45 same day tax payment worksheet

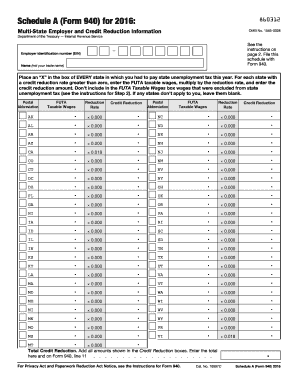

› payments › same-day-wire-federal-taxSame-Day Wire Federal Tax Payments | Internal Revenue Service Jan 12, 2022 · Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information. COMMON IRS TAX TYPES AND SUBTYPES - EFTPS SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business ...

Publication 527 (2020), Residential Rental Property Electronic Federal Tax Payment System (EFTPS) POPULAR; Your Online Account; Tax Withholding Estimator; ... include the amount from Form 6198, line 21 (deductible loss), in column (b) of Form 8582, Worksheet 1 or 3, as required. ... t count such a day as a day of personal use even if family members use the property for recreational purposes on ...

Same day tax payment worksheet

PDF Same-day Taxpayer Worksheet To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. Legend for Tax Type Suffixes (the one character suffix follows the 4-digit form number for the tax type): Suffix Type Suffix Type 0 Amended 6 Estimated › publications › p969Publication 969 (2021), Health Savings Accounts and Other Tax ... Electronic Federal Tax Payment System: Best option for businesses. Enrollment is required. Check or Money Order: Mail your payment to the address listed on the notice or instructions. Cash: You may be able to pay your taxes with cash at a participating retail store. Same-Day Wire: You may be able to do same-day wire from your financial ... download.eftps.com › SameDayPaymentWorksheetCOMMON IRS TAX TYPES AND SUBTYPES - EFTPS SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business ...

Same day tax payment worksheet. Same Day Taxpayer Worksheet Form - signNow Follow the step-by-step instructions below to design your same day taxpayer worksheet common IRS tax type sirs: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Frequently Asked Questions About International Individual Tax Matters ... If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form 1040 and 1040-SR Instructions or your income tax preparation software. Get Same Day Payment Worksheet - US Legal Forms SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment:. ... Easily produce a Same Day Payment Worksheet without having to involve experts. There are already over 3 million users benefiting from our rich ... EFTPS: The Electronic Federal Tax Payment System Convenience at your fingertips Schedule payments up to 365 days in advance. Make your tax payment from home or office, 24/7. Pay your income, employment, estimated and excise federal tax payments. Easily change or cancel scheduled payments. Track your payment with email notifications. View 15 months of payment history.

PDF SAME-DAY TAXPAYER WORKSHEET - IRS tax forms SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identification number: Publication 550 (2021), Investment Income and Expenses - IRS tax forms Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Instructions for Form 1120-W (2022) | Internal Revenue Service Enter the 15th day of the 4th, 6th, 9th, and 12th months of your tax year in columns (a) through (d). If the due date falls on a Saturday, Sunday, or legal holiday, enter the next business day. Line 11. Required Installments Payments of estimated tax should reflect any 2021 overpayment that the corporation chose to credit against its 2022 tax. Fill - Free fillable Same- Day Taxpayer Worksheet PDF form The Same- Day Taxpayer Worksheet form is 2 pages long and contains: 0 signatures; 0 check-boxes; 11 other fields; Country of origin: OTHERS File type: PDF ... T o arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly.

Same Day Wire Federal Tax Payments | Internal Revenue Service Download the Same-Day Taxpayer Worksheet. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook for help with formatting and processing information. Electronic Same-Day Federal Tax Payment - 2290Tax.com To make a same-day federal tax payment you need to fill out the Same Day Payment Worksheet and present it to your bank. Electronic Same-Day Worksheet Things to know: Must schedule your payment before 5 p.m. ET otherwise your payment will be rejected. Errors in the worksheet will be cause for your payment to be rejected. Federal Tax Collection - Resources - Bureau of the Fiscal Service The Federal Tax-Wire Assistant is designed to assist taxpayers and financial institutions with the proper formatting of same day IRS tax Fedwires. The use of this spreadsheet is OPTIONAL. Taxpayers are not required to use this tool. Before opening the Federal Tax-Wire Assistant, close all other Excel spreadsheets. › publications › p590aPublication 590-A (2021), Contributions to Individual ... The same is true of alimony paid under a divorce or separation instrument executed before 2019 and modified after 2018, if the modification expressly states that the alimony isn't deductible to the payer or includible in the income of the recipient. For more information, see Pub. 504. Qualified disaster tax relief.

› publications › p527Publication 527 (2020), Residential Rental Property A mid-quarter convention must be used if the mid-month convention doesn’t apply and the total depreciable basis of MACRS property placed in service in the last 3 months of a tax year (excluding nonresidential real property, residential rental property, and property placed in service and disposed of in the same year) is more than 40% of the ...

Publication 969 (2021), Health Savings Accounts and Other Tax … The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or ... Electronic Federal Tax Payment System: Best option for businesses. Enrollment is required. ... Same-Day Wire: You may be able to do same-day wire from your financial institution. Contact your financial ...

Instructions for Form 2210 (2021) | Internal Revenue Service Estimated tax payments you made for the 2021 tax year, plus any federal income tax and excess social security and RRTA tax withheld. Any payment made on your balance due return for 2021. Use the date you filed (or will file) your return or April 15, 2022, whichever is earlier, as the payment date for these purposes.

fiscal.treasury.gov › SameDayPaymentWorksheetSAME-DAY TAXPAYER WORKSHEET - Bureau of the Fiscal Service SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identification number:

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Instructions for Schedule I (Form 1041) (2021) - IRS tax forms If you used Schedule D (Form 1041), the Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1041), or the Qualified Dividends Tax Worksheet in the Instructions for Form 1041, you may generally enter the amounts as instructed on Schedule I, lines 56, 57, and 58. But don’t use those amounts if any of the following apply.

Same-day taxpayer worksheet for business income taxes : tax - reddit April 18 tax filing deadline for most The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday, April 18, 2022, for most taxpayers. By law, Washington, D.C., holidays impact tax deadlines for everyone in the same way federal holidays do. The due date is April 18, instead of April 15, because of the ...

Electronic Federal Tax Payment System - Resources This handbook is designed to help you assist business and individual customers with their federal tax payments. It contains information related to customer-initiated payments, ACH credit for businesses, and more. EFTPS Financial Institution Handbook Same Day Payment Worksheet EFTPS Fact Sheet EFTPS Payment Instruction Booklet Regulations

Get Same Day Taxpayer Worksheet Example - US Legal Forms Complete Same Day Taxpayer Worksheet Example online with US Legal Forms. ... (2 digits) see Common IRS Tax Type table below OPTIONAL INFORMATION: If the payment includes tax, interest, and penalty: NOTE: The sum of lines 8 10 must equal the amount in line 1. 8 Tax amo. ...

Same-Day Wire Federal Tax Payments | Internal Revenue Service Jan 12, 2022 · Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information.

SAME-DAY TAXPAYER WORKSHEET - Bureau of the Fiscal … SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identification number:

Foreign Electronic Payments | Internal Revenue Service - IRS tax forms Tip - Please complete the Same Day Taxpayer Worksheet PRIOR to going to your bank. The information from the worksheet will be needed to complete the wiring application required by the bank. ... If your foreign bank needs assistance, they may contact the Federal Tax Payment Service Customer Service at 314-425-1810 (Not toll free). If you have ...

What do I put on the Same-Day Taxpayer Worksheet under tax/month ... Taxes. Get your taxes done. What do I put on the Same-Day Taxpayer Worksheet under tax/month quarter for a 1040X. intertax. Returning Member. posted. October 16, 2020 12:54 PM. last updated October 16, 2020 1:09 PM.

PDF SAME-DAY TAXPAYER WORKSHEET - PHD Tax SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your inancial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identiication number: 3 Taxpayer name control: (the irst four letters of your business ...

Publication 590-A (2021), Contributions to Individual Retirement ... Electronic Federal Tax Payment System (EFTPS) POPULAR; Your Online Account; Tax Withholding Estimator ... The Instructions for Form 1040 include a similar worksheet that you can use instead of the worksheet in this publication. ... On January 1, 2022, John took a distribution from IRA-1 and rolled it over into IRA-2 on the same day. For 2022 ...

download.eftps.com › SameDayPaymentWorksheetCOMMON IRS TAX TYPES AND SUBTYPES - EFTPS SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business ...

› publications › p969Publication 969 (2021), Health Savings Accounts and Other Tax ... Electronic Federal Tax Payment System: Best option for businesses. Enrollment is required. Check or Money Order: Mail your payment to the address listed on the notice or instructions. Cash: You may be able to pay your taxes with cash at a participating retail store. Same-Day Wire: You may be able to do same-day wire from your financial ...

PDF Same-day Taxpayer Worksheet To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. Legend for Tax Type Suffixes (the one character suffix follows the 4-digit form number for the tax type): Suffix Type Suffix Type 0 Amended 6 Estimated

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "45 same day tax payment worksheet"

Post a Comment