42 pastor's housing allowance worksheet

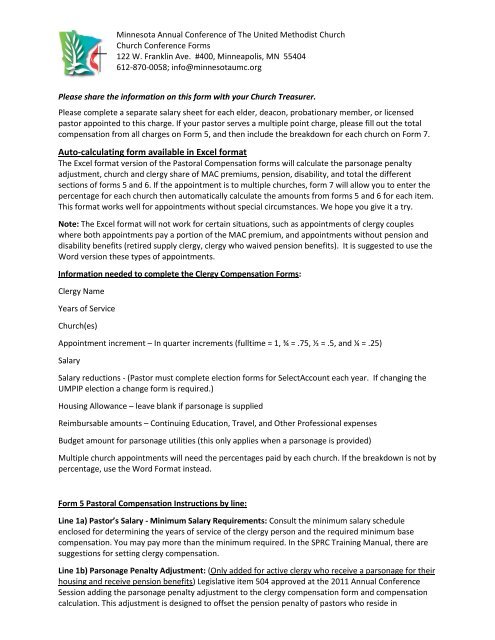

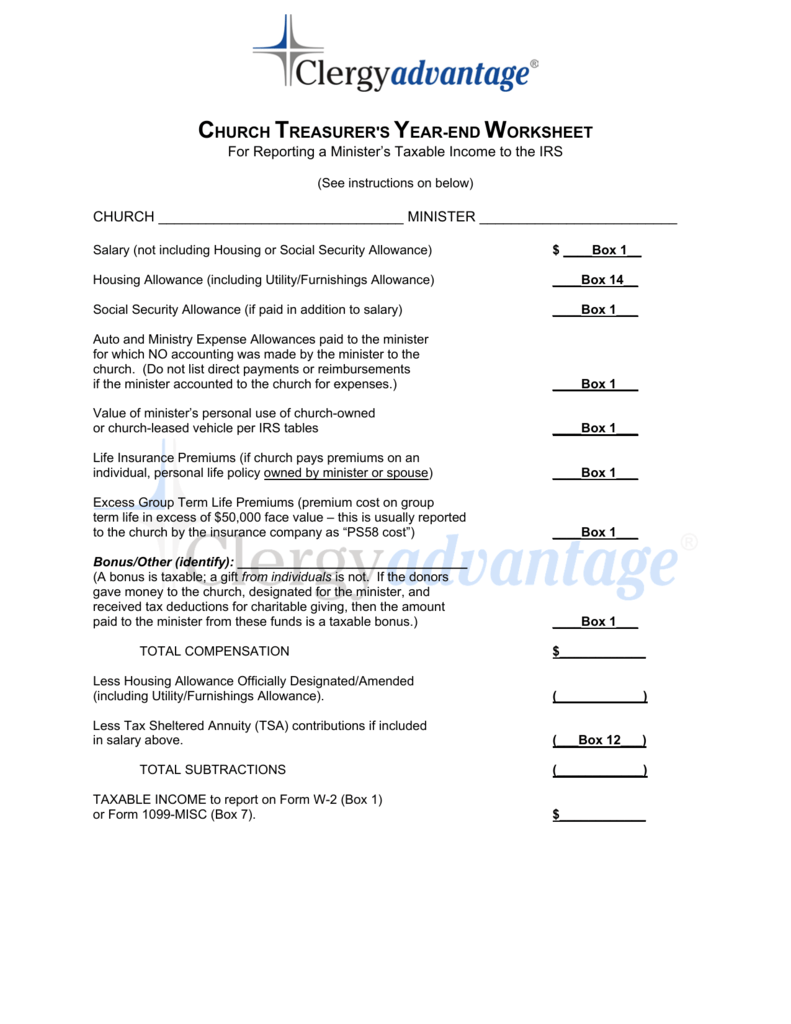

2022 Housing Allowance Form - Clergy Financial Resources 2022 Housing Allowance Form (888) 421-0101 Services 0 Resources 1 Store 2 About Us 3 Blog Home Tax - Quick Links 4 Payroll - Quick Links 5 Bookkeeping - Quick Links 6 Schedule Appointment Contact Us 7 Client Login 8 SIGN UP TODAY! - Be the first to get notified on new clergy tax, church payroll and HR updates. Clergy Financial Resources PDF MINISTER'S HOUSING EXPENSES WORKSHEET - AGFinancial TOTAL HOUSING EXPENSES $ MINISTER'S HOUSING ALLOWANCE In order to claim Minister's Housing Allowance exemptions for federal income tax purposes on your retirement distributions, you must: • Have been credentialed during the time the contribution was made • Have earned the income for the contribution from ministry • Be retired

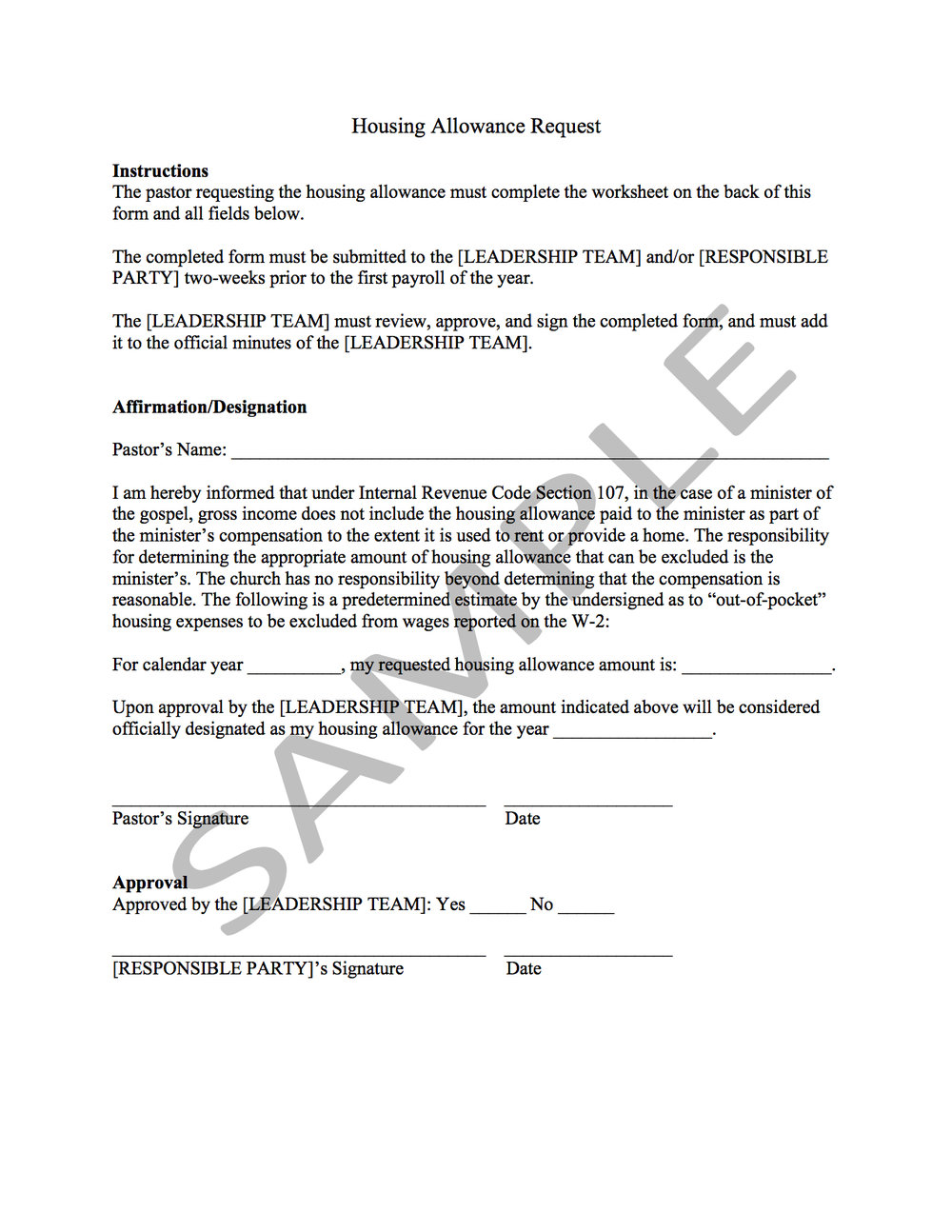

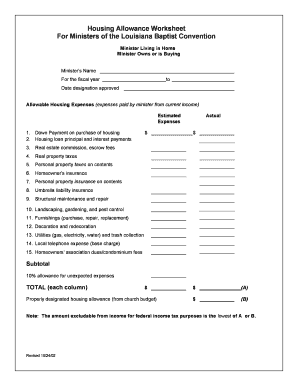

Allocating a Housing Allowance | Church Law & Tax Pastor Dave owns his own home. In December of 2012 his church board approved a compensation package for 2013 in the amount of $45,000. Of this amount, $30,000 was allocated to salary and $15,000 was designated as a housing allowance. The housing allowance was based on Pastor Dave's estimated housing expenses for 2013.

Pastor's housing allowance worksheet

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet ... Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet Housing Allowance for Pastors - Clergy Housing Allowance | MMBB How It Works. Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000. Housing Allowance Worksheets - ECFA.church Housing Allowance Worksheets Worksheets that may be used by ministries to officially designate the housing allowance. Register for a FREE account or log in to view this resource. Contact Evangelical Council for Financial Accountability. 800.323.9473. Sitemap. About; Our Team; Join ECFA;

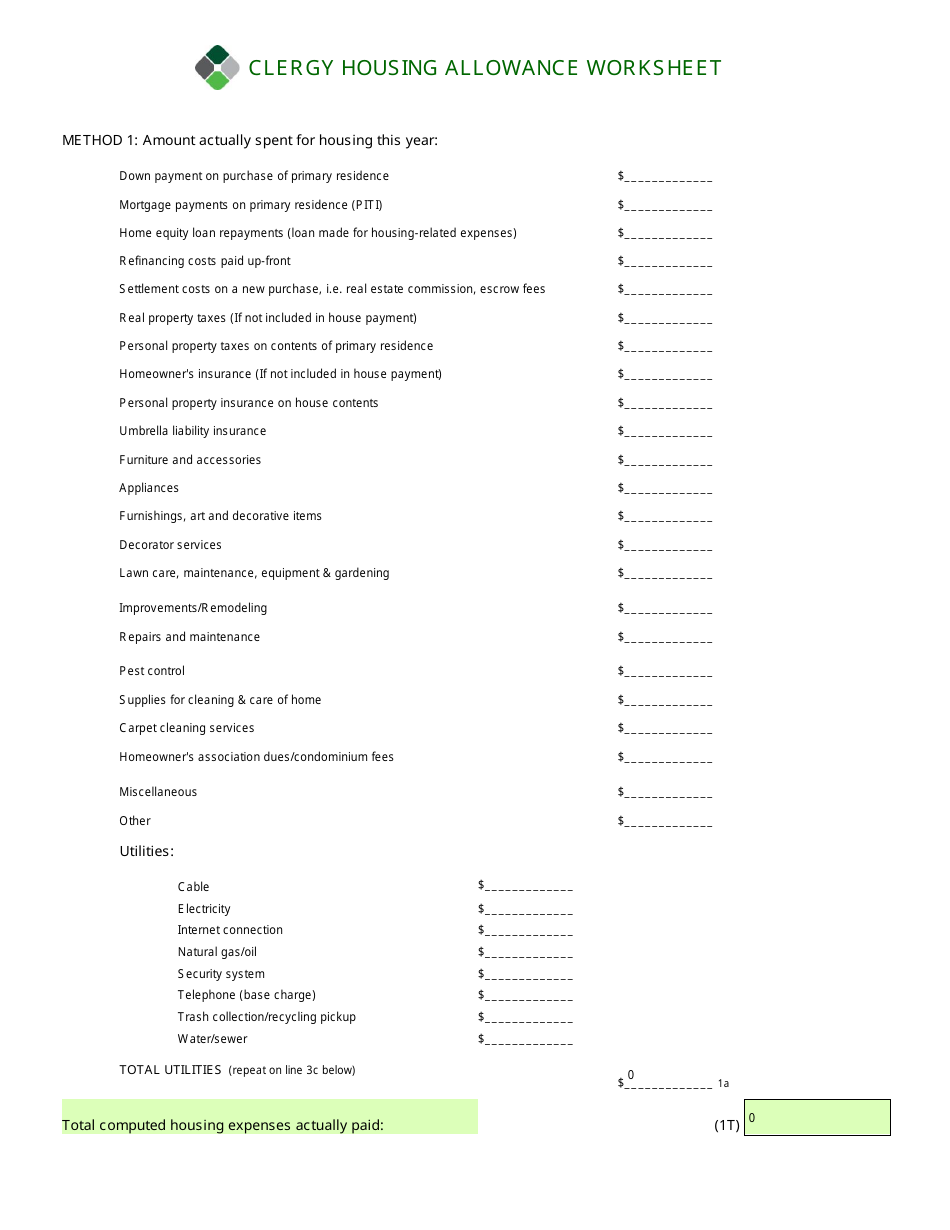

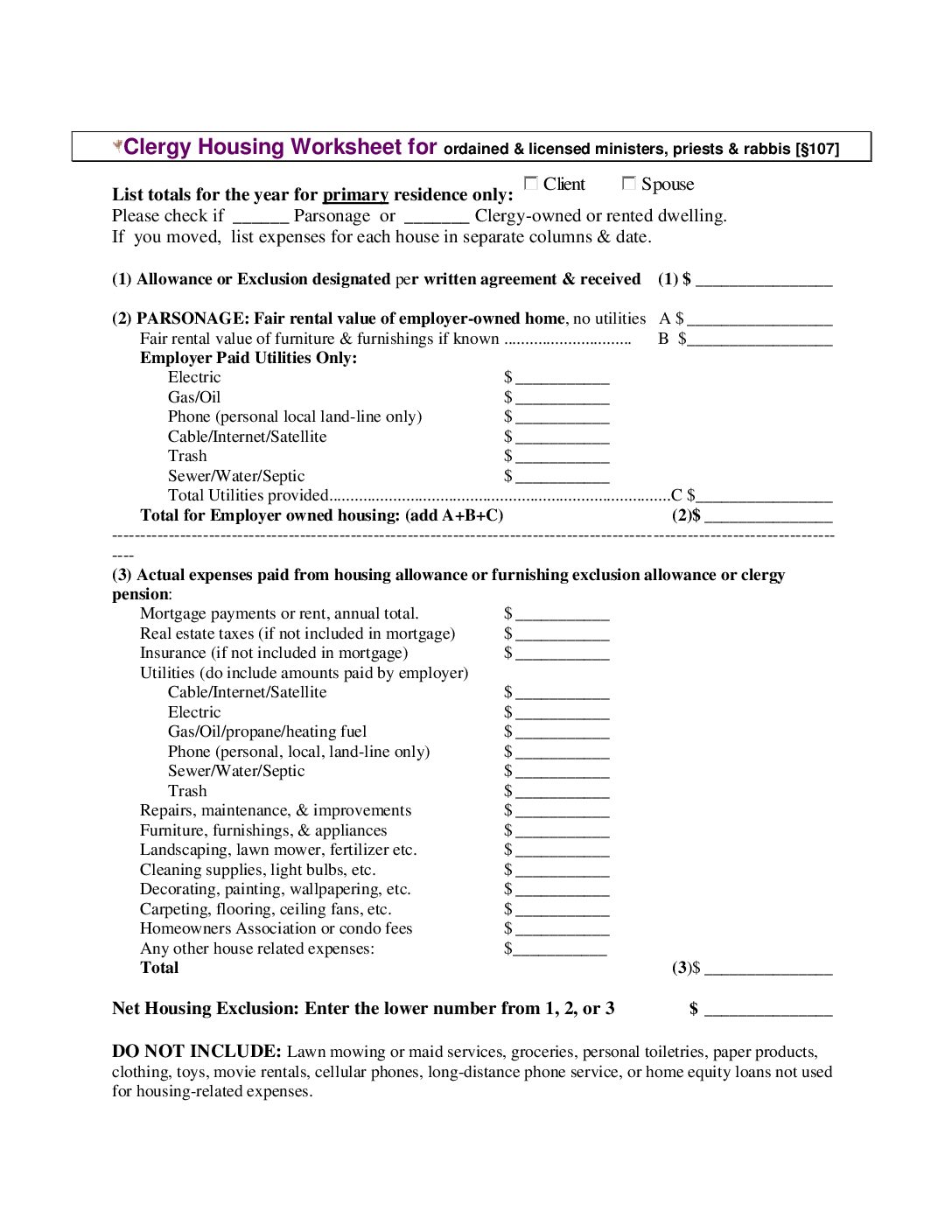

Pastor's housing allowance worksheet. Clergy Housing Allowance Worksheet - cchwebsites.com Clergy Housing Allowance Worksheet Use this calculator to help determine the amount that a member of the clergy can claim as a housing allowance. Clergy Housing Allowance is $0.00 * indicates required. Actual annual expenses paid: $0 Official allowance: $0 Annual fair rental value: $0 Clergy Housing Allowance Categories Definitions If active Ultimate Guide to the Housing Allowance for Pastors According to Christianity Today, 81% of full-time senior pastors take advantage of the housing allowance. In addition, this is saving pastors a total of about $800 million a year. For example, suppose a minister has an annual salary of $50,000, but their total housing allowance is $25,000. Sample Housing Allowance for Pastors - Payroll Partners whereas, ministers who own or rent their home do not pay federal income taxes on the amount of their compensation that their employing church designates in advance as a housing allowance, to the extent that the allowance represents compensation for ministerial services, is used to pay housing expenses, and does not exceed the fair rental value of … PDF 2021 Minister's Housing Allowance Worksheet - MinistryCPA between taxable and tax-free (i.e., excluded) ministerial income. (Sources: IRS Publication 1828; Clergy Housing Allowance Clarification Act of 2002; IRS Regulation Section 1.107-1). MinistryCPA Corey A. Pfaffe, CPA, LLC 302 N. 3rd Street, Suite 107, Watertown, WI 53094 ... Minister's Housing Allowance Worksheet. Yes. No. D . D .

PDF Clergy Housing Allowance Worksheet EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1. Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1. Everything Ministers/ Clergy Should Know About Their Housing Allowance Download: Housing Allowance Worksheet Package for Clergy and Churches If tax preparation is challenging for the general public, it can be even more so for members of the clergy, especially given recent changes to the tax code. That's why tax preparers who specialize in this area can be an invaluable partner when tax time rolls around.

Get Clergy Housing Allowance Worksheet 2010-2022 - US Legal Forms The tips below will allow you to fill out Clergy Housing Allowance Worksheet quickly and easily: Open the form in our feature-rich online editing tool by clicking on Get form. Complete the required fields that are marked in yellow. Hit the arrow with the inscription Next to jump from one field to another. Minister's Housing Allowance — Servant Solutions This resolution basically states that until a minister can submit a housing allowance request for the balance of the year, each paycheck issued to the minister will be X% (e.g. 60%) for salary and X% (e.g. 40%) for housing. As the minister prepares the request, (s)he will arrive at the grand total desired for housing - then subtract the total ... Pastoral Housing Allowance for 2021 - Geneva Benefits Group Both are located on our website, and mirror the forms in the back of the PCA Call Package Guidelines - just follow the links below. If you have questions, give us a call at (678) 825-1198 to schedule an appointment with a Financial Planning Advisor. You can also request an appointment online. Resources: Housing Allowance Worksheet I - Manse Housing Allowance Calculator - The Pastor's Wallet Housing Allowance Calculator Enter the ANNUAL cost for each category. If you pay on a monthly basis, simply multiply your payment by 12 to arrive at the ANNUAL cost. Real Estate Taxes If not included in mortgage payment. Homeowners Insurance If not included in mortgage payment. Utilities

PDF Position Paper Ministerial Housing Allowance and Worksheet Position Paper Ministerial Housing Allowance and Worksheet

PDF MMBB's Housing Allowance Worksheet Example Remember the tax code limits the nontaxable portion of housing compensation designated as. housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Ministers who own their homes should take the following expenses into account in. computing their housing allowance exclusion.

How Much Housing Allowance Can A Pastor Claim? If your mortgage payment is $2,000 a month but you could only rent the home for $1,500, then your housing allowance is limited to $1,500 a month. But, if your church has only designated $1,450 a month for your housing allowance, then that's the most you can claim.

Claiming A Minister's Housing Allowance In Retirement The following is an excerpt from my book, The Pastor's Wallet Complete Guide to the Clergy Housing Allowance: The IRS says it's still possible to claim a housing allowance even after you retire and stop receiving a paycheck. Unfortunately, there is no clear law or hard and fast rules about this.

2020 Housing Allowance For Pastors: What You Need To Know I've also created a worksheet that you can either open in Excel or print and fill in. 2020 Housing Allowance for Pastors Worksheet (.pdf) Download 2020 Housing Allowance for Pastors Excel Worksheet Download I hope you find these tools useful and if you have any questions as you go, don't hesitate to email me at amy@pastorswallet.com! Related

Minister's Housing Allowance Determination - Executive Pastor Online Estimate - The minister is asked to estimate housing expenses for the coming year in December. Their estimates are due to the executive pastor by or before the 2nd Friday in December. A "worksheet" is provided for the minister's use upon request. (Here's a link to the form: Minister's Housing Allowance Worksheet.)

Clergy Housing Allowance | Wespath Benefits & Investments Clearing the Clouds: Clergy Housing Allowance. Wespath Benefits and Investments (Wespath) recognizes the unique and often complex nature of clergy taxes. The following information is designed to help clear some of the gray when thinking about a housing allowance. It pertains to active clergy living in an owned or rented home, active clergy ...

Minister's Housing Expenses Worksheet | AGFinancial Minister's Housing Expenses Worksheet Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet Download the free resource now.

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

Get Minister Housing Allowance Worksheet - US Legal Forms Follow these simple actions to get Minister Housing Allowance Worksheet ready for sending: Find the sample you need in our collection of templates. Open the document in the online editing tool. Read through the instructions to determine which details you will need to include. Select the fillable fields and add the requested data.

Four Important Things to Know about Pastor's Housing Allowance Pastors who live in a church parsonage can still declare a housing allowance if they pay for utilities, repairs, furnishing, or other eligible expenses. They would declare the lower of: The housing allowance designated by their church. Actual housing expense not paid for by the church (like furnishings, repairs, or improvements). 3.

Housing Allowance Worksheets - ECFA.church Housing Allowance Worksheets Worksheets that may be used by ministries to officially designate the housing allowance. Register for a FREE account or log in to view this resource. Contact Evangelical Council for Financial Accountability. 800.323.9473. Sitemap. About; Our Team; Join ECFA;

Housing Allowance for Pastors - Clergy Housing Allowance | MMBB How It Works. Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000.

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet ... Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet

0 Response to "42 pastor's housing allowance worksheet"

Post a Comment