38 affordable care act worksheet form

Affordable Care Act Worksheets - K12 Workbook Displaying all worksheets related to - Affordable Care Act. Worksheets are Affordable care act, Affordable care act, 2019 instructions for schedule h form 990, This document explains the different options for, This document explains the aca configurations and when, Medicare, Affordable care act aca employee status code instructions, Guide to the acas employer reporting requirements. Form 8965 - Affordability Worksheet - Support Step One in completing the Affordability Worksheet is to calculate the Affordability Threshold which is 8.16% of Household Income.the tax program will automatically pull into the Household Income calculation all amounts that have been previously entered into the tax return on behalf of the taxpayer and/or spouse.

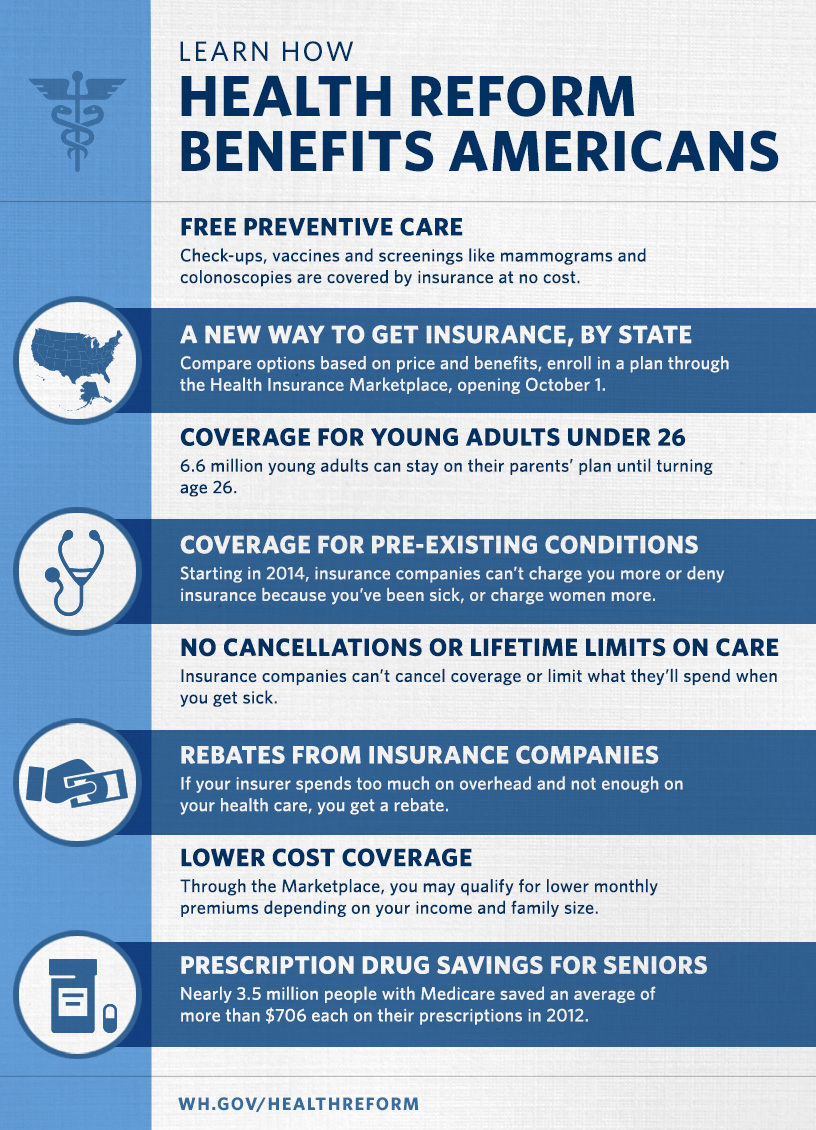

Affordable Care Act Estimator Tools | Internal Revenue Service Sep 29, 2022 · The Affordable Care Act (ACA) estimator tools help individuals and employers determine how ACA could affect them and estimate related tax credits and payments. The Taxpayer Advocate Service has developed several tools for individuals and employers to help determine how the Affordable Care Act might affect them and to estimate ACA related ...

Affordable care act worksheet form

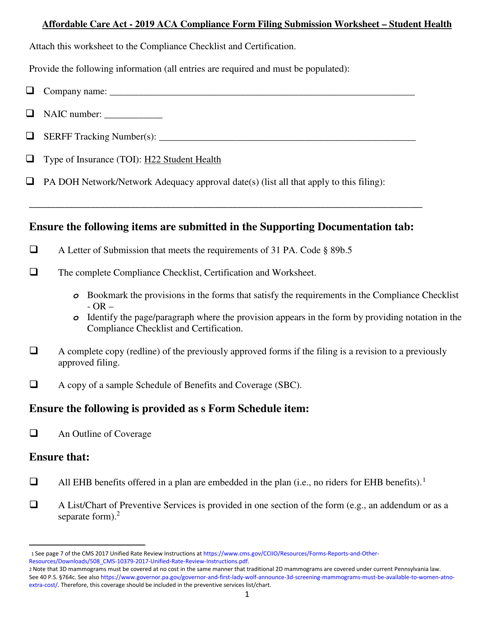

PDF Affordable Care Act - 2019 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2019 ACA Compliance Form Filing Submission Worksheet Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): ... List the form numbers of all forms that are being submitted with the filing: 1 https: ... PDF Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet . Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. Company name: _____ 2. NAIC number: _____ 3. Determining if an Employer is an Applicable Large Employer Sep 29, 2022 · Basic Information Two provisions of the Affordable Care Act apply only to applicable large employers (ALEs): The employer shared responsibility provisions; and The employer information reporting provisions for offers of minimum essential coverage Whether an employer is an ALE is determined each calendar year, and generally depends on the ...

Affordable care act worksheet form. PDF Affordable Care Act Worksheet - Cordell Neher & Company, PLLC Affordable Care Act Worksheet Are you required to comply with the Act? How many employees does your Company employ: 200 or more fulltime (FT) employees. (Continue to Step 2. You are required to comply with the Act and must automatically enroll all FT employees in health insurance.) Health Insurance Care Tax Forms, Instructions & Tools This form includes details about the Marketplace insurance you and household members had in 2021. You'll need it to complete Form 8962, Premium Tax Credit. Get a quick overview of health care tax Form 1095-A — when you'll get it, what to do if you don't, how to know if it's right, and how to use it. See a sample 1095-A (PDF, 132 KB). Privacy Impact Assessments - PIA | Internal Revenue Service Jan 24, 2022 · Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Request for Transcript of Tax Return Réservez des vols pas chers et trouvez des offres ... - easyJet Réservez des vols pas chers sur easyJet.com vers les plus grandes villes d'Europe. Trouvez aussi des offres spéciales sur votre hôtel, votre location de voiture et votre assurance voyage.

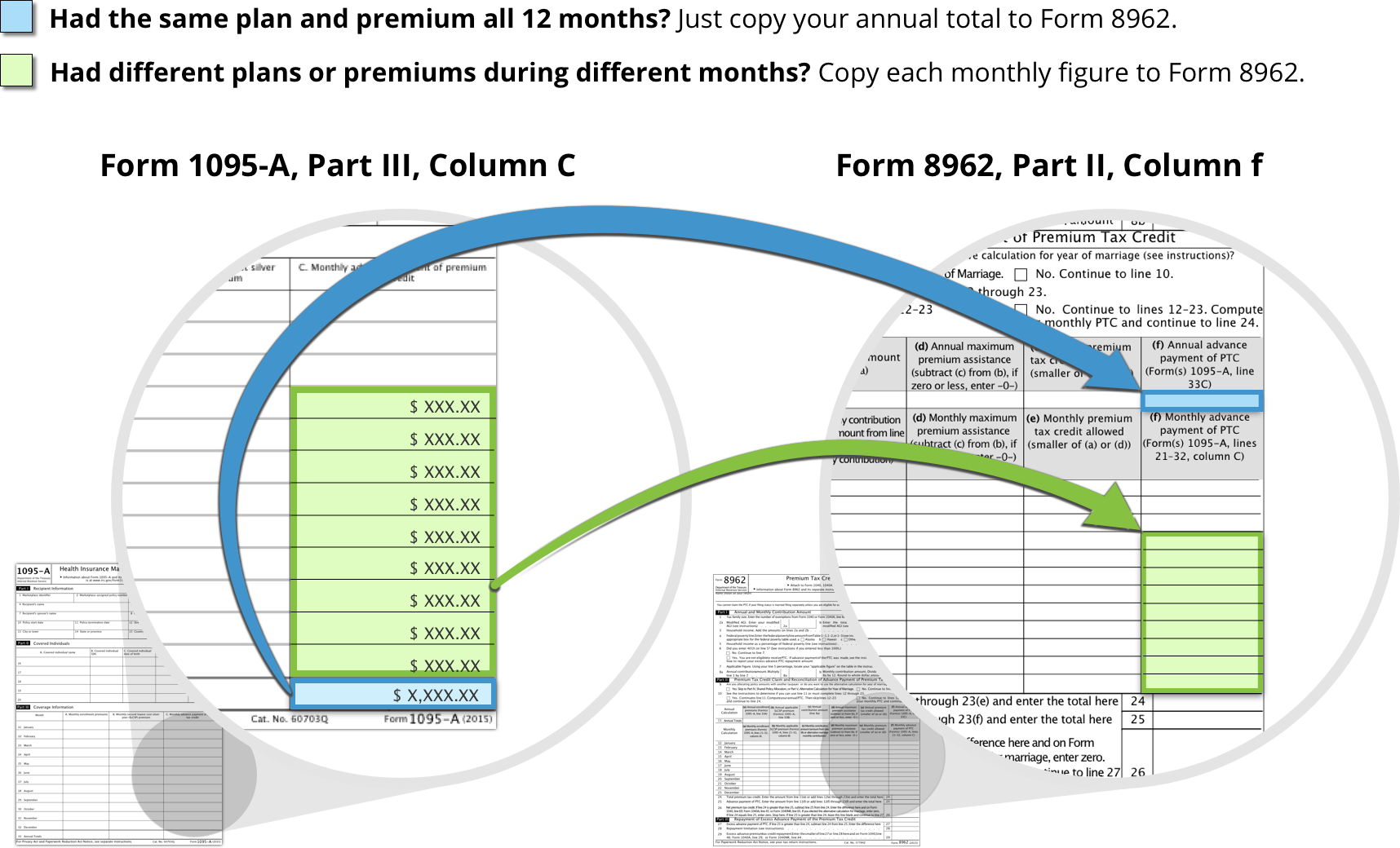

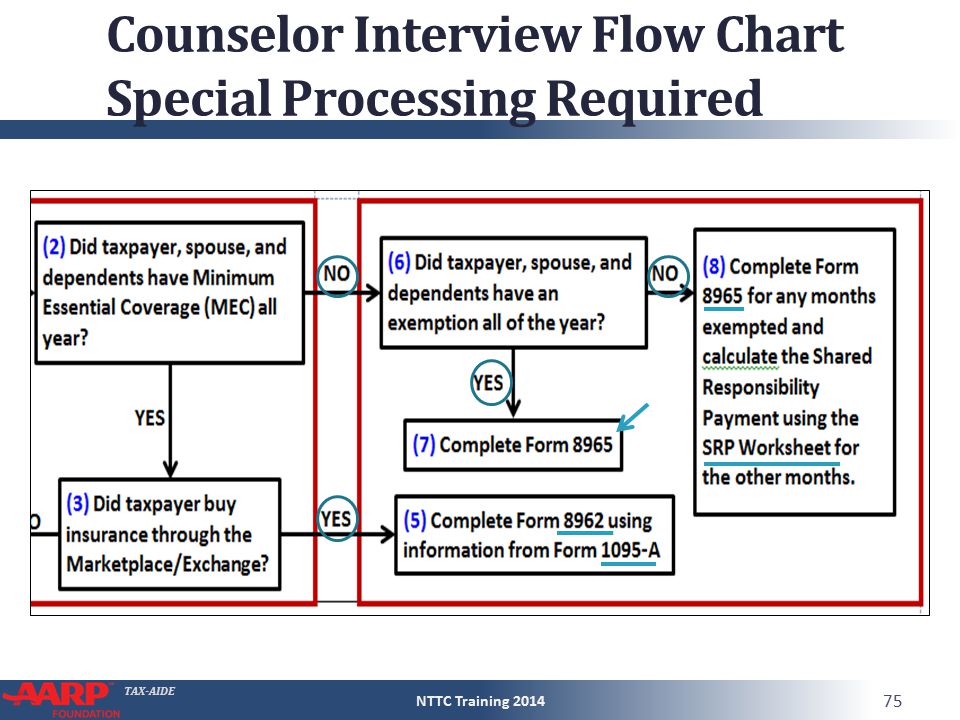

Affordable Care Act | Internal Revenue Service - IRS tax forms Employers The Affordable Care Act includes requirements for employers regarding health care coverage. The size and structure of your workforce determines your responsibility. If you don't have employees, the information doesn't apply to you. Affordable Care Act Forms, Letters and Publications Form 8962, Premium Tax Credit PDF Affordable Care Act Worksheet Form - groups.google.com All groups and messages ... ... Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. PDF Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is ... The form includes information about the coverage, who was covered, and when.

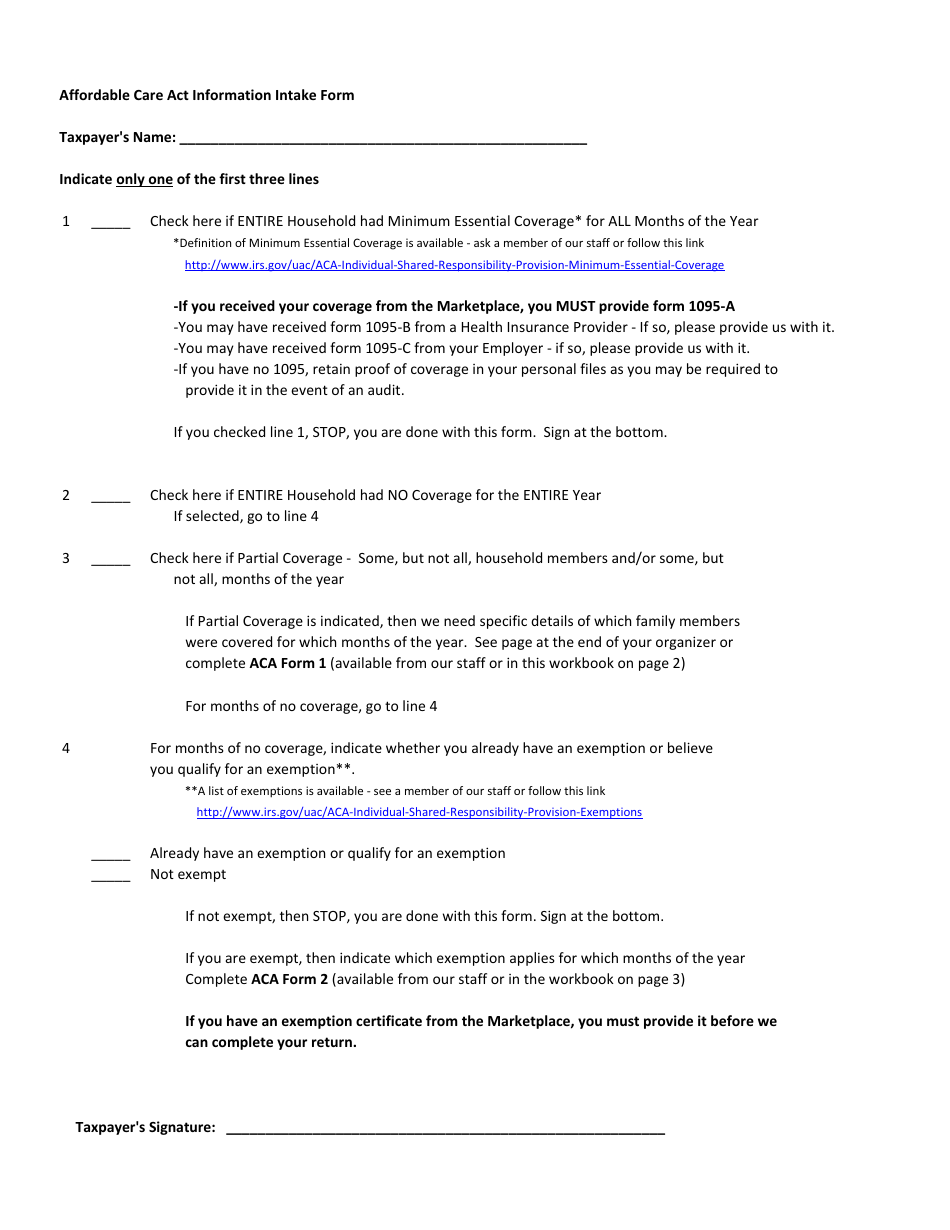

Fillable Welcome to the Affordable Care Act Worksheet for (Flightax) Welcome to the Affordable Care Act Worksheet for (Flightax) On average this form takes 16 minutes to complete The Welcome to the Affordable Care Act Worksheet for (Flightax) form is 1 page long and contains: 0 signatures 0 check-boxes 63 other fields Country of origin: US File type: PDF Adolescent Health | HHS Office of Population Affairs Gender-affirming care is a supportive form of healthcare that consists of an array of services. For young people, receiving this care early is crucial to overall health and well-being. In this resource, OPA describes research that demonstrates the importance of gender-affirming care as well as common terms and services. Affordable Care Act Worksheet Form - theconsultingstudents.net Affordable Care Act Worksheet Form. Why does my form include a former dependent? Anthem Blue Cross network, and includes prepaid access to care at the UCSC Student Health Center for illness or injury. The law also requires VA to provide this information to the Internal Revenue Service. Individual Shared Responsibility Provision | Internal Revenue ... Under the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018. Beginning in Tax Year 2019, Forms 1040 and 1040-SR will not have the “full-year health care coverage or exempt” box and Form 8965, Health Coverage Exemptions, will no longer be used.

Affordable Care Act - Tax Guide • 1040.com - File Your Taxes Online Form 1095-A shows monthly coverage from the Health Insurance Marketplace and qualifies you for the Premium Tax Credit Form 1095-B shows monthly coverage from your healthcare provider Form 1095-C shows monthly coverage from some employer-provided insurance Some taxpayers may receive multiple forms, depending on when and how they were insured.

Determining if an Employer is an Applicable Large Employer Sep 29, 2022 · Basic Information Two provisions of the Affordable Care Act apply only to applicable large employers (ALEs): The employer shared responsibility provisions; and The employer information reporting provisions for offers of minimum essential coverage Whether an employer is an ALE is determined each calendar year, and generally depends on the ...

PDF Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet . Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. Company name: _____ 2. NAIC number: _____ 3.

PDF Affordable Care Act - 2019 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2019 ACA Compliance Form Filing Submission Worksheet Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): ... List the form numbers of all forms that are being submitted with the filing: 1 https: ...

:max_bytes(150000):strip_icc()/imageedit_4_7778438120-f5a8a7aac0fd466ab91af5b4d29ebf6e.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

0 Response to "38 affordable care act worksheet form"

Post a Comment