40 qualified education expenses worksheet

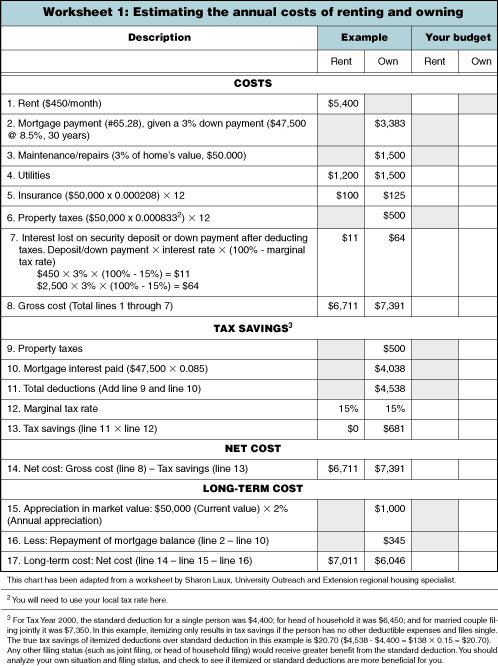

Guide to IRS Form 1099-Q: Payments from Qualified Education ... - TurboTax For example, suppose your qualified education expenses are $10,000, you receive a $2,000 Pell grant and boxes 1 and 2 of your 1099-Q report a gross distribution of $8,000 and earnings of $1,000. Your adjusted expenses are $8,000—which means you don't have to report any education program distributions on your tax return. Adjusted Qualified Education Expenses Worksheet Adjusted Qualified Education Expenses Worksheet. Use the adjusted qualified education expenses worksheet, later, to figure each student's adjusted qualified education expenses. 2020 education expense worksheet (h&rblock) on average this form takes 20 minutes to complete.

Qualified Education Worksheet - Intuit Qualified Education Worksheet The amount on line 18 would be the education expenses used for purposes of qualifying for an education credit or tuition and fees deduction. You can't use the same expenses to exclude income on your education plan that you used to receive an education expense credit or deduction.

Qualified education expenses worksheet

PDF A Opportunity Tax Credit Worksheet The IRS does have a worksheet for calculating the education credit included in Pub 970 and other sources, but it is used to calculate what can be excluded from income and lacks the logic included in the regulations for elective taxable ... Based on his adjusted qualified education expenses of $4,000, Bill would be able to claim an American ... PDF Determining Qualified Education Expenses - IRS tax forms the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ... PDF Education Expenses - IRS tax forms scholarship. (But for exceptions, see Payment for services in Publication 970, Tax Benefits for Education.) Use Worksheet 1-1 below to figure the amount of a scholarship or fellowship you can exclude from gross income. Education Expenses The following are qualified education expenses for the purposes of tax-free scholarships and fellowships:

Qualified education expenses worksheet. Qualified Ed Expenses | Internal Revenue Service - IRS tax forms Qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Who Must Pay Qualified education expenses must be paid by: You or your spouse if you file a joint return, A student you claim as a dependent on your return, or A third party including relatives or friends. Funds Used How do I calculate the amount of qualified education expenses? This total would become the qualified expenses plus any eligible books and supplies. For example, Box 5 is $1000 and Box 1 is $3000, then the qualified expense amount would be $2000 plus any books or supplies. If the amount in Box 5 is greater than the amount in Box 1, then you are not eligible to take an education credit. How do I enter qualified education expenses for Form 8863 in a ... - CCH In Box 70 - Qualified expenses override, enter the applicable amount. In Box 71 - Education code, use the lookup value (double-click or press F4) to select the applicable codes. Calculate the return. Note If you plan to take the American Opportunity Credit, you must select the checkbox on the IRS 1098-T, Box 57. Adjusted Qualified Education Expenses Worksheet - Tomas Blog You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from. The irs does have a worksheet for calculating the education credit included in pub 970 and other sources, but it is used to calculate what can be excluded from income and lacks the logic. Source: zzahz.blogspot.com

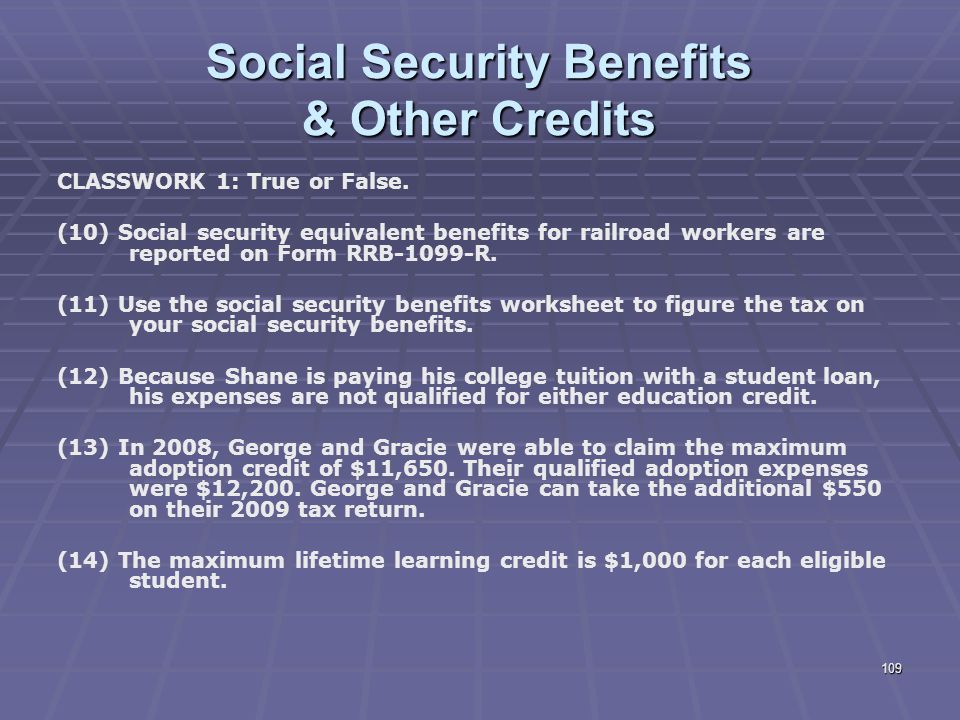

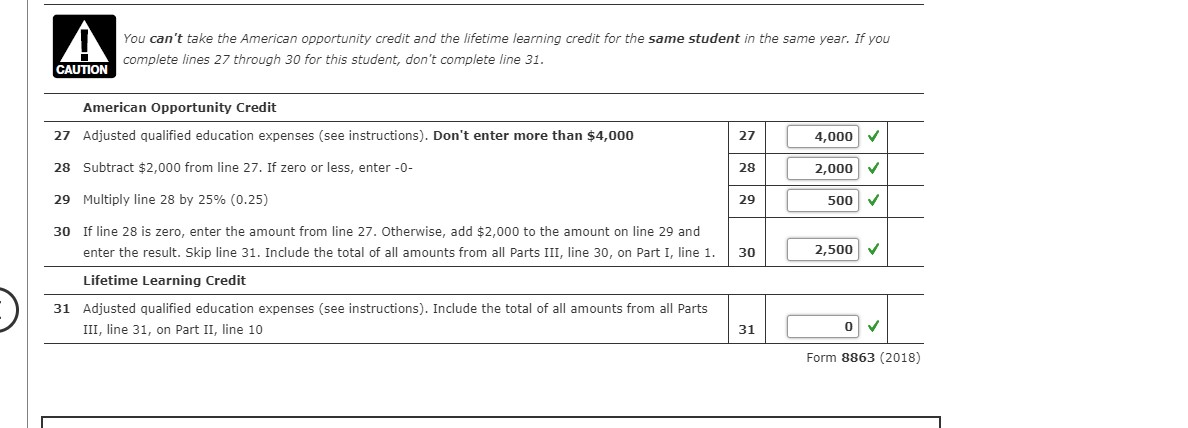

Education Credits - Tax Season Resources Remaining expenses that qualify for scholarships/grants but not LLC/AOC Line 9 $0. Line 3 - Line 4. Put 0 if negative. Amount of scholarships/grants to transfer to student as income Line 10 $0. See "Your 2018 tax return included education expenses" for amount to put on return. Line 7 - Line 8 - Line 9. Put 0 if negative. Instructions for Form 8863 (2021) | Internal Revenue Service This credit equals 100% of the first $2,000 and 25% of the next $2,000 of adjusted qualified education expenses paid for each eligible student. The amount of your credit for 2021 is gradually reduced (phased out) if your MAGI is between $80,000 and $90,000 ($160,000 and $180,000 if you file a joint return). receipt for qualified education expenses: Fill out & sign online | DocHub Edit your receipt for qualified k 12 education expenses online. Type text, add images, blackout confidential details, add comments, highlights and more. 02. Sign it in a few clicks ... Adhere to the instructions below to complete k 12 education expense credit worksheet online easily and quickly: ... Why are the Adjusted Qualified Higher Education Expenses on my ... - Intuit First, scholarships & grants are applied to qualified education expenses. The only qualified expenses for scholarships and grants are tuition, books, and lab fees. that's it. If there is any excess, then it's taxable income. It automatically gets transferred to and included in the total on line 7 of the 1040.

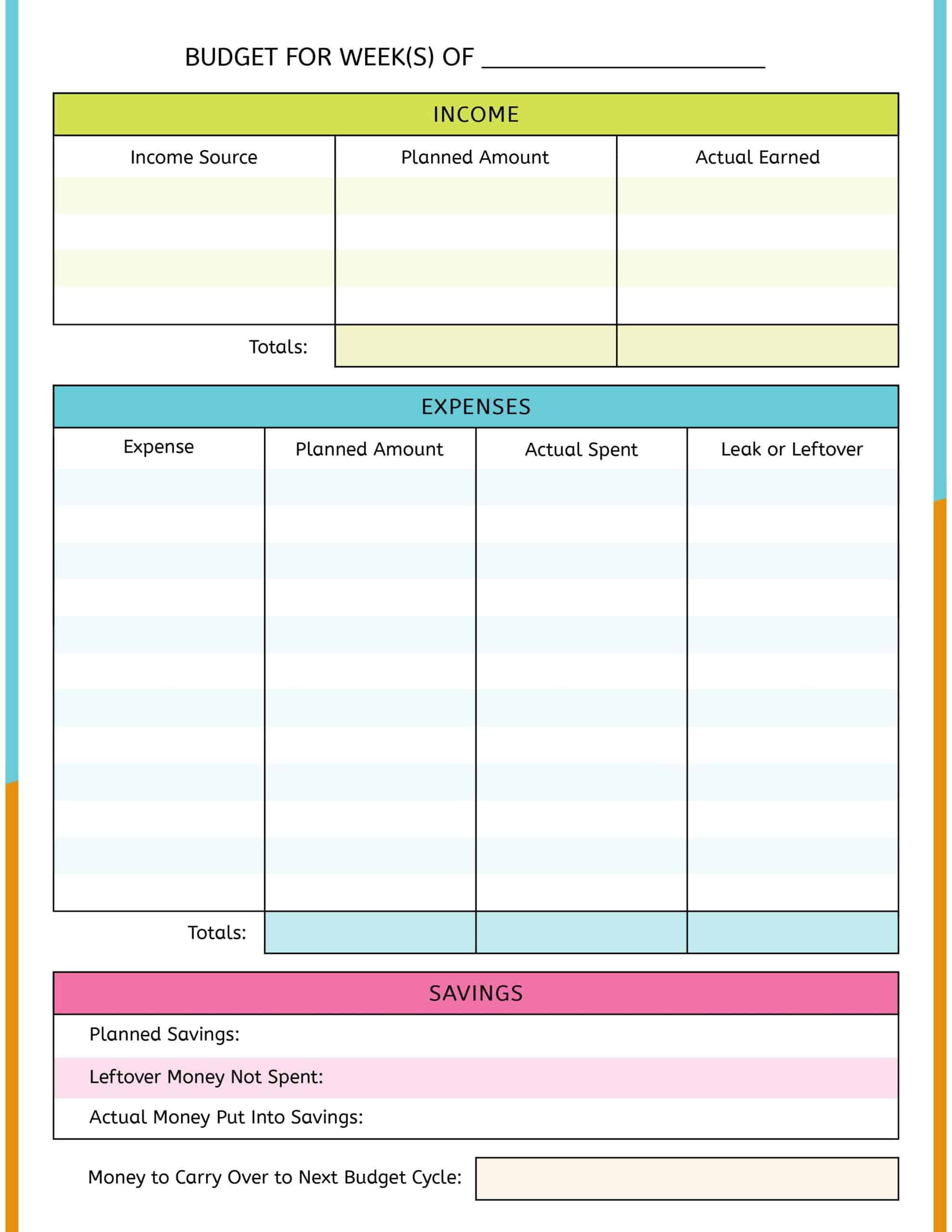

Entering education expenses in ProSeries - Intuit Step 1: Activating the Student Info Worksheet Open the tax return to the Federal Information Worksheet. If a dependent is the student:: Scroll down to Part III Dependent/Earned Income Credit/Child and Dependent Care Credit Information. Enter the basic identification information. Check the box for Educ Tuition and Fees box. PDF 2020 Education Expense Worksheet - H&R Block 2020 Education Expense Worksheet Keep for Your Records Student name Education type ... Qualified expenses after tax free education benefits {line 21 less line 23) . 24. ... 28. Qualified expenses after other tax related benefits (Line 24 less line 27) This amount will be used to calculate the credit or deduction . . . . . . . . . . 28. 20. 2020 Education Expense Worksheet (H&Rblock) - Fill 2020 Education Expense Worksheet (H&Rblock) On average this form takes 20 minutes to complete The 2020 Education Expense Worksheet (H&Rblock) form is 1 page long and contains: 0 signatures 0 check-boxes 80 other fields Country of origin: US File type: PDF Use our library of forms to quickly fill and sign your H&Rblock forms online. PDF IL-1040-RCPT, Receipt for Qualified K-12 Education Expenses - Illinois Add the amounts in the "Total Amount of Qualified Expenses Paid by Parent or Guardian" column for each student. Use this total to complete the K-12 Education Expense Credit Worksheet on Schedule ICR. Total $ (This required information may be (K-12 only) provided by the recipient)

Publication 970 (2021), Tax Benefits for Education | Internal Revenue ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, ...

AOTC | Internal Revenue Service - IRS tax forms American Opportunity Tax Credit. The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of ...

PDF Education Expenses - IRS tax forms scholarship. (But for exceptions, see Payment for services in Publication 970, Tax Benefits for Education.) Use Worksheet 1-1 below to figure the amount of a scholarship or fellowship you can exclude from gross income. Education Expenses The following are qualified education expenses for the purposes of tax-free scholarships and fellowships:

PDF Determining Qualified Education Expenses - IRS tax forms the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ...

PDF A Opportunity Tax Credit Worksheet The IRS does have a worksheet for calculating the education credit included in Pub 970 and other sources, but it is used to calculate what can be excluded from income and lacks the logic included in the regulations for elective taxable ... Based on his adjusted qualified education expenses of $4,000, Bill would be able to claim an American ...

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

0 Response to "40 qualified education expenses worksheet"

Post a Comment