45 flight attendant tax deductions worksheet

Downloads - flightax.com We will need the completed "Flight Deduction Organizer". 2020 Foreign Domicile Organizer Full Client Organizer for clients who lived and worked in another country in 2019 ACA Worksheet Required Form if not covered by insurance for the entire year. 8879 Only Electronic Filing Signature form for Tax Year 2021. Itemized Deduction Worksheet - Picket Fence Tax Preparation Service For most taxpayers, itemized deductions make up the vast majority of deductions. Understanding what you can and cannot deduct is critical. We find many taxpayers miss critical deductions. We created this worksheet to help make it easy to pull your tax paperwork together. For a downloadable copy click here: Itemized Deduction Worksheet

Flight Crew Deductions - Tax Court Rulings - Watson CPA Group - WCG CPAs Flight Crew Deductions. Some of this is moot, as fancy lawyers like to say, since the Tax Cuts and Jobs Act of 2017 basically killed most flight crew deductions. Some of this is still pertinent and some of it is just fun reading. Here is a sampling of important US Tax Court cases involving pilot and flight attendant tax deductions.

Flight attendant tax deductions worksheet

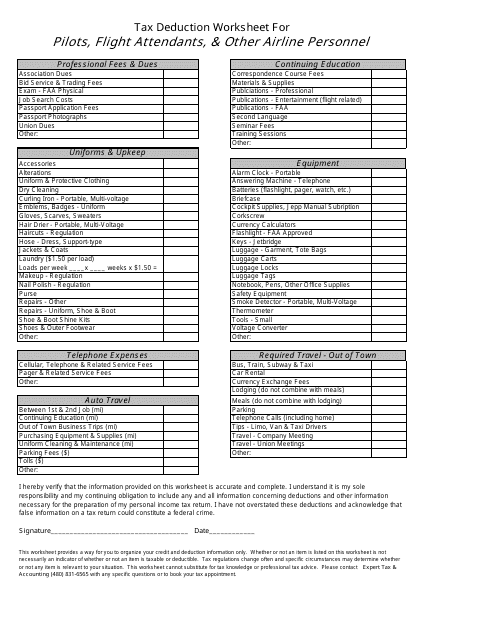

As a Flight Attendant, covered under transportation workers ... - Intuit If you are an employee receiving a W-2, starting in 2018 you can no longer deduct the expenses related to your work such as your uniforms, meals, travel, etc. This applies even to transportation workers and is part of the Tax Reform changes that were signed into law in late 2017. Please see the TurboTax article below for more information. › publications › p525Publication 525 (2021), Taxable and Nontaxable Income You're employed as a flight attendant for a company that owns both an airline and a hotel chain. Your employer allows you to take personal flights (if there is an unoccupied seat) and stay in any one of their hotels (if there is an unoccupied room) at no cost to you. The value of the personal flight isn't included in your income. Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

Flight attendant tax deductions worksheet. PDF Flight Crew Expense Report and Per Diem Information - WCG CPAs There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions. PDF Flight Attendant Professional Deductions - Diamond Financial If both Taxpayer and Spouse are flight attendants, use an additional Professional Deduction sheet. DO NOT combine expenses on this form! AIRLINE EMPLOYEED BY: BASE DOMICILED: ... Flight Attendant Fillable Worksheet Created Date: 12/5/2011 5:29:18 PM ... Tax Deductions for Flight Attendants | Occupation Deductions - TaxFitness Tax Deductions for Flight Attendants. 1/12/2018 1:54 PM. Average weekly pay: $1,110. Employment size: 12,000. Future growth: Very strong. Skill level Certificate III or IV. Flight attendants (also known as stewards/stewardesses, air hosts/hostesses, cabin attendants) are members of an aircrew employed by airlines primarily to ensure the safety ... Per Diem Calculation for Airline Pilots & Flight Attendants Taxes Simply put - the provisions under which pilots and flight attendants could deduct their excess per diem, union dues, uniform items, and other job-related expenses, are GONE. Starting with your 2018 tax return (filed early 2019), you no longer need to add up your trips to figure out your per diem calculation, as the deduction no longer applies.

Firefighter Tax Deductions 2018 Worksheet - Math Printing Sheets Flight Attendant Tax Deductions Worksheet Nidecmege . To be allowable deductions they also need to total more than 2 percent of your gross income. Firefighter tax deductions 2018 worksheet. This exception applies only for temporary workers hired in response to an unforeseen emergency. The most secure digital platform to get legally binding ... Flight Deductions - flightax.com If you are new to Flightax, below is a breakdown of the deductions we as Flight Attendants are allowed. Uniform Items Transportation Expenses Computer & Related Expenses Travel/Safety Items Communications Temporary Duty Expenses/SPA Union Expenses Training Job Search Commuter Pad Moving Expense 25 examples! What can flight crews write off? Why or why not? - EZPerDiem If you use a reimbursement on a deductible expense, you lose the deduction. Expense example 14: A flight attendant buys food at the airport while on a trip. Sort of. While food expenses are deductible, the per diem calculation is used in line of actual expenses. This creates a much higher deduction for meal expenses with a lot less work. PDF Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

Tax Deductions for Flight Attendants | National Tax & Accounting The most common work-related tax deductions for flight attendants and airline employees are summarised in a basic table below: * Conditions apply. If you would like to find out more about tax deductions for flight attendants, please contact us at National Tax & Accounting. 32 Flight Attendant Tax Deductions Worksheet - Worksheet Database 0AE Flight Attendant Training: Flight Attendent Training Visually enhanced, image enriched topic search for 32 Flight Attendant Tax Deductions Worksheet - Worksheet Database 0AE. Mungfali.com 2017 Air Crew Tax Specialist for Pilots and Crew Members Download 2015 Flight Attendant Worksheet Download Rental Real Estate Worksheet Download Small Business Worksheet Business Organizer for Corporations, S-Corporations and Partnerships Download Business Return Organizer Send Completed Tax Organizer to: Aircrew Taxes LLC 58 South Park Square Suite D Marietta, GA 30060 Fax (770) 795-9799 Or E-mail Flight crew - income and work-related deductions Deductions Record keeping Income - salary and allowances Include all the income you receive during the income year in your tax return, which includes: salary and wages allowances Don't include reimbursements. Your income statement or payment summary will show all your salary, wages and allowances for the income year. Salary and wages

PDF 2011 Aircrew Taxes Flight Attendant Worksheet Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer Married Pilots - If both you and your spouse fly, use an additional Professional Deduction ...

Instructions for Form 2106 (2021) | Internal Revenue Service Reimbursement Allocation Worksheet (keep for your records) Step 3—Figure Expenses To Deduct Line 9. Generally, you can deduct only 50% of your business meal expenses, including meals incurred while away from home on business. Meals that are not separately stated from entertainment are generally nondeductible.

› Individuals › Income-and-deductionsOccupation and industry specific guides | Australian Taxation ... Fire fighter deductions (PDF, 320KB) This link will download a file. Fitness and sporting industry employees. Fitness employee deductions (PDF, 302KB) This link will download a file. Flight Crew. Flight crew deductions (PDF, 336KB) This link will download a file. Gaming attendants. Gaming attendant deductions (PDF, 296KB) This link will ...

› story › moneyUnbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

Everything You Need to Know About Flight Attendant Tax Deductions Flight attendant tax deductions usually fall into one of two areas: out of pocket expenses such as uniforms, cell phone, union dues, etc. per diem allowances and deductions. Both are discussed below. Flight Attendant Tax Deductions - Out of Pocket Expenses… Virtually everyone in the corporate world will incur costs associated with their profession.

› publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible.

Flight Crew Tax Return and Deduction Checklist - H&R Block As a flight attendant, you can maximise your tax return by claiming work-related expenses as tax deductions. Learn more in our guide on deductions for flight crew. Maximise your tax refund from $99* *Available at participating offices. Terms & Conditions apply. ... There is a wide range of deductions you can claim as a flight attendant, such as:

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

The Epic Cheat Sheet to Deductions for Self-Employed Rockstars That means, if you go out for a $500 meal, the deductible portion is only $250. Also know that the 2018 tax bill eliminated client entertainment as a tax deduction. That means that you can no longer write off taking your client out to events, like the ballet or a baseball game.

List of Flight Attendant Tax Deductions | Sapling The instructions to Schedule A list all categories of expenses that you can itemize. Therefore, you should evaluate the additional expenses you can deduct in addition to your flight attendant expenses. Once you estimate your Schedule A deductions, compare the total to the standard deduction you are eligible for.

Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s.

tax deductions for flight attendants - Personal Tax Specialists If you work as a flight attendant, some of the tax deductions you may be able to claim on your personal tax return are: Meal and Travel. The cost of buying meals when you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to keep any receipts, provided you can show how you have calculated the amount you spent)

› playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

PDF PROFESSIONAL DEDUCTIONS - pilot-tax.com If you are a flight attendant and update your resume or fly to an interview, these expenses are deductible. If you do the same for another position outside of the industry, such as a retail position or professional job, these expenses may not be taken as a deduction.

› microsoft-says-a-sony-deal-withMicrosoft says a Sony deal with Activision stops Call of Duty ... Oct 21, 2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and

Pilot & Flight Crew Tax Preparation | Flight Attendant Tax Returns ... Business Related Expenses for Flight Crew. Expenditures over $75 - receipt needed; Expenditures below $75 - a diary containing the item purchased, date and amount spent must be maintained. Transporation Per Diem Expenses. The IRS allows a special per diem deduction for transportation workers.

work: Flight Crew Expense - Aligaen Accounting & Tax Services There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this online submit form to detail your flight attendant and pilot tax deductions.

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income You're employed as a flight attendant for a company that owns both an airline and a hotel chain. Your employer allows you to take personal flights (if there is an unoccupied seat) and stay in any one of their hotels (if there is an unoccupied room) at no cost to you. The value of the personal flight isn't included in your income.

As a Flight Attendant, covered under transportation workers ... - Intuit If you are an employee receiving a W-2, starting in 2018 you can no longer deduct the expenses related to your work such as your uniforms, meals, travel, etc. This applies even to transportation workers and is part of the Tax Reform changes that were signed into law in late 2017. Please see the TurboTax article below for more information.

/images/2022/05/05/smiling_cheerful_air_hostess_in_blue_uniform.jpg)

0 Response to "45 flight attendant tax deductions worksheet"

Post a Comment