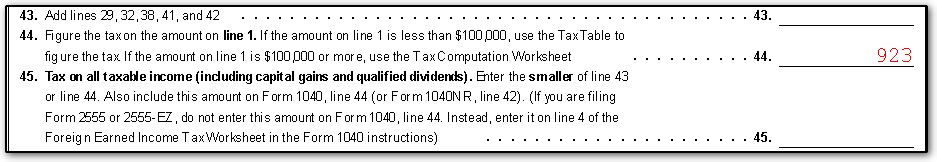

39 qualified dividends and capital gain tax worksheet line 44

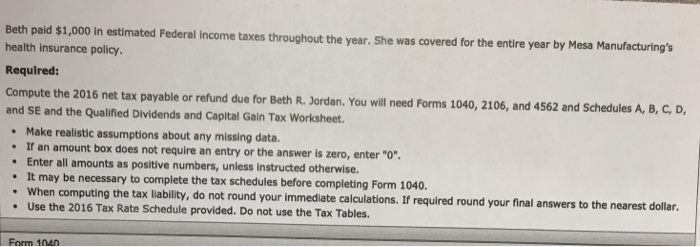

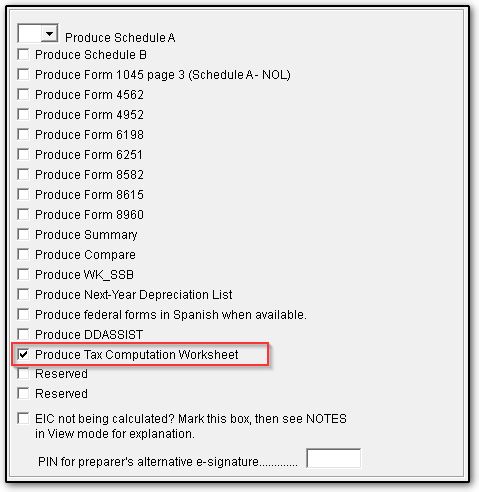

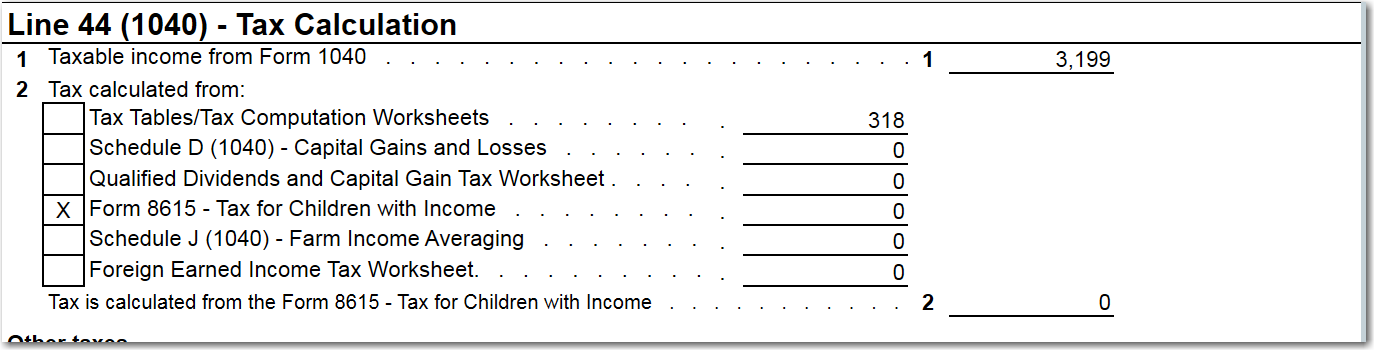

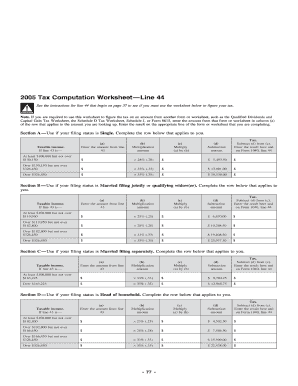

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Qualified Dividends and Capital Gain Tax Worksheet 2016.pdf... Ratings 100% (19) This preview shows page 1 out of 1 page. View full document 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 43.

Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon Qualified Dividends and Capital Gain Tax Worksheet—Line 44. Keep for Your Records: See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. May 16, 2017 · So lines 1-7 of this worksheet are figuring what is your total qualified ...

Qualified dividends and capital gain tax worksheet line 44

PDF Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Don't : complete lines 21 and 22 below. No. ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ... Qualified Dividends And Capital Gain Tax Worksheet Line 44 [PDF] - 50 ... We come up with the money for Qualified Dividends And Capital Gain Tax Worksheet Line 44 and numerous book collections from fictions to scientific research in any way. among them is this Qualified Dividends And Capital Gain Tax Worksheet Line 44 that can be your partner. Business Taxpayer Information Publications 2004 Tele-tax United States. Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill Online ... Fill Qualified Dividends And Capital Gain Tax Worksheet 2019, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. ... 2018 Form 1040—Line 11a. Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... line 44 1040 irs capital gain tax 1040 form

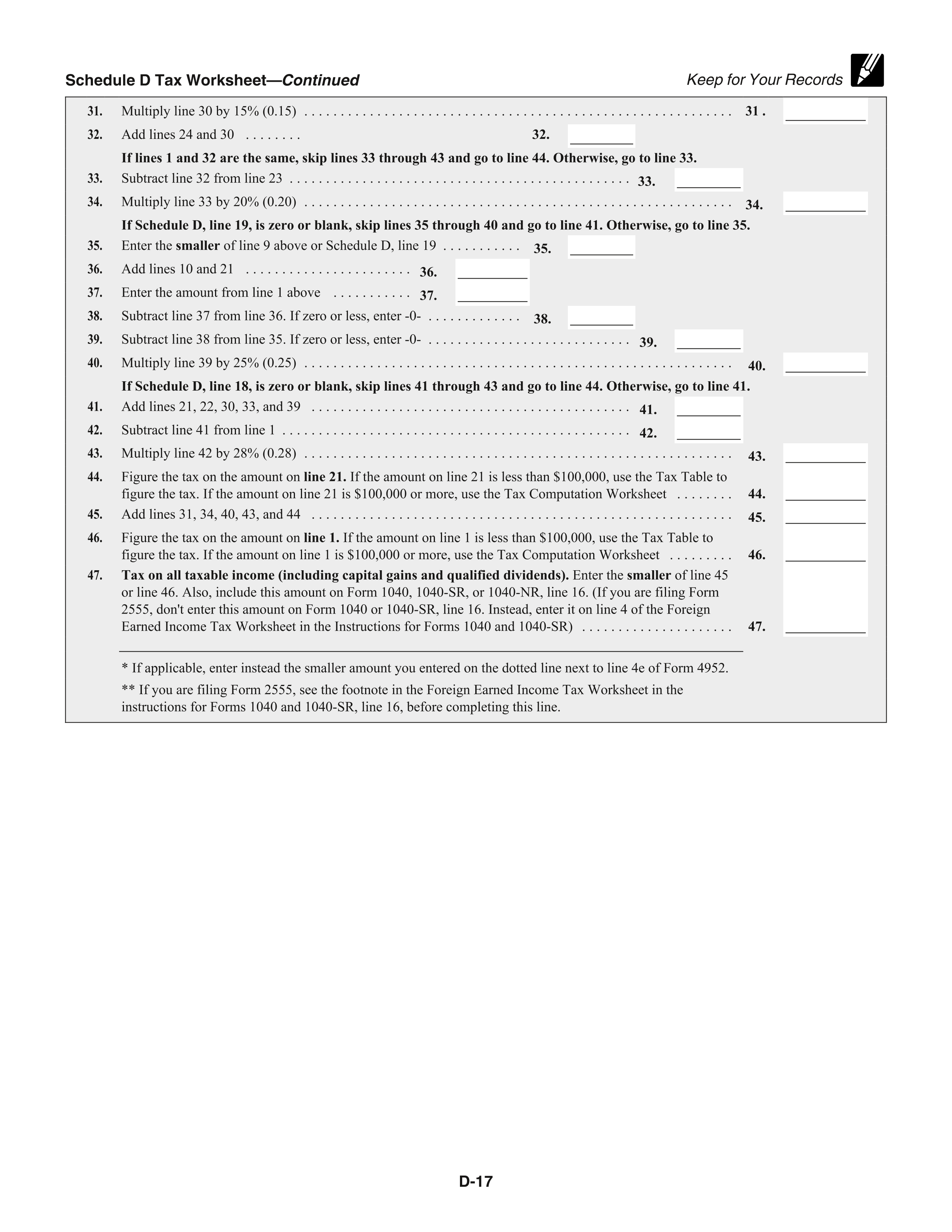

Qualified dividends and capital gain tax worksheet line 44. Qualified Dividends And Capital Gain Tax Line 44 Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, 2014 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work, Capital gains and losses, Capital gains and losses, 43 of 107 fileid ionsi10402017axmlcycle16, 2018 form 1041 es. *Click on Open button to open and print to worksheet. Qualified dividends and capital gain tax worksheet | Chegg.com Question: Qualified dividends and capital gain tax worksheet line 44 This question hasn't been solved yet Ask an expert Ask an expert Ask an expert done loading Qualified Dividends And Capital Gain Tax W0rksheet Line 44 *Click on Open button to open and print to worksheet. 1. Line 44 the Tax Computation Worksheet on if you are filing ... ReloadOpenDownload 2. Capital Gains and Losses ReloadOpenDownload 3. Qualified Dividends and Capital Gain Tax Worksheet -Line ... ReloadOpenDownload 4. Form 1040Lines 42 and 44 You must complete and attach ... ReloadOpenDownload PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 44 - Tax Guru Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

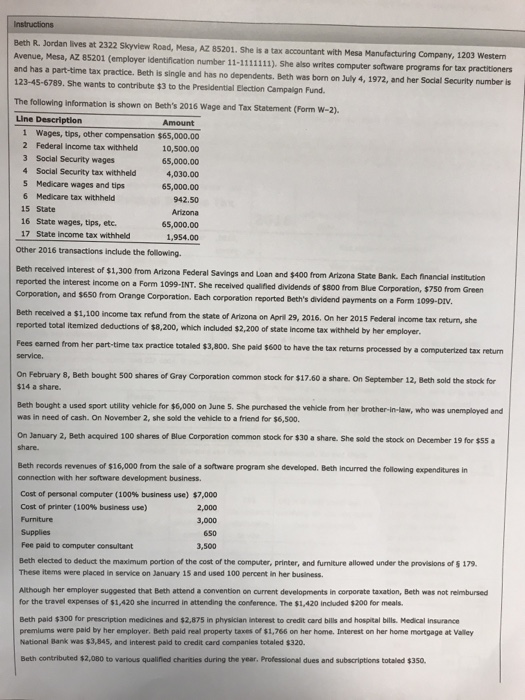

Instructions for Line 44 on Tax Form 1040 | Sapling Line 44 Inclusions The figure entered on line 44 is a total of taxes related to various applicable items. It can cover taxable income, unearned income of a dependent child (e.g., interest and dividends), lump sum distributions and capital gains, and foreign earned income. Line 44 also includes taxes on educational assistance or refunds. QUAL DIV - 2013 Form 1040—Line 44 Qualified Dividends and Capital Gain ... 2013 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain … PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can ...

PDF Line 44 the Tax Computation Worksheet on if you are filing Form 2555 or ... subtract Form 1040, line 43, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet). If the result is more than zero, that amount is your capital gain excess. If you do not have a capital gain excess, complete the rest of either of those worksheets according to the worksheet's ... How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 7. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill Online ... Fill Qualified Dividends And Capital Gain Tax Worksheet 2019, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. ... 2018 Form 1040—Line 11a. Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... line 44 1040 irs capital gain tax 1040 form

Qualified Dividends And Capital Gain Tax Worksheet Line 44 [PDF] - 50 ... We come up with the money for Qualified Dividends And Capital Gain Tax Worksheet Line 44 and numerous book collections from fictions to scientific research in any way. among them is this Qualified Dividends And Capital Gain Tax Worksheet Line 44 that can be your partner. Business Taxpayer Information Publications 2004 Tele-tax United States.

PDF Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Don't : complete lines 21 and 22 below. No. ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ...

0 Response to "39 qualified dividends and capital gain tax worksheet line 44"

Post a Comment