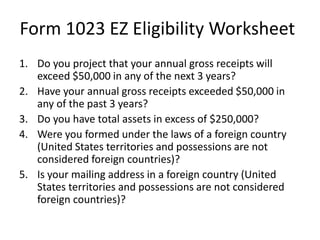

38 form 1023 ez eligibility worksheet

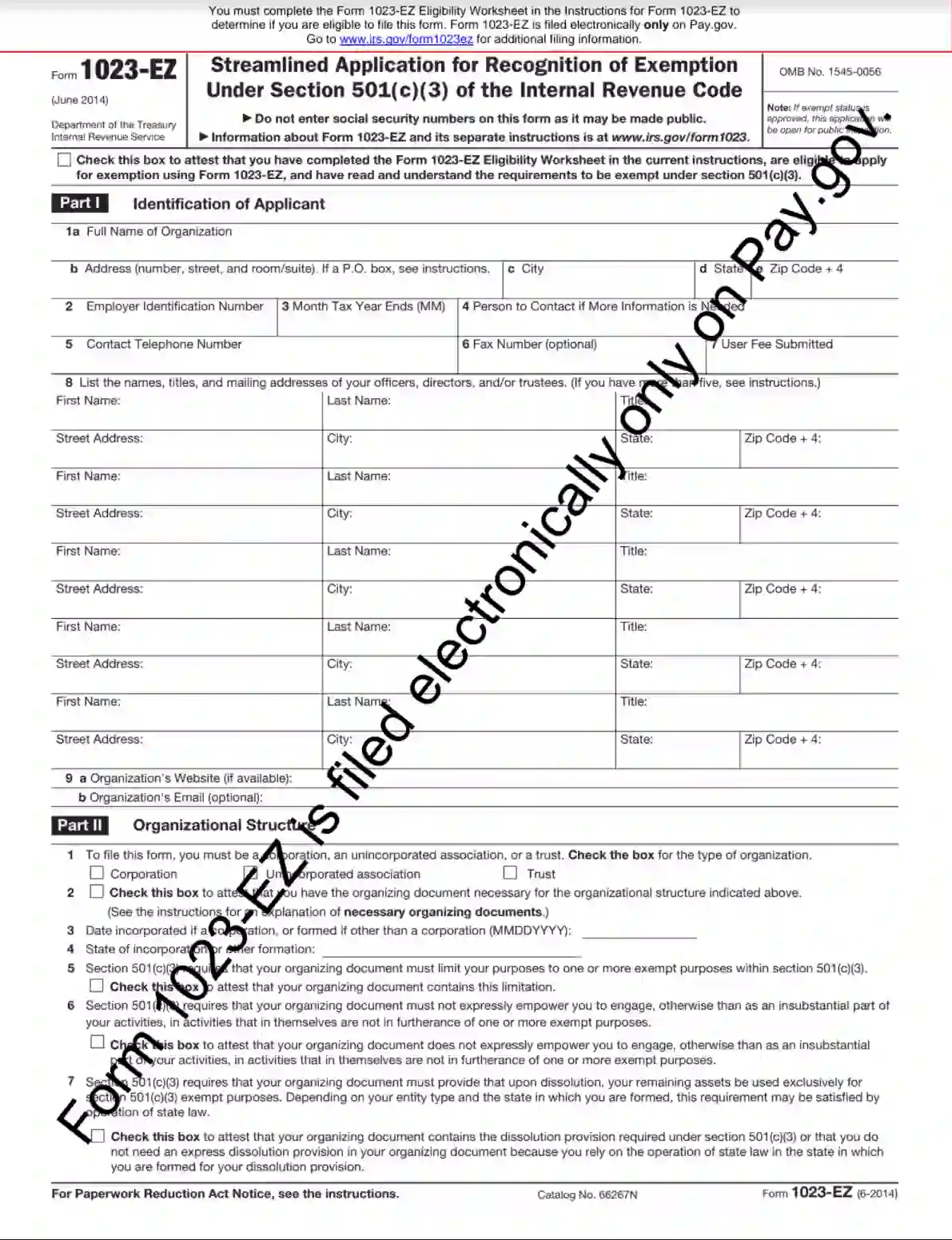

Application for Recognition of Exemption Under Section 501(c)(3) You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501 (c) (3). 1023-EZ Worksheet 2022 - 2023 - IRS Forms - Zrivo Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code is the easier version of Form 1023. ... The eligibility worksheet for Form 1023-EZ is eight pages long, and it should take you about ten minutes to complete from the start to finish. Before you start filling out Form 1023-EZ ...

Instructions for Form 1023 (01/2020) | Internal Revenue Service WebComplete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. You can visit IRS.gov/Charities for more information on application requirements. Leaving a group exemption. A subordinate organization under a group exemption can use Form 1023 to leave the group and obtain …

Form 1023 ez eligibility worksheet

1023 eligibility worksheet Form 1023 ez eligibility worksheet — db-excel.com. 1023 ez eligibility. Eligibility 1023 irs. Random Posts. worksheets sight words kindergarten; valentines day activities for preschoolers; unscramble sentences worksheets for kindergarten; 06.04 energy conservation design worksheet; IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Corporations ... IRS Form 1023-EZ Eligibility WorksheetRichard Keyt2020-03-07T09:04:08-07:00 An organization that seeks to be a tax-exempt charity under Section 501(c)(3) of the Internal Revenue Code must apply for tax exempt status by preparing and filing with the IRS one of the following two IRS forms: Easy Way: IRS Form 1023-EZ(2 pages submitted online). › public › formPay.gov - Streamlined Application for Recognition of ... Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3).

Form 1023 ez eligibility worksheet. › charities-non-profits › form-1023-ezForm 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Oct 05, 2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ... Form 1023-EZ Eligibility Worksheet - Cognito Forms Form 1023-EZ Eligibility Worksheet - Cognito Forms Form 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Web05.10.2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification … 1023 ez eligibility worksheet: Fill out & sign online | DocHub Follow these fast steps to modify the PDF 1023 ez eligibility worksheet online for free: Sign up and log in to your account. Sign in to the editor using your credentials or click Create free account to evaluate the tool's capabilities. Add the 1023 ez eligibility worksheet for redacting. Click the New Document option above, then drag and drop ...

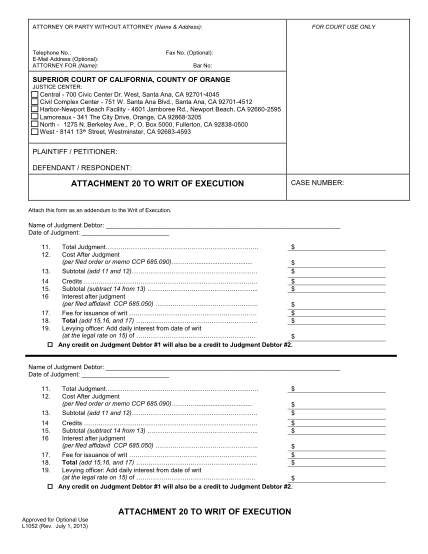

23 form 1023-ez eligibility worksheet - Free to Edit, Download & Print ... form 1023-ez eligibility worksheet. : EMail Address (Optional): ATTORNEY FOR (Name): FOR COURT USE ONLY For your protection and privacy, please press the Clear This Form button after you are done printing the form. A General Information - catawbaedu. 1023 Ez Eligibility Worksheet Form - signNow How to complete the Form 1023-EZ Eligibility Worksheet — National PTA — PTA online: To start the document, use the Fill camp; Sign Online button or tick the preview image of the blank. The advanced tools of the editor will lead you through the editable PDF template. Enter your official identification and contact details. Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons Web11.12.2022 · You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal rescue organizations and alike that don’t need big funds. If … PlayStation userbase "significantly larger" than Xbox even if every … Web12.10.2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

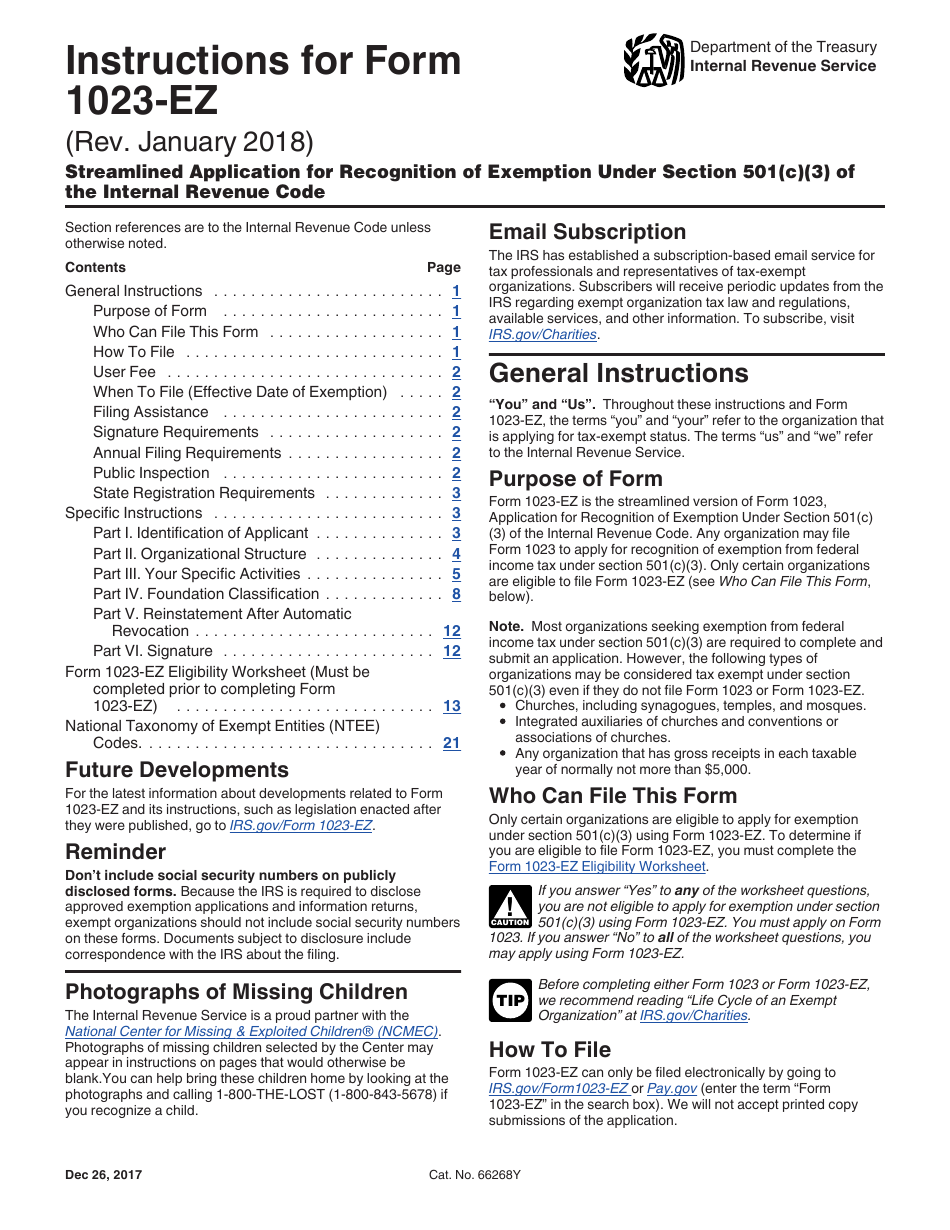

Pay.gov - Streamlined Application for Recognition of … WebNote: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3). See the Instructions for Form 1023-EZ for help in completing this … PDF ÅÈà ʸʷʹʺƖ ¿½¿¸¿Â¿ÊÏ ÅÈÁɾ»»Ê ƺ ËÉÊ ¸» ¹ÅÃÆ»ʻº ÆÈ¿ÅÈ ÊÅ ¹ÅÃÆ»ʿĽ ... Form 1023-EZ must be filled and submitted online on , this PDF copy is for reference only! ... Please go to and read the Pros & Cons and eligibility requirements before using the Form 1023-EZ.----- ¾ È» ÏÅË ÅȽ·Ä¿Ð»º ·É ·Ä »ÄÊ¿ÊÏ Åʾ»È ʾ·Ä · ¹ÅÈÆÅÈ·Ê¿ÅÄ ËÄ ... PPIC Statewide Survey: Californians and Their Government Web26.10.2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in … Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms WebForm 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Before completing either Form 1023 or …

› instructions › i1023ezInstructions for Form 1023-EZ (01/2018) | Internal Revenue ... To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501 (c) (3) using Form 1023-EZ. You must apply on Form 1023.

Form 1023 Ez Eligibility Worksheet: Fill & Download for Free Form 1023 Ez Eligibility Worksheet: Fill & Download for Free GET FORM Download the form The Guide of drawing up Form 1023 Ez Eligibility Worksheet Online If you take an interest in Modify and create a Form 1023 Ez Eligibility Worksheet, heare are the steps you need to follow: Hit the "Get Form" Button on this page.

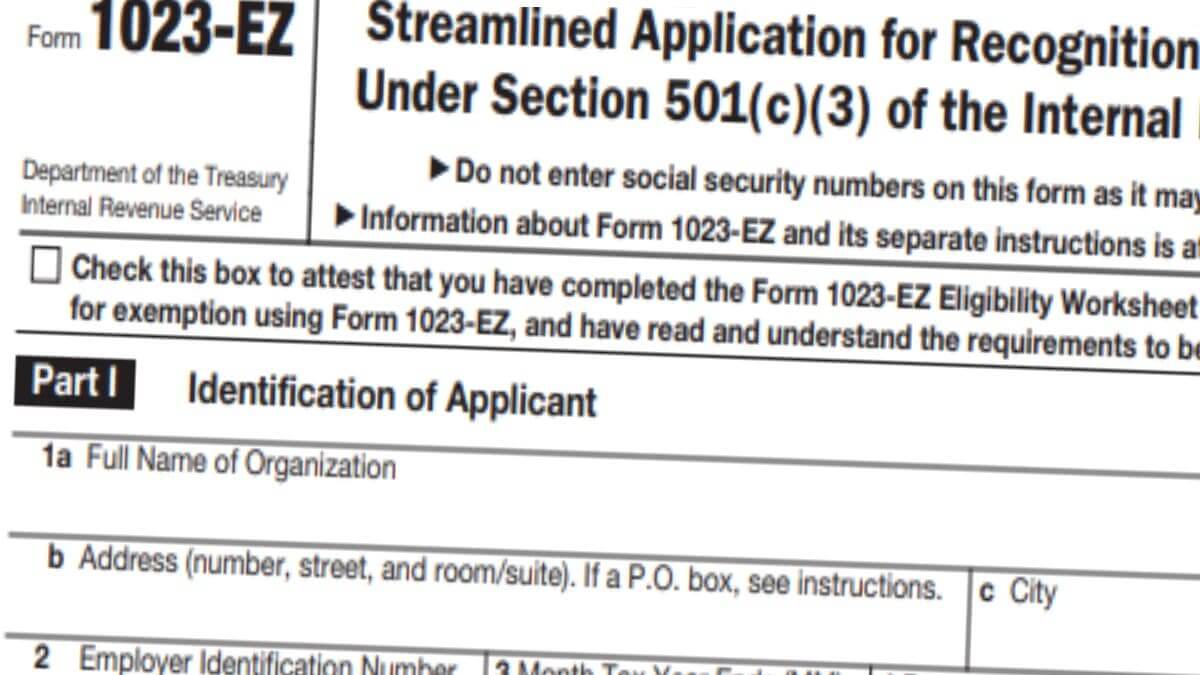

Instructions for Form 1023-EZ (01/2018) - IRS tax forms Web20.12.2019 · Before completing the Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you meet the eligibility requirements, you must check the box at the top of Form 1023-EZ to attest that you are eligible to file the form. By checking the box, you are also attesting that you have read and understand the requirements to be exempt ...

IRS Form 1023-EZ ≡ Fill Out Printable PDF Forms Online Before a business entity embarks on filing Form 1023-EZ, they have to submit the eligibility worksheet, a questionnaire including 30 questions. The worksheet is aimed to indicate the form you need to submit, depending on the answers you give on the questionnaire. An entity is required to fill the sheet with accuracy and honesty.

1023 ez eligibility worksheet - Fill online, Printable, Fillable Blank 1023 ez eligibility worksheet Form: What You Should Know. Did you ever engage in business or conduct any other trade or business? Incorporation, LCS, and S corporations must file Form 1023. 3. For each of the specified events in paragraphs (a) through (f) of Section 501(c)‹ (including the failure to be an officer, director, or controlling ...

form 1023-ez eligibility worksheet - pdfFiller 1023 ez eligibility worksheet - Form 1023-EZ (Rev. June 2014). Internal Revenue Code 501 (c) (3) Streamline Application Form Form 1023 ez eligibility worksheet - g 1003 2013 fillable form 1023 ez worksheet - sd fomr 812 form Form 1023 ez worksheet - Fannie mae form 1021 fillable 1023 eligibility worksheet - dhmh statistics hiv form

PDF PDF document created by PDFfiller Note: This worksheet must be completed prior to beginning the completion of Form 1023-EZ. This worksheet will determine whether or not your PTA is eligible to complete Form 1023-EZ. Do not file this worksheet with the IRS. If you answer "Yes" to any of the questions your PTA is not eligible to complete Form 1023-EZ and must complete the full ...

Get Form 1023 Ez Eligibility Worksheet 2020-2022 - US Legal Forms Keep to these simple instructions to get Form 1023 Ez Eligibility Worksheet completely ready for submitting: Get the sample you will need in the collection of legal forms. Open the template in our online editing tool. Go through the guidelines to discover which information you need to give. Click the fillable fields and put the required data.

About Form 1023-EZ, Streamlined Application for Recognition of ... WebTo submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ...

Can Your Organization Pass the IRS Form 1023-EZ Eligibility Worksheet ... LL.M (tax law) and his son former CPA Richard C. Keyt, JD, MS (accounting) to prepare and file an IRS form 1023-EZ for $450, your organization must pass do the following: Pass this test and submit click on the submit icon at the end of the test to send your answers to the Keyts.

› forms-pubs › about-form-1023About Form 1023, Application for Recognition of Exemption ... Changes to Jan. 2020 Revision of Instructions for Form 1023, Schedule E, Line 2 and Line 2a-- 27-JAN-2021. Updated Information on Signing Electronically Submitted Form 1023-- 05-MAY-2020. Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic-- 14-APR-2020. Electronic Filing of Form 1023-- 31-JAN-2020

› pub › irs-pdfInstructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ.

› forms-pubs › about-form-1023-ezAbout Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ...

About Form 1023, Application for Recognition of Exemption … WebYou must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. Current Revision. To submit Form 1023, you must: Register for an account on Pay.gov. Enter "1023" in the search box and select …

› instructions › i1023Instructions for Form 1023 (01/2020) | Internal Revenue Service Unless an exception applies, an organization must file Form 1023 or Form 1023-EZ (if eligible) to obtain recognition of exemption from federal income tax under section 501(c)(3). You can find information about eligibility to file Form 1023-EZ at IRS.gov/Charities.

› public › formPay.gov - Streamlined Application for Recognition of ... Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3).

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Corporations ... IRS Form 1023-EZ Eligibility WorksheetRichard Keyt2020-03-07T09:04:08-07:00 An organization that seeks to be a tax-exempt charity under Section 501(c)(3) of the Internal Revenue Code must apply for tax exempt status by preparing and filing with the IRS one of the following two IRS forms: Easy Way: IRS Form 1023-EZ(2 pages submitted online).

1023 eligibility worksheet Form 1023 ez eligibility worksheet — db-excel.com. 1023 ez eligibility. Eligibility 1023 irs. Random Posts. worksheets sight words kindergarten; valentines day activities for preschoolers; unscramble sentences worksheets for kindergarten; 06.04 energy conservation design worksheet;

0 Response to "38 form 1023 ez eligibility worksheet"

Post a Comment