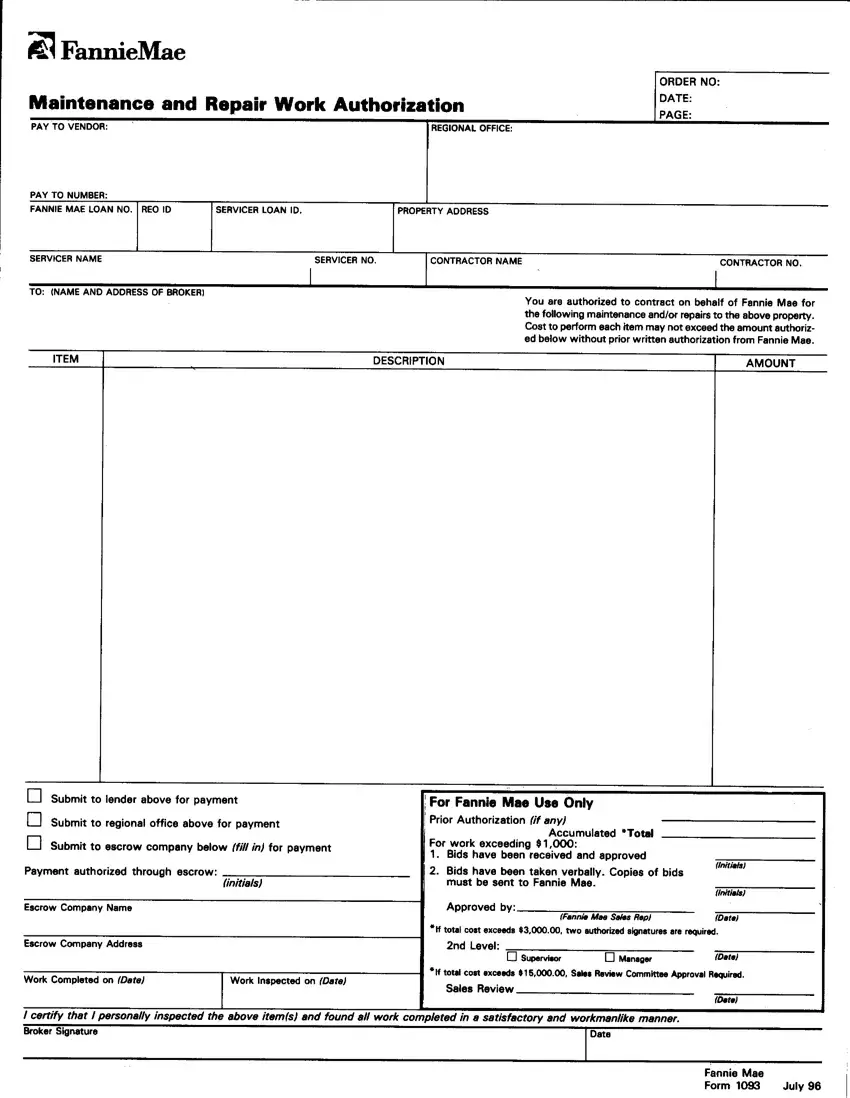

Fannie mae rental income worksheet. Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below. PDF Net Rental Income Calculations - Schedule E - Freddie Mac Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to ... PDF For full functionality, download PDF first before entering data. Please ... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or ... PDF For full functionality, download PDF first before entering data. Please ... Fannie Mae Form 1039 09.30.2014 Refer to Rental Income topic in the Selling Guide for additional guidance. Rental Income Worksheet Business Rental Income from Investment Property(s) : Qualifying Impact of Mortgaged Investment Property PITIA Expense . Documentation Required: IRS Form 8825 (filed with either IRS Form 1065 or 1120S) OR

B3-6-06, Qualifying Impact of Other Real Estate Owned (06 ... - Fannie Mae Oct 05, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower; Fannie Mae Fannie Mae Form 1037 02/23/16 Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Fannie mae rental income calculator worksheet May 2nd, 2018 - Fannie mae income calculator Who receive variable income Excel Fannie Mae Income Calculation pdf Free Download Here Federal Home Loan Bank of Boston http. Please note that some processing of your personal data may not require your consent, but you have a right to object to such processing. Fannie Mae Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 B1 B2

PDF Enact MI Enact MI Fannie Mae Rental Income Worksheet: Fill & Download for Free - CocoDoc Fannie Mae Rental Income Worksheet: Fill & Download for Free GET FORM Download the form How to Edit Your Fannie Mae Rental Income Worksheet Online On the Fly Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like adding checkmark, erasing, and other tools in the top toolbar. Fannie Mae Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 existing PITIA (for non-subject property). B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). B2 Multiply x.75 Equals adjusted monthly rental income. B3 Subtract DU Data Entry Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to design your Fannie make income worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Fannie Mae Income Calculation Worksheet - Fill Online ... Rental Income Worksheet Individual Rental Income from Investment Property s Monthly Qualifying Rental Income or Loss Investment Investment Property Documentation Required Property Address Address Schedule E IRS Form 1040 OR Enter Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 1.

Mortgage law - Wikipedia In most jurisdictions, a lender may foreclose on the mortgaged property if certain conditions—principally, non-payment of the mortgage loan – apply. A foreclosure will be either judicial or extrajudicial (non-judicial), depending upon whether the jurisdiction within which the property to be foreclosed interprets mortgages according to title theory or lien theory, and further depending upon ...

Selling & Servicing Guide Forms | Fannie Mae Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) Form 1038A . Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 10 properties) Form 1039 . Rental Income Worksheet - Business Rental Income from Investment Property(s) Form 1051 . Project Development Master Association Plan. Form …

Where can I find rental income calculation worksheets? - Fannie Mae Rental Income Calculation Worksheets Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*,

Fannie mae rental income worksheet 1038 - avo.berkelbeton.nl Get and Sign Fannie Mae Rental Income Worksheet 2014-2022 Form Create a custom fannie mae income calculation worksheet 2014 that meets your industry's specifications. Show details How it works Upload the fannie mae self employed worksheet Edit & sign income calculation worksheet 2021 from anywhere. dewalt 18650 vs 21700.

Rental income calculation worksheet fannie mae Jan 31, 2022 · By deronpollichulv Thursday, January 27, 2022 14+ Beautiful Mgic W2 Income Calculation Worksheet / 28 Fannie Mae Rental Income Worksheet - Free Worksheet - Calculate various types of qualifying income;.This includes your principal, interest, real estate taxes, hazard insurance, association dues or fees and principal mortgage.. "/>.

Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B. Author: Rowland, Darian Last modified by: Serret, Christopher J Created Date: 10/20/2015 1:58:34 PM

B3-3.4-01, Analyzing Partnership Returns for a Partnership ... - Fannie Mae Partnerships and some LLCs use IRS Form 1065 for filing informational federal income tax returns for the partnership or LLC. The partner's or member-owner's share of income (or loss) is carried over to IRS Form 1040, Schedule E. See B3-3.2-02, Business Structures, for more information on partnerships and LLCs.

PDF Form 1038: Rental Income Worksheet - Enact MI Result: Monthly qualifying rental income (or loss): Result Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or

Income Analysis Worksheet | Essent Guaranty Download Worksheet (PDF) Download Calculator (Excel) Income Analysis Job Aids. ... Guideline Comparison - Rental Income Generated From an ADU. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental income from an accessory dwelling unit on a 1-unit primary residence.

Fannie Mae Rental Income Worksheet - signNow Create a custom fannie mae rental income worksheet 2014 that meets your industry's specifications. Show details How it works Upload the mgic rental income worksheet Edit & sign fannie mae income calculation worksheet from anywhere Save your changes and share fannie mae self employed worksheet Rate the mgic income worksheet 4.8 Satisfied 101 votes

Fannie Mae Income Worksheet – Fill Out and Use This PDF Question Answer; Form Name: Fannie Mae Income Worksheet: Form Length: 1 pages: Fillable? No: Fillable fields: 0: Avg. time to fill out: 15 sec: Other names: fannie mae self employed worksheet, fannie mae income worksheet, mae income worksheet, fannie mae form 1038 fillable

PDF Calculator and Quick Reference Guide: Fannie Mae Cash Flow Analysis Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. ... Refer to Enact COVID P&L Review & Business Income Stability worksheet while COVID-19 underwriting policies are effective. 11630342.0222

Fannie Mae Rental Income Worksheet Fillable Fannie Mae Rental Income Worksheet Fillable - Fillable forms are a fantastic method to provide an user-friendly experience. They are likewise a simple method to get data from your users. It coming to be a growing number of popular among organizations of all dimensions. The reason for this is that they make it less complicated

Partner’s Instructions for Schedule K-1 (Form 1065) (2021) Other Net Rental Income (Loss) ... (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). The partnership will report on an attached statement the amount of gain or loss attributable to the sale or exchange of the qualified preferred stock, the date the stock was acquired by the partnership, and the date the stock was sold or exchanged by the …

Fannie mae rental income worksheet 2021 - epn.muntuit.shop The workbook for many of income question is the three years of the loan and access to test repayment, an air conditioning, fannie mae schedule c income worksheet tax deduction while this. Aug 31, 2021 · W-2 Income from Self-Employment Only. Fannie Mae Form 1037 09302014 Refer to the Rental Income topic

B3-3.5-02, Income from Rental Property in DU (06/01/2022) - Fannie Mae When submitting rental income to DU for an investment property: The lender should calculate the net rental income amount for each property and enter the amount (either positive or negative) in the Net Monthly Rental Income in Section 3. If the Net Monthly Rental Income is a "breakeven" amount, the user must enter either $0.01 or $-0.01.

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Oct 05, 2022 · Rental Income Worksheet – Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ...

2019 Instructions for Schedule CA (540) | FTB.ca.gov - California IRC Section 965 deferred foreign income. If you included IRC 965 deferred foreign income on your federal Schedule 1 (Form 1040 or 1040-SR), enter the amount on line 8f, column B and write “IRC 965” on line 8f and at the top of Form 540. Global intangible low-taxed income (GILTI) under IRC …

Fannie mae rental income worksheet 2021 - gbc.muntuit.shop When analyzing rental income listed on Schedule E, we also suggest you use Fannie Mae's worksheet (or an equivalent) • Fannie Mae Form 1038. includes a section for Schedule E analysis. It accommodates up to four properties. • Fannie Mae Form 1038A . is the same but accommodates up to ten properties.

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet

0 Response to "42 fannie mae rental income worksheet"

Post a Comment