44 capital gains tax worksheet

1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. Ordinary Dividends. Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on line 3b. This amount should be shown in box 1a of Form(s ... › reduce-avoid-capital-gainsHow to Reduce or Avoid Capital Gains Tax on Property or ... Aug 26, 2022 · If you sell capital assets like vehicles, stocks, bonds, collectibles, jewelry, precious metals, or real estate at a gain, you’ll likely pay a capital gains tax on some of the proceeds. Capital gains rates can be as high as 37%, and as low as 0%. Therefore, it’s worth exploring strategies to keep these taxes at a minimum. Capital Gains Tax ...

› how-to-figure-capital-gains-taxHow to Calculate Capital Gains Tax | H&R Block The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for — adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%.

Capital gains tax worksheet

Qualified Dividends and Capital Gains Worksheet.pdf qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 or 1040-sr through line 11b.if you don't have to file schedule d and you received capital gain distributions, be … Guide to capital gains tax 2022 | Australian Taxation Office a Capital gain or capital loss worksheet (PDF 144KB) for working out your capital gain or capital loss for each CGT event a CGT summary worksheet for 2022 tax returns (PDF 235KB) (CGT summary worksheet) to help you summarise your capital gains, capital losses and produce the final net amount you need to include on your tax return. capital gain tax worksheet 2021 Capital Gains Tax Spreadsheet Shares | Capital Gains Tax, Capital Gain . tax capital gains spreadsheet calculator excel hmrc shares company limited worksheet timetotrade gain summary example 2021 intended irs template losses. 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends gain

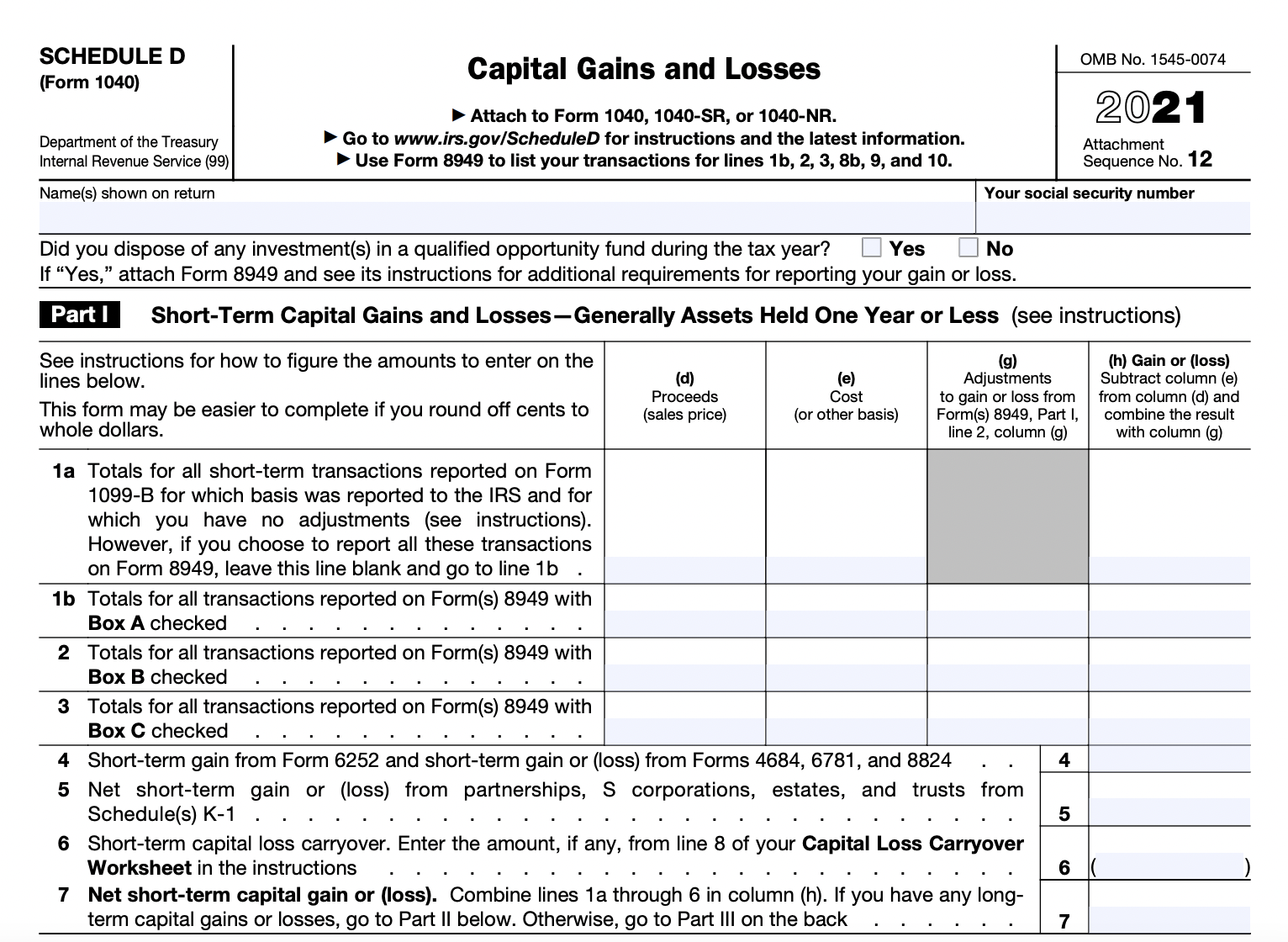

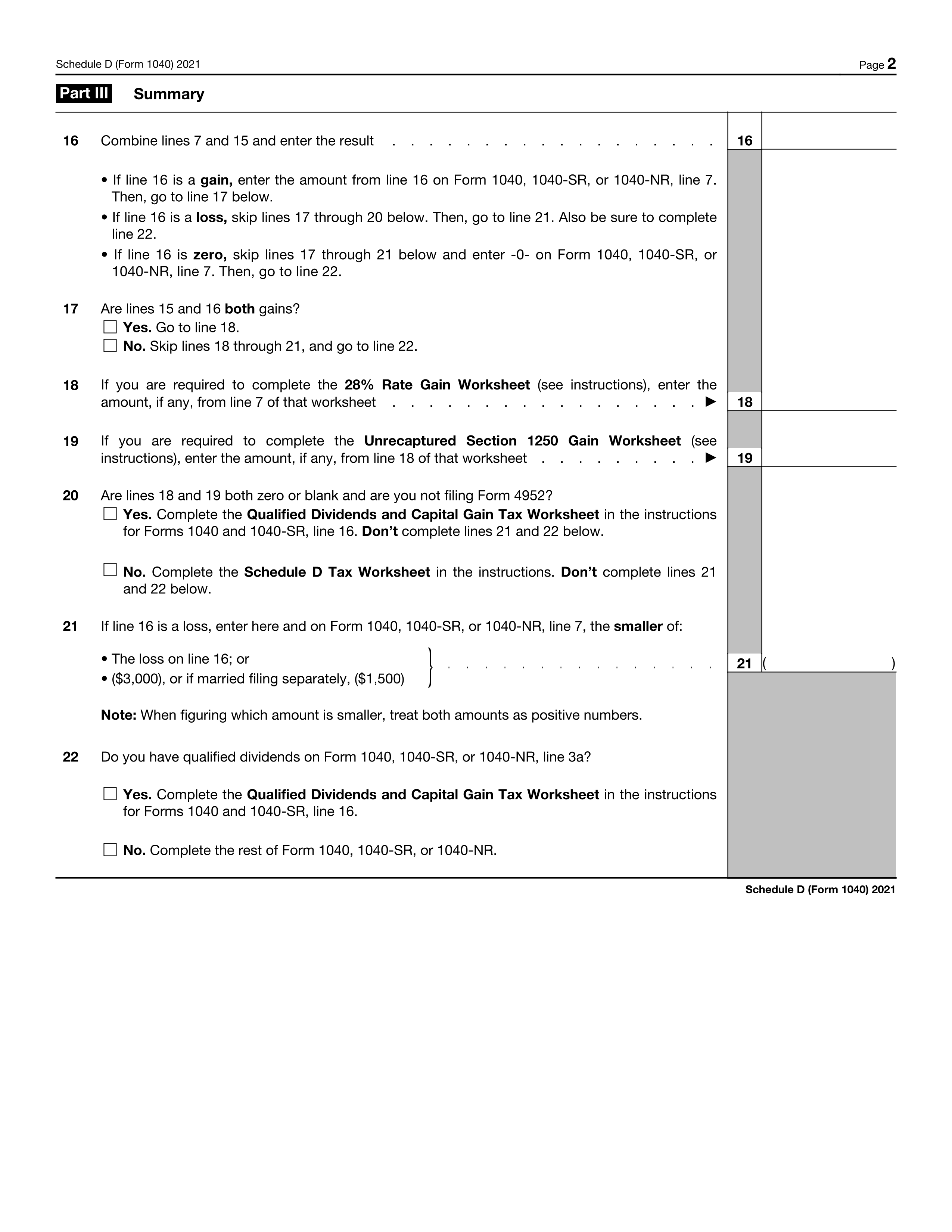

Capital gains tax worksheet. Long Term Capital Gains Tax - TurboTax Online - Intuit From the schedule D worksheet, line 15 (net Long Term Capital Gains) is $37,477. Line 20 is checked Yes to complete the Qual Div/ Cap Gain Tax Worksheet, but it's not included in my downloaded paperwork from TurboTax Online Return. This should be taxed at 15% with my income bracket. Why is the full amount $37,477 listed on line 7 (Cap Gains) of ... PDF and Losses Capital Gains - IRS tax forms 2021 Instructions for Schedule DCapital Gains and Losses ... the tax year. Capital Asset Most property you own and use for per-sonal purposes or investment is a capital asset. For example, your house, furni- ... Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. turbotax.intuit.com › tax-tips › investments-andCapital Gains and Losses - TurboTax Tax Tips & Videos Oct 18, 2022 · The tax law divides capital gains into two main classes determined by the calendar. Short-term gains come from the sale of property owned one year or less and are typically taxed at your maximum tax rate, as high as 37% in 2022. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

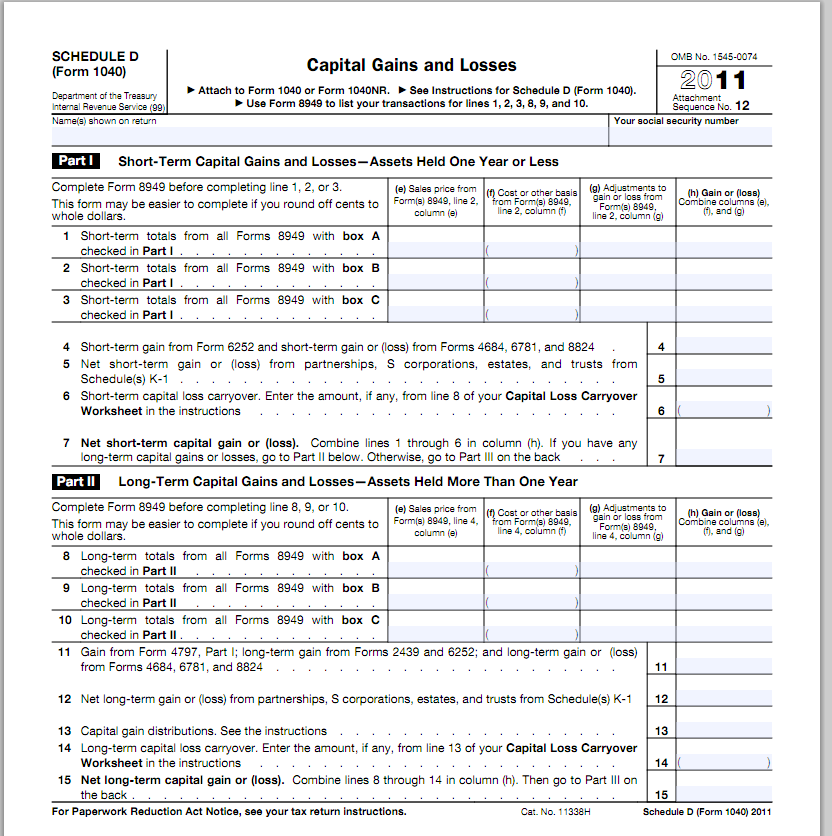

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is ... › t4037 › capital-gainsCapital Gains – 2021 - Canada.ca If you had a net capital loss during the period from January 1, 1985, to May 22, 1985, and you had taxable capital gains later in 1985, your taxable capital gains will reduce your pre-1986 capital loss balance. turbotax.intuit.com › tax-tips › investments-andGuide to Schedule D: Capital Gains and Losses - TurboTax Tax ... Oct 18, 2022 · If you have a deductible loss on the sale of a capital asset, you might be able to use the losses you incur to offset other current and future capital gains. Capital gains and losses are generally calculated as the difference between what you bought the asset for (the IRS calls this the “ tax basis ”) and what you sold the asset for (the ... Using the capital gain or capital loss worksheet The Capital gain or capital loss worksheet (PDF, 143KB) calculates a capital gain or capital loss for each separate capital gains tax (CGT) event. Remember that: you show the type of CGT asset or CGT event that resulted in the capital gain or capital loss, and if a capital gain was made, you calculate it using the indexation method

Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet. Qualified Dividends and Capital Gains Worksheet - StuDocu Brunner and Suddarth's Textbook of Medical-Surgical Nursing Interpersonal Communication Give Me Liberty!: an American History Forecasting, Time Series, and Regression Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) 2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets:... 2022 Download Qualified Dividends Worksheet - WRKSHTS Get a fillable 2021 qualified dividends and capital gains worksheet template online. The former is taxed at the capital gains rate. The qualified dividends worksheet, however, has 27 lines enabling you to compute your tax and you will not comprehend what each figure is attempting to get at, but marotta on.

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains 1121 11/29/2021

› australia › capital-gains-taxAustralia Capital Gains Tax Calculator 2022 A superb online calculator for individuals and business to calculate capital gains tax in australia. Applies resident and non-resident capital gains tax rates and allowances in 2022 to produce a capital gains tax calculation you can print or email.

PDF Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form

capital gain tax worksheet 2021 Capital Gains Tax Spreadsheet Shares | Capital Gains Tax, Capital Gain . tax capital gains spreadsheet calculator excel hmrc shares company limited worksheet timetotrade gain summary example 2021 intended irs template losses. 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends gain

Guide to capital gains tax 2022 | Australian Taxation Office a Capital gain or capital loss worksheet (PDF 144KB) for working out your capital gain or capital loss for each CGT event a CGT summary worksheet for 2022 tax returns (PDF 235KB) (CGT summary worksheet) to help you summarise your capital gains, capital losses and produce the final net amount you need to include on your tax return.

Qualified Dividends and Capital Gains Worksheet.pdf qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 or 1040-sr through line 11b.if you don't have to file schedule d and you received capital gain distributions, be …

:max_bytes(150000):strip_icc()/GettyImages-907066380-0867bbed74914d3eab8d7d0c318a7577.jpg)

0 Response to "44 capital gains tax worksheet"

Post a Comment