39 flsa professional exemption worksheet

PDF U.S. Department of Labor Wage and Hour Division - DOL Highly compensated employees performing office or non-manual work and paid total annual compensation of $107,432 or more (which must include at least $684* per week paid on a salary or fee basis) are exempt from the FLSA if they customarily and regularly perform at least one of the duties of an exempt executive, administrative or profess... Governor Newsom Signs Sweeping Climate Measures, Ushering … Sep 16, 2022 · SB 1382 by Senator Lena Gonzalez (D-Long Beach) – Air pollution: Clean Cars 4 All Program: Sales and Use Tax Law: zero emissions vehicle exemption. Governor Newsom previously signed: AB 2251 by Assemblymember Lisa Calderon (D-Whittier) – Urban forestry: statewide strategic plan.

What is FLSA Status and How to Classify Employees with It Mar 31, 2021 · 1. FLSA Executive Exemption Employees are considered exempt if they satisfy the following criteria: Regularly supervise two or more full-time employees; Have people management as a primary job duty; Have input into others’ employment, for example, hiring, promoting, and termination; 2. FLSA Learned Professional Exemption

Flsa professional exemption worksheet

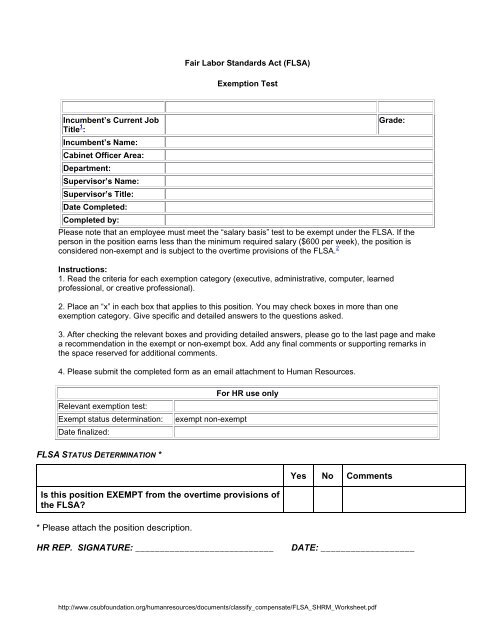

FLSA Exemption Worksheet | MRA The following FLSA exemption worksheet is designed to assist employers in conducting a review of employees' classifications under the Fair Labor Standards Act exemption rules and to document their process. ... Connect directly with an experienced HR Professional with your specific request. 866-HR-Hotline Fact Sheet #17A: Exemption for Executive, Administrative, Professional ... Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) Revised September 2019 *Note: The Department of Labor revised the regulations located at 29 C.F.R. part 541 with an effective date of January 1, 2020. WHD will continue to enforce the 2004 part 541 ... Position Description Supervisory Certification: I certify that this is an accurate statement of the major duties and responsibilities of this position and its organizational relationships, and that the position is necessary to carry out Government functions for which I am responsible. This certification is made with the knowledge that this information is to be used for statutory purposes relating to …

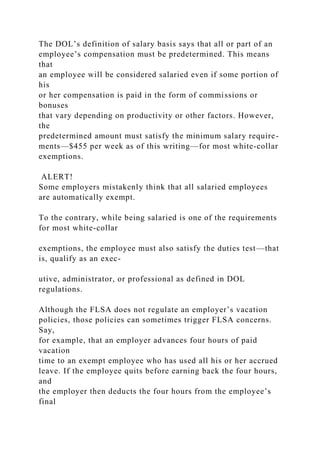

Flsa professional exemption worksheet. PDF FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET - United States Department of ... III. PROFESSIONAL EXEMPTION (5 CFR 551.207) & LEARNED PROFESSIONAL EXEMPTION (5 CFR 551.208) An employee whose primary duty meets A, B, and C below. An employee whose primary duty is managing an organizational unit, and who meets both of the conditions below. U.S. Department of State FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET DS-5105 05-2017 ... Fact Sheet 13: Employment Relationship Under the Fair Labor ... - DOL Fact Sheet 13: Employment Relationship Under the Fair Labor Standards Act (FLSA) Revised March 2022. On March 14, 2022 a district court in the Eastern District of Texas vacated the Department’s Delay Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Delay of Effective Date, 86 FR 12535 (Mar. 4, 2021), and the Withdrawal Rule, Independent Contractor Status Under ... U.S. appeals court says CFPB funding is unconstitutional - Protocol Oct 20, 2022 · The 5th Circuit Court of Appeals ruling sets up a major legal battle and could create uncertainty for fintechs. PDF Exempt Worksheet - ThinkHR Note that only salaried employees are eligible for executive, administrative, and professional exemptions. All EMPLOYER positions generally meet the salary threshold requirement of $455 per week. Computer professionals must earn an hourly rate of at least $27.63 an hour to be eligible for an FLSA exemption. Outside salespersons need not be paid ...

weather 85249 - crvyn.brs-schwerin.de FLSA exempt employees, as defined in 5 U.S.C. 5541 (2), who work full-time, part-time, or intermittent tours of duty are eligible for title 5 overtime pay. ... and Professional overtime exemptions changes as of January 1, 2020. The new overtime rule sets the minimum yearly salary for exempt employees at $35,568 or $684 per week, versus the ... FLSA Exemption Determination Checklist - Learned Professional Exemption ... GSA 1789A - Former President's Domestic Mail - Canceled - 9/22/2022 The GSA Forms Library contains these forms and views: GSA Forms (GSA) This is a list of all GSA forms. These are most often used by GSA employees, contractors and customers. Standard Forms (SF) This is a list of standard government forms that start with the letters "SF". PlayStation userbase "significantly larger" than Xbox even if … Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... 5.3 Employee Pay - University System of Georgia 5.3.1 Method of Payment for Compensation (Last Modified on January 25, 2018) Section 7.5.1.1 of the BOR Policy Manual, states that “electronic funds transfer is the required method of payroll payments to employees”.All employees are required to be paid by electronic funds transfer by authorizing the direct deposit of funds into their financial institution account within thirty (30) …

PDF FLSA Exemption Test Worksheet - Jacksonville State University To be considered for being classified as an exempt professional employee, an employee must be paid a weekly salary of $684 or above; have duties requiring advanced or very specialized education and training and require the exercise of discretion and judgment, or; consist of work requiring invention, imagination or talent in a recognized field of... PDF Fair Labor Standards Act (FLSA) Designation Worksheet (5 CFR Part 551) Professional Exemption (§551.207) o this exemption criteria, must check the "Primary Duty" box AND the boxes of at least one of the two Professionals or Computer Employees listed below ☐ Primary duty must be the performance of work requiring knowledge of an advanced type in aield of f science or learning customarily Overtime Pay: Fact Sheets | U.S. Department of Labor - DOL Fluctuating Workweek Method of Computing Overtime Under the Fair Labor Standards Act (FLSA) / “Bonus Rule” Final Rule; Additional Fact Sheets. Executive, Administrative, and Professional Fact Sheets By Exemption. Overview for Executive, Administrative, Professional, Computer, & Outside Sales Employees (Spanish Version) Executive Employees DOCX FLSA Designation Worksheet - Oregon The FLSA and Oregon laws exempt executive, administrative, professional and computer ("white collar") employees from overtime and minimum wage requirements. However, "non-exempt" employees must receive at least the minimum wage for every hour worked and must receive overtime for anything in excess of 40 hours in a work week.

Property Tax Forms - Texas Comptroller of Public Accounts 50-758, Application for Exemption of Goods-in-Transit (PDF) 50-759, Application for Property Tax Exemption: for Vehicle Used to Produce Income and Personal Non-Income Producing Activities (PDF) 50-776, Exemption Application for Nonprofit Community Business Organization Providing Economic Development Services to Local Community (PDF)

Fact Sheet #17D: Exemption for Professional Employees Under the ... - DOL However, Section 13 (a) (1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees. Section 13 (a) (1) and Section 13 (a) (17) also exempt certain computer employees.

Flsa Exemption Determination Checklist Administrative Exemption 7. The employee meets the definition of FLSA-exempt administrative employee only if you answered YES to all questions, and should be marked as exempt. If you answered NO to any of the questions, then the employee does not meet the definition for the administrative exemption, and you must mark the employee as non-exempt.

Commercial Application Engineer Job Dallas Texas USA,IT/Tech Job Description & How to Apply Below. JOB TITLE: Commercial Application Engineer EEO CATEGORY: Professional/2 FLSA STATUS: Exempt REPORTS TO: Director, Advanced Commercial Support ON-CALL DUTY: 24h/7d BASIC. PURPOSE: Configures hardware for customer premise installs. Installs and develops the Companys last mile network to support Advanced ...

FLSA Exemption Test Worksheet (Completed by Human Resources) To be classified as an exempt computer employee, an employee must be paid an hourly rate of $27.63 or $23,600 annual or higher; hold a position where primary position duties require work in computer systems analysis, computer programming, software engineering or similarly skilled work in the computer field.

PDF Application for Exemption of Goods Exported from Texas (Freeport Exemption) This application is used to claim a property tax exemption for freeport goods pursuant to Texas Constitution Article 8, Section 1-j and Tax Code Section 11.251. The amount of the exemption for this year is normally based on the percentage of inventory made up by such goods last year. The exemption applies to items in inventory that:

Position Description Supervisory Certification: I certify that this is an accurate statement of the major duties and responsibilities of this position and its organizational relationships, and that the position is necessary to carry out Government functions for which I am responsible. This certification is made with the knowledge that this information is to be used for statutory purposes relating to …

Fact Sheet #17A: Exemption for Executive, Administrative, Professional ... Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) Revised September 2019 *Note: The Department of Labor revised the regulations located at 29 C.F.R. part 541 with an effective date of January 1, 2020. WHD will continue to enforce the 2004 part 541 ...

FLSA Exemption Worksheet | MRA The following FLSA exemption worksheet is designed to assist employers in conducting a review of employees' classifications under the Fair Labor Standards Act exemption rules and to document their process. ... Connect directly with an experienced HR Professional with your specific request. 866-HR-Hotline

0 Response to "39 flsa professional exemption worksheet"

Post a Comment