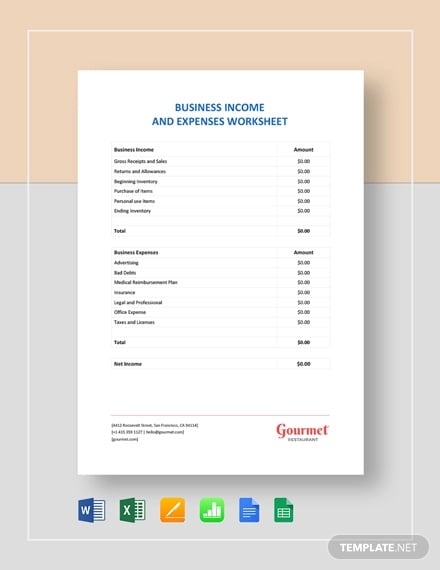

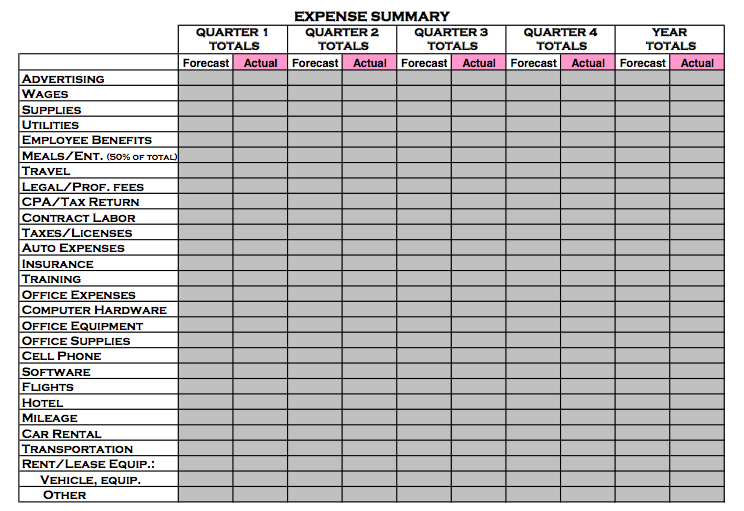

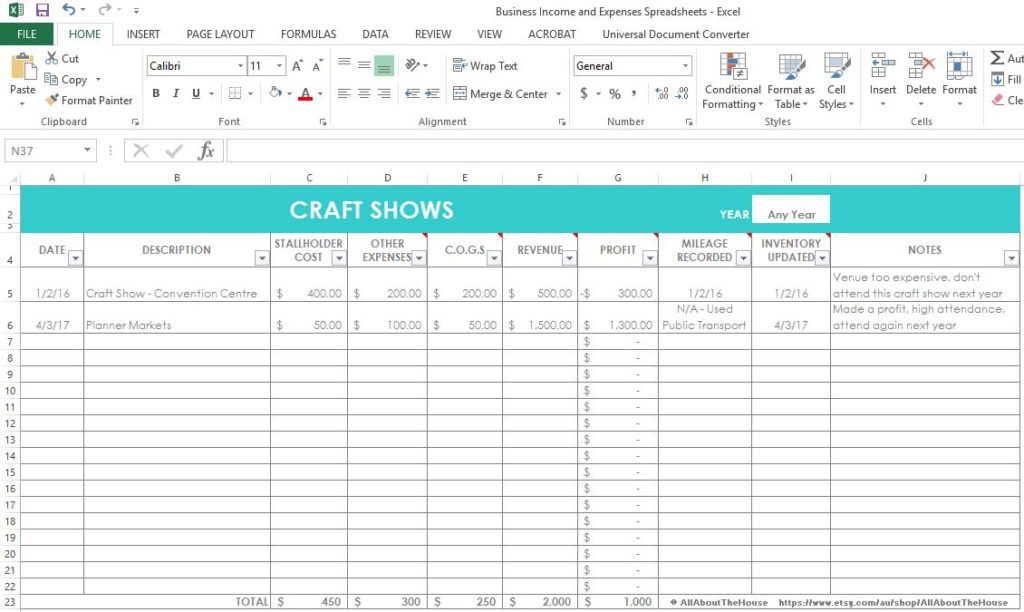

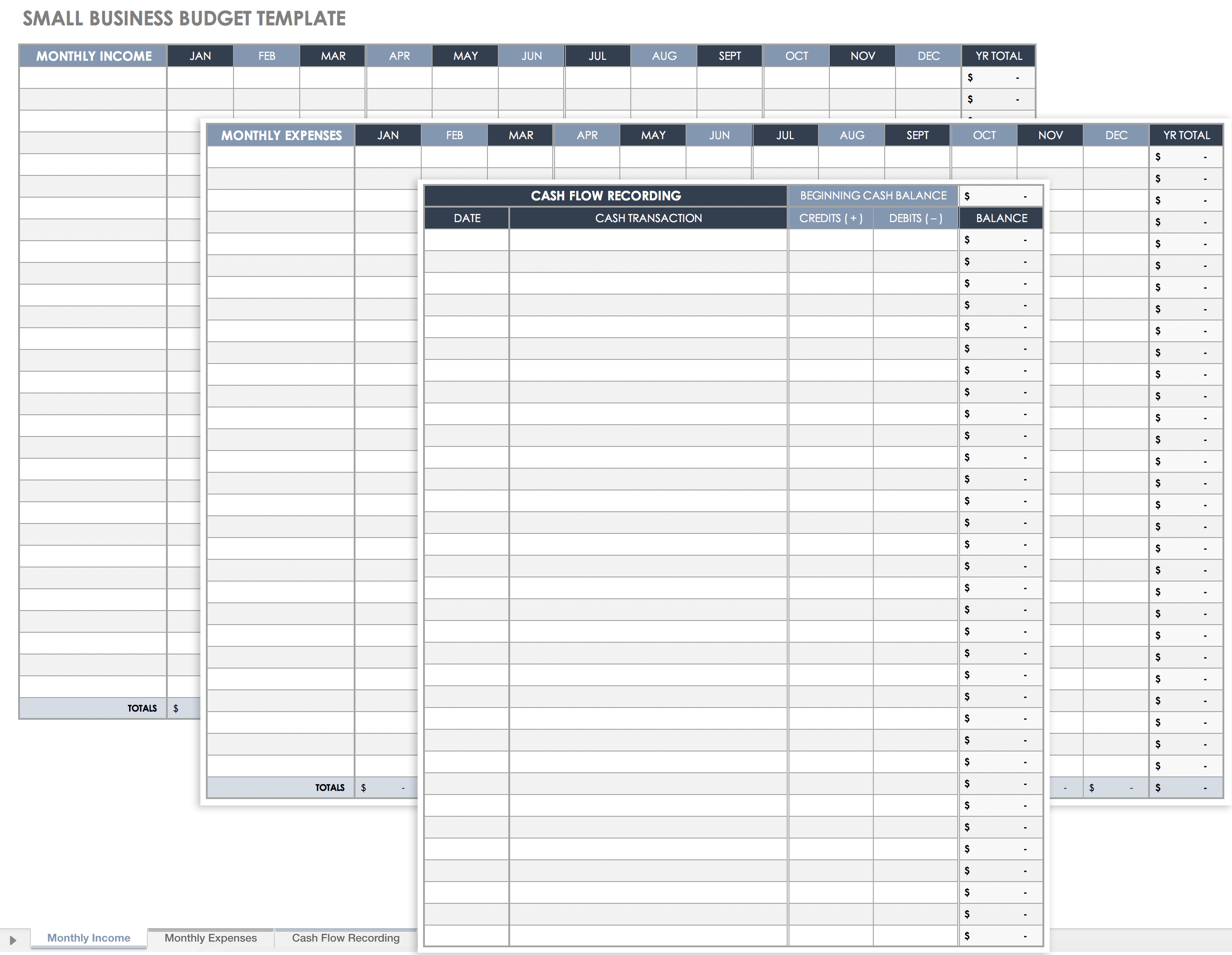

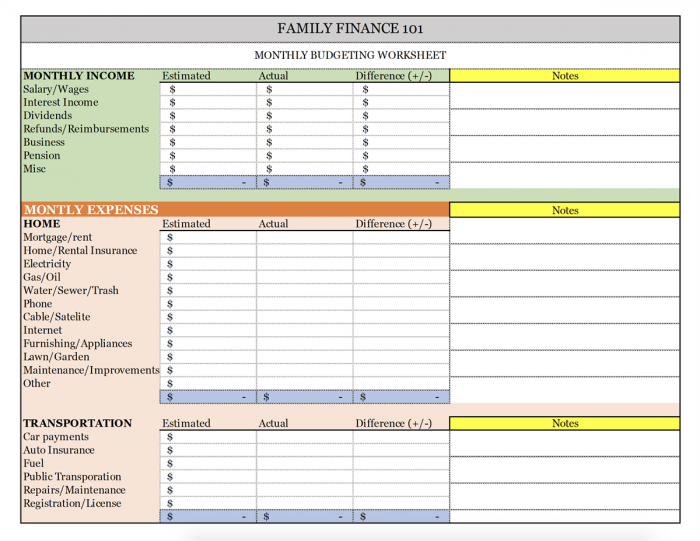

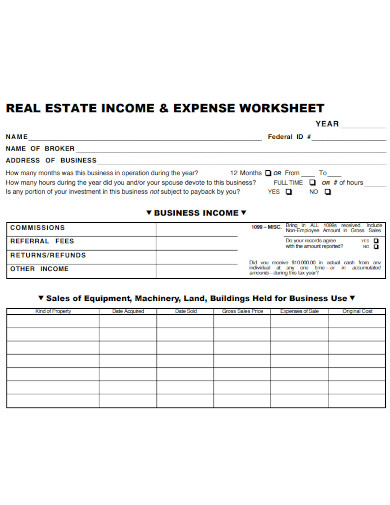

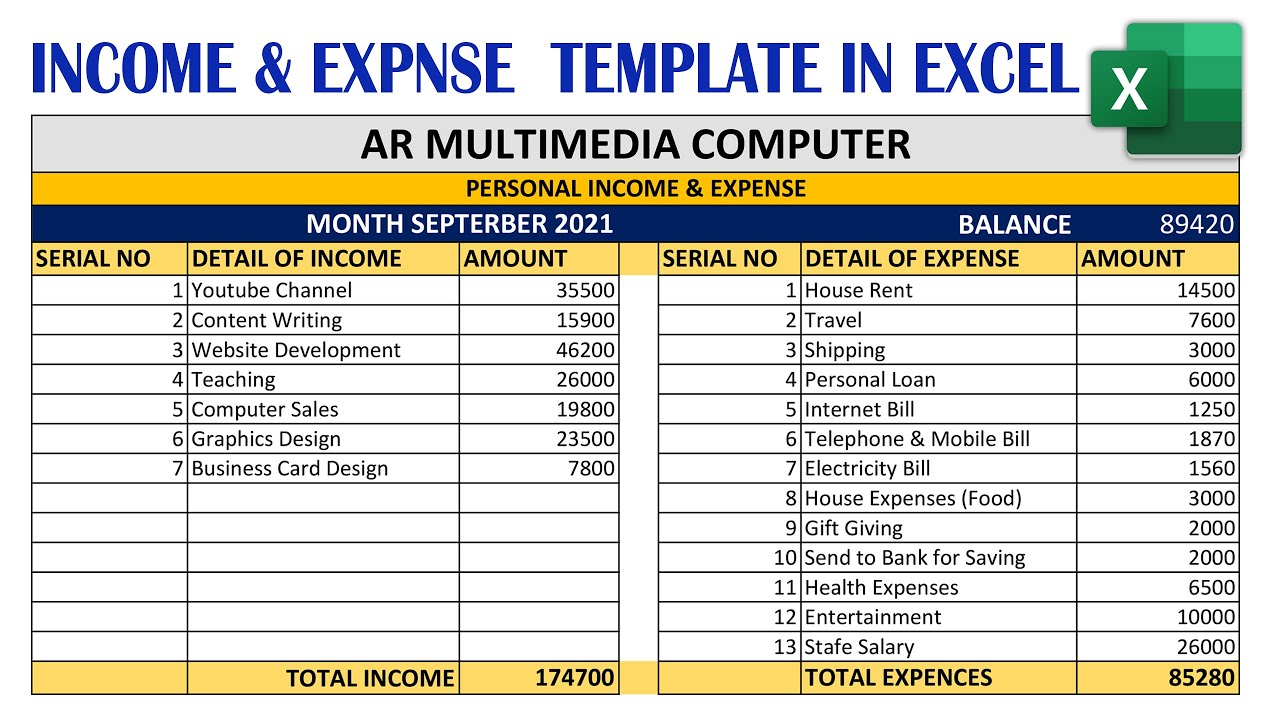

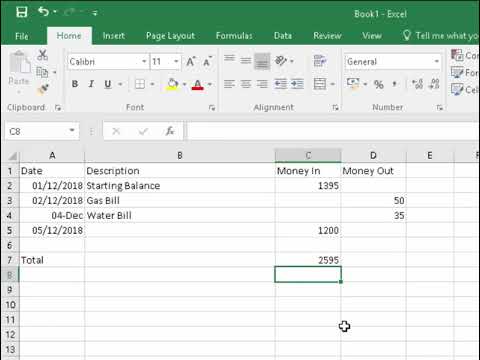

44 business income and expense worksheet

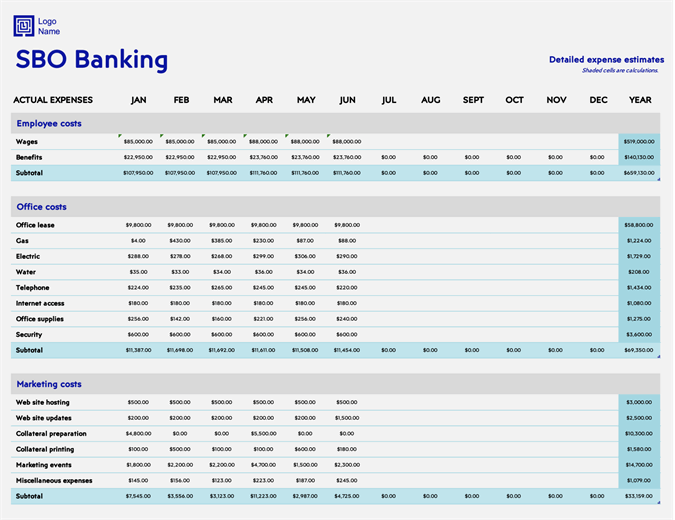

Publication 970 (2021), Tax Benefits for Education | Internal ... Business deduction for work-related education. Generally, if you claim a business deduction for work-related education and you drive your car to and from school, the amount you can deduct for miles driven from January 1, 2021, through December 31, 2021, is 56 cents a mile. See chapter 11. Publication 560 (2021), Retirement Plans for Small Business For example, sole proprietors deduct them on Schedule C (Form 1040) or Schedule F (Form 1040), Profit or Loss From Farming; partnerships deduct them on Form 1065, U.S. Return of Partnership Income; and corporations deduct them on Form 1120, U.S. Corporation Income Tax Return, or Form 1120-S, U.S. Income Tax Return for an S Corporation.

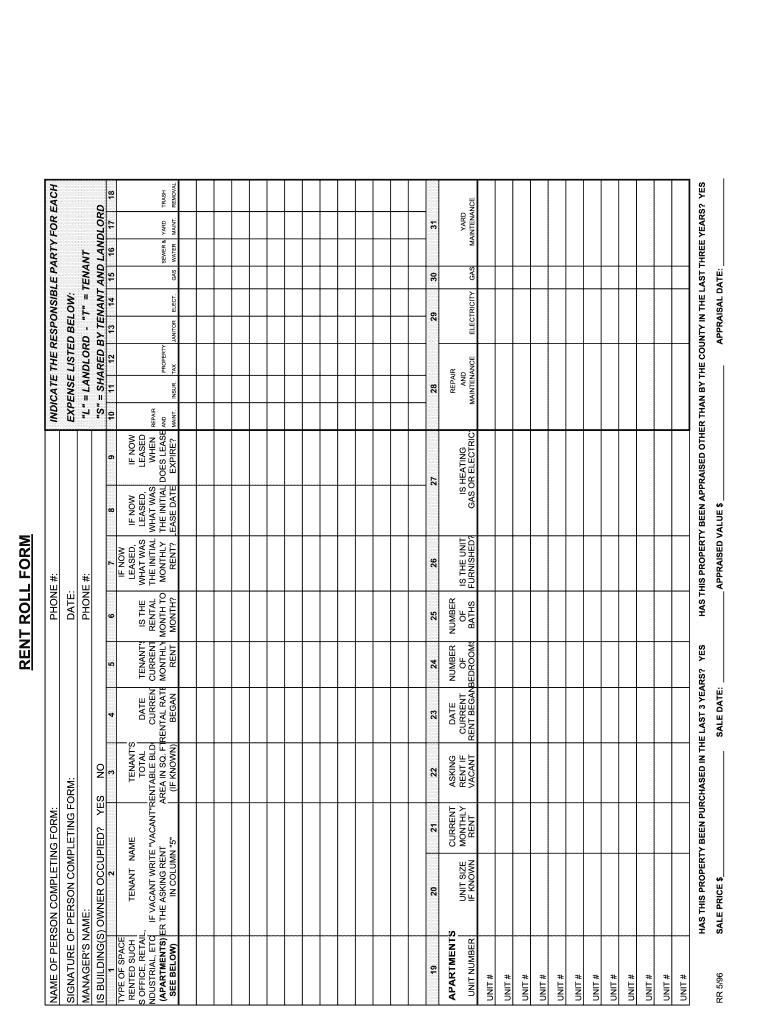

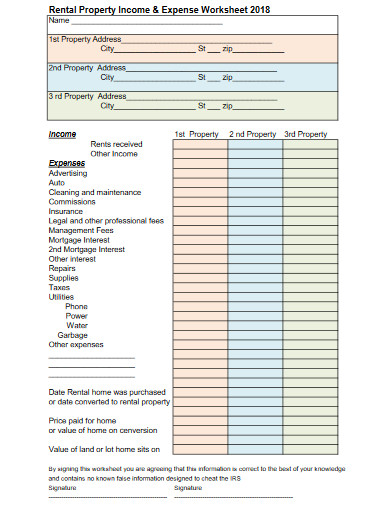

Rental Property Income and Expenses Worksheet » The ... As mentioned above, this template is very useful for expense tracking, rental income tracking, as well as tracking of the rental property profits or rental property losses that results from its business activities. However, keep in mind that it wouldn’t be appropriate to use an Expense Worksheet in every situation.

Business income and expense worksheet

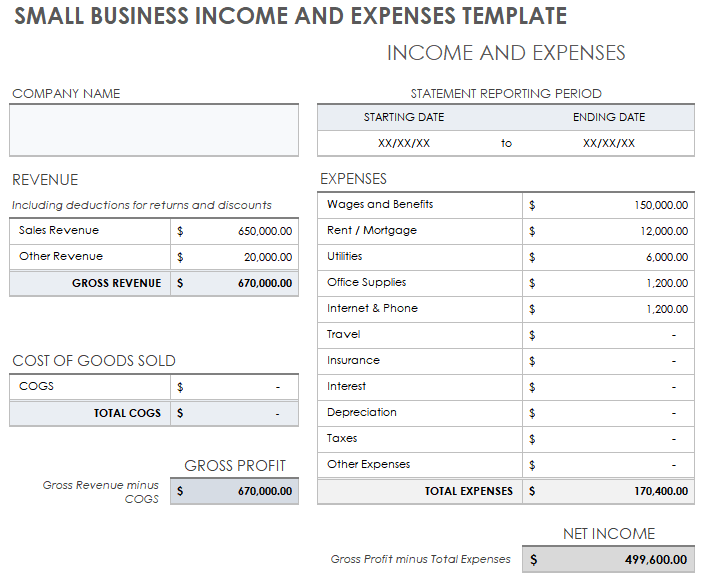

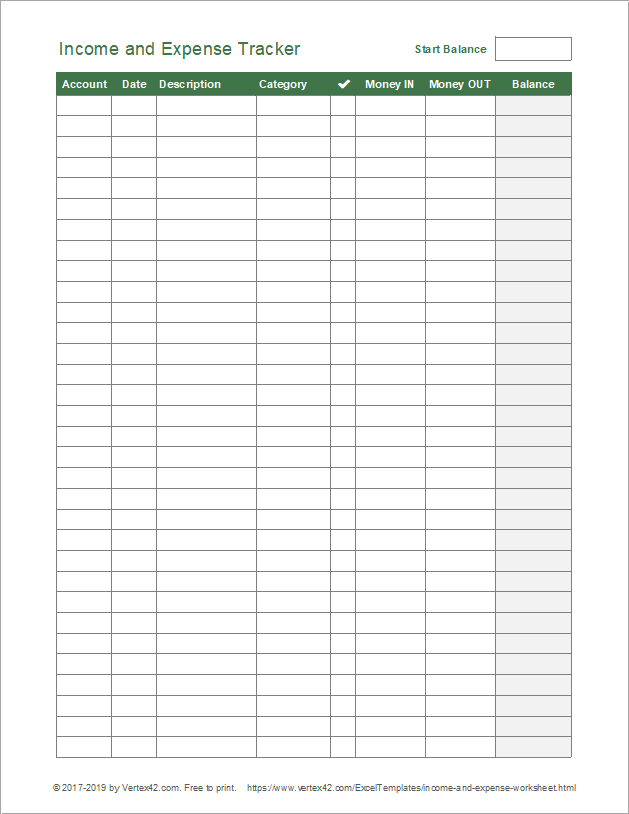

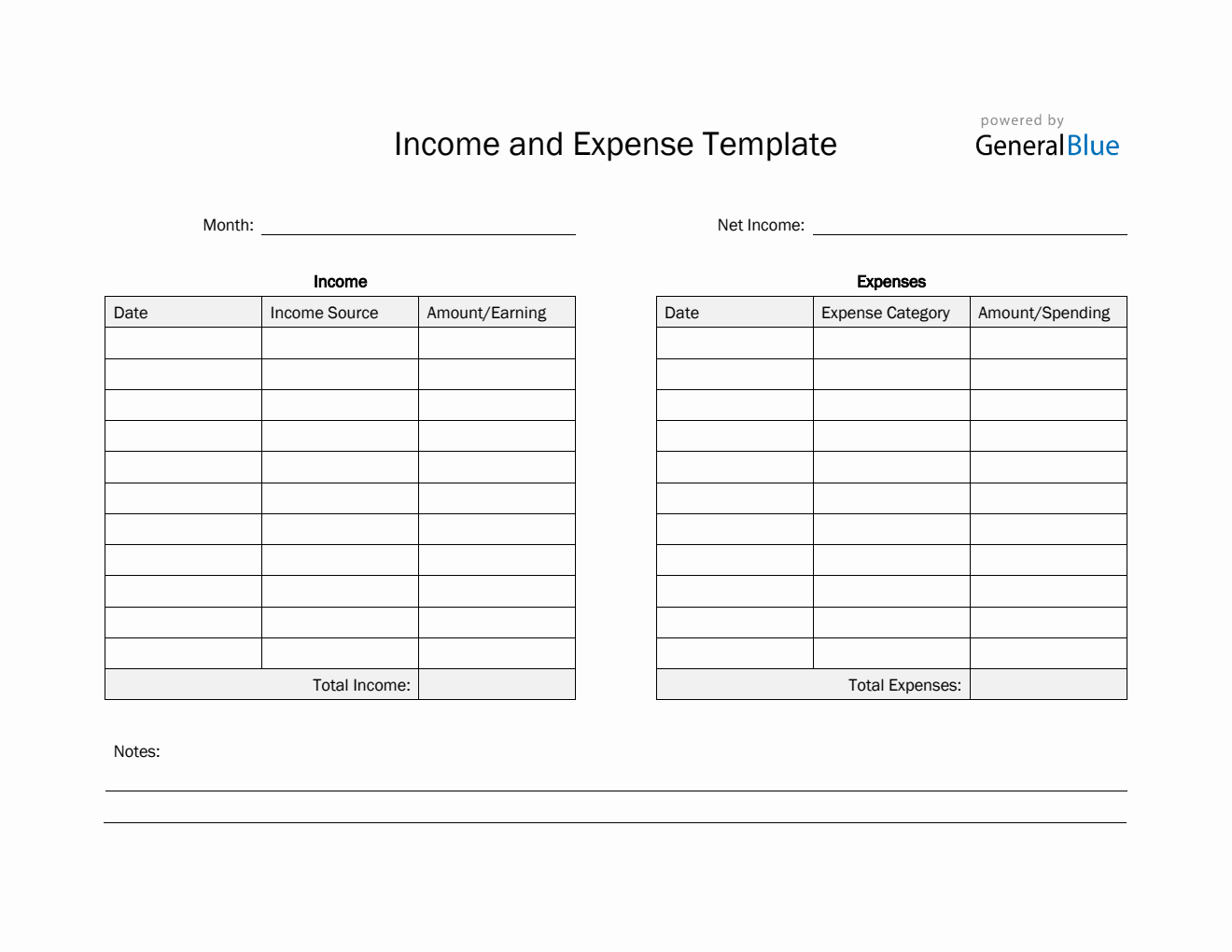

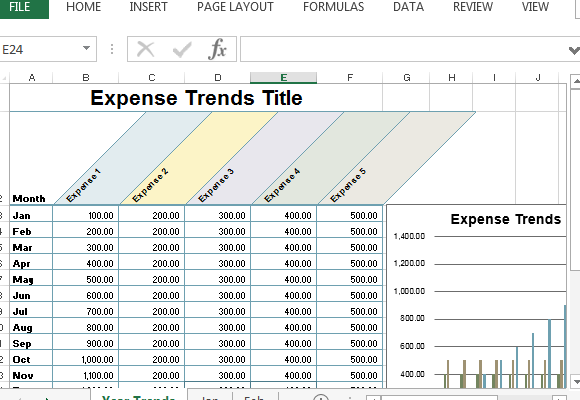

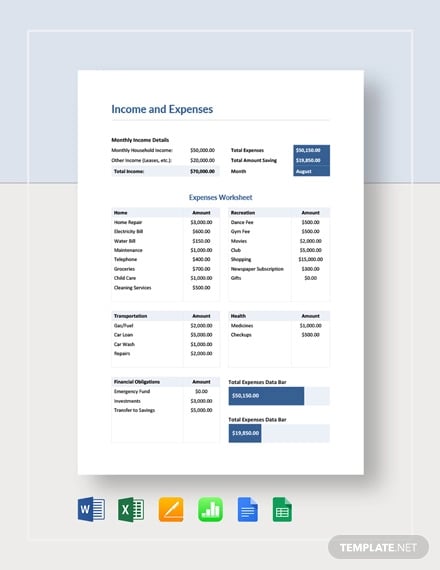

Rental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category. Rental Income - Canada.ca See line 22100 in the Federal Income Tax and Benefit Guide, or the "Expenses" chapter in Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income. If the funds are for personal use, you cannot deduct the interest expenses. Income and Expense Tracking Worksheet - Vertex42.com Aug 25, 2021 · Download a simple income and expense tracking worksheet, or customize and edit it using Excel or Google Sheets. Designed as a printable handout for a basic course on personal finances.

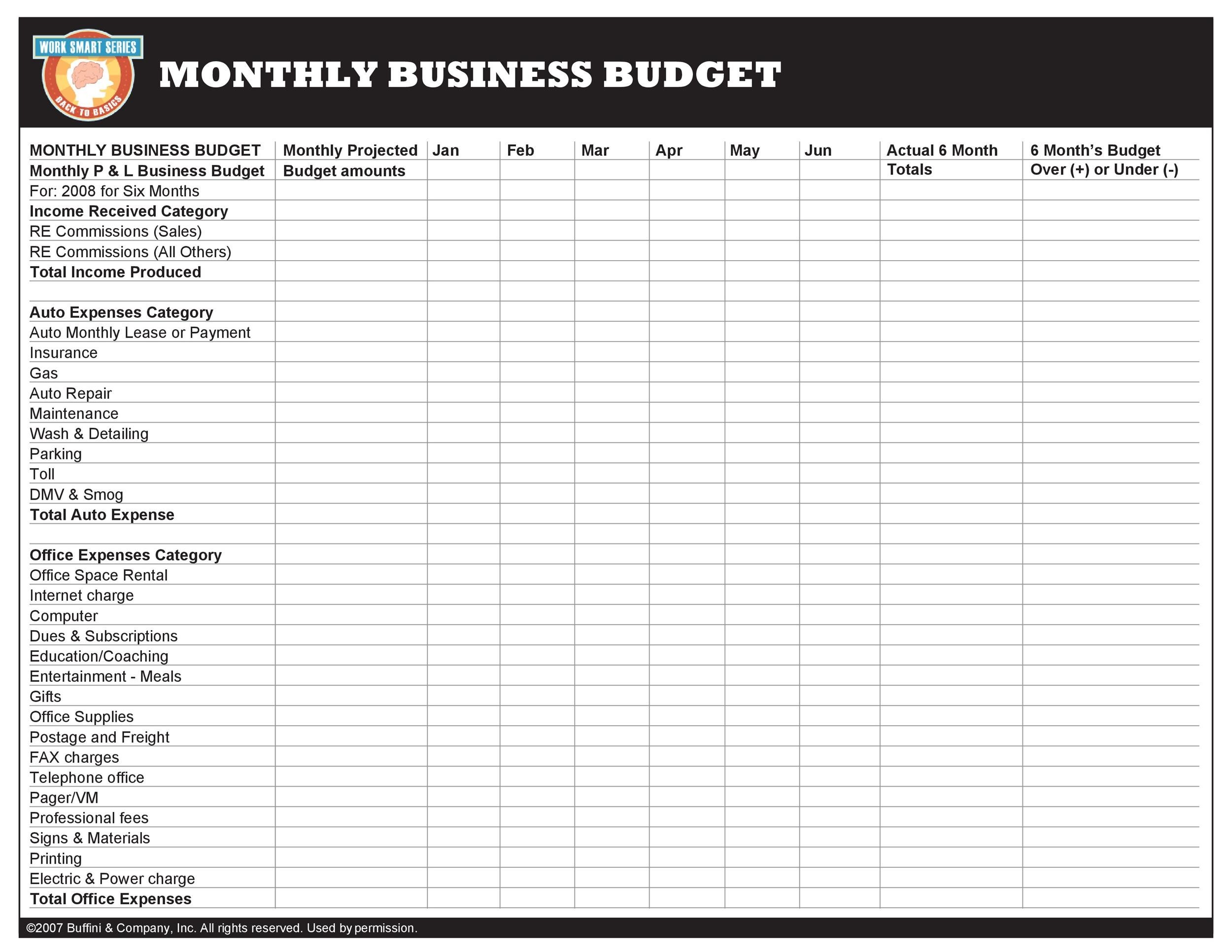

Business income and expense worksheet. 8+ Income & Expense Worksheet Templates - PDF, DOC | Free ... How to create expense and income spreadsheets. A budget spreadsheet is one of the best tools that you can use to manage your finances plans.Once you have all of the information within the example spreadsheet, you can use it to analyze how you go about your spending and how you can prevent yourself from spending more than you need to. Income and Expense Tracking Worksheet - Vertex42.com Aug 25, 2021 · Download a simple income and expense tracking worksheet, or customize and edit it using Excel or Google Sheets. Designed as a printable handout for a basic course on personal finances. Rental Income - Canada.ca See line 22100 in the Federal Income Tax and Benefit Guide, or the "Expenses" chapter in Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income. If the funds are for personal use, you cannot deduct the interest expenses. Rental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

0 Response to "44 business income and expense worksheet"

Post a Comment